概述

该策略是一个结合了多个技术指标的趋势跟踪交易系统。它主要利用抛物线转向指标(SAR)、移动平均线(SMA)和方向动量指标(DMI)来确定市场趋势和入场时机,并通过百分比止盈和MACD背离来优化出场。策略设计的核心思想是在确认强势趋势后入场,并在达到预设盈利目标或出现趋势转折信号时及时出场。

策略原理

策略使用了多层过滤机制来确认交易信号: 1. 通过SAR指标的交叉来捕捉初始交易信号 2. 使用50周期SMA判断整体趋势方向 3. 运用DMI指标确认趋势强度和方向 4. 入场条件需同时满足:价格上穿SAR、价格在SMA之上且DMI显示多头趋势 5. 出场采用双重机制:达到3%的目标利润或MACD死叉信号出现 6. ATR指标用于市场波动性参考

策略优势

- 多重技术指标交叉验证,能有效降低虚假信号

- 结合趋势跟踪和动量指标,提高交易成功率

- 固定百分比止盈策略,保证稳定获利

- MACD背离出场机制,避免趋势反转带来的回撤

- 策略参数可根据不同市场特征灵活调整

- 使用ATR进行波动性监控,提供市场状态参考

策略风险

- 多重指标可能导致信号滞后

- 固定百分比止盈可能在强势趋势中提前离场

- 没有止损机制增加了风险敞口

- 在横盘市场可能产生过多假信号

- DMI指标在震荡市场可能产生误导性信号

策略优化方向

- 引入自适应止损机制,如基于ATR的动态止损

- 开发波动率过滤器,在高波动期间调整持仓规模

- 优化MACD参数,提高趋势转折判断准确性

- 加入成交量确认机制,提高信号可靠性

- 开发动态止盈机制,根据市场波动调整目标利润

总结

该策略通过多重技术指标的协同配合,构建了一个相对完整的趋势跟踪交易系统。其优势在于信号确认的可靠性和风险控制的灵活性。虽然存在一定的滞后性风险,但通过参数优化和加入动态管理机制,策略的整体表现仍具有较好的应用价值。通过持续优化和改进,该策略可以成为一个稳健的交易工具。

策略源码

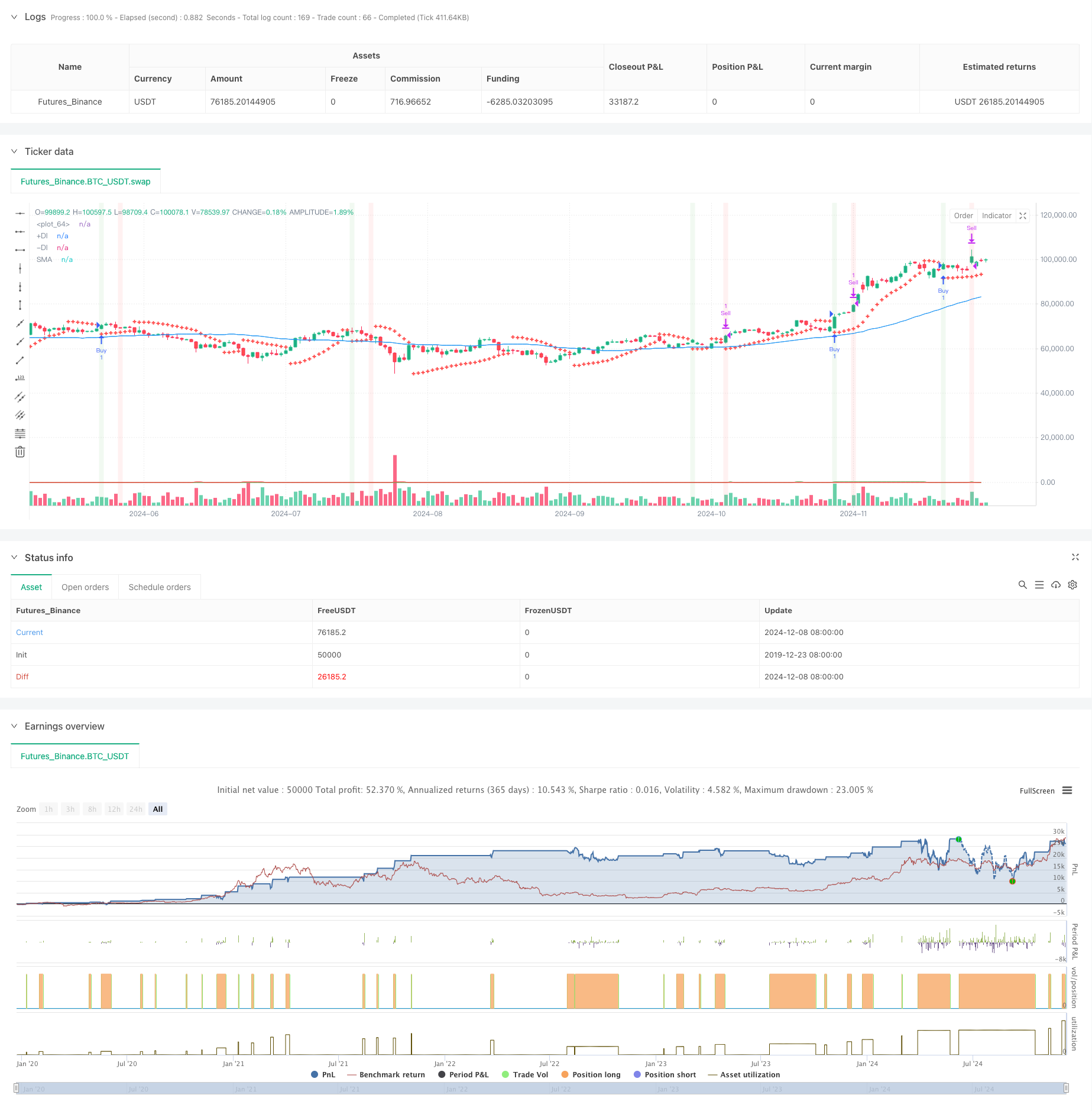

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading Strategy with DMI", overlay=true)

// Define parameters

sarStart = input.float(0.02, title="SAR Start")

sarIncrement = input.float(0.02, title="SAR Increment")

sarMax = input.float(0.2, title="SAR Max")

atrLength = input.int(10, title="ATR Length")

macdShort = input.int(12, title="MACD Short Length")

macdLong = input.int(26, title="MACD Long Length")

macdSignal = input.int(9, title="MACD Signal Length")

smaLength = input.int(50, title="SMA Length")

dmiLength = input.int(14, title="DMI Length")

adxSmoothing = input.int(14, title="ADX Smoothing") // Smoothing period for ADX

targetProfitPercentage = input.float(3.0, title="Target Profit Percentage")

// Calculate SAR

sar = ta.sar(sarStart, sarIncrement, sarMax)

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate MACD

[macdLine, macdSignalLine, _] = ta.macd(close, macdShort, macdLong, macdSignal)

// Calculate SMA

sma = ta.sma(close, smaLength)

bullishTrend = close > sma

// Calculate DMI

[plusDI, minusDI, adx] = ta.dmi(dmiLength, adxSmoothing) // Specify ADX smoothing period

// Determine if DMI is bullish

dmiBullish = plusDI > minusDI

// Define buy signal

buySignal = ta.crossover(close, sar) and bullishTrend and dmiBullish

// Track buy price and position state

var float buyPrice = na

var bool inPosition = false

// Enter position

if (buySignal and not inPosition)

buyPrice := close

inPosition := true

strategy.entry("Buy", strategy.long)

// Define target price (3% above the buy price)

targetPrice = na(buyPrice) ? na : buyPrice * (1 + targetProfitPercentage / 100)

// Define MACD sell signal

macdSellSignal = ta.crossunder(macdLine, macdSignalLine)

// Define sell signal

sellSignal = inPosition and (close >= targetPrice or macdSellSignal)

// Exit position

if (sellSignal)

inPosition := false

strategy.exit("Sell", "Buy", limit=targetPrice)

// Plot SAR on the chart

plot(sar, color=color.red, style=plot.style_cross, linewidth=2)

// Plot SMA (optional, for visualizing the trend)

plot(sma, color=color.blue, title="SMA")

// Plot DMI +DI and -DI

plot(plusDI, color=color.green, title="+DI")

plot(minusDI, color=color.red, title="-DI")

// Plot buy signal on the chart

//plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

// Plot sell signal on the chart

//plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Optional: Plot background color for buy and sell signals

bgcolor(buySignal ? color.new(color.green, 90) : na, title="Buy Signal Background")

bgcolor(sellSignal ? color.new(color.red, 90) : na, title="Sell Signal Background")

相关推荐