概述

该策略是一个结合了加速震荡指标(AC)和随机指标(Stochastic)的量化交易系统。它通过识别价格与技术指标之间的背离来捕捉市场动量的转变,从而预测潜在的趋势反转。该策略还整合了均线(SMA)和相对强弱指标(RSI)来增强信号的可靠性,并设置了固定的止盈止损来控制风险。

策略原理

策略的核心逻辑基于多重技术指标的协同配合。首先计算加速震荡指标(AC),它是通过价格中值的5周期和34周期均线之差,再减去其N周期均线得到。同时计算随机指标的K值和D值,用于确认背离信号。当价格创新低而AC指标走高时,形成看涨背离;当价格创新高而AC指标走低时,形成看跌背离。策略还引入了RSI作为辅助确认指标,通过多重指标的交叉验证来提高信号的准确性。

策略优势

- 多重指标协同:通过AC、Stochastic和RSI三个指标的配合,能够有效过滤虚假信号

- 自动化风控:内置了固定点数的止盈止损设置,可以有效控制每笔交易的风险

- 视觉化提示:在图表上清晰标注买卖信号,便于交易者快速识别机会

- 灵活性强:参数可调整性强,适用于不同的市场环境和交易周期

- 实时预警:集成了实时警报系统,确保不会错过交易机会

策略风险

- 假突破风险:在震荡市场中可能产生虚假的背离信号

- 滑点风险:由于使用固定点数止盈止损,在市场波动剧烈时可能面临较大滑点

- 参数敏感性:不同参数组合可能导致策略表现差异较大

- 市场环境依赖:在趋势不明显的市场中,策略效果可能不佳

- 信号滞后性:由于使用均线计算,信号可能存在一定滞后

策略优化方向

- 动态止盈止损:可以根据市场波动率动态调整止盈止损点位

- 引入成交量指标:通过成交量确认来增强信号可靠性

- 市场环境过滤:增加趋势判断模块,在不同市场环境下采用不同的交易策略

- 优化参数选择:使用机器学习方法优化各指标参数组合

- 增加时间过滤:考虑市场时间特征,避免在不利时段交易

总结

这是一个融合多重技术指标的量化交易策略,通过背离信号来捕捉市场转折点。策略的优势在于多重指标的交叉验证和完善的风险控制系统,但也需要注意假突破和参数优化等问题。通过持续优化和改进,该策略有望在不同市场环境下保持稳定的表现。

策略源码

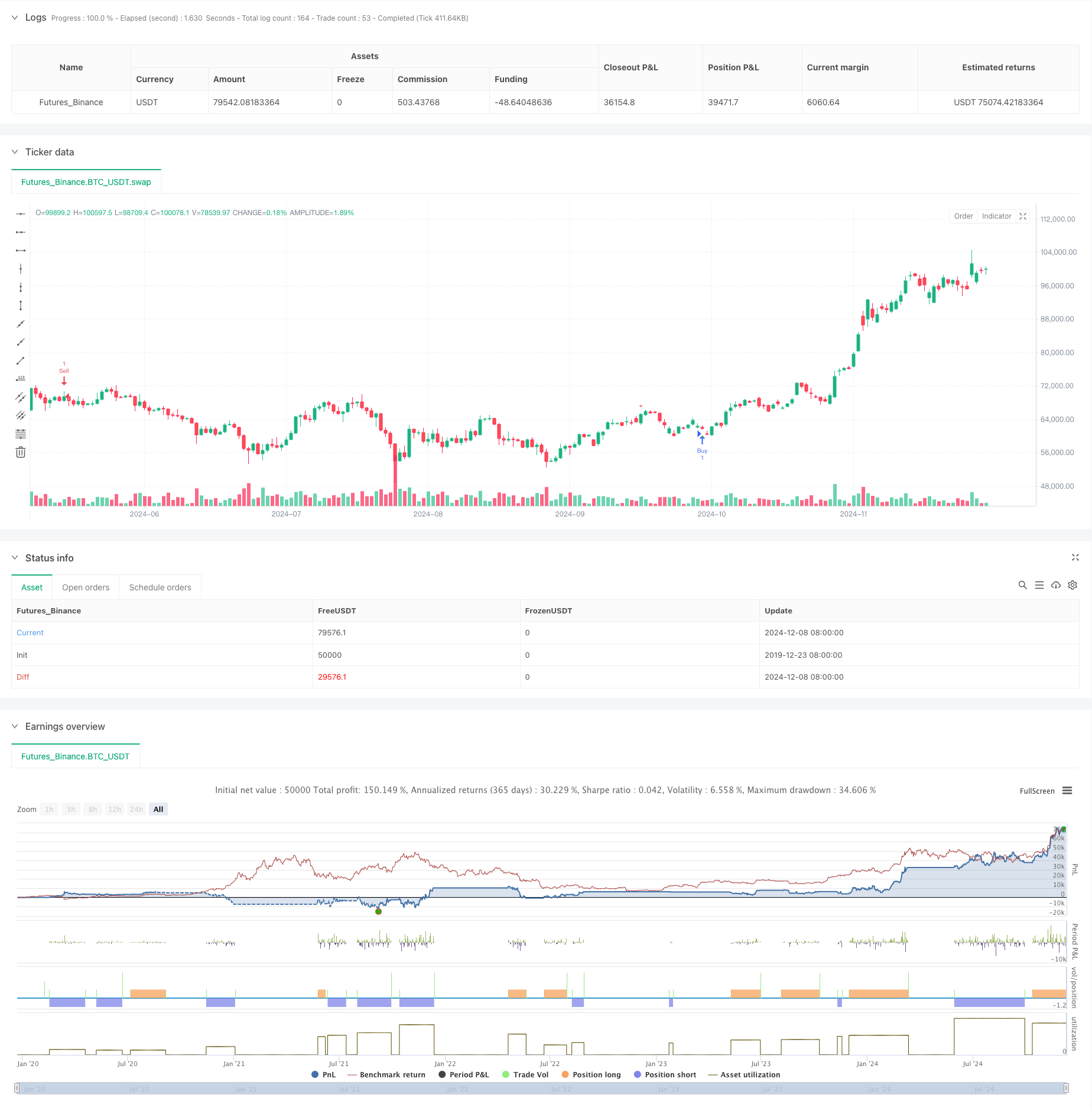

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © JayQwae

//@version=5

strategy("Enhanced AC Divergence Strategy with Stochastic Divergence", overlay=true)

// Input settings

tp_pips = input.float(0.0020, "Take Profit (in price)", step=0.0001)

sl_pips = input.float(0.0040, "Stop Loss (in price)", step=0.0001) // 40 pips

ac_length = input.int(5, "AC Length")

rsi_length = input.int(14, "RSI Length")

stoch_k = input.int(14, "Stochastic K Length")

stoch_d = input.int(3, "Stochastic D Smoothing")

stoch_ob = input.float(80, "Stochastic Overbought Level")

stoch_os = input.float(20, "Stochastic Oversold Level")

// Accelerator Oscillator Calculation

high_low_mid = (high + low) / 2

ao = ta.sma(high_low_mid, 5) - ta.sma(high_low_mid, 34)

ac = ao - ta.sma(ao, ac_length)

// RSI Calculation

rsi = ta.rsi(close, rsi_length)

// Stochastic Oscillator Calculation

k = ta.sma(ta.stoch(close, high, low, stoch_k), stoch_d)

d = ta.sma(k, stoch_d)

// Stochastic Divergence Detection

stoch_bull_div = ta.lowest(close, 5) < ta.lowest(close[1], 5) and ta.lowest(k, 5) > ta.lowest(k[1], 5)

stoch_bear_div = ta.highest(close, 5) > ta.highest(close[1], 5) and ta.highest(k, 5) < ta.highest(k[1], 5)

// Main Divergence Detection

bullish_div = ta.lowest(close, 5) < ta.lowest(close[1], 5) and ac > ac[1] and stoch_bull_div

bearish_div = ta.highest(close, 5) > ta.highest(close[1], 5) and ac < ac[1] and stoch_bear_div

// Plot divergences

plotshape(bullish_div, title="Bullish Divergence", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(bearish_div, title="Bearish Divergence", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Strategy rules

if (bullish_div)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=close + tp_pips, stop=close - sl_pips)

if (bearish_div)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=close - tp_pips, stop=close + sl_pips)

// Alerts

if (bullish_div)

alert("Bullish Divergence detected! Potential Buy Opportunity", alert.freq_once_per_bar)

if (bearish_div)

alert("Bearish Divergence detected! Potential Sell Opportunity", alert.freq_once_per_bar)

相关推荐