概述

该策略是一个基于多周期均线的趋势跟踪交易系统。策略利用89周期和21周期简单移动平均线(SMA)确定市场总体趋势方向,同时结合5周期指数移动平均线(EMA)的高点和低点来寻找具体的交易信号。策略采用双重仓位管理方式,并结合固定止损和追踪止盈来控制风险。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 趋势判断:使用89周期和21周期SMA的相对位置以及价格位置来确定趋势。当价格和5周期EMA都位于21周期SMA之上,且21周期SMA位于89周期SMA之上时,判定为上升趋势;反之则为下降趋势。 2. 入场信号:在上升趋势中,当价格回调至5周期EMA低点时入场做多;在下降趋势中,当价格反弹至5周期EMA高点时入场做空。 3. 仓位管理:每次信号触发时开立两个相同数量的合约仓位。 4. 风险控制:对第一个仓位采用固定止损和获利目标,对第二个仓位采用追踪止损方式管理。

策略优势

- 多重时间周期确认:通过不同周期的移动平均线组合,能够更全面地判断市场趋势,减少虚假信号。

- 灵活的止盈方式:结合固定止盈和追踪止盈,既能在短期波动中获利了结,又不会错过大趋势行情。

- 风险可控:设置明确的止损位置,且每个交易信号的风险敞口固定。

- 系统化操作:交易规则明确,不受主观判断影响,易于程序化实现。

策略风险

- 震荡市风险:在横盘整理行情中,频繁的均线交叉可能导致过多假信号。

- 滑点风险:在市场波动较大时,实际成交价格可能与理论信号价格产生较大偏差。

- 资金管理风险:固定合约数量的交易方式可能不适合所有资金规模。

- 参数敏感性:移动平均线周期的选择对策略表现影响较大,需要针对不同市场进行优化。

策略优化方向

- 动态仓位管理:建议根据账户净值和市场波动率动态调整交易合约数量。

- 市场环境过滤:增加趋势强度指标(如ADX),在震荡市场降低交易频率。

- 止损优化:可考虑使用ATR动态调整止损距离,提高策略对不同市场环境的适应性。

- 信号确认:增加成交量、动量等辅助指标,提高交易信号的可靠性。

总结

该策略是一个结构完整的趋势跟踪系统,通过多周期均线组合捕捉市场趋势,并采用灵活的仓位管理和止盈止损方式控制风险。虽然存在一定的优化空间,但策略的基本框架具有较好的实用性和可扩展性。针对不同的交易品种和市场环境,可以通过调整参数和增加过滤条件来提升策略的稳定性。

策略源码

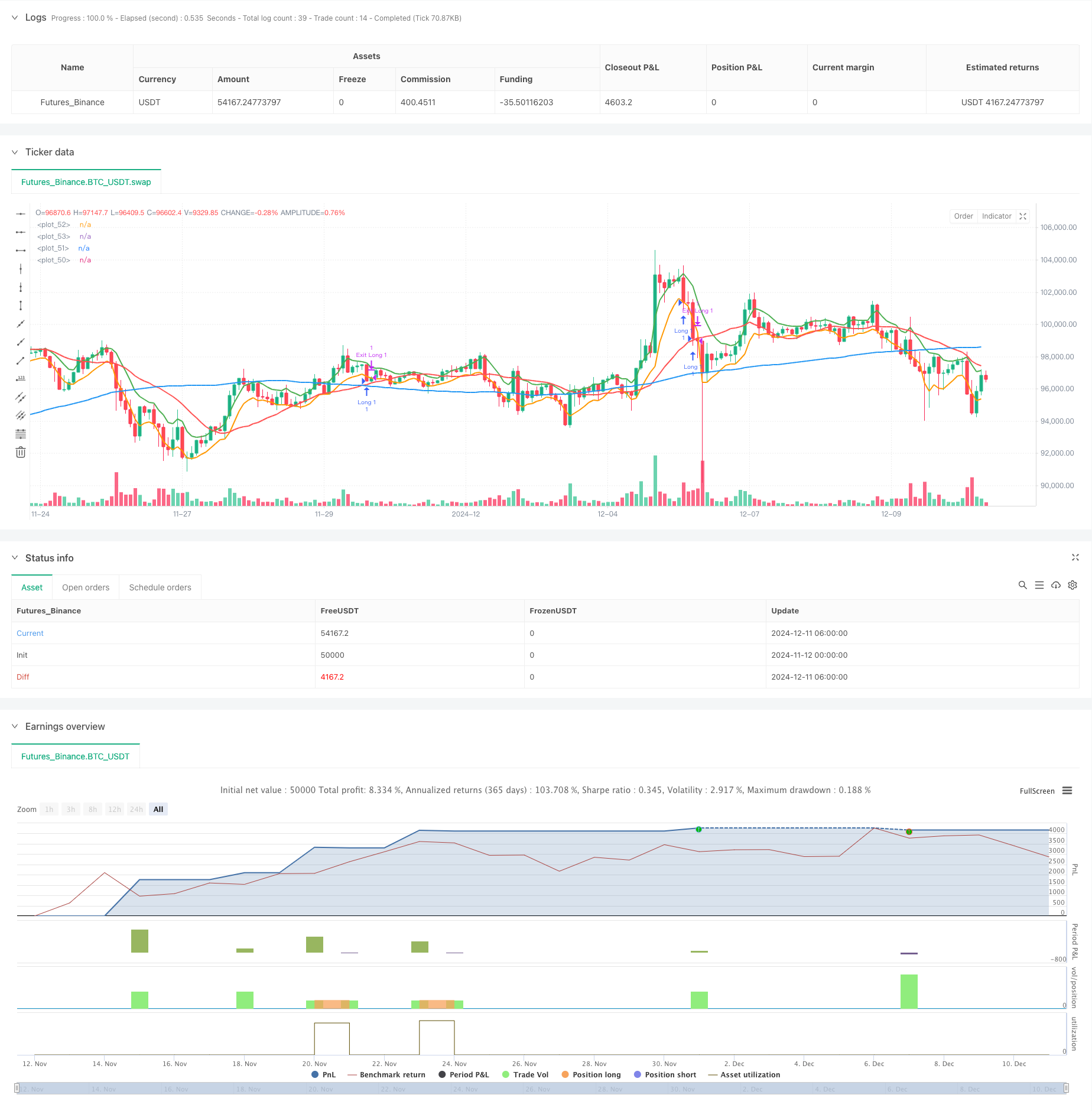

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tobiashartemink2

//@version=5

strategy("High 5 Trading Technique", overlay=true)

// --- Input parameters ---

sma89Length = input.int(title="SMA 89 Length", defval=89)

sma21Length = input.int(title="SMA 21 Length", defval=21)

ema5HighLength = input.int(title="EMA 5 High Length", defval=5)

ema5LowLength = input.int(title="EMA 5 Low Length", defval=5)

contracts = input.int(title="Aantal Contracten", defval=1)

stopLossPoints = input.int(title="Stop Loss Points per Contract", defval=25)

takeProfitPoints = input.int(title="Take Profit Points per Contract", defval=25)

// --- Calculate moving averages ---

sma89 = ta.sma(close, sma89Length)

sma21 = ta.sma(close, sma21Length)

ema5High = ta.ema(high, ema5HighLength)

ema5Low = ta.ema(low, ema5LowLength)

// --- Identify trend and order of moving averages ---

longSetup = close > sma89 and close > sma21 and ema5High > sma21 and sma21 > sma89

shortSetup = close < sma89 and close < sma21 and ema5Low < sma21 and sma21 < sma89

// --- Entry signals ---

longTrigger = longSetup and close <= ema5Low

shortTrigger = shortSetup and close >= ema5High

// --- Entry orders ---

if (longTrigger)

strategy.entry("Long 1", strategy.long, qty=contracts)

strategy.entry("Long 2", strategy.long, qty=contracts)

if (shortTrigger)

strategy.entry("Short 1", strategy.short, qty=contracts)

strategy.entry("Short 2", strategy.short, qty=contracts)

// --- Stop-loss and take-profit for long positions ---

if (strategy.position_size > 0)

strategy.exit("Exit Long 1", "Long 1", stop=strategy.position_avg_price - stopLossPoints, limit=strategy.position_avg_price + takeProfitPoints)

strategy.exit("Exit Long 2", "Long 2", stop=strategy.position_avg_price - stopLossPoints, trail_offset=takeProfitPoints, trail_points=takeProfitPoints)

// --- Stop-loss and take-profit for short positions ---

if (strategy.position_size < 0)

strategy.exit("Exit Short 1", "Short 1", stop=strategy.position_avg_price + stopLossPoints, limit=strategy.position_avg_price - takeProfitPoints)

strategy.exit("Exit Short 2", "Short 2", stop=strategy.position_avg_price + stopLossPoints, trail_offset=takeProfitPoints, trail_points=takeProfitPoints)

// --- Plot moving averages ---

plot(sma89, color=color.blue, linewidth=2)

plot(sma21, color=color.red, linewidth=2)

plot(ema5High, color=color.green, linewidth=2)

plot(ema5Low, color=color.orange, linewidth=2)

相关推荐