概述

该策略是一个基于WaveTrend指标的量化交易系统,结合了动态风险管理机制。策略通过计算价格波动的趋势强度,在超买超卖区域进行信号过滤,同时应用了止损、止盈和追踪止损等风险控制手段,实现了全方位的交易管理。

策略原理

策略的核心是通过HLC3价格计算WaveTrend指标。首先计算n1周期的指数移动平均线(EMA)作为基准线,然后计算价格与基准线的偏差,并使用0.015作为系数进行归一化处理。最终得到两条波浪线wt1和wt2,分别代表快线和慢线。交易信号基于这两条线与超买超卖水平的交叉产生,同时结合了多层次的风险控制系统。

策略优势

- 信号系统具有良好的趋势跟踪能力,通过双重超买超卖水平提高了信号的可靠性

- 完整的风险管理体系,包含固定止损、固定止盈和动态追踪止损

- 参数可调节性强,便于根据不同市场情况进行优化

- 结合了波动率自适应机制,提高了策略的适应性

- 通过分层设计的信号系统,有效降低了虚假信号的影响

策略风险

- 在剧烈波动市场中可能出现止损频繁的情况

- 参数设置不当可能导致交易成本过高

- 在横盘市场中可能产生过多假信号

- 需要合理设置止损和止盈比例,避免风险收益比失衡

- 追踪止损可能在快速反转行情中导致较大回撤

策略优化方向

- 引入成交量指标进行信号确认,提高交易的可靠性

- 优化追踪止损参数,使其更好地适应不同的市场环境

- 增加趋势强度过滤器,减少横盘市场的交易频率

- 考虑加入动态止损机制,根据市场波动率自动调整止损位置

- 引入时间过滤器,避免在不利的交易时段开仓

总结

该策略通过结合WaveTrend指标和完善的风险管理系统,实现了一个较为全面的量化交易策略。策略的核心优势在于其适应性强且风险可控,但仍需要交易者根据实际市场情况进行参数优化和策略改进。通过持续优化和完善,该策略有望在实际交易中取得稳定的收益。

策略源码

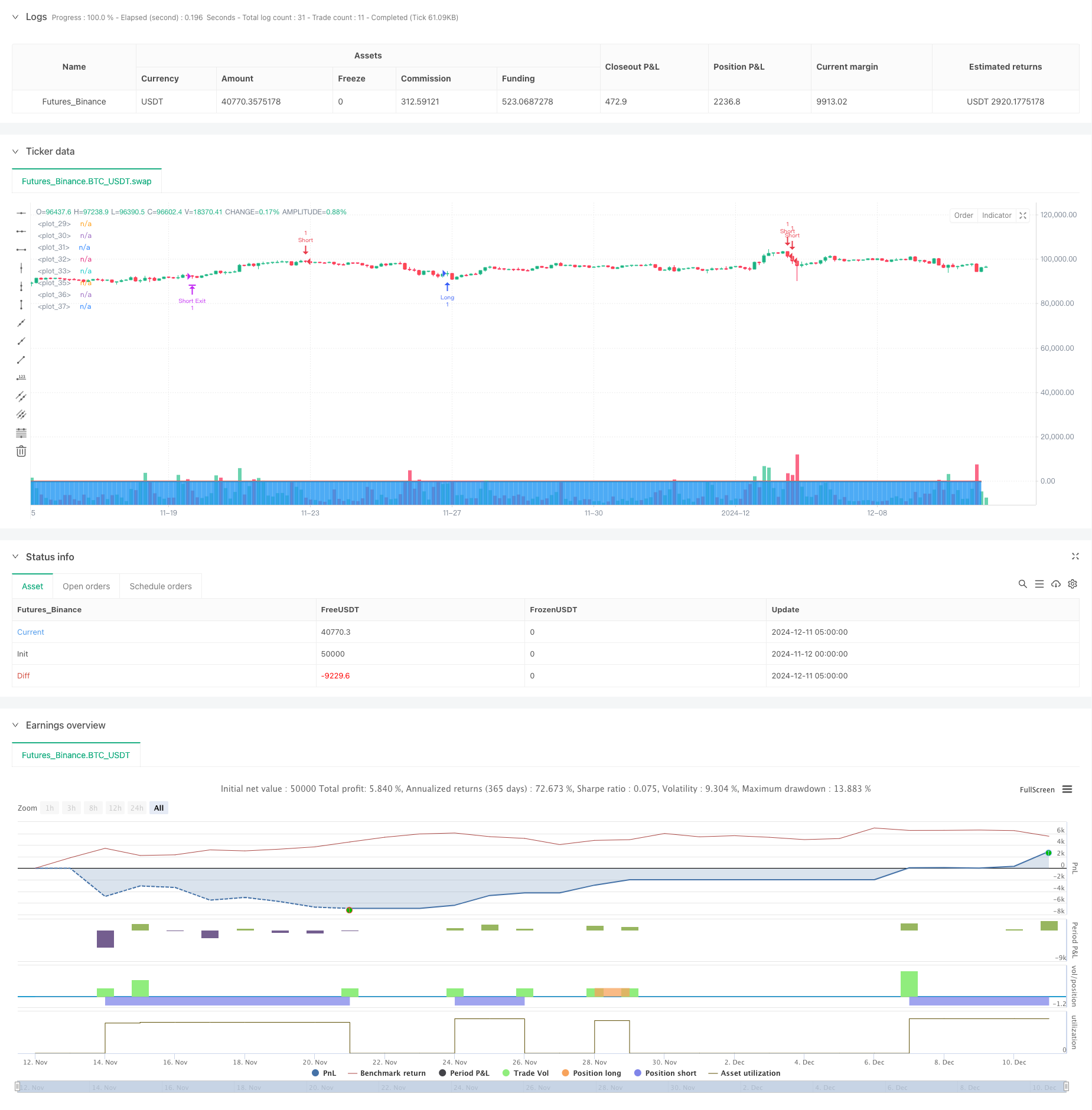

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="WaveTrend [LazyBear] with Risk Management", shorttitle="WT_LB_RM", overlay=true)

// Input Parameters

n1 = input.int(10, "Channel Length")

n2 = input.int(21, "Average Length")

obLevel1 = input.int(60, "Over Bought Level 1")

obLevel2 = input.int(53, "Over Bought Level 2")

osLevel1 = input.int(-60, "Over Sold Level 1")

osLevel2 = input.int(-53, "Over Sold Level 2")

// Risk Management Inputs

stopLossPercent = input.float(50.0, "Stop Loss (%)", minval=0.1, maxval=100)

takeProfitPercent = input.float(5.0, "Take Profit (%)", minval=0.1, maxval=100)

trailingStopPercent = input.float(3.0, "Trailing Stop (%)", minval=0.1, maxval=100)

trailingStepPercent = input.float(2.0, "Trailing Stop Step (%)", minval=0.1, maxval=100)

// WaveTrend Calculation

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Plotting Original Indicators

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=plot.style_line)

plot(osLevel2, color=color.green, style=plot.style_line)

plot(wt1, color=color.green)

plot(wt2, color=color.red, style=plot.style_line)

plot(wt1-wt2, color=color.blue, style=plot.style_area, transp=80)

// Buy and Sell Signals with Risk Management

longCondition = ta.crossover(wt1, osLevel1) or ta.crossover(wt1, osLevel2)

shortCondition = ta.crossunder(wt1, obLevel1) or ta.crossunder(wt1, obLevel2)

// Strategy Entry with Risk Management

if (longCondition)

entryPrice = close

stopLossPrice = entryPrice * (1 - stopLossPercent/100)

takeProfitPrice = entryPrice * (1 + takeProfitPercent/100)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long",

stop=stopLossPrice,

limit=takeProfitPrice,

trail_price=close * (1 + trailingStopPercent/100),

trail_offset=close * (trailingStepPercent/100))

if (shortCondition)

entryPrice = close

stopLossPrice = entryPrice * (1 + stopLossPercent/100)

takeProfitPrice = entryPrice * (1 - takeProfitPercent/100)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short",

stop=stopLossPrice,

limit=takeProfitPrice,

trail_price=close * (1 - trailingStopPercent/100),

trail_offset=close * (trailingStepPercent/100))

相关推荐