概述

这是一个结合了UT Bot和50周期指数移动平均线(EMA)的趋势追踪交易策略。该策略主要在1分钟时间周期进行短线交易,同时使用5分钟时间周期的趋势线作为方向过滤。策略采用ATR指标动态计算止损位置,并设置了双重止盈目标来优化收益。

策略原理

策略的核心逻辑基于以下几个关键组件: 1. 使用UT Bot计算动态支撑阻力位 2. 利用5分钟周期的50周期EMA判断总体趋势方向 3. 结合21周期EMA和UT Bot信号确定具体入场点 4. 通过ATR倍数设置动态跟踪止损 5. 设置0.5%和1%两个止盈目标,分别平仓50%仓位

当价格突破UT Bot计算的支撑/阻力位,并且21周期EMA与UT Bot发生交叉时,如果价格位于5分钟50周期EMA的正确方向,则触发交易信号。

策略优势

- 多重时间周期结合提高了交易可靠性

- 动态ATR止损可以根据市场波动自适应调整

- 双重止盈目标平衡了收益和胜率

- 使用Heikin Ashi蜡烛图可以过滤部分假突破

- 支持灵活的交易方向选择(可以只做多、只做空或者双向交易)

策略风险

- 短周期交易可能面临较高的点差和手续费成本

- 在横盘整理市场中可能产生频繁的假信号

- 多重条件的限制可能导致错过一些潜在的交易机会

- ATR参数的设置需要针对不同市场进行优化

策略优化方向

- 可以添加成交量指标作为辅助确认

- 考虑引入更多的市场情绪指标

- 针对不同市场波动特征开发自适应参数

- 增加交易时间段的过滤

- 开发更智能的仓位管理系统

总结

该策略通过多重技术指标和时间周期的结合,构建了一个完整的交易系统。它不仅包含了明确的入场出场条件,还提供了完善的风险管理机制。虽然在实际应用中仍需要根据具体市场情况进行参数优化,但整体框架具有良好的实用性和扩展性。

策略源码

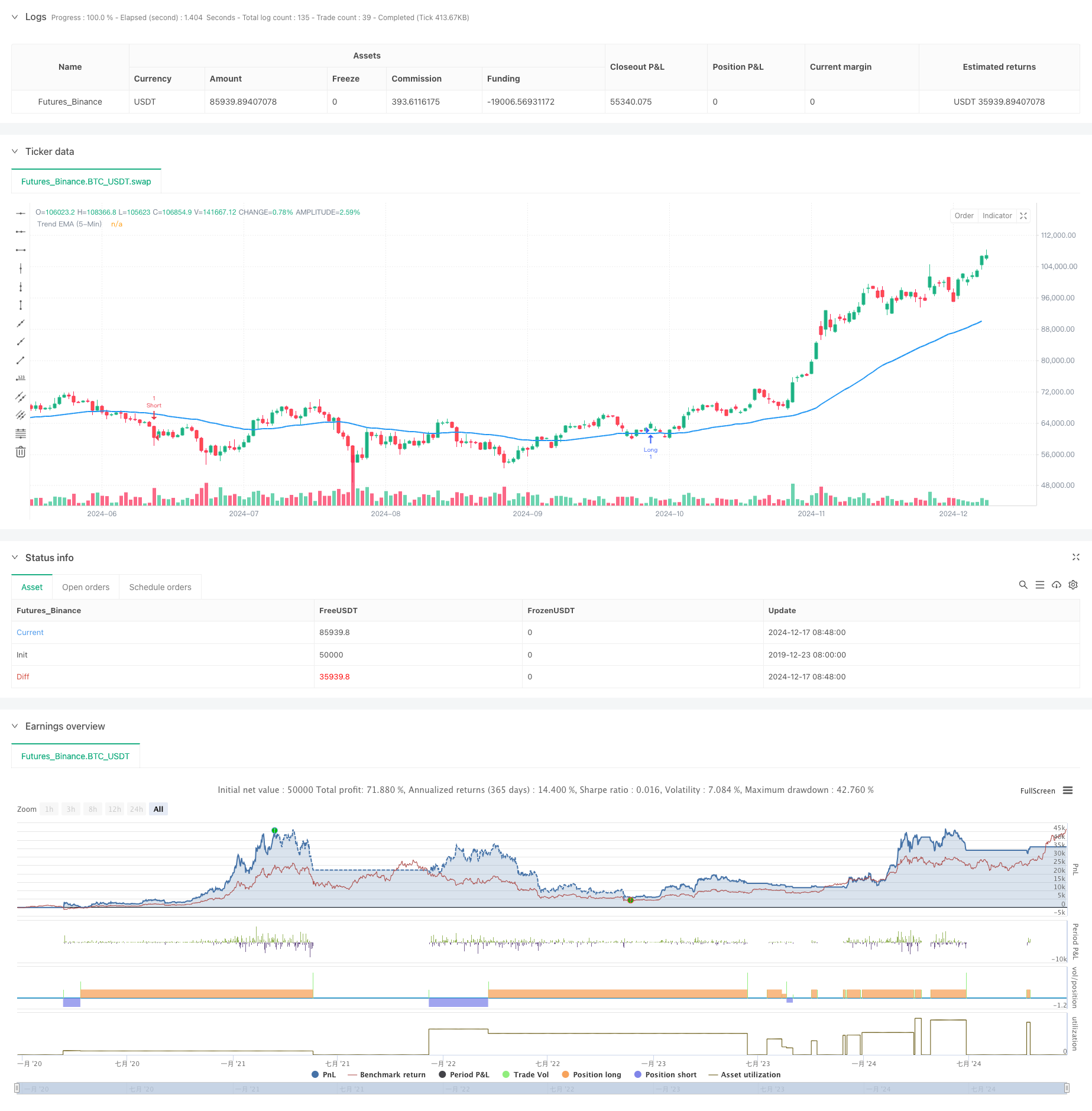

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Created by Nasser mahmoodsani' all rights reserved

// E-mail : [email protected]

strategy("UT Bot Strategy with T/P and S/L and Trend EMA", overlay=true)

// Inputs

along = input(1, title='Key Value (Sensitivity - Long)', group="LONG")

clong = input(10, title='ATR Period (Long)', group="LONG")

h = input(true, title='Signals from Heikin Ashi Candles')

ashort = input(7, title='Key Value (Sensitivity - Short)', group="SHORT")

cshort = input(2, title='ATR Period (Short)', group="SHORT")

tradeType = input.string("Both", title="Trade Type", options=["Buy Only", "Sell Only", "Both"])

tp1_percent = input.float(0.5, title="TP1 Percentage", step=0.1, group="TP Settings") // TP1 % input

tp2_percent = input.float(1.0, title="TP2 Percentage", step=0.1, group="TP Settings") // TP2 % input

sl_percent = input.float(1.0, title="Stop Loss Percentage", step=0.1, group="TP Settings") // SL % input

sl_in_percent = input(true, title="Use Stop Loss in Percentage", group="TP Settings")

tp1_qty = input.float(0.5, title="Take Profit 1 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

tp2_qty = input.float(0.5, title="Take Profit 2 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

// Check that total quantities for TPs do not exceed 100%

if tp1_qty + tp2_qty > 1

runtime.error("The sum of Take Profit quantities must not exceed 100%.")

// Calculate 50 EMA from 5-Minute Timeframe

trendEmaPeriod = 50

trendEma_5min = request.security(syminfo.tickerid, "5", ta.ema(close, trendEmaPeriod))

plot(trendEma_5min, title="Trend EMA (5-Min)", color=color.blue, linewidth=2)

// Calculations

xATRlong = ta.atr(clong)

xATRshort = ta.atr(cshort)

nLosslong = along * xATRlong

nLossshort = ashort * xATRshort

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close) : close

// LONG

var float xATRTrailingStoplong = na

var float stopLossLong = na

var float takeProfit1 = na

var float takeProfit2 = na

iff_1long = src > nz(xATRTrailingStoplong[1], 0) ? src - nLosslong : src + nLosslong

iff_2long = src < nz(xATRTrailingStoplong[1], 0) and src[1] < nz(xATRTrailingStoplong[1], 0) ? math.min(nz(xATRTrailingStoplong[1]), src + nLosslong) : iff_1long

xATRTrailingStoplong := src > nz(xATRTrailingStoplong[1], 0) and src[1] > nz(xATRTrailingStoplong[1], 0) ? math.max(nz(xATRTrailingStoplong[1]), src - nLosslong) : iff_2long

buy = src > xATRTrailingStoplong and ta.crossover(ta.ema(src, 21), xATRTrailingStoplong) and close > trendEma_5min

if buy and (tradeType == "Buy Only" or tradeType == "Both")

takeProfit1 := close * (1 + tp1_percent / 100)

takeProfit2 := close * (1 + tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossLong := close * (1 - sl_percent / 100)

else

stopLossLong := close - nLosslong

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit 1", from_entry="Long", limit=takeProfit1, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2", from_entry="Long", limit=takeProfit2, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossLong, qty=strategy.position_size)

// // Create Position Projectile for Long

// var line tpLineLong1 = na

// var line tpLineLong2 = na

// var line slLineLong = na

// var label entryLabelLong = na

// // Update projectile on entry

// line.delete(tpLineLong1)

// line.delete(tpLineLong2)

// line.delete(slLineLong)

// label.delete(entryLabelLong)

// tpLineLong1 := line.new(x1=bar_index, y1=takeProfit1, x2=bar_index + 1, y2=takeProfit1, color=color.green, width=2, style=line.style_solid)

// tpLineLong2 := line.new(x1=bar_index, y1=takeProfit2, x2=bar_index + 1, y2=takeProfit2, color=color.green, width=2, style=line.style_dashed)

// slLineLong := line.new(x1=bar_index, y1=stopLossLong, x2=bar_index + 1, y2=stopLossLong, color=color.red, width=2, style=line.style_solid)

// SHORT

var float xATRTrailingStopshort = na

var float stopLossShort = na

var float takeProfit1Short = na

var float takeProfit2Short = na

iff_1short = src > nz(xATRTrailingStopshort[1], 0) ? src - nLossshort : src + nLossshort

iff_2short = src < nz(xATRTrailingStopshort[1], 0) and src[1] < nz(xATRTrailingStopshort[1], 0) ? math.min(nz(xATRTrailingStopshort[1]), src + nLossshort) : iff_1short

xATRTrailingStopshort := src > nz(xATRTrailingStopshort[1], 0) and src[1] > nz(xATRTrailingStopshort[1], 0) ? math.max(nz(xATRTrailingStopshort[1]), src - nLossshort) : iff_2short

sell = src < xATRTrailingStopshort and ta.crossover(xATRTrailingStopshort, ta.ema(src, 21)) and close < trendEma_5min

if sell and (tradeType == "Sell Only" or tradeType == "Both")

takeProfit1Short := close * (1 - tp1_percent / 100)

takeProfit2Short := close * (1 - tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossShort := close * (1 + sl_percent / 100)

else

stopLossShort := close + nLossshort

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit 1 Short", from_entry="Short", limit=takeProfit1Short, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2 Short", from_entry="Short", limit=takeProfit2Short, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss Short", from_entry="Short", stop=stopLossShort, qty=strategy.position_size)

// Create Position Projectile for Short

// var line tpLineShort1 = na

// var line tpLineShort2 = na

// var line slLineShort = na

// var label entryLabelShort = na

// // Update projectile on entry

// line.delete(tpLineShort1)

// line.delete(tpLineShort2)

// line.delete(slLineShort)

// label.delete(entryLabelShort)

// tpLineShort1 := line.new(x1=bar_index, y1=takeProfit1Short, x2=bar_index + 1, y2=takeProfit1Short, color=color.green, width=2, style=line.style_solid)

// tpLineShort2 := line.new(x1=bar_index, y1=takeProfit2Short, x2=bar_index + 1, y2=takeProfit2Short, color=color.green, width=2, style=line.style_dashed)

// slLineShort := line.new(x1=bar_index, y1=stopLossShort, x2=bar_index + 1, y2=stopLossShort, color=color.red, width=2, style=line.style_solid)

// Updating Stop Loss after hitting Take Profit 1

if buy and close >= takeProfit1

strategy.exit("Adjusted Stop Loss", from_entry="Long", stop=close)

// Updating Stop Loss after hitting Take Profit 1 for Short

if sell and close <= takeProfit1Short

strategy.exit("Adjusted Stop Loss Short", from_entry="Short", stop=close)

相关推荐