概述

该策略是一个结合了多个技术指标的综合交易系统,主要通过动态监测市场动量和趋势变化来捕捉交易机会。策略整合了均线系统(EMA)、相对强弱指标(RSI)、移动平均收敛散度指标(MACD)、布林带(BB)等多个指标,并引入了基于真实波幅(ATR)的动态止损机制,实现了对市场多维度的分析和风险控制。

策略原理

策略采用多层次信号确认机制,主要包括以下几个方面: 1. 趋势判断:使用7周期和14周期EMA的交叉来确定市场趋势方向 2. 动量分析:通过RSI指标监测市场超买超卖状态,设定了30/70的动态阈值 3. 趋势强度确认:引入ADX指标判断趋势强度,当ADX>25时确认强趋势存在 4. 波动区间判断:运用布林带来界定价格波动区间,结合价格触及布林带情况产生交易信号 5. 成交量验证:使用动态成交量均线过滤,确保交易发生在足够的市场活跃度下 6. 风险控制:基于ATR指标设计的动态止损策略,止损距离为1.5倍ATR

策略优势

- 多维度信号验证,可以有效降低虚假信号

- 动态止损机制提高了策略的风险调适能力

- 结合成交量和趋势强度分析,提高了交易的可靠性

- 指标参数可调,具有良好的适应性

- 完整的进场和出场机制,交易逻辑清晰

- 采用标准技术指标,易于理解和维护

策略风险

- 多重指标可能导致信号滞后

- 参数优化可能存在过拟合风险

- 在横盘市场可能产生频繁交易

- 复杂的信号系统可能增加计算负担

- 需要较大的样本量来验证策略有效性

策略优化方向

- 引入市场波动率自适应机制,动态调整指标参数

- 增加时间过滤器,避免在不利时段交易

- 优化止盈策略,可考虑采用移动止盈

- 加入交易成本考虑,优化开平仓条件

- 引入位置管理机制,实现仓位动态调整

总结

该策略通过多指标协同配合,构建了一个较为完整的交易系统。核心优势在于多维度的信号确认机制和动态的风险控制系统,但也需要注意参数优化和市场适应性问题。通过持续优化和调整,该策略有望在不同市场环境下保持稳定的表现。

策略源码

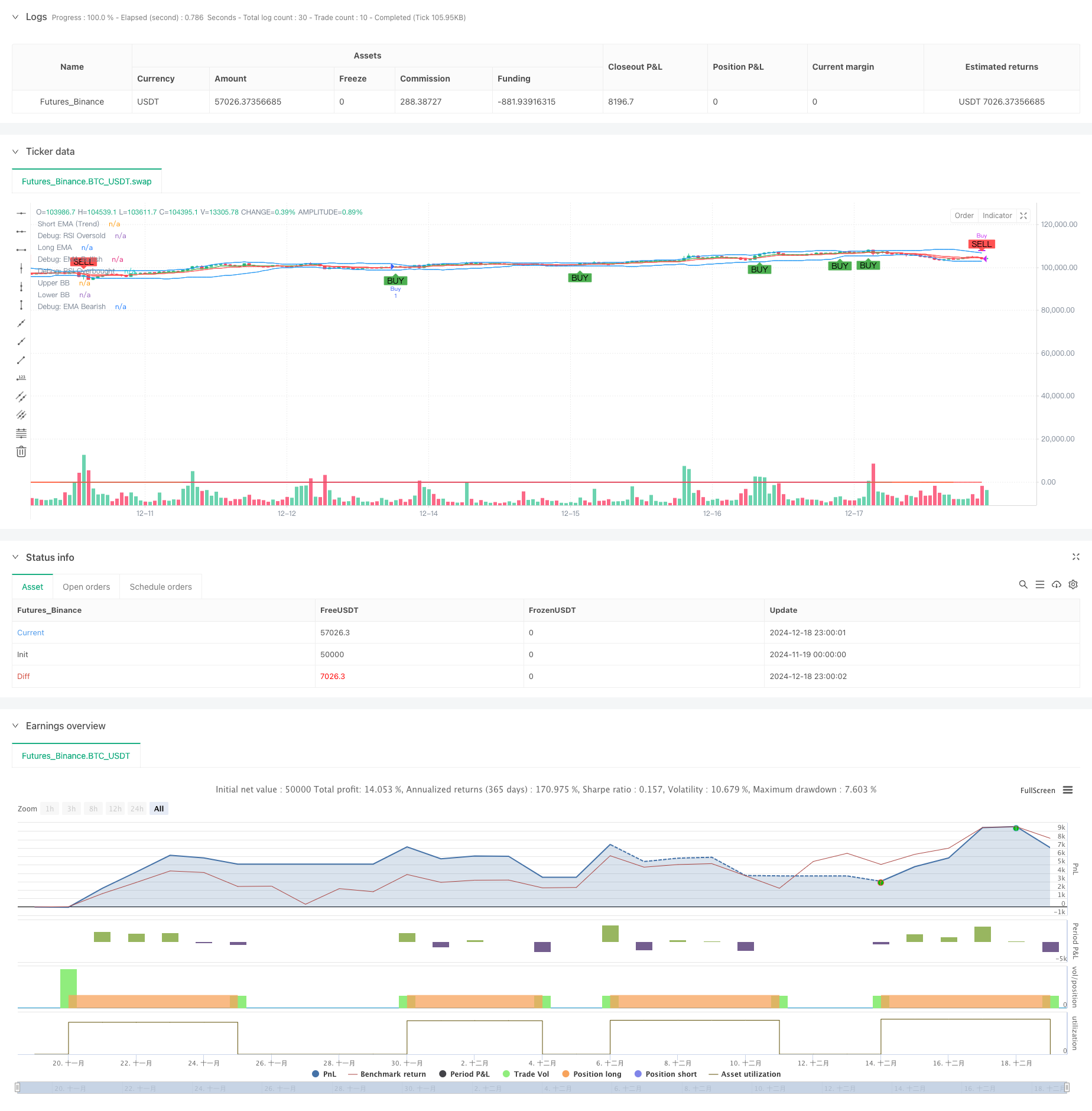

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT Scalping Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(7, title="Short EMA Length")

emaLongLength = input.int(14, title="Long EMA Length")

rsiLength = input.int(7, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level") // Adjusted to 70 for broader range

rsiOversold = input.int(30, title="RSI Oversold Level") // Adjusted to 30 for broader range

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Standard Deviation") // Adjusted to 2.0 for better signal detection

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

// Bollinger Bands Calculation

basis = ta.sma(close, bbLength)

deviation = ta.stdev(close, bbLength)

bbUpper = basis + (bbStdDev * (deviation > 1e-5 ? deviation : 1e-5)) // Ensure robust Bollinger Band calculation

bbLower = basis - bbStdDev * deviation

// Volume Condition

volCondition = volume > ta.sma(volume, input.int(20, title="Volume SMA Period")) // Dynamic volume filter

// Trend Strength (ADX)

// True Range Calculation

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

// Directional Movement

plusDM = high - high[1] > low[1] - low ? math.max(high - high[1], 0) : 0

minusDM = low[1] - low > high - high[1] ? math.max(low[1] - low, 0) : 0

// Smooth Moving Averages

atr_custom = ta.rma(tr, 14)

plusDI = 100 * ta.rma(plusDM, 14) / atr_custom // Correct reference to atr_custom

minusDI = 100 * ta.rma(minusDM, 14) / atr_custom // Correct reference to atr_custom

// ADX Calculation

adx = plusDI + minusDI > 0 ? 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), 14) : na // Simplified ternary logic for ADX calculation // Prevent division by zero // Prevent division by zero // Final ADX

strongTrend = adx > 25

// Conditions for Buy Signal

emaBullish = emaShort > emaLong

rsiOversoldCondition = rsi < rsiOversold

macdBullishCrossover = ta.crossover(macdLine, signalLine)

priceAtLowerBB = close <= bbLower

buySignal = emaBullish and (rsiOversoldCondition or macdBullishCrossover or priceAtLowerBB) // Relaxed conditions by removing volCondition and strongTrend

// Conditions for Sell Signal

emaBearish = emaShort < emaLong

rsiOverboughtCondition = rsi > rsiOverbought

macdBearishCrossover = ta.crossunder(macdLine, signalLine)

priceAtUpperBB = close >= bbUpper

sellSignal = emaBearish and (rsiOverboughtCondition or macdBearishCrossover or priceAtUpperBB) // Relaxed conditions by removing volCondition and strongTrend

// Plot EMA Lines

trendColor = emaShort > emaLong ? color.green : color.red

plot(emaShort, color=trendColor, title="Short EMA (Trend)") // Simplified color logic

plot(emaLong, color=color.red, title="Long EMA")

// Plot Bollinger Bands

plot(bbUpper, color=color.blue, title="Upper BB")

plot(bbLower, color=color.blue, title="Lower BB")

// Plot Buy and Sell Signals

plot(emaBullish ? 1 : na, color=color.green, linewidth=1, title="Debug: EMA Bullish")

plot(emaBearish ? 1 : na, color=color.red, linewidth=1, title="Debug: EMA Bearish")

plot(rsiOversoldCondition ? 1 : na, color=color.orange, linewidth=1, title="Debug: RSI Oversold")

plot(rsiOverboughtCondition ? 1 : na, color=color.purple, linewidth=1, title="Debug: RSI Overbought")

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small) // Dynamic size for signals

// Strategy Execution with ATR-based Stop Loss and Take Profit

// Reuse atr_custom from earlier calculation

stopLoss = low - (input.float(1.5, title="Stop Loss Multiplier") * atr_custom) // Consider dynamic adjustment based on market conditions // Adjustable stop-loss multiplier

takeProfit = close + (2 * atr_custom)

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss) // Removed limit to simplify trade execution

if (sellSignal)

strategy.close("Buy")

相关推荐