概述

本策略是一个结合了Supertrend指标和考夫曼自适应移动平均线(KAMA)的趋势跟踪交易系统。该策略通过动态识别市场趋势变化,在上升趋势中寻找做多机会,并采用灵活的止损机制来控制风险。策略的核心思想是利用Supertrend指标的趋势方向判断能力,结合KAMA指标对市场波动的自适应特性,在市场上涨趋势中建立多头仓位。

策略原理

策略采用了双重技术指标确认系统。首先,Supertrend指标通过ATR和自定义系数计算趋势方向,当指标线位于价格下方时表示上升趋势。其次,KAMA指标通过自适应机制调整移动平均线的敏感度,能够更好地适应不同市场环境。入场信号需同时满足两个条件:Supertrend指示上升趋势且价格位于KAMA线之上。同样,出场信号也需要双重确认:Supertrend转为下降趋势且价格跌破KAMA线。这种双重确认机制有效降低了虚假信号的影响。

策略优势

- 采用双重技术指标确认机制,提高信号可靠性

- KAMA指标具有自适应特性,能够根据市场波动调整灵敏度

- Supertrend指标提供明确的趋势方向指示

- 具有完善的止损机制,能够有效控制风险

- 策略逻辑清晰,参数可调整性强

- 入场和出场信号明确,易于执行

策略风险

- 震荡市场可能产生频繁交易信号,增加交易成本

- 趋势反转初期可能出现滞后性,影响止损效果

- 参数选择不当可能导致过度敏感或迟钝

- 市场快速波动时可能面临较大滑点

- 交易成本和滑点可能影响策略整体收益

策略优化方向

- 引入波动率过滤机制,在高波动率期间调整参数或暂停交易

- 增加成交量指标作为辅助确认

- 优化止损机制,可考虑采用跟踪止损

- 增加策略适用的市场环境判断

- 加入时间过滤,避免特定时间段的交易

- 开发自适应参数优化系统

总结

该策略通过结合Supertrend和KAMA两个技术指标,构建了一个稳健的趋势跟踪交易系统。策略的主要优势在于其自适应性和风险控制能力,通过双重确认机制提高了交易信号的可靠性。虽然在震荡市场中可能面临一些挑战,但通过合理的参数设置和优化方向的实施,策略的整体表现可以得到进一步提升。该策略特别适合中长期趋势交易,在明确趋势的市场环境中表现较好。

策略源码

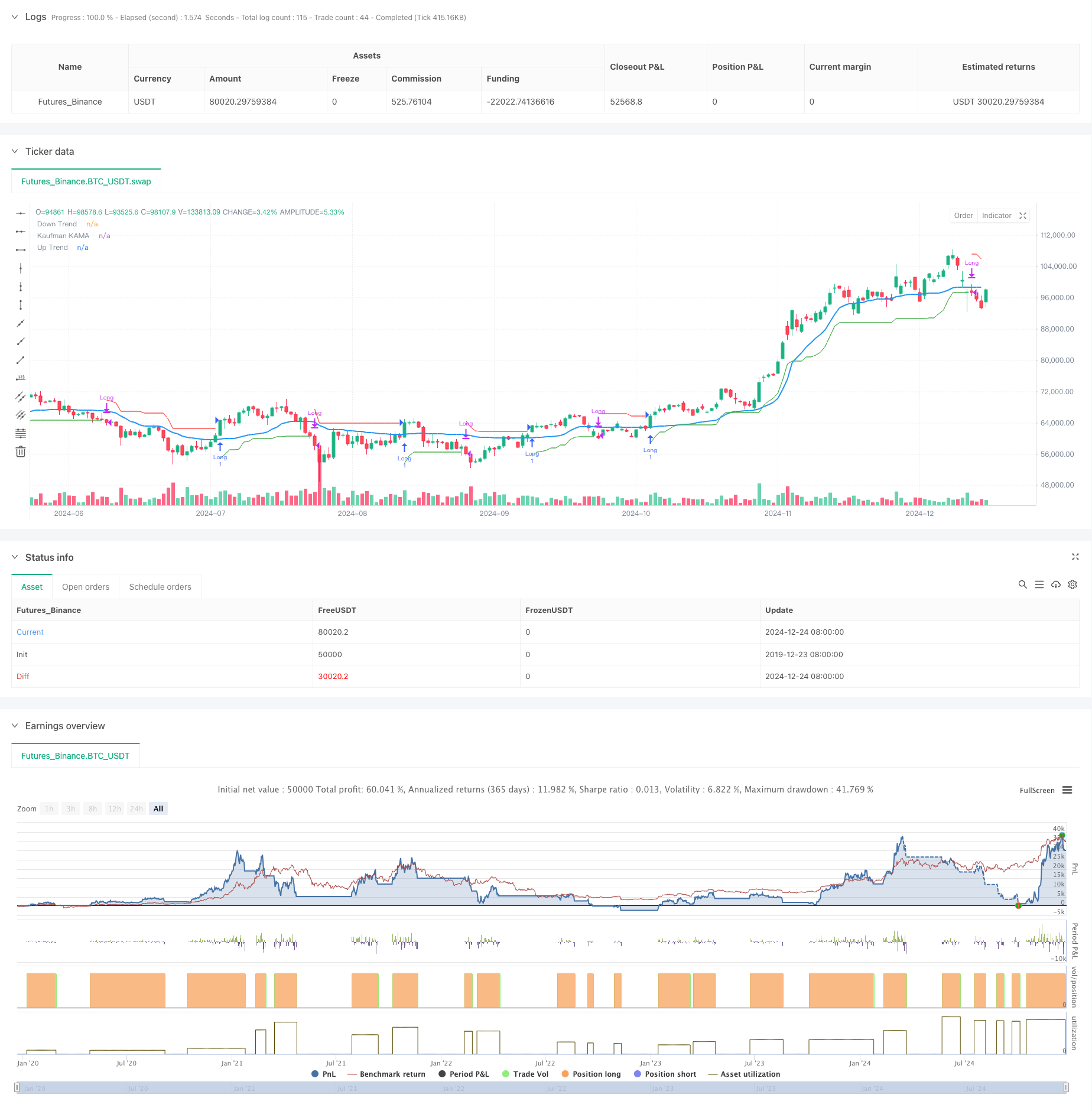

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Supertrend + KAMA Long Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// User-defined inputs for date range

startDate = input(timestamp("2018-01-01 00:00:00"), title="Start Date")

endDate = input(timestamp("2069-12-31 23:59:59"), title="End Date")

inDateRange = true

// Inputs for KAMA and Supertrend

kamaLength = input.int(21, title="KAMA Length", minval=1)

atrPeriod = input.int(10, title="Supertrend ATR Length", minval=1)

factor = input.float(3.0, title="Supertrend Factor", minval=0.01, step=0.01)

//------------------------- Kaufman Moving Average Adaptive (KAMA) -------------------------

xPrice = close

xvnoise = math.abs(xPrice - xPrice[1])

Length = kamaLength

nfastend = 0.666

nslowend = 0.0645

nsignal = math.abs(xPrice - xPrice[Length])

float nnoise = 0.0

for i = 0 to Length - 1

nnoise := nnoise + xvnoise[i]

nefratio = nnoise != 0.0 ? nsignal / nnoise : 0.0

nsmooth = math.pow(nefratio * (nfastend - nslowend) + nslowend, 2)

var float nAMA = na

nAMA := nz(nAMA[1]) + nsmooth * (xPrice - nz(nAMA[1]))

plot(nAMA, color=color.blue, linewidth=2, title="Kaufman KAMA")

//------------------------- Supertrend Calculation -------------------------

[stValue, dirValue] = ta.supertrend(factor, atrPeriod)

upTrend = dirValue < 0

downTrend = dirValue >= 0

plot(dirValue < 0 ? stValue : na, "Up Trend", color=color.green, style=plot.style_linebr)

plot(dirValue >= 0 ? stValue : na, "Down Trend", color=color.red, style=plot.style_linebr)

//------------------------- Strategy Logic -------------------------

// Entry condition: Supertrend is in uptrend AND price is above KAMA

canLong = inDateRange and upTrend and close > nAMA

// Exit condition (Take Profit): Supertrend switches to downtrend AND price is below KAMA

stopLoss = inDateRange and downTrend and close < nAMA

if canLong

strategy.entry("Long", strategy.long)

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_down, size=size.normal)

if stopLoss

strategy.close("Long", comment="Stop Loss")

label.new(bar_index, high, "STOP LOSS", color=color.red, textcolor=color.white, style=label.style_label_up, size=size.normal)

//------------------------- Alerts -------------------------

alertcondition(canLong, title="Long Entry", message="Supertrend + KAMA Long Signal")

alertcondition(stopLoss, title="Stop Loss", message="Supertrend switched to Downtrend and Price below KAMA")

相关推荐