概述

该策略是一个结合了中枢点参考(CPR)、指数移动平均线(EMA)、相对强弱指标(RSI)和突破逻辑的综合交易系统。策略采用ATR动态追踪止损机制,通过多重技术指标的协同配合来识别市场趋势和交易机会,并实现风险的动态管理。该策略适用于日内和中短期交易,具有较强的适应性和风险控制能力。

策略原理

策略主要基于以下几个核心组件: 1. CPR指标用于确定关键支撑阻力位,计算日度周期的枢轴点、上轨和下轨。 2. 双EMA系统(9日和21日)用于判断趋势方向,通过金叉死叉产生交易信号。 3. RSI指标(14日)用于确认市场超买超卖状态,并作为交易过滤器。 4. 突破逻辑结合价格对枢轴点的突破来确认交易信号。 5. ATR指标用于设置动态追踪止损,根据市场波动性自适应调整止损距离。

策略优势

- 多重技术指标的综合运用提高了信号的可靠性。

- 动态追踪止损机制能够有效锁定利润并控制风险。

- CPR指标提供了重要的价格参考位,有助于准确定位市场结构。

- 策略具有良好的适应性,可以根据不同市场条件调整参数。

- RSI过滤器和突破确认增强了交易信号的质量。

策略风险

- 多重指标可能在震荡市场产生滞后和假信号。

- 追踪止损可能在高波动期间被过早触发。

- 参数优化需要考虑市场特征,不当的参数设置可能影响策略表现。

- 信号冲突时可能影响决策的准确性。

策略优化方向

- 引入成交量指标来确认价格突破的有效性。

- 增加趋势强度过滤器,提高趋势跟踪的准确性。

- 优化止损参数的动态调整机制,提高防护效果。

- 添加市场波动率自适应机制,动态调整交易参数。

- 考虑加入情绪指标,提升市场时机判断。

总结

该策略通过多重技术指标的协同作用,构建了一个较为完整的交易系统。动态止损机制和多维度的信号确认提供了较好的风险收益特征。策略的优化空间主要在于信号质量的提升和风险管理的完善。通过持续优化和调整,该策略有望在不同市场环境下保持稳定的表现。

策略源码

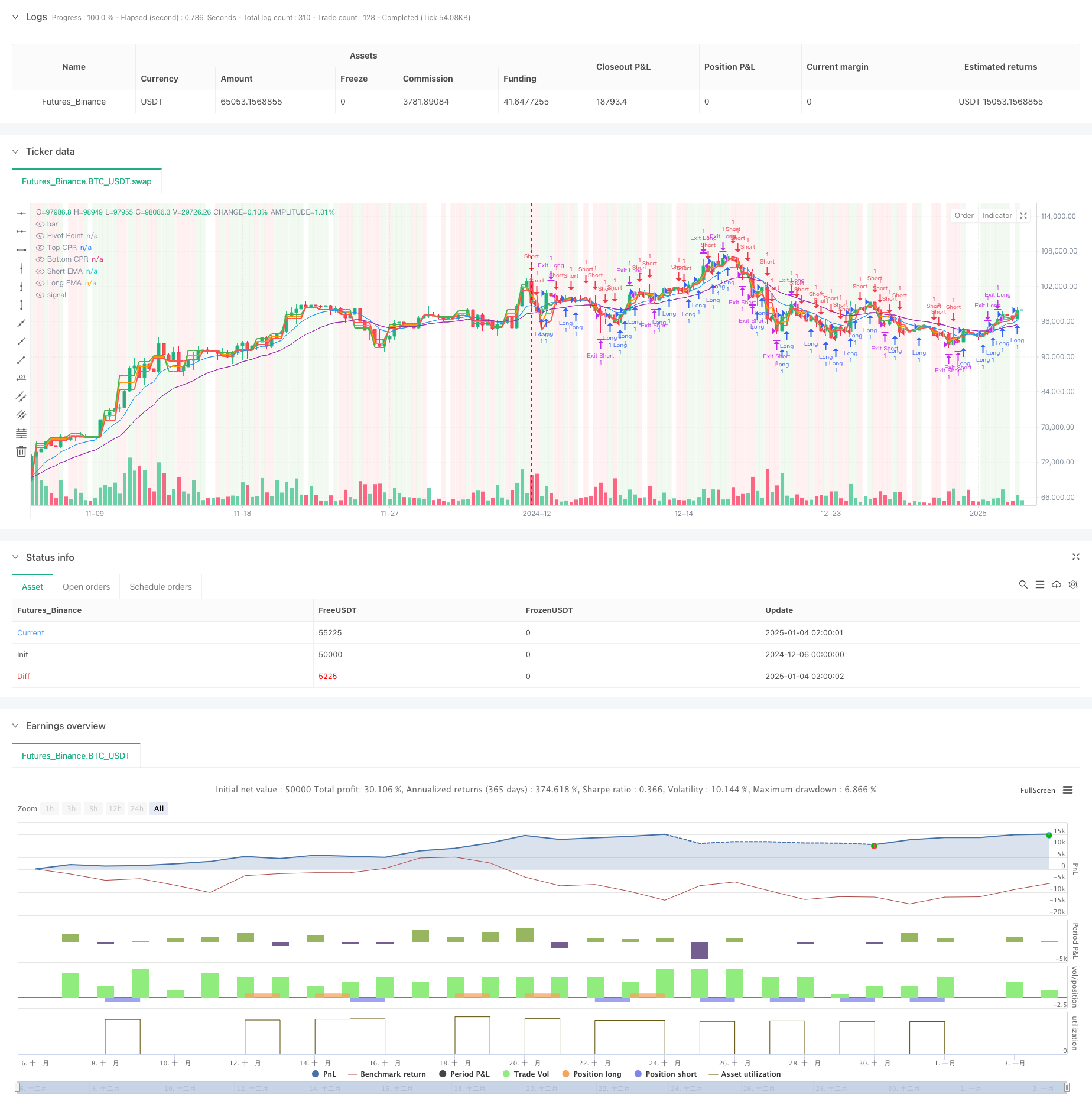

/*backtest

start: 2024-12-06 00:00:00

end: 2025-01-04 08:00:00

period: 7h

basePeriod: 7h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Enhanced CPR + EMA + RSI + Breakout Strategy", overlay=true)

// Inputs

ema_short = input(9, title="Short EMA Period")

ema_long = input(21, title="Long EMA Period")

cpr_lookback = input.timeframe("D", title="CPR Timeframe")

atr_multiplier = input.float(1.5, title="ATR Multiplier")

rsi_period = input(14, title="RSI Period")

rsi_overbought = input(70, title="RSI Overbought Level")

rsi_oversold = input(30, title="RSI Oversold Level")

breakout_buffer = input.float(0.001, title="Breakout Buffer (in %)")

// Calculate EMAs

short_ema = ta.ema(close, ema_short)

long_ema = ta.ema(close, ema_long)

// Request Daily Data for CPR Calculation

high_cpr = request.security(syminfo.tickerid, cpr_lookback, high)

low_cpr = request.security(syminfo.tickerid, cpr_lookback, low)

close_cpr = request.security(syminfo.tickerid, cpr_lookback, close)

// CPR Levels

pivot = (high_cpr + low_cpr + close_cpr) / 3

bc = (high_cpr + low_cpr) / 2

tc = pivot + (pivot - bc)

// ATR for Stop-Loss and Take-Profit

atr = ta.atr(14)

// RSI Calculation

rsi = ta.rsi(close, rsi_period)

// Entry Conditions with RSI Filter and Breakout Logic

long_condition = ((close > tc) and (ta.crossover(short_ema, long_ema)) and (rsi > 50 and rsi < rsi_overbought)) or (rsi > 80) or (close > (pivot + pivot * breakout_buffer))

short_condition = ((close < bc) and (ta.crossunder(short_ema, long_ema)) and (rsi < 50 and rsi > rsi_oversold)) or (rsi < 20) or (close < (pivot - pivot * breakout_buffer))

// Dynamic Exit Logic

long_exit = short_condition

short_exit = long_condition

// Trailing Stop-Loss Implementation

if long_condition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long",

trail_points=atr * atr_multiplier,

trail_offset=atr * atr_multiplier / 2)

if short_condition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short",

trail_points=atr * atr_multiplier,

trail_offset=atr * atr_multiplier / 2)

// Plot CPR Levels and EMAs

plot(pivot, title="Pivot Point", color=color.orange, linewidth=2)

plot(tc, title="Top CPR", color=color.green, linewidth=2)

plot(bc, title="Bottom CPR", color=color.red, linewidth=2)

plot(short_ema, title="Short EMA", color=color.blue, linewidth=1)

plot(long_ema, title="Long EMA", color=color.purple, linewidth=1)

// Highlight Buy and Sell Signals

bgcolor(long_condition ? color.new(color.green, 90) : na, title="Buy Signal Highlight")

bgcolor(short_condition ? color.new(color.red, 90) : na, title="Sell Signal Highlight")

相关推荐