概述

该策略是一个结合了指数移动平均线(EMA)和时间间隔的双向交易系统。系统在用户定义的固定时间间隔内,根据不同周期EMA的位置关系确定主要交易方向,同时通过监控另一组EMA指标的交叉信号或时间临近下一个交易周期时,选择合适时机进行反向对冲交易,从而实现双向交易机会的把握。

策略原理

策略运作基于两个核心机制:固定时间间隔的主要交易和灵活的反向交易。主要交易依据5/40分钟EMA的相对位置判断趋势方向,在每个交易间隔(默认30分钟)执行交易。反向交易则通过监控5/10分钟EMA的交叉信号,或在距离下一次主要交易前1分钟时进行,以较早发生的条件为准。整个交易在用户自定义的时间窗口内进行,确保交易的时效性。

策略优势

- 结合了趋势跟踪和均值回归两种交易思路,能够在不同市场环境下捕捉交易机会

- 通过时间间隔控制交易频率,避免过度交易

- 反向交易机制提供了风险对冲的功能,有助于控制回撤

- 参数可高度自定义,包括EMA周期、交易时间间隔等,适应性强

- 交易时间窗口可调,便于针对不同市场特征进行优化

策略风险

- EMA指标具有滞后性,可能在剧烈波动市场中产生滞后信号

- 固定时间间隔的交易可能错过重要的市场机会

- 反向交易可能在趋势强烈时造成不必要的损失

- 参数选择不当可能导致交易信号过多或过少

- 需要考虑交易成本对策略收益的影响

策略优化方向

- 引入波动率指标,动态调整EMA参数,提高策略适应性

- 增加成交量分析,提高交易信号的可靠性

- 开发动态的时间间隔机制,根据市场活跃度调整交易频率

- 加入止损和利润目标管理,优化资金管理

- 考虑引入其他技术指标作为交叉验证,提高交易的准确性

总结

这是一个融合了趋势跟踪和反向交易的综合策略,通过时间间隔和EMA指标的配合,实现了交易机会的双向把握。策略的可定制性强,具有良好的风险控制潜力,但需要根据实际市场情况进行参数优化和风险管理的完善。在实盘应用时,建议进行充分的回测和参数优化,并结合市场特征进行针对性的调整。

策略源码

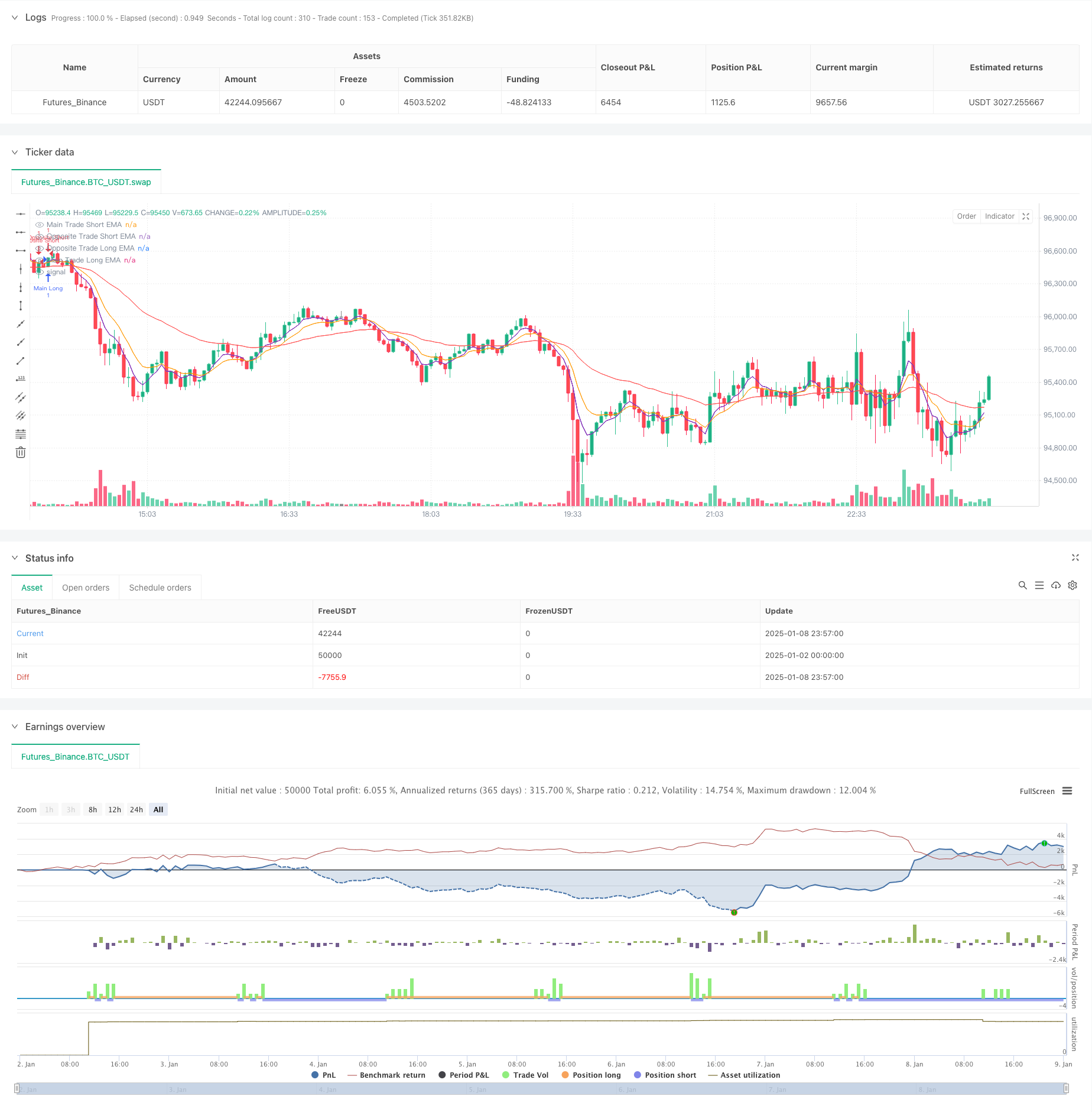

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SPX EMA Strategy with Opposite Trades", overlay=true)

// User-defined inputs

tradeIntervalMinutes = input.int(30, title="Main Trade Interval (in minutes)", minval=1)

oppositeTradeDelayMinutes = input.int(1, title="Opposite Trade time from next trade (in minutes)", minval=1) // Delay of opposite trade (1 min before the next trade)

startHour = input.int(10, title="Start Hour", minval=0, maxval=23)

startMinute = input.int(30, title="Start Minute", minval=0, maxval=59)

stopHour = input.int(15, title="Stop Hour", minval=0, maxval=23)

stopMinute = input.int(0, title="Stop Minute", minval=0, maxval=59)

// User-defined EMA periods for main trade and opposite trade

mainEmaShortPeriod = input.int(5, title="Main Trade EMA Short Period", minval=1)

mainEmaLongPeriod = input.int(40, title="Main Trade EMA Long Period", minval=1)

oppositeEmaShortPeriod = input.int(5, title="Opposite Trade EMA Short Period", minval=1)

oppositeEmaLongPeriod = input.int(10, title="Opposite Trade EMA Long Period", minval=1)

// Calculate the EMAs for main trade

emaMainShort = ta.ema(close, mainEmaShortPeriod)

emaMainLong = ta.ema(close, mainEmaLongPeriod)

// Calculate the EMAs for opposite trade (using different periods)

emaOppositeShort = ta.ema(close, oppositeEmaShortPeriod)

emaOppositeLong = ta.ema(close, oppositeEmaLongPeriod)

// Condition to check if it is during the user-defined time window

startTime = timestamp(year, month, dayofmonth, startHour, startMinute)

stopTime = timestamp(year, month, dayofmonth, stopHour, stopMinute)

currentTime = timestamp(year, month, dayofmonth, hour, minute)

// Ensure the script only trades within the user-defined time window

isTradingTime = currentTime >= startTime and currentTime <= stopTime

// Time condition: Execute the trade every tradeIntervalMinutes

var float lastTradeTime = na

timePassed = na(lastTradeTime) or (currentTime - lastTradeTime) >= tradeIntervalMinutes * 60 * 1000

// Entry Conditions for Main Trade

longCondition = emaMainShort > emaMainLong // Enter long if short EMA is greater than long EMA

shortCondition = emaMainShort < emaMainLong // Enter short if short EMA is less than long EMA

// Detect EMA crossovers for opposite trade (bullish or bearish)

bullishCrossoverOpposite = ta.crossover(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses above long

bearishCrossoverOpposite = ta.crossunder(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses below long

// Track the direction of the last main trade (true for long, false for short)

var bool isLastTradeLong = na

// Track whether an opposite trade has already been executed after the last main trade

var bool oppositeTradeExecuted = false

// Execute the main trades if within the time window and at the user-defined interval

if isTradingTime and timePassed

if longCondition

strategy.entry("Main Long", strategy.long)

isLastTradeLong := true // Mark the last trade as long

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, low, "Main Long", color=color.green, textcolor=color.white, size=size.small)

else if shortCondition

strategy.entry("Main Short", strategy.short)

isLastTradeLong := false // Mark the last trade as short

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, high, "Main Short", color=color.red, textcolor=color.white, size=size.small)

// Execute the opposite trade only once after the main trade

if isTradingTime and not oppositeTradeExecuted

// 1 minute before the next main trade or EMA crossover

if (currentTime - lastTradeTime) >= (tradeIntervalMinutes - oppositeTradeDelayMinutes) * 60 * 1000 or bullishCrossoverOpposite or bearishCrossoverOpposite

if isLastTradeLong

// If the last main trade was long, enter opposite short trade

strategy.entry("Opposite Short", strategy.short)

//label.new(bar_index, high, "Opposite Short", color=color.red, textcolor=color.white, size=size.small)

else

// If the last main trade was short, enter opposite long trade

strategy.entry("Opposite Long", strategy.long)

//label.new(bar_index, low, "Opposite Long", color=color.green, textcolor=color.white, size=size.small)

// After entering the opposite trade, set the flag to true so no further opposite trades are placed

oppositeTradeExecuted := true

// Plot the EMAs for visual reference

plot(emaMainShort, title="Main Trade Short EMA", color=color.blue)

plot(emaMainLong, title="Main Trade Long EMA", color=color.red)

plot(emaOppositeShort, title="Opposite Trade Short EMA", color=color.purple)

plot(emaOppositeLong, title="Opposite Trade Long EMA", color=color.orange)

相关推荐