概述

该策略是一个基于多维度云图(Ichimoku Cloud)指标的趋势跟踪交易系统。策略通过云图的核心组件交叉来识别市场趋势,并在价格突破关键技术位时产生交易信号。该策略采用非重绘方式,所有信号均在K线收盘时确认,有效降低了虚假信号的风险。策略适用于多个时间周期,尤其适合波动性较强的市场环境。

策略原理

策略的核心逻辑基于以下三个关键条件: 1. 价格突破基准线(Base Line)上方,表明短期趋势转强 2. 价格突破前导线A(Lead Line A)上方,确认中期趋势方向 3. 价格位于转换线(Conversion Line)上方,验证趋势持续性 当这三个条件同时满足时,系统会在K线收盘时发出做多信号。相反的条件组合则触发平仓信号。策略还采用了云图填充来增强趋势的可视化效果,云图呈绿色表示多头市场,红色表示空头市场。

策略优势

- 信号可靠性高:采用多重条件确认,有效降低假突破风险

- 非重绘设计:所有信号在K线收盘时确认,避免回测美化

- 多周期适用:可在5分钟到周线等多个时间周期上应用

- 趋势跟踪能力强:通过云图组件的配合,准确把握主要趋势

- 可视化效果好:使用三角形标记信号点,云图填充清晰显示趋势变化

- 灵活性强:关键参数可调整,适应不同市场环境

策略风险

- 震荡市场风险:在横盘整理阶段可能产生频繁假信号

- 滞后性风险:使用移动平均计算导致信号存在一定滞后

- 资金管理风险:缺乏止损机制可能导致较大回撤

- 参数优化风险:过度优化可能导致过拟合

- 市场环境依赖:策略在强趋势市场表现最佳,弱趋势期效果欠佳

策略优化方向

- 增加波动率过滤:引入ATR指标过滤低波动期间的信号

- 完善止损机制:设置跟踪止损来保护利润

- 优化信号确认:结合RSI、MACD等指标增强信号可靠性

- 加入成交量分析:通过成交量确认价格突破的有效性

- 市场环境识别:开发趋势强度指标来选择最佳交易时机

总结

该策略通过对云图指标的创新应用,建立了一个可靠的趋势跟踪交易系统。策略的非重绘设计和多重确认机制显著提高了信号质量。虽然在震荡市场表现欠佳,但通过建议的优化方向可以进一步提升策略的稳定性和适用性。策略特别适合追踪中长期趋势,对于寻求趋势跟踪机会的交易者来说是一个很好的选择。

策略源码

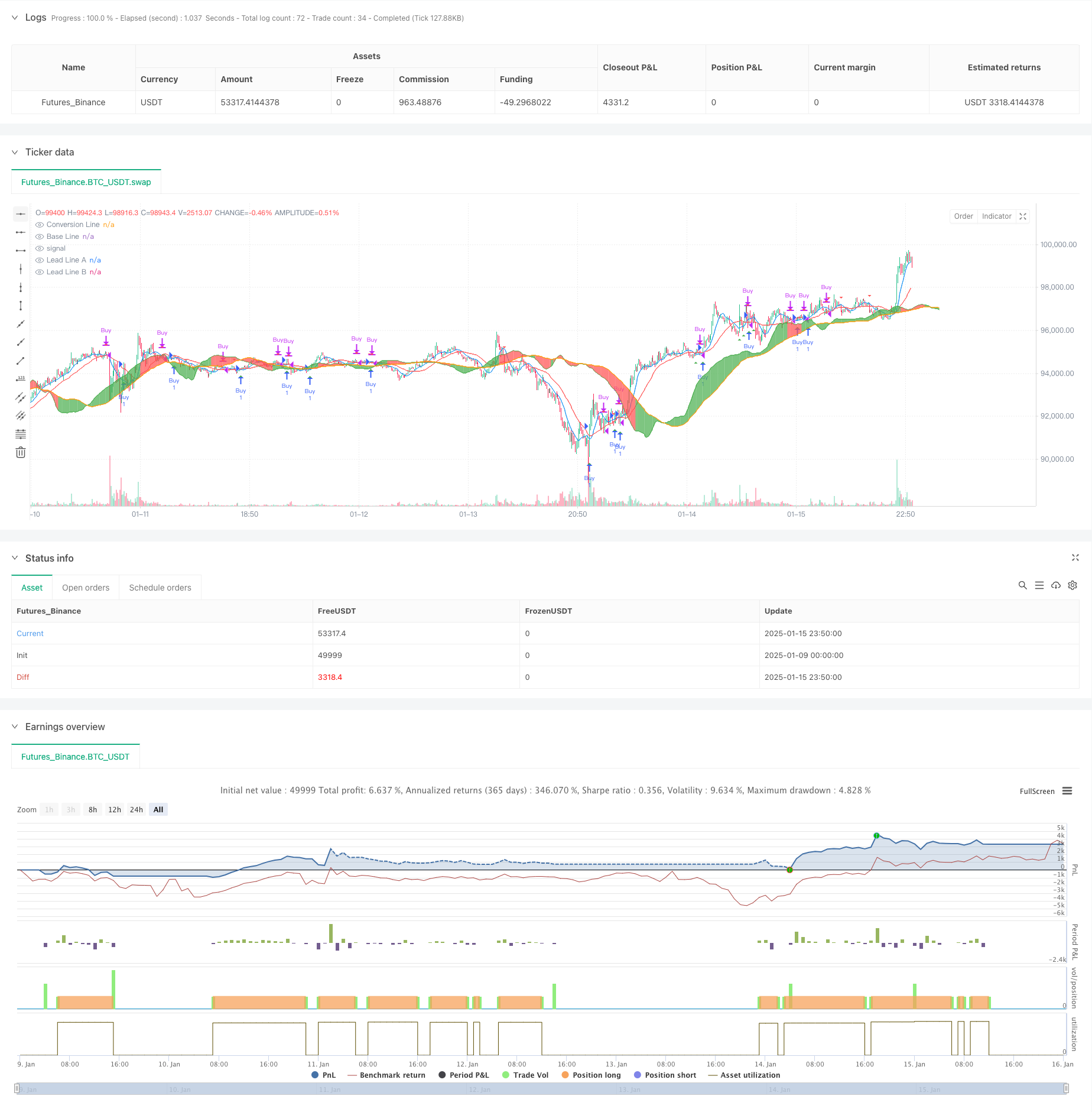

/*backtest

start: 2025-01-09 00:00:00

end: 2025-01-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Ichimoku Cloud Buy Strategy (Non-Repainting)", overlay=true)

// === Ichimoku Cloud Settings ===

lengthConversionLine = input(9, title="Conversion Line Length")

lengthBaseLine = input(26, title="Baseline Length")

lengthLeadLine = input(52, title="Lead Line Length")

// === Calculate Ichimoku Cloud Components ===

conversionLine = ta.sma((high + low) / 2, lengthConversionLine)

baseLine = ta.sma((high + low) / 2, lengthBaseLine)

leadLineA = (conversionLine + baseLine) / 2

leadLineB = ta.sma((high + low) / 2, lengthLeadLine)

// === Forward Projected Lead Lines (Fixes Ichimoku Calculation) ===

leadLineA_Future = leadLineA[lengthBaseLine] // Shift forward

leadLineB_Future = leadLineB[lengthBaseLine]

// === Define Buy and Sell Conditions (Confirmed at Bar Close) ===

buyCondition = ta.crossover(close, baseLine) and ta.crossover(close, leadLineA) and close > conversionLine and bar_index > bar_index[1]

sellCondition = ta.crossunder(close, baseLine) and ta.crossunder(close, leadLineA) and close < conversionLine and bar_index > bar_index[1]

// === Plot Buy and Sell Signals (Confirmed at Bar Close) ===

plotshape(buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// === Implement Strategy Logic (Trades at Bar Close) ===

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// === Plot Ichimoku Cloud Components with Future Projection ===

pConversionLine = plot(conversionLine, color=color.blue, title="Conversion Line")

pBaseLine = plot(baseLine, color=color.red, title="Base Line")

pLeadLineA = plot(leadLineA_Future, color=color.green, title="Lead Line A", offset=lengthBaseLine)

pLeadLineB = plot(leadLineB_Future, color=color.orange, title="Lead Line B", offset=lengthBaseLine)

// === Fill Ichimoku Cloud for Better Visualization ===

fill(pLeadLineA, pLeadLineB, color=leadLineA > leadLineB ? color.green : color.red, transp=80)

// === Alert Conditions (Only Triggered on Confirmed Signals) ===

alertcondition(buyCondition, title="Ichimoku Cloud Buy Signal", message="Ichimoku Cloud Buy Signal Triggered")

alertcondition(sellCondition, title="Ichimoku Cloud Sell Signal", message="Ichimoku Cloud Sell Signal Triggered")

相关推荐