概述

该策略是一个基于多重平滑移动平均线的趋势跟踪系统,通过三重平滑处理来过滤市场噪音,同时结合RSI动量指标、ATR波动率指标和200周期EMA趋势过滤器来确认交易信号。策略采用1小时时间周期,这个时间框架能够有效平衡交易频率和趋势可靠性,同时与机构交易行为相匹配。

策略原理

策略的核心是通过对价格进行三次平滑处理来构建主要趋势线,并使用较短周期的信号线与之交叉产生交易信号。交易信号需要同时满足以下条件才会执行: 1. 价格位置与200EMA的关系确认主趋势方向 2. RSI指标位置确认动量 3. ATR指标确认足够的波动性 4. 信号线与三重平滑均线的交叉确认具体入场点 止损采用基于ATR的动态止损,止盈采用2倍ATR设置,确保良好的风险收益比。

策略优势

- 三重平滑处理显著降低了虚假信号,提高了趋势判断的可靠性

- 多重确认机制确保交易方向与主要趋势保持一致

- 动态的止损和止盈设置适应不同的市场波动环境

- 策略在1小时周期上运行,能够有效避免更低时间周期的震荡

- 无重绘特性保证了回测结果的可靠性

策略风险

- 在横盘市场可能产生连续的小幅亏损

- 多重确认机制可能导致错过一些交易机会

- 信号滞后性可能影响入场点位的优化程度

- 需要足够的波动率才能产生有效信号

- 在极端市场环境下动态止损可能不够及时

策略优化方向

- 可以增加成交量指标作为辅助确认

- 考虑引入自适应的参数优化机制

- 可以增加趋势强度的量化判断

- 优化止损止盈的倍数设置

- 考虑加入震荡指标以优化横盘市场表现

总结

这是一个结构完整、逻辑严密的趋势跟踪策略。通过多重平滑处理和多重确认机制,有效地提高了交易信号的可靠性。动态的风险管理机制使其具有良好的适应性。虽然存在一定的滞后性,但通过参数优化和增加辅助指标,策略仍有较大的改进空间。

策略源码

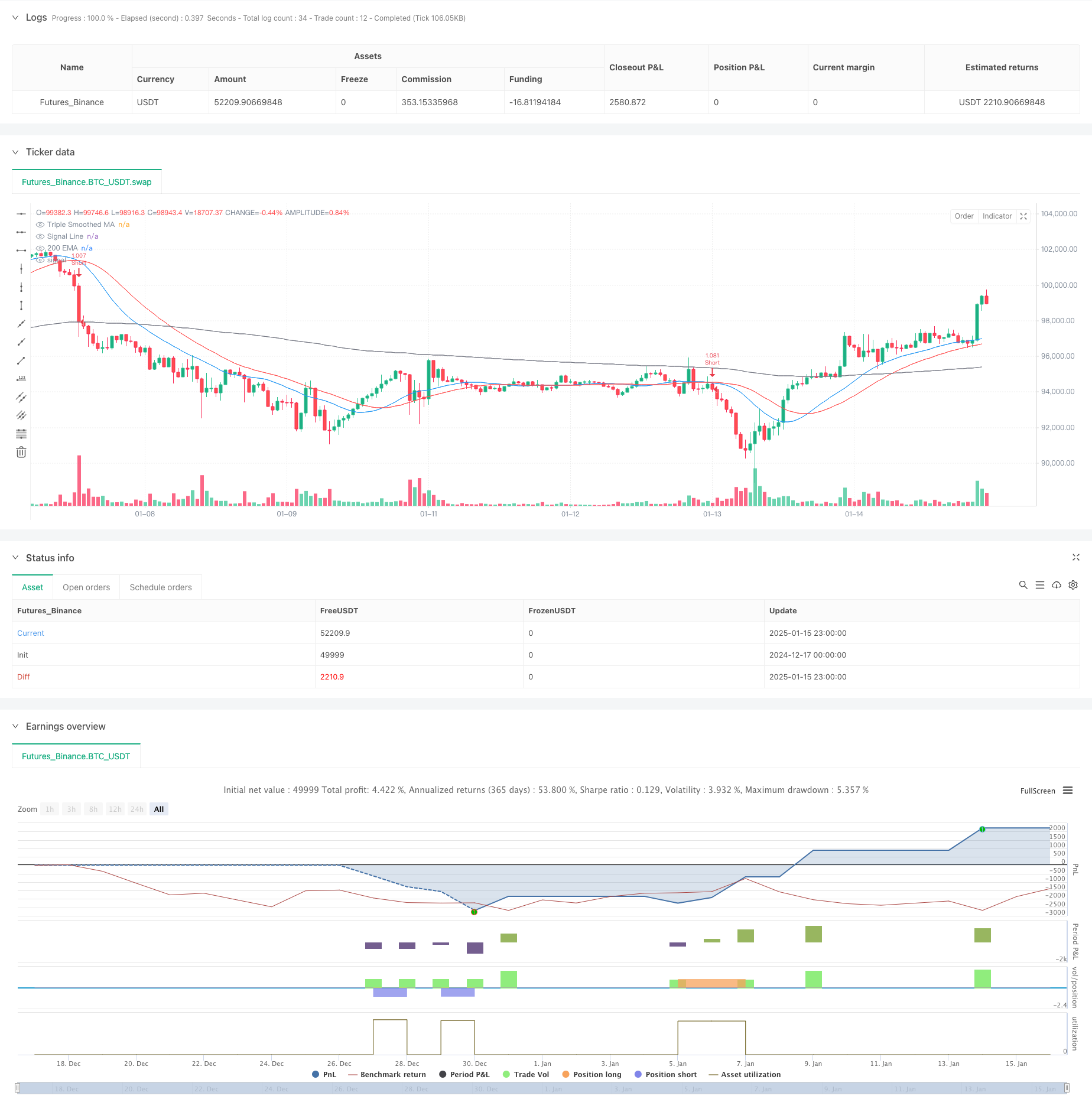

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-16 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Optimized Triple Smoothed MA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// === Input Settings ===

slength = input.int(7, "Main Smoothing Length", group="Moving Average Settings")

siglen = input.int(12, "Signal Length", group="Moving Average Settings")

src = input.source(close, "Data Source", group="Moving Average Settings")

mat = input.string("EMA", "Triple Smoothed MA Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

mat1 = input.string("EMA", "Signal Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

// === Trend Confirmation (Higher Timeframe Filter) ===

useTrendFilter = input.bool(true, "Enable Trend Filter (200 EMA)", group="Trend Confirmation")

trendMA = ta.ema(close, 200)

// === Momentum Filter (RSI Confirmation) ===

useRSIFilter = input.bool(true, "Enable RSI Confirmation", group="Momentum Confirmation")

rsi = ta.rsi(close, 14)

rsiThreshold = input.int(50, "RSI Threshold", group="Momentum Confirmation")

// === Volatility Filter (ATR) ===

useATRFilter = input.bool(true, "Enable ATR Filter", group="Volatility Filtering")

atr = ta.atr(14)

atrMa = ta.sma(atr, 14)

// === Risk Management (ATR-Based Stop Loss) ===

useAdaptiveSL = input.bool(true, "Use ATR-Based Stop Loss", group="Risk Management")

atrMultiplier = input.float(1.5, "ATR Multiplier for SL", minval=0.5, maxval=5, group="Risk Management")

takeProfitMultiplier = input.float(2, "Take Profit Multiplier", group="Risk Management")

// === Moving Average Function ===

ma(source, length, MAtype) =>

switch MAtype

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"RMA" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

// === Triple Smoothed Calculation ===

tripleSmoothedMA = ma(ma(ma(src, slength, mat), slength, mat), slength, mat)

signalLine = ma(tripleSmoothedMA, siglen, mat1)

// === Crossovers (Entry Signals) ===

bullishCrossover = ta.crossunder(signalLine, tripleSmoothedMA)

bearishCrossover = ta.crossover(signalLine, tripleSmoothedMA)

// === Additional Confirmation Conditions ===

trendLongCondition = not useTrendFilter or (close > trendMA) // Only long if price is above 200 EMA

trendShortCondition = not useTrendFilter or (close < trendMA) // Only short if price is below 200 EMA

rsiLongCondition = not useRSIFilter or (rsi > rsiThreshold) // RSI above 50 for longs

rsiShortCondition = not useRSIFilter or (rsi < rsiThreshold) // RSI below 50 for shorts

atrCondition = not useATRFilter or (atr > atrMa) // ATR must be above its MA for volatility confirmation

// === Final Trade Entry Conditions ===

longCondition = bullishCrossover and trendLongCondition and rsiLongCondition and atrCondition

shortCondition = bearishCrossover and trendShortCondition and rsiShortCondition and atrCondition

// === ATR-Based Stop Loss & Take Profit ===

longSL = close - (atr * atrMultiplier)

longTP = close + (atr * takeProfitMultiplier)

shortSL = close + (atr * atrMultiplier)

shortTP = close - (atr * takeProfitMultiplier)

// === Strategy Execution ===

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

// === Plots ===

plot(tripleSmoothedMA, title="Triple Smoothed MA", color=color.blue)

plot(signalLine, title="Signal Line", color=color.red)

plot(trendMA, title="200 EMA", color=color.gray)

// === Alerts ===

alertcondition(longCondition, title="Bullish Signal", message="Triple Smoothed MA Bullish Crossover Confirmed")

alertcondition(shortCondition, title="Bearish Signal", message="Triple Smoothed MA Bearish Crossover Confirmed")

相关推荐