概述

这是一个基于18日移动平均线(SMA18)的策略,结合了日内交易模式识别和智能追踪止损机制。该策略主要通过观察价格与SMA18的关系,结合日内高低点位置,在合适的时机进行多头入场。策略采用灵活的止损方案,既可以使用固定止损点,也可以使用两日最低点作为追踪止损基准。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 入场条件基于价格与18日均线的相对位置,可以选择在突破均线时入场或在均线之上入场 2. 通过分析日内K线形态,特别关注内部K线(Inside Bar)模式,提高入场的准确性 3. 根据每周不同交易日的表现特征,可以选择性地在特定日期进行交易 4. 入场价格设置采用限价单方式,在低点之上小幅溢价以提高成交概率 5. 止损机制支持两种模式:一种是基于入场价的固定止损,另一种是基于前两个交易日最低点的追踪止损

策略优势

- 结合技术指标和价格形态,入场信号更加可靠

- 灵活的交易时间选择机制,可以针对不同市场特征进行优化

- 智能的止损方案,既保护利润又给予价格足够的波动空间

- 策略参数可调节性强,适应不同市场环境

- 通过内部K线模式的筛选,有效降低虚假信号

策略风险

- 在剧烈波动市场中,固定止损可能导致过早出场

- 对于快速反转的行情,追踪止损可能锁定较少利润

- 在横盘整理阶段,频繁的内部K线可能导致过多交易 应对措施:

- 根据市场波动率动态调整止损距离

- 增加趋势确认指标

- 设置最小盈利目标来过滤低质量交易

策略优化方向

- 引入波动率指标(如ATR)来动态调整止损距离

- 增加成交量分析维度,提高信号可靠性

- 开发更智能的日期选择算法,根据历史表现自动优化交易时间

- 增加趋势强度过滤器,避免在弱趋势中交易

- 优化内部K线的识别算法,提高形态识别的准确性

总结

该策略通过结合多个维度的分析方法,构建了一个相对完整的交易系统。策略的核心优势在于其灵活的参数设置和智能的止损机制,使其能够适应不同的市场环境。通过持续优化和改进,该策略有望在各种市场条件下都能保持稳定的表现。

策略源码

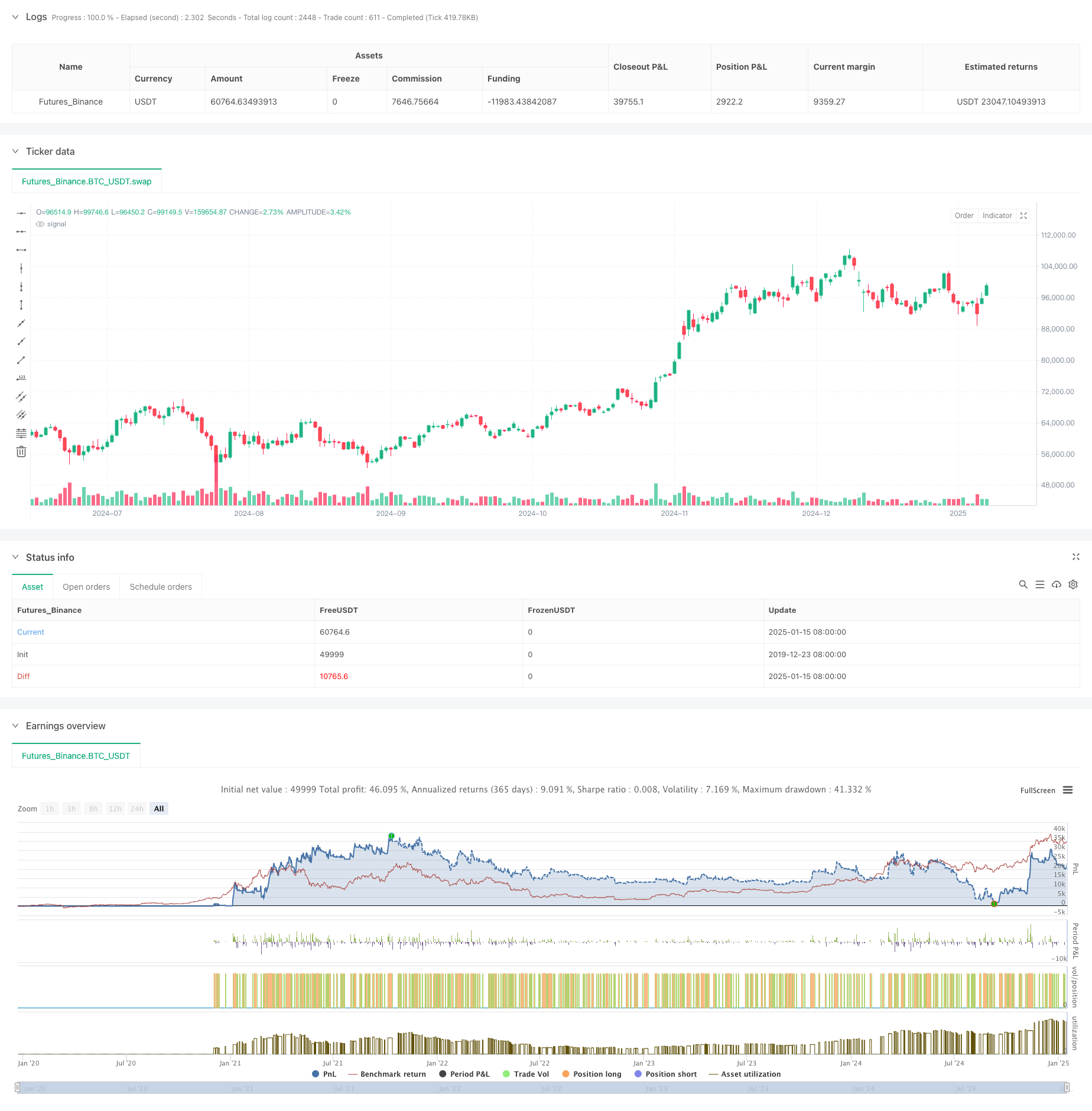

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-16 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © zweiprozent

strategy('Buy Low over 18 SMA Strategy', overlay=true, default_qty_value=1)

xing = input(false, title='crossing 18 sma?')

sib = input(false, title='trade inside Bars?')

shortinside = input(false, title='trade inside range bars?')

offset = input(title='offset', defval=0.001)

belowlow = input(title='stop below low minus', defval=0.001)

alsobelow = input(false, title='Trade only above 18 sma?')

tradeabove = input(false, title='Trade with stop above order?')

trailingtwo = input(false, title='exit with two days low trailing?')

insideBar() => //and high <= high[1] and low >= low[1] ? 1 : 0

open <= close[1] and close >= open[1] and close <= close[1] or open >= close[1] and open <= open[1] and close <= open[1] and close >= close[1] ? 1 : 0

inside() =>

high <= high[1] and low >= low[1] ? 1 : 0

enterIndex = 0.0

enterIndex := enterIndex[1]

inPosition = not na(strategy.position_size) and strategy.position_size > 0

if inPosition and na(enterIndex)

enterIndex := bar_index

enterIndex

//if strategy.position_size <= 0

// strategy.exit("Long", stop=low[0]-stop_loss,comment="stop loss")

//if not na(enterIndex) and bar_index - enterIndex + 0 >= 0

// strategy.exit("Long", stop=low[0]-belowlow,comment="exit")

// enterIndex := na

T_Low = request.security(syminfo.tickerid, 'D', low[0])

D_High = request.security(syminfo.tickerid, 'D', high[1])

D_Low = request.security(syminfo.tickerid, 'D', low[1])

D_Close = request.security(syminfo.tickerid, 'D', close[1])

D_Open = request.security(syminfo.tickerid, 'D', open[1])

W_High2 = request.security(syminfo.tickerid, 'W', high[1])

W_High = request.security(syminfo.tickerid, 'W', high[0])

W_Low = request.security(syminfo.tickerid, 'W', low[0])

W_Low2 = request.security(syminfo.tickerid, 'W', low[1])

W_Close = request.security(syminfo.tickerid, 'W', close[1])

W_Open = request.security(syminfo.tickerid, 'W', open[1])

//longStopPrice = strategy.position_avg_price * (1 - stopl)

// Go Long - if prev day low is broken and stop loss prev day low

entryprice = ta.sma(close, 18)

//(high[0]<=high[1]or close[0]<open[0]) and low[0]>vwma(close,30) and time>timestamp(2020,12,0,0,0)

showMon = input(true, title='trade tuesdays?')

showTue = input(true, title='trade wednesdayy?')

showWed = input(true, title='trade thursday?')

showThu = input(true, title='trade friday?')

showFri = input(true, title='trade saturday?')

showSat = input(true, title='trade sunday?')

showSun = input(true, title='trade monday?')

isMon() =>

dayofweek(time('D')) == dayofweek.monday and showMon

isTue() =>

dayofweek(time('D')) == dayofweek.tuesday and showTue

isWed() =>

dayofweek(time('D')) == dayofweek.wednesday and showWed

isThu() =>

dayofweek(time('D')) == dayofweek.thursday and showThu

isFri() =>

dayofweek(time('D')) == dayofweek.friday and showFri

isSat() =>

dayofweek(time('D')) == dayofweek.saturday and showSat

isSun() =>

dayofweek(time('D')) == dayofweek.sunday and showSun

clprior = close[0]

entryline = ta.sma(close, 18)[1]

//(isMon() or isTue()or isTue()or isWed()

noathigh = high < high[1] or high[2] < high[3] or high[1] < high[2] or low[1] < ta.sma(close, 18)[0] and close > ta.sma(close, 18)[0]

if noathigh and time > timestamp(2020, 12, 0, 0, 0) and (alsobelow == false or high >= ta.sma(close, 18)[0]) and (isMon() or isTue() or isWed() or isThu() or isFri() or isSat() or isSun()) and (high >= high[1] or sib or low <= low[1]) //((sib == false and inside()==true) or inside()==false) and (insideBar()==true or shortinside==false)

if tradeabove == false

strategy.entry('Long', strategy.long, limit=low + offset * syminfo.mintick, comment='long')

if tradeabove == true and (xing == false or clprior < entryline) // and high<high[1]

strategy.entry('Long', strategy.long, stop=high + offset * syminfo.mintick, comment='long')

//if time>timestamp(2020,12,0,0,0) and isSat()

// strategy.entry("Long", strategy.long, limit=0, comment="long")

//strategy.exit("Long", stop=low-400*syminfo.mintick)

//strategy.exit("Long", stop=strategy.position_avg_price-10*syminfo.mintick,comment="exit")

//strategy.exit("Long", stop=low[1]-belowlow*syminfo.mintick, comment="stop")

if strategy.position_avg_price > 0 and trailingtwo == false and close > strategy.position_avg_price

strategy.exit('Long', stop=strategy.position_avg_price, comment='stop')

if strategy.position_avg_price > 0 and trailingtwo == false and (low > strategy.position_avg_price or close < strategy.position_avg_price)

strategy.exit('Long', stop=low[0] - belowlow * syminfo.mintick, comment='stop')

if strategy.position_avg_price > 0 and trailingtwo

strategy.exit('Long', stop=ta.lowest(low, 2)[0] - belowlow * syminfo.mintick, comment='stop')

相关推荐