概述

这是一个结合了指数移动平均线(EMA)、成交量确认和波动率指标(ATR)的高级量化交易策略。该策略通过多重技术指标的配合使用,不仅能够准确把握市场趋势,还能通过成交量确认来提高交易的可靠性,同时利用ATR动态调整止损止盈位置,实现了一个全面的风险管理系统。

策略原理

策略的核心逻辑包含三个主要部分: 1. 趋势判断:使用EMA(50)作为趋势判断的主要指标。当价格位于EMA之上时判断为上升趋势,反之为下降趋势。 2. 成交量确认:通过计算20周期的成交量移动平均线(Volume MA),要求当前成交量不仅要高于移动平均线的1.5倍,还要大于前一周期成交量,以确保市场有足够的参与度。 3. 风险管理:基于14周期的ATR动态设置止损和止盈位置。止损设置为2倍ATR,止盈设置为3倍ATR,这种设置既保护了资金安全,又给了趋势充分发展的空间。

策略优势

- 多重确认机制:通过趋势和成交量的双重确认,大大提高了交易信号的可靠性。

- 动态风险管理:使用ATR进行动态止损止盈设置,能够更好地适应市场波动性的变化。

- 灵活性强:策略参数都可以根据不同市场条件进行调整,适应性强。

- 可视化清晰:策略提供了清晰的图形化信号显示,便于交易者直观判断。

策略风险

- 趋势反转风险:在剧烈的市场波动中,EMA可能产生滞后反应,导致信号延迟。

- 成交量假突破:某些特殊市场条件下,高成交量可能是假性突破的表现。

- 止损幅度:在某些情况下,2倍ATR的止损设置可能较大,需要考虑调整。

策略优化方向

- 引入趋势强度指标:可以考虑添加ADX等趋势强度指标,进一步提高趋势判断的准确性。

- 优化成交量过滤:可以引入更复杂的成交量分析方法,如OBV或者成交量加权移动平均等。

- 完善止损机制:可以考虑添加移动止损或者基于支撑阻力位的止损方式。

- 增加时间过滤:添加交易时间段过滤,避免在市场低活跃度期间产生虚假信号。

总结

该策略通过综合运用多个技术指标,建立了一个逻辑严密的交易系统。策略的核心优势在于多重确认机制和动态风险管理,但同时也需要注意趋势反转和成交量假突破等风险。通过持续优化和完善,该策略有望在实际交易中取得更好的表现。

策略源码

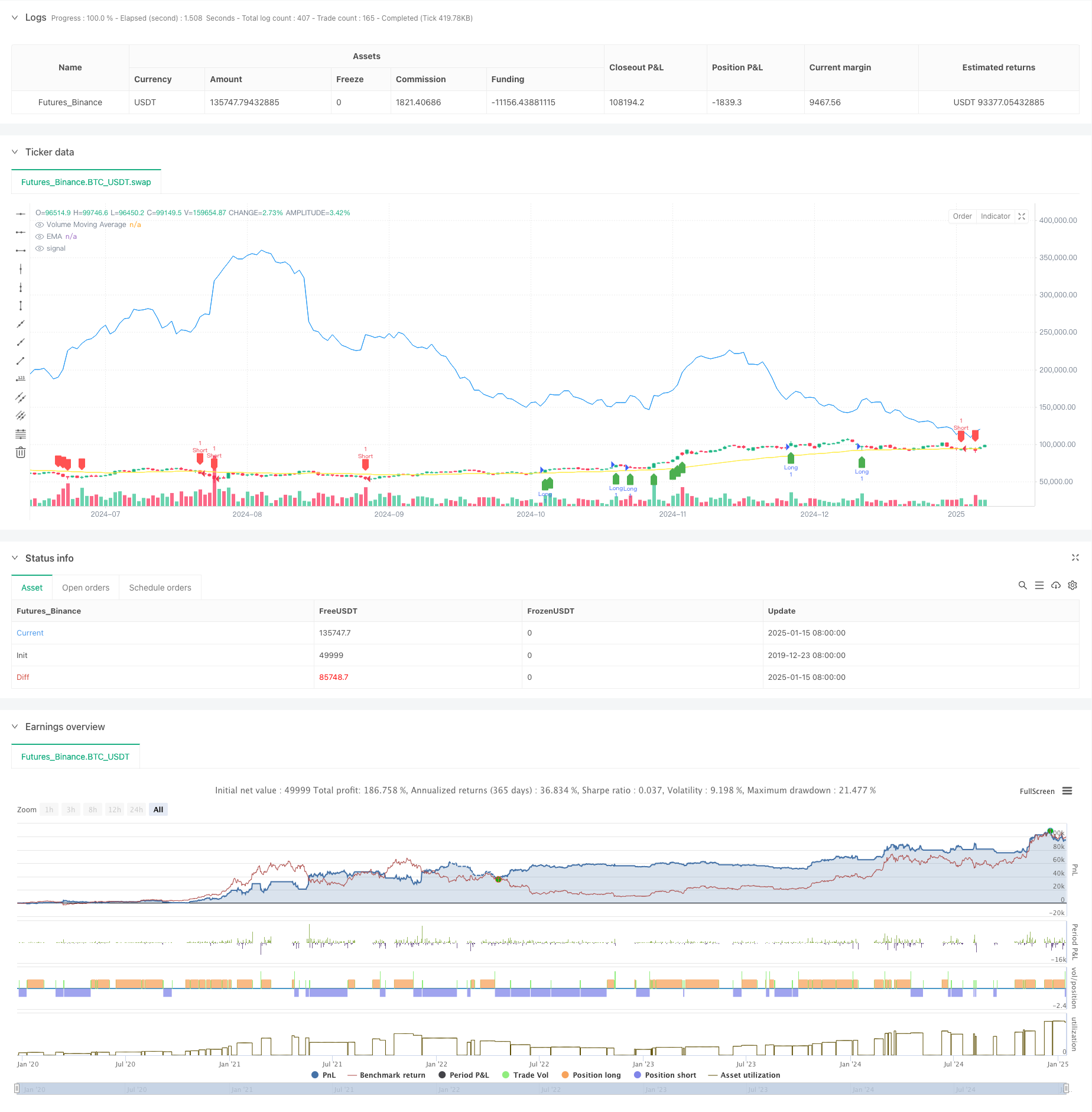

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-16 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Enhanced Volume + Trend Strategy", overlay=true)

// Inputs

emaLength = input.int(50, title="EMA Length")

atrLength = input.int(14, title="ATR Length")

atrMultiplierSL = input.float(2.0, title="ATR Multiplier for Stop Loss")

atrMultiplierTP = input.float(3.0, title="ATR Multiplier for Take Profit")

volLength = input.int(20, title="Volume Moving Average Length")

volMultiplier = input.float(1.5, title="Volume Multiplier (Relative to Previous Volume)")

// Trend Detection using EMA

ema = ta.ema(close, emaLength)

// ATR Calculation for Stop Loss/Take Profit

atr = ta.atr(atrLength)

// Volume Moving Average

volMA = ta.sma(volume, volLength)

// Additional Volume Condition (Current Volume > Previous Volume + Multiplier)

volCondition = volume > volMA * volMultiplier and volume > volume[1]

// Entry Conditions based on Trend (EMA) and Volume (Volume Moving Average)

longCondition = close > ema and volCondition

shortCondition = close < ema and volCondition

// Stop Loss and Take Profit Levels

longStopLoss = close - (atr * atrMultiplierSL)

longTakeProfit = close + (atr * atrMultiplierTP)

shortStopLoss = close + (atr * atrMultiplierSL)

shortTakeProfit = close - (atr * atrMultiplierTP)

// Strategy Execution

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", stop=longStopLoss, limit=longTakeProfit)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Short", stop=shortStopLoss, limit=shortTakeProfit)

// Plotting EMA

plot(ema, color=color.yellow, title="EMA")

// Plot Volume Moving Average

plot(volMA, color=color.blue, title="Volume Moving Average")

// Signal Visualizations

plotshape(series=longCondition, color=color.green, style=shape.labelup, location=location.belowbar, title="Buy Signal")

plotshape(series=shortCondition, color=color.red, style=shape.labeldown, location=location.abovebar, title="Sell Signal")

相关推荐