概述

该策略是一个基于高斯通道和随机RSI指标的动量交易系统,结合了季节性过滤和波动率管理。策略通过自适应高斯通道来识别市场趋势,使用随机RSI进行动量确认,并在特定的季节性窗口内执行交易。系统还整合了基于ATR的仓位管理,以控制每笔交易的风险敞口。

策略原理

策略的核心是基于多极点高斯滤波器构建的价格通道。该通道通过计算HLC3价格的高斯滤波值,并结合真实波动幅度(TR)的滤波结果,形成动态的上下轨道。交易信号的产生需要满足以下条件: 1. 价格突破上轨且主滤波趋势向上 2. 随机RSI指标显示超买状态 3. 当前时间在预设的季节性窗口内 4. 仓位规模基于ATR动态计算

平仓信号则由价格跌破下轨触发。整个系统通过多重过滤机制,提高了交易的稳定性。

策略优势

- 高斯滤波器具有出色的噪音过滤能力,能够有效捕捉真实的市场趋势

- 多极点设计提供了更精确的价格通道边界

- 整合了动量和趋势指标,提高了信号的可靠性

- 季节性过滤有助于避免不利的市场环境

- 动态仓位管理确保了风险的一致性

- 系统参数可根据不同市场条件进行优化

策略风险

- 高斯滤波器计算复杂,可能导致执行延迟

- 多重过滤条件可能错过一些重要的交易机会

- 系统对参数设置较为敏感,需要careful优化

- 季节性窗口的固定设置可能不适应市场环境变化

- 在高波动期间,ATR基础的仓位控制可能过于保守

策略优化方向

- 引入自适应的季节性窗口,通过市场条件动态调整交易时间

- 优化高斯滤波器的计算效率,减少执行延迟

- 加入市场波动率调节机制,在不同市场环境下调整过滤条件

- 开发更灵活的仓位管理系统,平衡风险和收益

- 增加多时间框架分析,提高信号的可靠性

总结

这是一个构建完善的趋势跟踪系统,通过多层过滤和风险管理机制提高了交易的稳定性。虽然存在一些优化空间,但整体设计理念符合现代量化交易的要求。策略的成功关键在于参数的精确调整和对市场环境的适应性。

策略源码

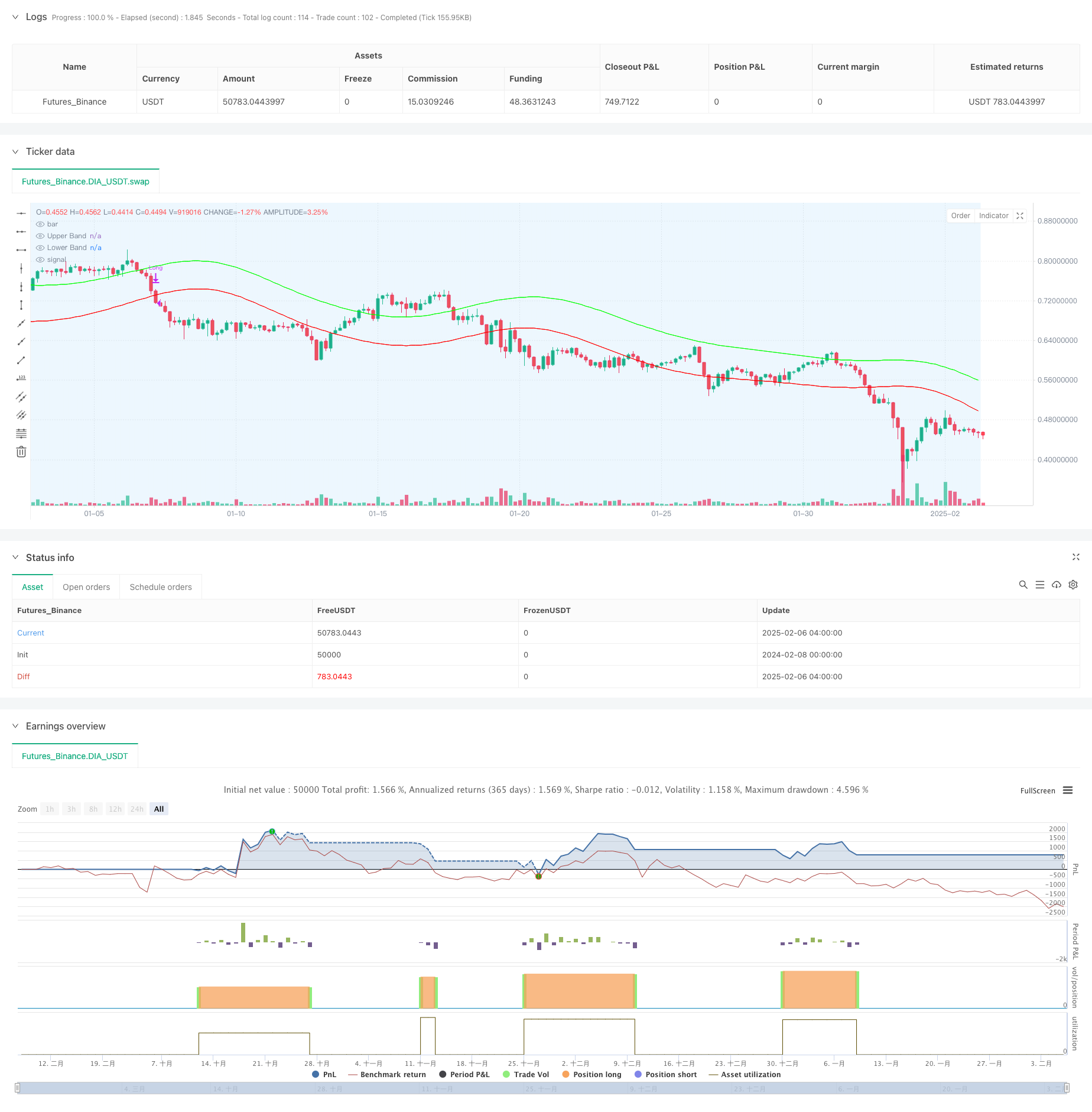

/*backtest

start: 2024-02-08 00:00:00

end: 2025-02-06 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"DIA_USDT"}]

*/

//@version=6

strategy("Demo GPT - Gold Gaussian Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1)

// ====== INPUTS ======

// Gaussian Channel

lengthGC = input.int(144, "Gaussian Period", minval=20)

poles = input.int(4, "Poles", minval=1, maxval=9)

multiplier = input.float(1.414, "Volatility Multiplier", minval=1)

// Stochastic RSI

smoothK = input.int(3, "Stoch K", minval=1)

lengthRSI = input.int(14, "RSI Length", minval=1)

lengthStoch = input.int(14, "Stoch Length", minval=1)

overbought = input.int(80, "Overbought Level", minval=50)

// Seasonal Filter (corrected)

startMonth = input.int(9, "Start Month (1-12)", minval=1, maxval=12)

endMonth = input.int(2, "End Month (1-12)", minval=1, maxval=12)

// Volatility Management

atrLength = input.int(22, "ATR Length", minval=5)

riskPercent = input.float(0.5, "Risk per Trade (%)", minval=0.1, step=0.1)

// ====== GAUSSIAN CHANNEL ======

f_filt9x(alpha, source, iterations) =>

float f = 0.0

float x = 1 - alpha

int m2 = iterations == 9 ? 36 : iterations == 8 ? 28 : iterations == 7 ? 21 :

iterations == 6 ? 15 : iterations == 5 ? 10 : iterations == 4 ? 6 :

iterations == 3 ? 3 : iterations == 2 ? 1 : 0

int m3 = iterations == 9 ? 84 : iterations == 8 ? 56 : iterations == 7 ? 35 :

iterations == 6 ? 20 : iterations == 5 ? 10 : iterations == 4 ? 4 :

iterations == 3 ? 1 : 0

int m4 = iterations == 9 ? 126 : iterations == 8 ? 70 : iterations == 7 ? 35 :

iterations == 6 ? 15 : iterations == 5 ? 5 : iterations == 4 ? 1 : 0

int m5 = iterations == 9 ? 126 : iterations == 8 ? 56 : iterations == 7 ? 21 :

iterations == 6 ? 6 : iterations == 5 ? 1 : 0

int m6 = iterations == 9 ? 84 : iterations == 8 ? 28 : iterations == 7 ? 7 :

iterations == 6 ? 1 : 0

int m7 = iterations == 9 ? 36 : iterations == 8 ? 8 : iterations == 7 ? 1 : 0

int m8 = iterations == 9 ? 9 : iterations == 8 ? 1 : 0

int m9 = iterations == 9 ? 1 : 0

f := math.pow(alpha, iterations) * nz(source) +

iterations * x * nz(f[1]) -

(iterations >= 2 ? m2 * math.pow(x, 2) * nz(f[2]) : 0) +

(iterations >= 3 ? m3 * math.pow(x, 3) * nz(f[3]) : 0) -

(iterations >= 4 ? m4 * math.pow(x, 4) * nz(f[4]) : 0) +

(iterations >= 5 ? m5 * math.pow(x, 5) * nz(f[5]) : 0) -

(iterations >= 6 ? m6 * math.pow(x, 6) * nz(f[6]) : 0) +

(iterations >= 7 ? m7 * math.pow(x, 7) * nz(f[7]) : 0) -

(iterations >= 8 ? m8 * math.pow(x, 8) * nz(f[8]) : 0) +

(iterations == 9 ? m9 * math.pow(x, 9) * nz(f[9]) : 0)

f

f_pole(alpha, source, iterations) =>

float fn = na

float f1 = f_filt9x(alpha, source, 1)

float f2 = iterations >= 2 ? f_filt9x(alpha, source, 2) : na

float f3 = iterations >= 3 ? f_filt9x(alpha, source, 3) : na

float f4 = iterations >= 4 ? f_filt9x(alpha, source, 4) : na

float f5 = iterations >= 5 ? f_filt9x(alpha, source, 5) : na

float f6 = iterations >= 6 ? f_filt9x(alpha, source, 6) : na

float f7 = iterations >= 7 ? f_filt9x(alpha, source, 7) : na

float f8 = iterations >= 8 ? f_filt9x(alpha, source, 8) : na

float f9 = iterations == 9 ? f_filt9x(alpha, source, 9) : na

fn := iterations == 1 ? f1 :

iterations == 2 ? f2 :

iterations == 3 ? f3 :

iterations == 4 ? f4 :

iterations == 5 ? f5 :

iterations == 6 ? f6 :

iterations == 7 ? f7 :

iterations == 8 ? f8 :

iterations == 9 ? f9 : na

[fn, f1]

beta = (1 - math.cos(4 * math.asin(1) / lengthGC)) / (math.pow(1.414, 2 / poles) - 1)

alpha = -beta + math.sqrt(math.pow(beta, 2) + 2 * beta)

lag = int((lengthGC - 1) / (2 * poles))

srcAdjusted = hlc3 + (hlc3 - hlc3[lag])

[mainFilter, filt1] = f_pole(alpha, srcAdjusted, poles)

[trFilter, tr1] = f_pole(alpha, ta.tr(true), poles)

upperBand = mainFilter + trFilter * multiplier

lowerBand = mainFilter - trFilter * multiplier

// ====== STOCHASTIC RSI ======

rsiValue = ta.rsi(close, lengthRSI)

k = ta.sma(ta.stoch(rsiValue, rsiValue, rsiValue, lengthStoch), smoothK)

stochSignal = k >= overbought

// ====== SEASONAL FILTER (FIXED) ======

currentMonth = month(time)

inSeason = (currentMonth >= startMonth and currentMonth <= 12) or

(currentMonth >= 1 and currentMonth <= endMonth)

// ====== VOLATILITY MANAGEMENT ======

atr = ta.atr(atrLength)

positionSize = math.min((strategy.equity * riskPercent/100) / atr, strategy.equity * 0.5 / close)

// ====== TRADING LOGIC ======

trendUp = mainFilter > mainFilter[1]

priceAbove = close > upperBand

longCondition = trendUp and priceAbove and stochSignal and inSeason

exitCondition = ta.crossunder(close, lowerBand)

// ====== EXECUTION ======

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

if exitCondition

strategy.close("Long")

// ====== VISUALIZATION ======

plot(upperBand, "Upper Band", color=color.new(#00FF00, 0))

plot(lowerBand, "Lower Band", color=color.new(#FF0000, 0))

bgcolor(inSeason ? color.new(color.blue, 90) : na, title="Season Filter")

相关推荐