概述

该策略是一个基于技术分析的动态趋势跟踪系统,主要利用双均线(200日简单移动平均线和21周指数移动平均线)来识别市场趋势。策略通过整合相对强弱指标(RSI)和平均趋向指标(ADX)作为动量过滤器,并结合真实波幅(ATR)进行动态风险管理,实现了对上升趋势的精确捕捉和风险的有效控制。

策略原理

策略的核心逻辑建立在以下几个关键要素之上: 1. 使用200日简单移动平均线(SMA)和21周指数移动平均线(EMA)的双重确认来定义多头市场条件 2. 通过RSI>50的条件确保动量持续向上 3. 利用ADX>25的条件验证趋势强度 4. 基于ATR的动态止损设置,提供了与市场波动相适应的风险控制 5. 采用百分比止盈机制,确保在达到预期收益时及时获利了结

策略优势

- 系统具有良好的适应性,可以根据市场波动动态调整止损位置

- 双均线交叉提供了可靠的趋势确认信号,有效降低假突破风险

- 通过RSI和ADX的配合,显著提高了入场信号的质量

- 策略参数高度可定制,便于根据不同市场环境进行优化

- 采用日线级别交易,降低了交易成本和短期波动影响

策略风险

- 在震荡市场中可能产生频繁的假信号,增加交易成本

- 均线策略天然具有滞后性,可能错过趋势初期的部分收益

- 多重过滤条件可能导致错过某些潜在的交易机会

- 在剧烈波动市场中,基于ATR的止损可能会过于宽松

- 固定百分比止盈可能在强势趋势中过早了结盈利部位

策略优化方向

- 可以引入成交量指标作为辅助确认,提高信号可靠性

- 考虑添加动态止盈机制,更好地适应不同市场阶段

- 优化RSI和ADX的参数设置,提高信号的及时性

- 增加趋势强度的分级判断,实现仓位的动态管理

- 引入市场波动率指标,在高波动期间适当调整交易频率

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略,通过多重技术指标的配合使用,较好地平衡了收益和风险。策略的可定制性强,适合在不同市场环境下通过参数优化来保持其有效性。虽然存在一定的滞后性风险,但通过完善的风险控制机制,策略整体表现出较好的稳定性和可靠性。

策略源码

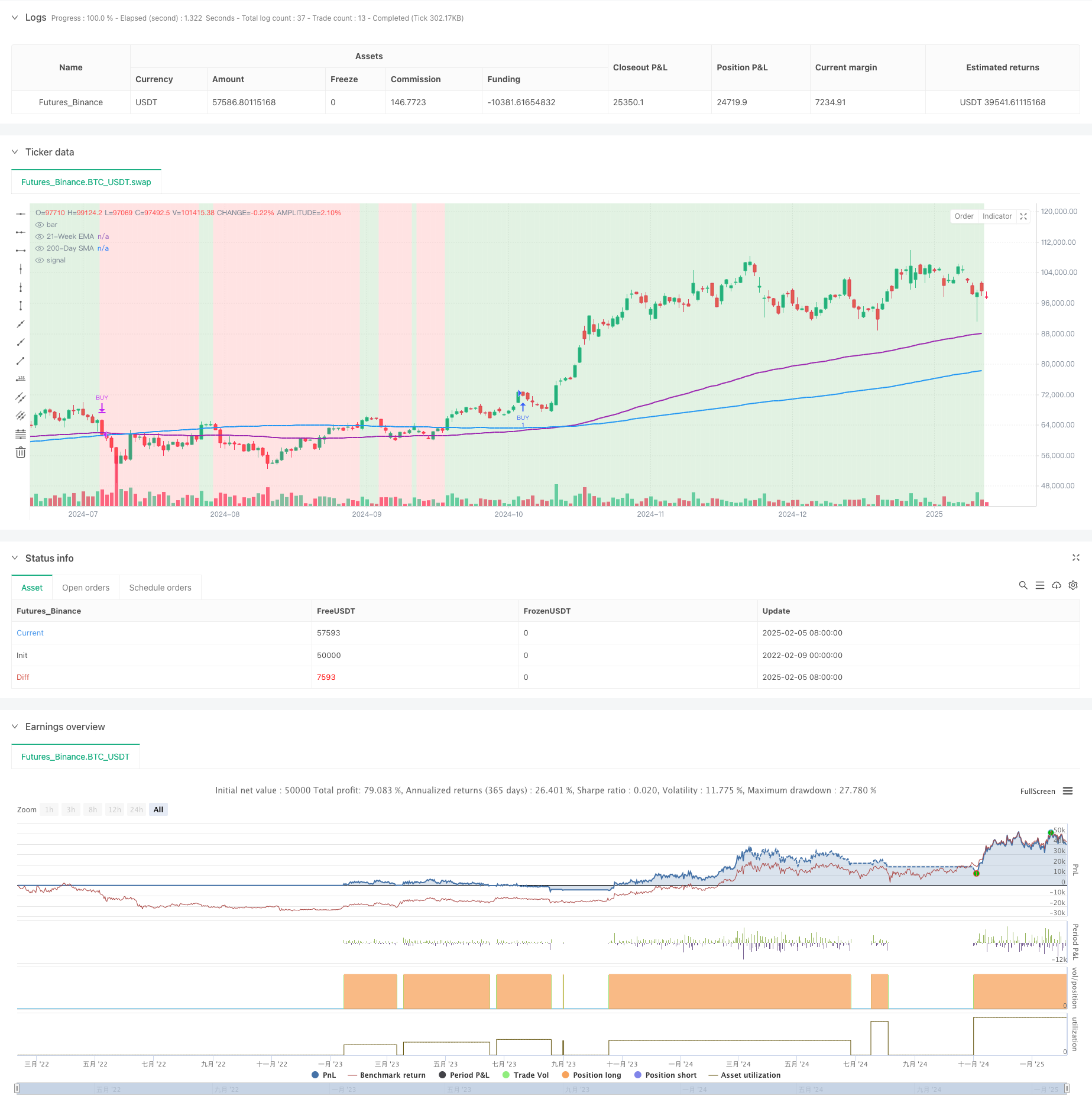

/*backtest

start: 2022-02-09 00:00:00

end: 2025-02-06 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("BTCUSDT Daily - Enhanced Bitcoin Bull Market Support [CYRANO]", shorttitle="BTCUSDT Daily BULL MARKET", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs

smaLength = input.int(200, title="SMA Length (Bull Market)")

emaLength = input.int(147, title="EMA Length (21-Week Approximation)")

atrLength = input.int(14, title="ATR Length")

riskATR = input.float(2.0, title="ATR Multiplier for Stop Loss", step=0.1)

takeProfitPercent = input.float(10.0, title="Take Profit (%)", step=0.1)

rsiFilter = input.bool(true, title="Enable RSI Filter")

rsiLength = input.int(14, title="RSI Length")

adxFilter = input.bool(true, title="Enable ADX Filter")

adxThreshold = input.float(25, title="ADX Threshold")

// Date Range Filter

startDate = input(timestamp("2018-01-01 00:00 +0000"), title="Start Date")

endDate = input(timestamp("2069-12-31 00:00 +0000"), title="End Date")

inDateRange = true

// Moving Averages

sma200 = ta.sma(close, smaLength)

ema21w = ta.ema(close, emaLength)

// ATR Calculation

atr = ta.atr(atrLength)

stopLoss = close - (riskATR * atr)

takeProfit = close * (1 + takeProfitPercent / 100)

// RSI Filter

rsi = ta.rsi(close, rsiLength)

rsiCondition = rsiFilter ? rsi > 50 : true

// ADX Filter

[diplus, diminus, adx] = ta.dmi(14, 14)

adxCondition = adxFilter ? adx > adxThreshold : true

// Entry and Exit Conditions

buyCondition = inDateRange and close > sma200 and close > ema21w and rsiCondition and adxCondition

exitCondition = inDateRange and (close < sma200 or close < ema21w)

// Strategy Execution

if buyCondition

strategy.entry("BUY", strategy.long, stop=stopLoss, limit=takeProfit)

if exitCondition

strategy.close("BUY")

// Plot MAs

plot(sma200, title="200-Day SMA", color=color.blue, linewidth=2)

plot(ema21w, title="21-Week EMA", color=color.purple, linewidth=2)

// Background Highlight

bullColor = color.new(color.green, 80)

bearColor = color.new(color.red, 80)

bgcolor(close > sma200 and close > ema21w ? bullColor : bearColor, title="Bull Market Background")

相关推荐