概述

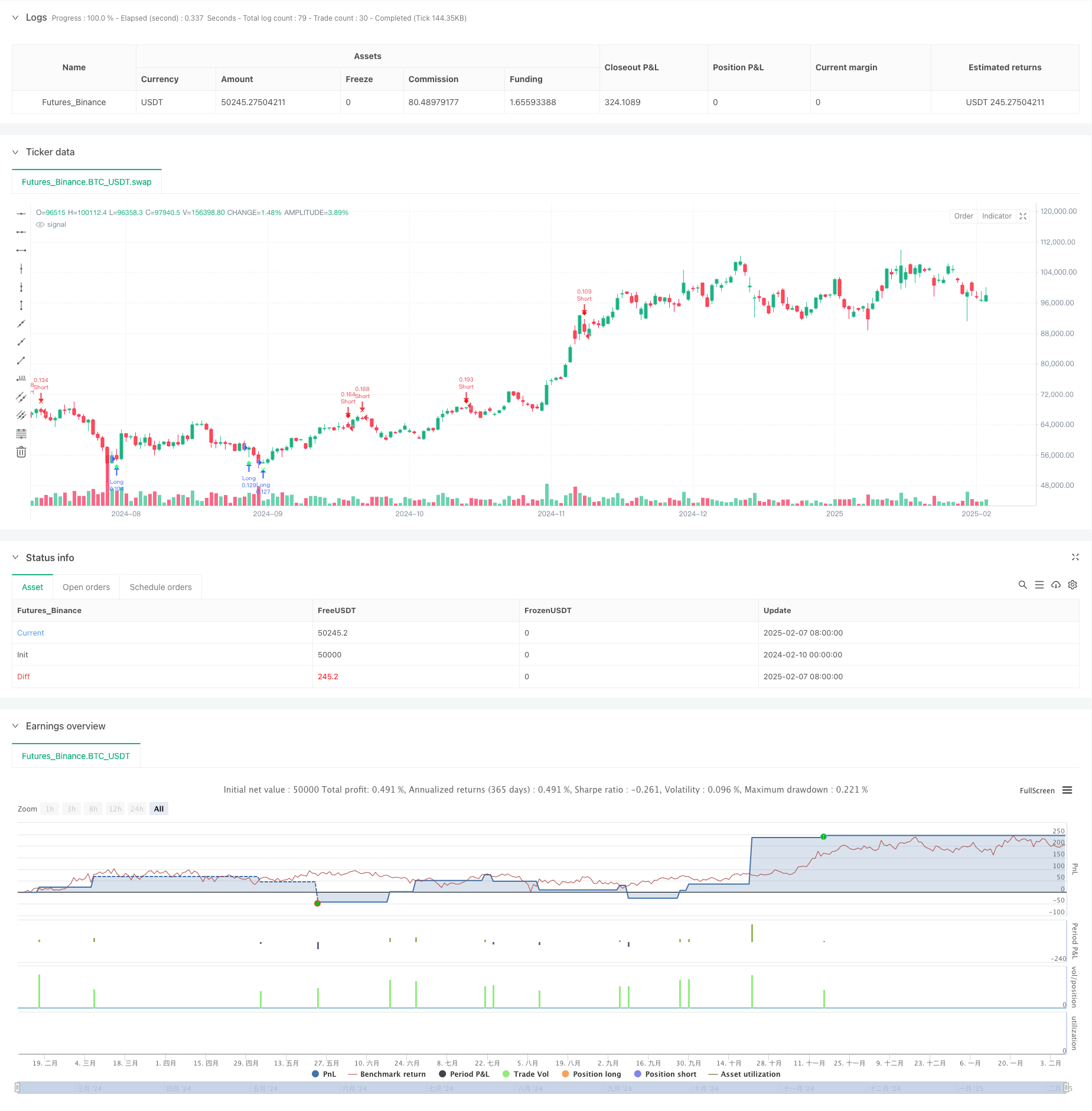

本策略是一个基于市场疲劳度分析的多层级交易系统,通过对价格动态的深入分析来识别市场可能出现转折的关键时刻。该策略结合了动态的风险管理机制,包括资金管理、止损优化以及回撤控制等多个维度,形成了一个完整的交易决策框架。

策略原理

策略核心是通过监测价格连续运动来判断市场疲劳程度。具体来说: 1. 通过比较当前收盘价与之前第4根K线的收盘价来确定趋势方向 2. 设置了三个不同强度级别(9/12/14)的信号触发点 3. 当价格持续朝一个方向运动时,系统会累积信号计数 4. 一旦达到预设的信号强度阈值,系统会给出相应级别的交易信号 5. 整合了基于ATR的动态止损机制和风险回报比的仓位管理系统

策略优势

- 多层级信号系统提供了不同程度的交易机会识别

- 通过资金管理和风险控制机制来保护资金安全

- 采用ATR动态止损,能更好地适应市场波动

- 引入了追踪止损机制,可以更好地锁定利润

- 设置了最大回撤保护,避免过度损失

- 系统具有良好的可扩展性和参数优化空间

策略风险

- 在震荡市场中可能产生错误信号

- 固定的信号阈值可能不适合所有市场环境

- 快速反转行情下止损可能较大

- 需要较多的参数优化工作

- 资金管理系统可能在某些情况下限制获利空间

策略优化方向

- 引入市场波动率过滤机制,在不同波动环境下调整信号阈值

- 增加成交量分析维度,提高信号可靠性

- 开发自适应的参数优化系统

- 加入更多的市场环境分析指标

- 优化资金管理系统,使其更具灵活性

总结

该策略通过多层级的疲劳度分析和完善的风险管理系统,为交易者提供了一个系统化的交易框架。虽然存在一些需要优化的地方,但整体设计理念完整,具有实际应用价值。建议在实盘中采用保守的资金管理策略,并持续进行参数优化和系统改进。

策略源码

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(title="Improved Exhaustion Signal with Risk Management and Drawdown Control", shorttitle="Exhaustion Signal", overlay=true)

// ———————————————— INPUT SETTINGS ————————————————

showLevel1 = input.bool(true, 'Show Level 1 Signals')

showLevel2 = input.bool(true, 'Show Level 2 Signals')

showLevel3 = input.bool(true, 'Show Level 3 Signals')

// Thresholds for signal strength levels

level1 = 9

level2 = 12

level3 = 14

// Risk management inputs

riskPercentage = input.float(1.0, title="Risk Percentage per Trade", minval=0.1, maxval=5.0) // Risk per trade in percentage

riskRewardRatio = input.float(2.0, title="Risk-to-Reward Ratio", minval=1.0, maxval=5.0) // Reward-to-risk ratio

trailingStop = input.bool(true, title="Enable Trailing Stop") // Enable/Disable trailing stop

trailingStopDistance = input.int(50, title="Trailing Stop Distance (in points)", minval=1) // Distance for trailing stop

// Drawdown protection settings

maxDrawdown = input.float(10.0, title="Max Drawdown Percentage", minval=0.1, maxval=50.0) // Max allowable drawdown before stopping trading

// ———————————————— GLOBAL VARIABLES ————————————————

var int cycle = 0

var int bullishSignals = 0

var int bearishSignals = 0

var float equityHigh = na // Initialize as undefined

// Track equity drawdown

if (na(equityHigh) or strategy.equity > equityHigh)

equityHigh := strategy.equity

drawdownPercent = 100 * (equityHigh - strategy.equity) / equityHigh

// Stop trading if drawdown exceeds the limit

if drawdownPercent >= maxDrawdown

strategy.close_all()

// ———————————————— FUNCTION: RESET & IMMEDIATE RECHECK USING AN ARRAY RETURN ————————————————

f_resetAndRecheck(_bullish, _bearish, _cycle, _close, _close4) =>

newBullish = _bullish

newBearish = _bearish

newCycle = _cycle

// Reset cycle if necessary based on price action

newBullish := 0

newBearish := 0

newCycle := 0

if _close < _close4

newBullish := 1

newCycle := newBullish

else if _close > _close4

newBearish := 1

newCycle := newBearish

resultArray = array.new_int(3, 0)

array.set(resultArray, 0, newBullish)

array.set(resultArray, 1, newBearish)

array.set(resultArray, 2, newCycle)

resultArray

// ———————————————— EXHAUSTION LOGIC ————————————————

if cycle < 9

// Bullish cycle: close < close[4]

if close < close[4]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

// Bearish cycle: close > close[4]

else if close > close[4]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

// ——— BULLISH checks ———

if bullishSignals > 0

if bullishSignals < (level3 - 1)

if close < close[3]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bullishSignals == (level3 - 1)

if close < close[2]

bullishSignals := level3

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ——— BEARISH checks ———

else if bearishSignals > 0

if bearishSignals < (level3 - 1)

if close > close[3]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bearishSignals == (level3 - 1)

if close > close[2]

bearishSignals := level3

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ———————————————— SIGNAL FLAGS ————————————————

bullishLevel1 = showLevel1 and (bullishSignals == level1)

bearishLevel1 = showLevel1 and (bearishSignals == level1)

bullishLevel2 = showLevel2 and (bullishSignals == level2)

bearishLevel2 = showLevel2 and (bearishSignals == level2)

bullishLevel3 = showLevel3 and (bullishSignals == level3)

bearishLevel3 = showLevel3 and (bearishSignals == level3)

// ———————————————— PLOT SIGNALS ————————————————

plotshape(bullishLevel1, style=shape.diamond, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 1 Bullish Signal")

plotshape(bearishLevel1, style=shape.diamond, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 1 Bearish Signal")

plotshape(bullishLevel2, style=shape.xcross, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 2 Bullish Signal")

plotshape(bearishLevel2, style=shape.xcross, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 2 Bearish Signal")

plotshape(bullishLevel3, style=shape.flag, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 3 Bullish Signal")

plotshape(bearishLevel3, style=shape.flag, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 3 Bearish Signal")

// ———————————————— RESET AFTER LEVEL 3 ————————————————

if bullishSignals == level3 or bearishSignals == level3

bullishSignals := 0

bearishSignals := 0

cycle := 0

// ———————————————— BACKTEST LOGIC ————————————————

// Set up basic long and short entry conditions based on signal levels

longCondition = bullishLevel1 or bullishLevel2 or bullishLevel3

shortCondition = bearishLevel1 or bearishLevel2 or bearishLevel3

// Calculate position size based on risk percentage

equity = strategy.equity

riskAmount = equity * riskPercentage / 100

atr = ta.atr(14)

stopLossLevel = atr * 1.5 // Using ATR for dynamic stop-loss

positionSize = riskAmount / stopLossLevel

// Initialize strategy logic

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

if shortCondition

strategy.entry("Short", strategy.short, qty=positionSize)

// ———————————————— CONCRETE STOP LOSS AND TAKE PROFIT ————————————————

stopLoss = stopLossLevel

takeProfit = stopLoss * riskRewardRatio

// Apply stop loss and take profit to the strategy based on concrete price levels

strategy.exit("Exit Long", from_entry="Long", stop=close - stopLoss, limit=close + takeProfit)

strategy.exit("Exit Short", from_entry="Short", stop=close + stopLoss, limit=close - takeProfit)

// ———————————————— TRAILING STOP ————————————————

if trailingStop

strategy.exit("Exit Long Trailing", from_entry="Long", trail_price=close - trailingStopDistance, trail_offset=trailingStopDistance)

strategy.exit("Exit Short Trailing", from_entry="Short", trail_price=close + trailingStopDistance, trail_offset=trailingStopDistance)

相关推荐