概述

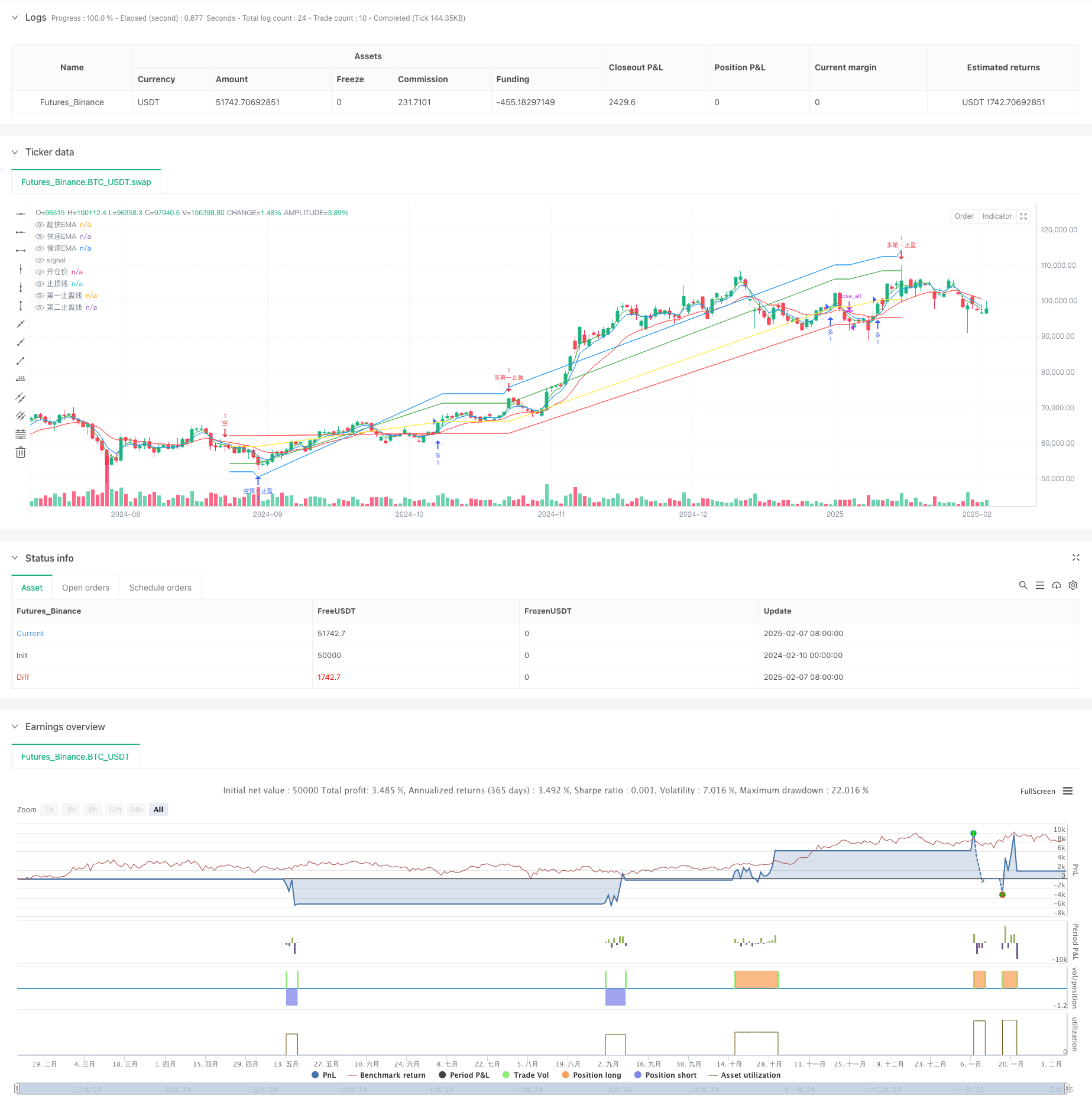

这是一个结合了趋势跟随和技术分析的量化交易策略。该策略通过多重技术指标确认交易信号,采用分批止盈和动态仓位管理机制,旨在捕捉市场的主要趋势同时控制风险。策略整合了EMA、MACD和RSI等多个技术指标,通过指标之间的交叉和背离来识别潜在的交易机会。

策略原理

策略的核心交易逻辑基于以下几个关键要素: 1. 入场信号采用多重技术指标过滤:快速EMA与慢速EMA的交叉、MACD金叉/死叉信号以及RSI超买超卖指标。多头入场要求快速EMA上穿慢速EMA、MACD金叉且RSI低于70;空头入场则需要快速EMA下穿慢速EMA、MACD死叉且RSI高于30。 2. 风险控制采用固定比例止损,设置在开仓价格的5%处。 3. 分批止盈机制:第一止盈位于8%处,第二止盈位于12%处,通过动态调整第二止盈位置来适应市场波动。 4. 仓位管理基于ATR动态计算,单笔最大风险控制在5%,最大仓位不超过账户权益的40%。

策略优势

- 多重技术指标交叉验证,能有效过滤虚假信号,提高交易质量。

- 采用分批止盈机制,既能锁定部分盈利,又不会完全错过行情延续带来的收益。

- 动态仓位管理系统能根据市场波动性自动调整交易规模,有效控制风险。

- 完善的风控体系,包括固定止损、动态仓位和最大持仓限制,确保策略的长期稳定性。

- 策略逻辑清晰,参数可调整性强,便于根据不同市场环境进行优化。

策略风险

- 快速波动市场中可能面临止损频繁的问题,需要注意市场波动率过高时调整参数或暂停交易。

- 横盘市场中来回震荡可能导致连续止损,建议增加横盘判断机制。

- 多重指标过滤可能导致错过部分行情,在强趋势市场中的表现可能不及单一指标策略。

- 分批止盈机制在急速反转市场中可能无法及时平仓,需要考虑增加反转信号判断。

策略优化方向

- 考虑引入市场波动率过滤机制,在波动率过高时降低仓位或暂停交易。

- 可以增加趋势强度判断,在强趋势期间调整止盈位置,以获取更多趋势利润。

- 优化仓位管理系统,考虑加入基于盈亏比的动态仓位调整。

- 增加市场状态判断机制,在不同市场状态下使用不同的参数组合。

- 考虑加入成交量指标,提高交易信号的可靠性。

总结

该策略通过多重技术指标的配合使用,结合分批止盈和动态仓位管理,构建了一个相对完善的交易系统。策略的优势在于风险控制全面,交易信号可靠性高,但也存在可能错过部分行情的劣势。通过持续优化和参数调整,该策略有望在不同市场环境下保持稳定表现。

策略源码

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Hang Strategy Aggressive", overlay=true, initial_capital=1000, currency=currency.USDT, default_qty_type=strategy.cash, default_qty_value=100)

// === 参数设置 ===

fastLength = input.int(5, "快速EMA长度")

slowLength = input.int(15, "慢速EMA长度")

rsiLength = input.int(7, "RSI长度")

atrPeriod = input.int(10, "ATR周期")

leverageMultiple = input.float(3.0, "杠杆倍数", minval=1.0, step=0.5)

// === 止盈止损参数 ===

stopLossPercent = input.float(5.0, "止损百分比", minval=1.0, step=0.5)

firstTakeProfitPercent = input.float(8.0, "第一止盈点百分比", minval=1.0, step=0.5)

secondTakeProfitPercent = input.float(12.0, "第二止盈点百分比", minval=1.0, step=0.5)

firstTakeProfitQtyPercent = input.float(50.0, "第一止盈仓位百分比", minval=1.0, maxval=100.0, step=5.0)

// === 技术指标 ===

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

superFastEMA = ta.ema(close, 3)

rsi = ta.rsi(close, rsiLength)

atr = ta.atr(atrPeriod)

// === 趋势判断 ===

[macdLine, signalLine, histLine] = ta.macd(close, 12, 26, 9)

macdCross = (macdLine > signalLine) and (macdLine[1] < signalLine[1])

macdCrossDown = (macdLine < signalLine) and (macdLine[1] > signalLine[1])

// === 交易信号 ===

longCondition = (fastEMA > slowEMA) and macdCross and (rsi < 70)

shortCondition = (fastEMA < slowEMA) and macdCrossDown and (rsi > 30)

// === 平仓信号 ===

exitLong = shortCondition or (fastEMA < slowEMA)

exitShort = longCondition or (fastEMA > slowEMA)

// === 仓位管理 ===

maxRiskPerTrade = 0.05

basePosition = strategy.equity * maxRiskPerTrade

atrAmount = atr * close

riskPosition = basePosition / atrAmount * leverageMultiple

positionSize = math.min(riskPosition, strategy.equity * 0.4 / close)

// === 交易状态变量 ===

var isLong = false

var isShort = false

var partialTpTriggered = false

var float stopPrice = na

var float firstTpPrice = na

var float secondTpPrice = na

var float firstTpQty = na

// === 交易执行 ===

// 多头入场

if (longCondition and not isLong and not isShort)

strategy.entry("多", strategy.long, qty=positionSize)

isLong := true

partialTpTriggered := false

// 空头入场

if (shortCondition and not isShort and not isLong)

strategy.entry("空", strategy.short, qty=positionSize)

isShort := true

partialTpTriggered := false

// === 止盈止损逻辑 ===

if (strategy.position_size > 0) // 多仓

stopPrice := strategy.position_avg_price * (1 - stopLossPercent/100)

firstTpPrice := strategy.position_avg_price * (1 + firstTakeProfitPercent/100)

// 只在未触发第一止盈时计算第二止盈价格

if not partialTpTriggered

secondTpPrice := strategy.position_avg_price * (1 + secondTakeProfitPercent/100)

if (close[1] <= stopPrice or low <= stopPrice)

strategy.close_all("多止损")

isLong := false

partialTpTriggered := false

if (not partialTpTriggered and (close[1] >= firstTpPrice or high >= firstTpPrice))

strategy.order("多第一止盈", strategy.short, qty=firstTpQty)

partialTpTriggered := true

// 在这里重新计算第二止盈价格

secondTpPrice := high * (1 + 0.04) // 基于当前最高价再上涨4%

if (close[1] >= secondTpPrice or high >= secondTpPrice)

strategy.close_all("多第二止盈")

isLong := false

partialTpTriggered := false

if (strategy.position_size < 0) // 空仓

stopPrice := strategy.position_avg_price * (1 + stopLossPercent/100)

firstTpPrice := strategy.position_avg_price * (1 - firstTakeProfitPercent/100)

// 只在未触发第一止盈时计算第二止盈价格

if not partialTpTriggered

secondTpPrice := strategy.position_avg_price * (1 - secondTakeProfitPercent/100)

if (close[1] >= stopPrice or high >= stopPrice)

strategy.close_all("空止损")

isShort := false

partialTpTriggered := false

if (not partialTpTriggered and (close[1] <= firstTpPrice or low <= firstTpPrice))

strategy.order("空第一止盈", strategy.long, qty=firstTpQty)

partialTpTriggered := true

// 在这里重新计算第二止盈价格

secondTpPrice := low * (1 - 0.04) // 基于当前最低价再下跌4%

if (close[1] <= secondTpPrice or low <= secondTpPrice)

strategy.close_all("空第二止盈")

isShort := false

partialTpTriggered := false

// === 其他平仓条件 ===

if (exitLong and isLong)

strategy.close_all("多平仓")

isLong := false

partialTpTriggered := false

if (exitShort and isShort)

strategy.close_all("空平仓")

isShort := false

partialTpTriggered := false

// === 绘图 ===

plot(fastEMA, "快速EMA", color=color.blue)

plot(slowEMA, "慢速EMA", color=color.red)

plot(superFastEMA, "超快EMA", color=color.green)

// 绘制止盈止损线

plot(strategy.position_size != 0 ? strategy.position_avg_price : na, "开仓价", color=color.yellow)

plot(strategy.position_size != 0 ? stopPrice : na, "止损线", color=color.red)

plot(strategy.position_size != 0 ? firstTpPrice : na, "第一止盈线", color=color.green)

plot(strategy.position_size != 0 ? secondTpPrice : na, "第二止盈线", color=color.blue)

相关推荐