概述

该策略是一个结合了多个技术指标的复杂量化交易系统,通过趋势跟随和动量分析相结合的方式进行交易。策略整合了成交量加权平均价(VWAP)、指数移动平均线(EMA)、相对强弱指标(RSI)等多个指标,构建了一个全面的交易决策框架。该策略主要关注市场趋势的确认和动量的持续性,同时采用严格的风险控制措施。

策略原理

策略采用多层过滤机制来确认交易信号。当价格位于VWAP和EMA20上方,且SuperTrend指标显示上升趋势时,系统开始寻找做多机会。同时结合RSI指标进行动量确认,使用布林带来识别波动性扩张。策略还整合了MACD指标来确认趋势的持续性,并使用ADX来衡量趋势强度。止损设置采用ATR的1.5倍,获利目标设为止损的1.5倍。

策略优势

- 多维度分析: 通过整合多个技术指标,提供了更全面的市场视角

- 风险控制完善: 使用ATR动态调整止损位置,能更好地适应市场波动

- 趋势确认可靠: 采用多重指标交叉验证,显著减少假突破

- 自适应性强: 止损和获利目标会根据市场波动性自动调整

- 策略逻辑严谨: 入场条件经过多重过滤,降低了错误信号的概率

策略风险

- 信号滞后: 多重确认机制可能导致入场时机略有延迟

- 震荡市场表现欠佳: 在横盘震荡市场中可能产生频繁的假信号

- 参数优化风险: 过多的指标可能导致过度优化

- 执行成本较高: 频繁交易可能带来较高的交易成本

- 市场环境依赖: 策略在不同市场周期的表现可能存在较大差异

策略优化方向

- 引入波动率过滤: 在低波动率环境下降低交易频率

- 优化指标权重: 对不同市场环境下各指标的重要性进行动态调整

- 加入成交量分析: 结合成交量变化来强化信号可靠性

- 开发智能止损: 根据市场结构动态调整止损位置

- 时间过滤: 在特定时间段增加入场条件的严格程度

总结

该策略通过综合运用多个技术指标,构建了一个较为完善的交易系统。虽然存在一定的滞后性和参数优化风险,但通过严格的风险控制和多重信号确认,策略展现出较好的稳定性和适应性。通过持续优化和改进,该策略有望在不同市场环境下都能保持稳定的表现。

策略源码

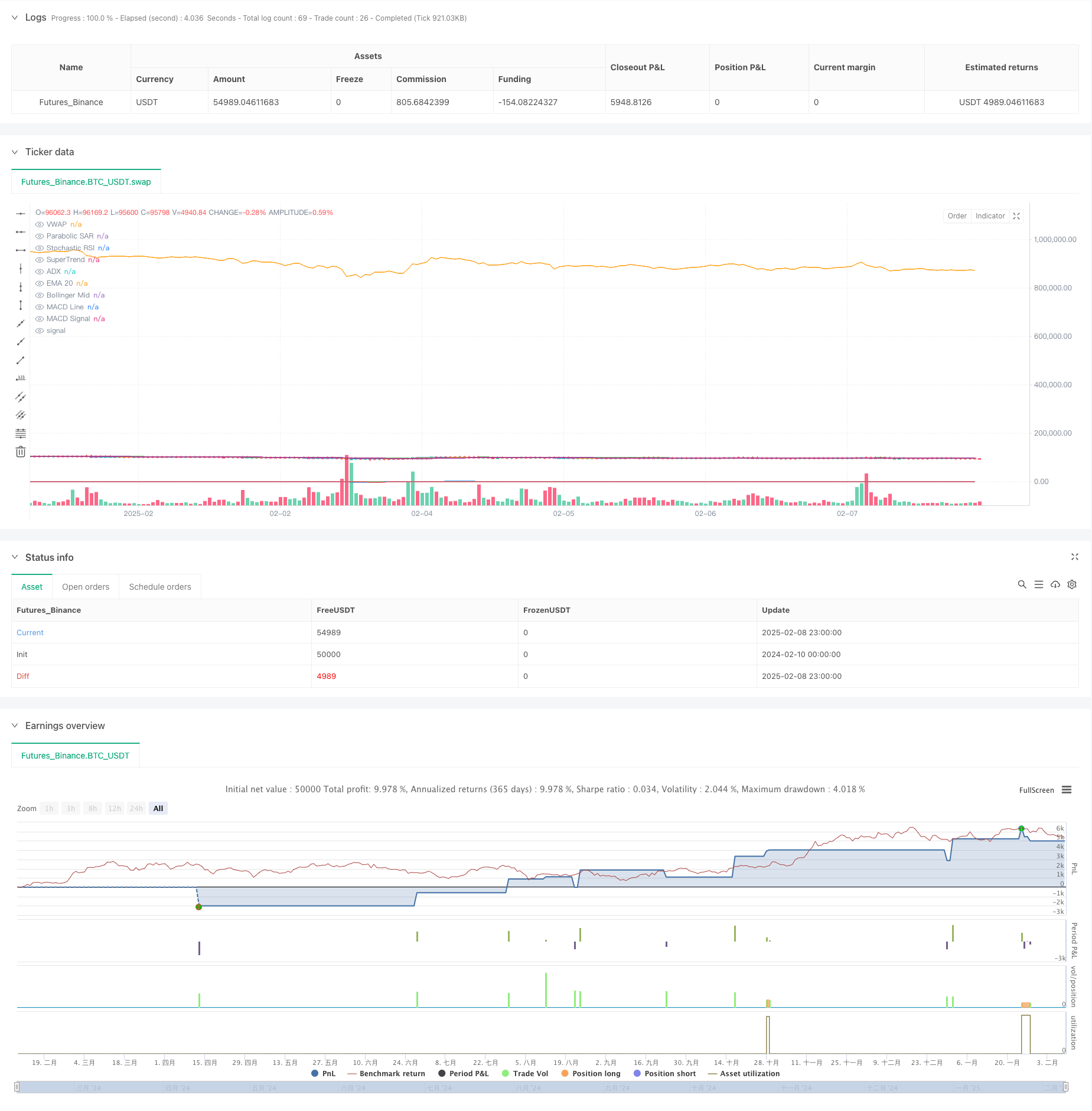

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-09 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Nifty 1-Min Advanced Scalping", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Indicators

vwap = ta.vwap(close)

ema20 = ta.ema(close, 20)

supertrendFactor = 2

supertrendLength = 10

[superTrend, superTrendDirection] = ta.supertrend(supertrendFactor, supertrendLength)

atr = ta.atr(14)

psar = ta.sar(0.02, 0.2, 0.2)

rsi = ta.rsi(close, 14)

[bbMid, bbUpper, bbLower] = ta.bb(close, 20, 2)

[macdLine, macdSignal, _] = ta.macd(close, 12, 26, 9)

[adx, _, _] = ta.dmi(14, 14)

stochRsi = ta.stoch(close, 14, 3, 3)

// Buy Condition

buyCondition = close > vwap and close > ema20 and superTrendDirection == 1 and rsi > 50 and close > bbMid and close > psar and macdLine > macdSignal and adx > 25 and stochRsi > 20

// Sell Condition

sellCondition = close < vwap and close < ema20 and superTrendDirection == -1 and rsi < 50 and close < bbMid and close < psar and macdLine < macdSignal and adx > 25 and stochRsi < 80

// Stop Loss & Take Profit

sl = atr * 1.5

long_sl = close - sl

short_sl = close + sl

tp = sl * 1.5

long_tp = close + tp

short_tp = close - tp

// Execute Trades

if buyCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=long_sl, limit=long_tp)

if sellCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=short_sl, limit=short_tp)

// Plot indicators

plot(vwap, title="VWAP", color=color.blue)

plot(ema20, title="EMA 20", color=color.orange)

plot(superTrend, title="SuperTrend", color=color.green)

plot(psar, title="Parabolic SAR", color=color.red, style=plot.style_cross)

plot(bbMid, title="Bollinger Mid", color=color.purple)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignal, title="MACD Signal", color=color.red)

plot(adx, title="ADX", color=color.green)

plot(stochRsi, title="Stochastic RSI", color=color.orange)

// Alerts

alertcondition(buyCondition, title="Buy Signal", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Signal", message="Sell Signal Triggered")

相关推荐