概述

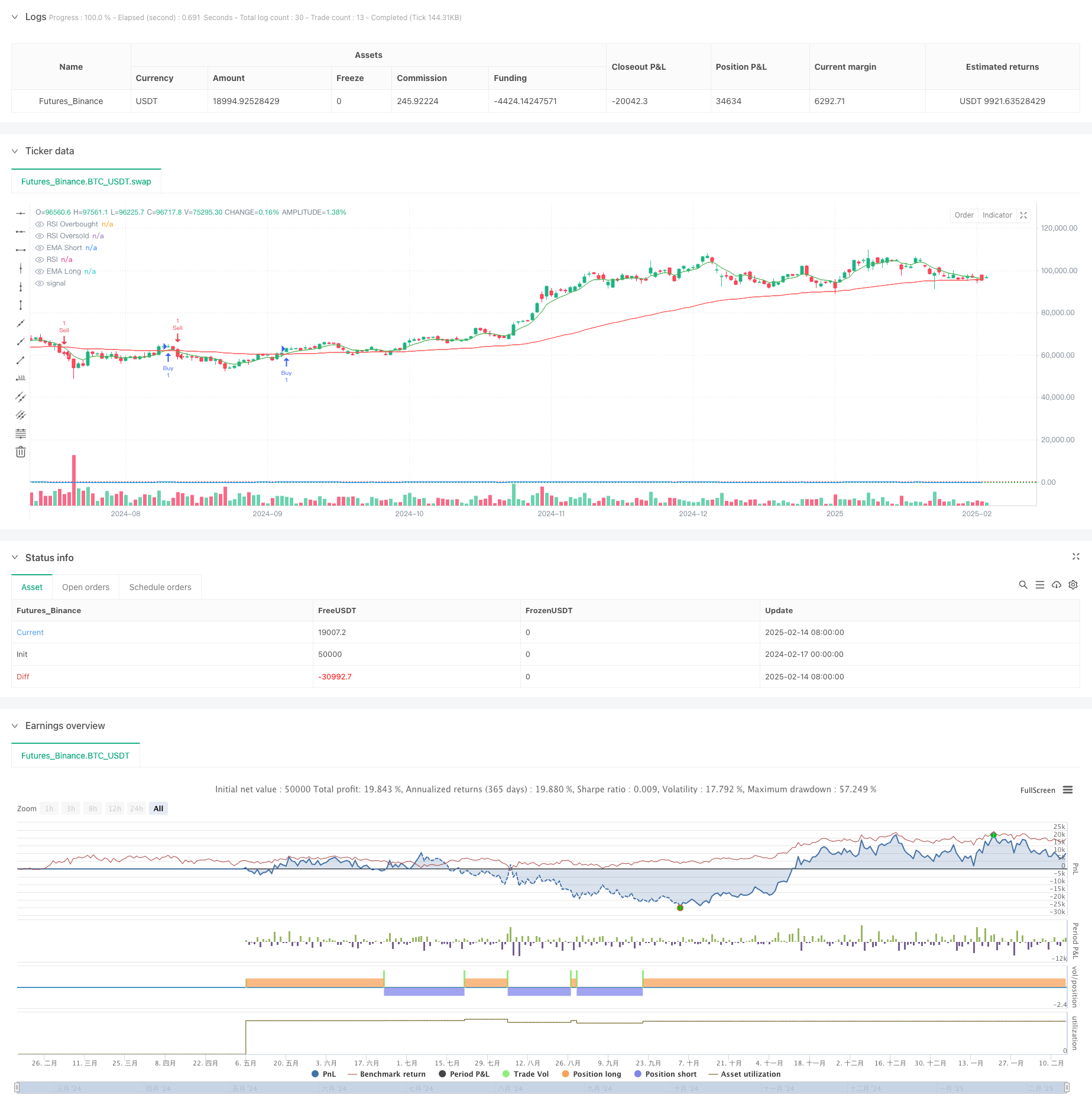

本策略是一个基于双均线系统和RSI指标的趋势跟踪交易系统。该策略结合了均线交叉信号、RSI超买超卖判断以及价格突破确认,构建了一个多重过滤的交易决策框架。策略通过6周期和82周期的指数移动平均线(EMA)来捕捉中短期趋势,同时利用相对强弱指数(RSI)来过滤市场过热和过冷的情况,最后通过价格突破来确认交易信号。

策略原理

策略的核心逻辑包含三个维度的信号过滤: 1. 趋势判断:使用快速EMA(6周期)和慢速EMA(82周期)的交叉来判断趋势方向。当快线上穿慢线时产生做多信号,当快线下穿慢线时产生做空信号。 2. 动量过滤:使用14周期的RSI指标来过滤过度追涨杀跌的情况。当RSI大于70时认为市场过热,抑制做多;当RSI小于22时认为市场过冷,抑制做空。 3. 价格确认:要求在入场时必须有价格突破确认。做多要求收盘价创新高,做空要求收盘价创新低。

策略优势

- 多重信号过滤:通过结合技术指标和价格行为,构建了严格的信号过滤机制,可以有效降低虚假信号。

- 趋势跟踪与动量结合:既可以捕捉持续性趋势,又能避免过度追涨杀跌。

- 参数可调整性强:策略的关键参数如均线周期、RSI阈值等都可以根据不同市场特征进行优化。

- 风险控制完善:通过RSI超买超卖判断,内置了风险控制机制。

策略风险

- 震荡市场风险:在横盘震荡市场中,均线交叉信号可能频繁出现,导致过多交易。

- 滞后性风险:EMA和RSI都具有一定滞后性,在市场快速转向时可能反应不及时。

- 参数敏感性:策略效果对参数选择较为敏感,不同市场环境可能需要不同的参数组合。

- 信号稀少:多重过滤机制可能导致有效信号较少,影响策略收益机会。

策略优化方向

- 动态参数调整:可以引入自适应机制,根据市场波动率动态调整均线周期和RSI阈值。

- 引入止损机制:增加移动止损或固定止损规则,提升风险控制能力。

- 市场环境分类:增加市场环境判断模块,在不同市场状态下使用不同的参数组合。

- 信号强度分级:可以根据信号条件满足程度设计分级制度,用于调整持仓规模。

总结

该策略通过均线系统和RSI指标的巧妙结合,构建了一个逻辑严密的趋势跟踪系统。策略的多重过滤机制有效控制了风险,但也可能错过部分交易机会。通过持续优化和完善,策略有望在不同市场环境下都能保持稳定表现。

策略源码

/*backtest

start: 2024-02-17 00:00:00

end: 2025-02-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA RSI Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(6, title="EMA Short Length")

emaLongLength = input.int(82, title="EMA Long Length")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.float(70, title="RSI Overbought Level")

rsiOversold = input.float(22, title="RSI Oversold Level")

// Calculations

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

rsi = ta.rsi(close, rsiLength)

// Conditions

emaBuyCondition = ta.crossover(emaShort, emaLong)

emaSellCondition = ta.crossunder(emaShort, emaLong)

higherHighCondition = close > ta.highest(close[1], 1)

lowerLowCondition = close < ta.lowest(close[1], 1)

rsiNotOverbought = rsi < rsiOverbought

rsiNotOversold = rsi > rsiOversold

// Entry Signals

buySignal = emaBuyCondition and rsiNotOverbought and higherHighCondition

sellSignal = emaSellCondition and rsiNotOversold and lowerLowCondition

// Execute Trades

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Plotting

plot(emaShort, color=color.green, title="EMA Short")

plot(emaLong, color=color.red, title="EMA Long")

plot(rsi, title="RSI", color=color.blue, linewidth=1)

hline(rsiOverbought, title="RSI Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOversold, title="RSI Oversold", color=color.green, linestyle=hline.style_dotted)

相关推荐