Based on the provided code, I’ll help create an SEO-friendly article analyzing this trading strategy in both Chinese and English.

Based on the provided code, I’ll help create an SEO-friendly article analyzing this trading strategy in both Chinese and English.

概述

本策略基于价格行为分析(Price Action)和Bill Williams的K线三等分理论,通过对当前和前一根K线的开盘价、收盘价在K线三等分区间的位置关系进行分析,识别市场趋势的转折点和持续性,从而生成交易信号。该策略完全基于价格行为,不依赖任何技术指标,通过系统化的方法消除了交易过程中的情绪偏差。

策略原理

策略的核心逻辑是将每根K线的波动区间分为三等份,通过分析开盘价和收盘价在这些区间的位置来判断市场趋势。具体包括: 1. K线分类 - 根据开收盘价位置将K线分为多种类型: - 看多形态:1-3(下开上收)、2-3(中开上收)、3-3(上开上收) - 看空形态:3-1(上开下收)、2-1(中开下收)、1-1(下开下收) 2. 信号生成 - 通过连续两根K线的形态组合确认交易信号: - 买入信号:前一根K线为任意看多形态,当前K线为1-3或3-3形态 - 卖出信号:前一根K线为任意看空形态,当前K线为1-1或3-1形态 3. 交易执行 - 在确认信号后自动执行市价单: - 出现买入信号时,平掉空仓并开多 - 出现卖出信号时,平掉多仓并开空

策略优势

- 纯价格驱动 - 完全基于价格行为分析,避免了技术指标的滞后性

- 系统化交易 - 通过明确的规则体系执行交易,降低主观判断带来的偏差

- 趋势跟踪 - 能够有效捕捉价格的大幅波动,提高单笔盈利空间

- 风险控制 - 通过对连续两根K线的分析提高信号可靠性

- 简单直观 - 策略逻辑清晰,易于理解和执行

策略风险

- 震荡市不适用 - 在区间震荡行情中可能产生频繁的假信号

- 入场时机滞后 - 需要等待K线收盘才能确认信号,可能错过最佳入场点

- 资金管理不足 - 策略本身不包含止损止盈机制,需要额外的风险控制措施

- 市场环境依赖 - 在流动性不足或高波动率环境下可能表现不佳

- 参数敏感性 - K线周期的选择对策略表现有重要影响

策略优化方向

- 引入波动率过滤 - 通过添加ATR等波动率指标,在不同市场环境下动态调整交易频率

- 完善风险控制 - 设计基于K线三等分的动态止损止盈机制

- 优化信号确认 - 考虑引入成交量、波动率等辅助指标提高信号可靠性

- 增加市场环境分析 - 开发市场状态识别模块,在不同市场环境下采用不同的交易参数

- 改进仓位管理 - 根据信号强度和市场环境动态调整持仓比例

总结

该策略通过将K线三等分的创新方法分析价格行为,建立了一个简单而有效的趋势跟踪系统。虽然存在一定的局限性,但通过合理的优化和风险控制措施,可以在趋势明显的市场环境下获得稳定的收益。策略的核心优势在于其系统化的方法论和对价格行为的深入分析,为量化交易提供了一个值得参考的研究方向。

策略源码

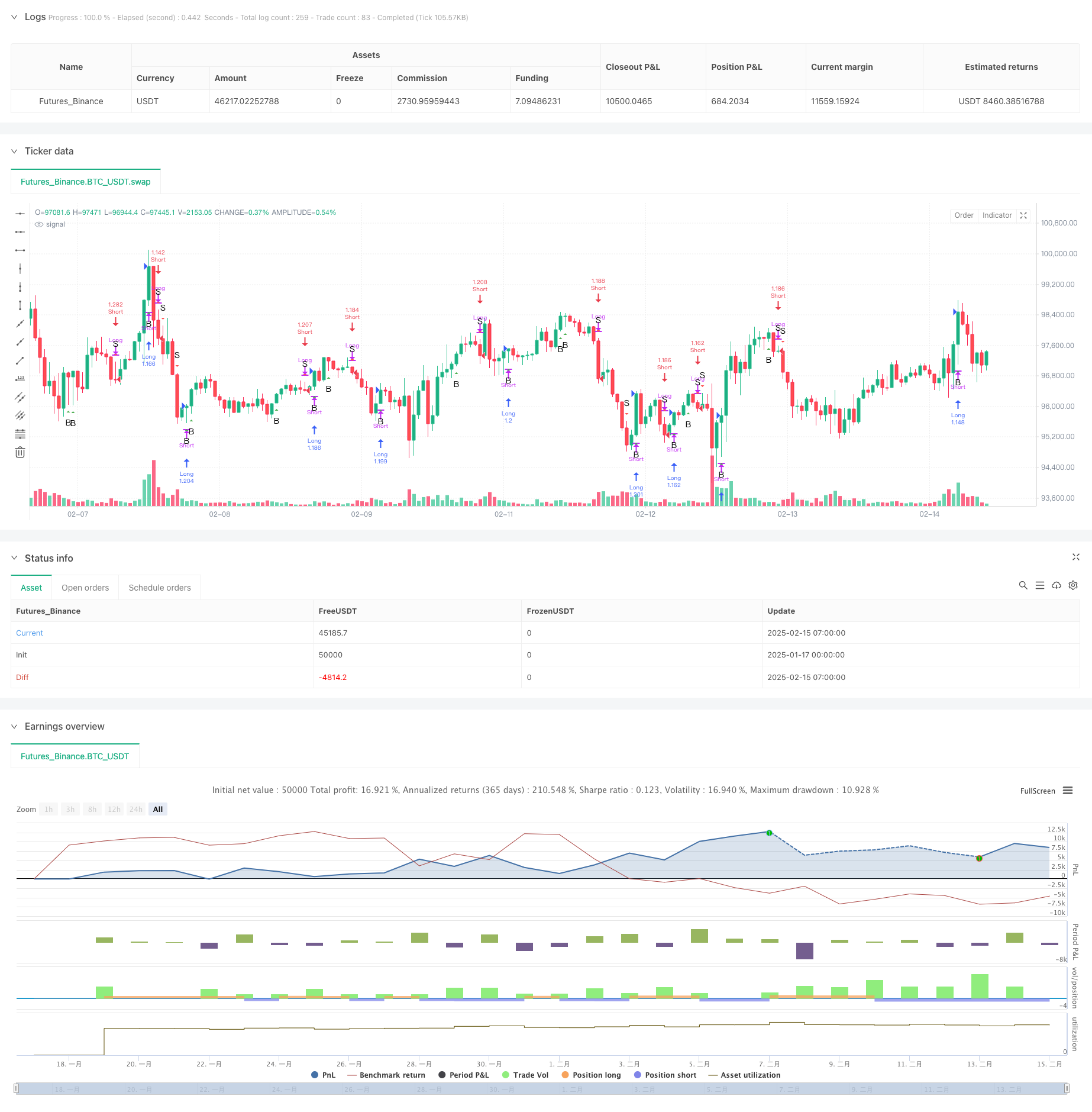

/*backtest

start: 2025-01-17 00:00:00

end: 2025-02-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TrinityBar", overlay=true, initial_capital=100000,

default_qty_type=strategy.percent_of_equity, default_qty_value=200)

//─────────────────────────────────────────────────────────────

// Current Bar Thirds Calculations

//─────────────────────────────────────────────────────────────

cur_range = high - low

cur_lowerThird = low + cur_range / 3

cur_upperThird = high - cur_range / 3

//─────────────────────────────────────────────────────────────

// Previous Bar Thirds Calculations

//─────────────────────────────────────────────────────────────

prev_range = high[1] - low[1]

prev_lowerThird = low[1] + prev_range / 3

prev_upperThird = high[1] - prev_range / 3

//─────────────────────────────────────────────────────────────

// Define Bullish Bar Types for Current Bar

//─────────────────────────────────────────────────────────────

is_1_3 = (open <= cur_lowerThird) and (close >= cur_upperThird)

is_3_3 = (open >= cur_upperThird) and (close >= cur_upperThird)

is_2_3 = (open > cur_lowerThird) and (open < cur_upperThird) and (close >= cur_upperThird)

//─────────────────────────────────────────────────────────────

// Define Bearish Bar Types for Current Bar

//─────────────────────────────────────────────────────────────

is_3_1 = (open >= cur_upperThird) and (close <= cur_lowerThird)

is_1_1 = (open <= cur_lowerThird) and (close <= cur_lowerThird)

is_2_1 = (open > cur_lowerThird) and (open < cur_upperThird) and (close <= cur_lowerThird)

//─────────────────────────────────────────────────────────────

// Define Bullish Bar Types for Previous Bar

//─────────────────────────────────────────────────────────────

prev_is_1_3 = (open[1] <= prev_lowerThird) and (close[1] >= prev_upperThird)

prev_is_3_3 = (open[1] >= prev_upperThird) and (close[1] >= prev_upperThird)

prev_is_2_3 = (open[1] > prev_lowerThird) and (open[1] < prev_upperThird) and (close[1] >= prev_upperThird)

//─────────────────────────────────────────────────────────────

// Define Bearish Bar Types for Previous Bar

//─────────────────────────────────────────────────────────────

prev_is_3_1 = (open[1] >= prev_upperThird) and (close[1] <= prev_lowerThird)

prev_is_1_1 = (open[1] <= prev_lowerThird) and (close[1] <= prev_lowerThird)

prev_is_2_1 = (open[1] > prev_lowerThird) and (open[1] < prev_upperThird) and (close[1] <= prev_lowerThird)

//─────────────────────────────────────────────────────────────

// Valid Signal Conditions

//─────────────────────────────────────────────────────────────

// Bullish Signal: If the previous bar is any bullish type (2‑3, 3‑3, or 1‑3)

// and the current bar is either a 1‑3 or a 3‑3 bar.

validBuy = (prev_is_2_3 or prev_is_3_3 or prev_is_1_3) and (is_1_3 or is_3_3)

// Bearish Signal: If the previous bar is any bearish type (2‑1, 1‑1, or 3‑1)

// and the current bar is either a 1‑1 or a 3‑1 bar.

validSell = (prev_is_2_1 or prev_is_1_1 or prev_is_3_1) and (is_1_1 or is_3_1)

//─────────────────────────────────────────────────────────────

// Plot Only the Signal Triangles

//─────────────────────────────────────────────────────────────

plotshape(validBuy, title="Valid Buy", style=shape.triangleup, location=location.belowbar,

color=color.green, size=size.small, text="B")

plotshape(validSell, title="Valid Sell", style=shape.triangledown, location=location.abovebar,

color=color.red, size=size.small, text="S")

//─────────────────────────────────────────────────────────────

// Market Order Execution Based on Signals

//─────────────────────────────────────────────────────────────

if validBuy

// Close any short positions.

strategy.close("Short", comment="")

// If not already long, enter a market long.

if strategy.position_size <= 0

strategy.entry("Long", strategy.long, comment="")

if validSell

// Close any long positions.

strategy.close("Long", comment="")

// If not already short, enter a market short.

if strategy.position_size >= 0

strategy.entry("Short", strategy.short, comment="")

相关推荐