概述

本策略是一个基于高斯滤波和StochRSI指标的趋势跟踪交易系统。该策略通过高斯通道来识别市场趋势,并结合StochRSI指标的超买超卖区间来优化入场时机。系统采用多项式拟合方法构建高斯通道,通过上下轨道的动态调整来跟踪价格趋势,实现对市场走势的精确跟踪。

策略原理

策略的核心是基于高斯滤波算法构建的价格通道。具体实现包括以下几个关键步骤: 1. 使用多项式函数f_filt9x实现9阶高斯滤波,通过极点优化来提高滤波效果 2. 基于HLC3价格计算主滤波线和波动率通道 3. 引入reducedLag模式降低滤波延迟,fastResponse模式提高响应速度 4. 利用StochRSI指标的超买超卖区间(80⁄20)确定交易信号 5. 在高斯通道向上且价格突破上轨时,结合StochRSI指标产生做多信号 6. 当价格跌破上轨时平仓出场

策略优势

- 高斯滤波具有优秀的降噪能力,可以有效过滤市场噪音

- 通过多项式拟合实现对趋势的平滑跟踪,减少虚假信号

- 支持延迟优化和快速响应模式,可根据市场特征灵活调整

- 结合StochRSI指标优化入场时机,提高交易成功率

- 采用动态通道宽度,自适应市场波动率变化

策略风险

- 高斯滤波存在一定滞后性,可能导致入场或出场不够及时

- 在震荡市场中可能产生频繁交易信号,增加交易成本

- StochRSI指标在某些市场条件下可能产生滞后信号

- 参数优化过程复杂,不同市场环境需要重新调整参数

- 系统对计算资源要求较高,实时计算存在一定延迟

策略优化方向

- 引入自适应参数优化机制,根据市场状态动态调整参数

- 增加市场环境识别模块,在不同市场条件下采用不同参数组合

- 优化高斯滤波算法,进一步降低计算延迟

- 引入更多技术指标进行交叉验证,提高信号可靠性

- 开发智能止损机制,提高风险控制能力

总结

该策略通过高斯滤波和StochRSI指标的结合,实现了对市场趋势的有效跟踪。系统具有良好的降噪能力和趋势识别能力,但也存在一定的滞后性和参数优化难度。通过持续优化和完善,该策略有望在实际交易中取得稳定收益。

策略源码

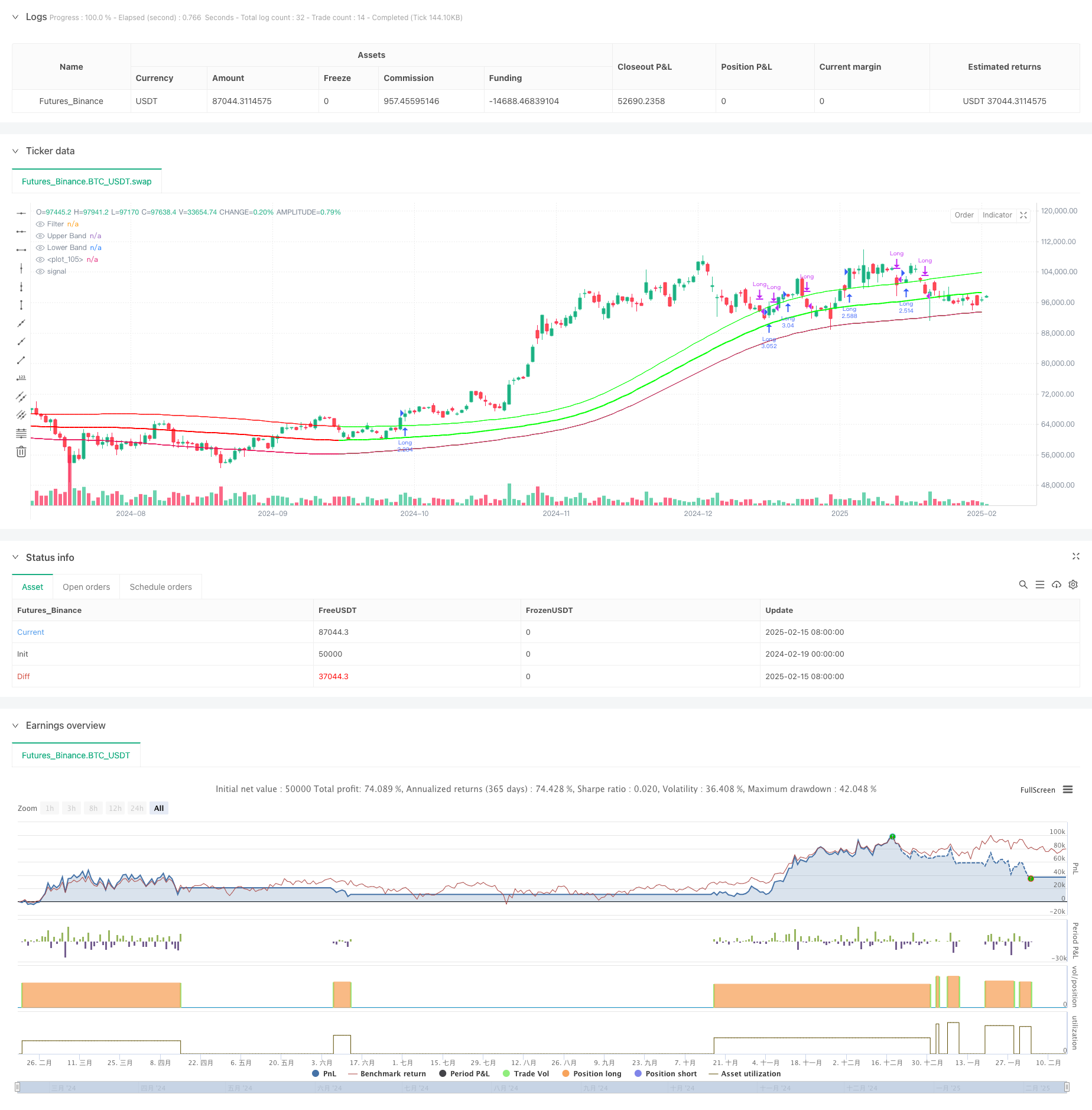

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Demo GPT - Gaussian Channel Strategy v3.0", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=0, default_qty_type=strategy.percent_of_equity, default_qty_value=250)

// ============================================

// Gaussian Functions (Must be at top)

// ============================================

f_filt9x(_a, _s, _i) =>

var int _m2 = 0, var int _m3 = 0, var int _m4 = 0, var int _m5 = 0, var int _m6 = 0,

var int _m7 = 0, var int _m8 = 0, var int _m9 = 0, var float _f = 0.0

_x = 1 - _a

_m2 := _i == 9 ? 36 : _i == 8 ? 28 : _i == 7 ? 21 : _i == 6 ? 15 : _i == 5 ? 10 : _i == 4 ? 6 : _i == 3 ? 3 : _i == 2 ? 1 : 0

_m3 := _i == 9 ? 84 : _i == 8 ? 56 : _i == 7 ? 35 : _i == 6 ? 20 : _i == 5 ? 10 : _i == 4 ? 4 : _i == 3 ? 1 : 0

_m4 := _i == 9 ? 126 : _i == 8 ? 70 : _i == 7 ? 35 : _i == 6 ? 15 : _i == 5 ? 5 : _i == 4 ? 1 : 0

_m5 := _i == 9 ? 126 : _i == 8 ? 56 : _i == 7 ? 21 : _i == 6 ? 6 : _i == 5 ? 1 : 0

_m6 := _i == 9 ? 84 : _i == 8 ? 28 : _i == 7 ? 7 : _i == 6 ? 1 : 0

_m7 := _i == 9 ? 36 : _i == 8 ? 8 : _i == 7 ? 1 : 0

_m8 := _i == 9 ? 9 : _i == 8 ? 1 : 0

_m9 := _i == 9 ? 1 : 0

_f := math.pow(_a, _i) * nz(_s) + _i * _x * nz(_f[1]) - (_i >= 2 ? _m2 * math.pow(_x, 2) * nz(_f[2]) : 0) + (_i >= 3 ? _m3 * math.pow(_x, 3) * nz(_f[3]) : 0) - (_i >= 4 ? _m4 * math.pow(_x, 4) * nz(_f[4]) : 0) + (_i >= 5 ? _m5 * math.pow(_x, 5) * nz(_f[5]) : 0) - (_i >= 6 ? _m6 * math.pow(_x, 6) * nz(_f[6]) : 0) + (_i >= 7 ? _m7 * math.pow(_x, 7) * nz(_f[7]) : 0) - (_i >= 8 ? _m8 * math.pow(_x, 8) * nz(_f[8]) : 0) + (_i == 9 ? _m9 * math.pow(_x, 9) * nz(_f[9]) : 0)

_f

f_pole(_a, _s, _i) =>

_f1 = f_filt9x(_a, _s, 1)

_f2 = _i >= 2 ? f_filt9x(_a, _s, 2) : 0.0

_f3 = _i >= 3 ? f_filt9x(_a, _s, 3) : 0.0

_f4 = _i >= 4 ? f_filt9x(_a, _s, 4) : 0.0

_f5 = _i >= 5 ? f_filt9x(_a, _s, 5) : 0.0

_f6 = _i >= 6 ? f_filt9x(_a, _s, 6) : 0.0

_f7 = _i >= 7 ? f_filt9x(_a, _s, 7) : 0.0

_f8 = _i >= 8 ? f_filt9x(_a, _s, 8) : 0.0

_f9 = _i == 9 ? f_filt9x(_a, _s, 9) : 0.0

_fn = _i == 1 ? _f1 : _i == 2 ? _f2 : _i == 3 ? _f3 : _i == 4 ? _f4 : _i == 5 ? _f5 : _i == 6 ? _f6 : _i == 7 ? _f7 : _i == 8 ? _f8 : _i == 9 ? _f9 : na

[_fn, _f1]

// ============================================

// Date Filter

// ============================================

startDate = input(timestamp("1 Jan 2018"), "Start Date", group="Time Settings")

endDate = input(timestamp("31 Dec 2069"), "End Date", group="Time Settings")

timeCondition = true

// ============================================

// Stochastic RSI (Hidden Calculations)

// ============================================

stochRsiK = input.int(3, "Stoch RSI K", group="Stochastic RSI", tooltip="Only for calculations, not visible")

stochRsiD = input.int(3, "Stoch RSI D", group="Stochastic RSI")

rsiLength = input.int(14, "RSI Length", group="Stochastic RSI")

stochLength = input.int(14, "Stochastic Length", group="Stochastic RSI")

rsiValue = ta.rsi(close, rsiLength)

k = ta.sma(ta.stoch(rsiValue, rsiValue, rsiValue, stochLength), stochRsiK)

d = ta.sma(k, stochRsiD)

// ============================================

// Gaussian Channel

// ============================================

gaussianSrc = input(hlc3, "Source", group="Gaussian")

poles = input.int(4, "Poles", minval=1, maxval=9, group="Gaussian")

samplingPeriod = input.int(144, "Sampling Period", minval=2, group="Gaussian")

multiplier = input.float(1.414, "Multiplier", step=0.1, group="Gaussian")

reducedLag = input.bool(false, "Reduced Lag Mode", group="Gaussian")

fastResponse = input.bool(false, "Fast Response Mode", group="Gaussian")

// Gaussian Calculations

beta = (1 - math.cos(4 * math.asin(1) / samplingPeriod)) / (math.pow(1.414, 2 / poles) - 1)

alpha = -beta + math.sqrt(math.pow(beta, 2) + 2 * beta)

lag = (samplingPeriod - 1) / (2 * poles)

srcData = reducedLag ? gaussianSrc + (gaussianSrc - gaussianSrc[lag]) : gaussianSrc

trData = reducedLag ? ta.tr(true) + (ta.tr(true) - ta.tr(true)[lag]) : ta.tr(true)

[mainFilter, filter1] = f_pole(alpha, srcData, poles)

[trFilter, trFilter1] = f_pole(alpha, trData, poles)

finalFilter = fastResponse ? (mainFilter + filter1) / 2 : mainFilter

finalTrFilter = fastResponse ? (trFilter + trFilter1) / 2 : trFilter

upperBand = finalFilter + finalTrFilter * multiplier

lowerBand = finalFilter - finalTrFilter * multiplier

// ============================================

// Trading Logic

// ============================================

longCondition =

finalFilter > finalFilter[1] and // Green Channel

close > upperBand and // Price above upper band

(k >= 80 or k <= 20) and // Stoch RSI condition

timeCondition

exitCondition = ta.crossunder(close, upperBand)

if longCondition

strategy.entry("Long", strategy.long)

if exitCondition

strategy.close("Long")

// ============================================

// Visuals (Gaussian Only)

// ============================================

bandColor = finalFilter > finalFilter[1] ? color.new(#00ff00, 0) : color.new(#ff0000, 0)

plot(finalFilter, "Filter", bandColor, 2)

plot(upperBand, "Upper Band", bandColor)

plot(lowerBand, "Lower Band", bandColor)

fill(plot(upperBand), plot(lowerBand), color.new(bandColor, 90))

barcolor(close > open and close > upperBand ? color.green :

close < open and close < lowerBand ? color.red : na)

相关推荐