概述

该策略是一个结合了动量指标(MACD、RSI)和成交量过滤器的趋势反转交易系统。通过引入范围过滤器(Range Filter)对价格波动的监控,实现对市场顶部和底部的精确捕捉。策略在传统技术指标的基础上加入了成交量确认机制,有效提高了交易信号的可靠性。

策略原理

策略采用多重指标验证的方式进行交易: 1. MACD指标用于捕捉价格动量的变化,通过快线与慢线的交叉确认趋势转折点 2. RSI指标监测市场的超买超卖状态,在RSI达到极值时寻找潜在反转机会 3. 范围过滤器通过计算价格的平滑范围带,确保交易发生在显著偏离趋势的位置 4. 成交量过滤器要求交易信号必须得到放量确认,提高信号的可靠性

多重条件的协同触发机制如下: - 做多条件:MACD金叉 + RSI处于超卖区域 + 价格低于下轨 + 成交量超过均值 - 做空条件:MACD死叉 + RSI处于超买区域 + 价格高于上轨 + 成交量超过均值

策略优势

- 多重指标的交叉验证提高了信号的准确性,有效降低了虚假信号的干扰

- 范围过滤器的引入确保交易发生在价格显著偏离的位置,提高了潜在收益空间

- 成交量确认机制避免了在低流动性环境下的误判,增强了交易的可靠性

- 策略参数可灵活调整,适应不同市场环境和交易品种的特点

- 清晰的信号生成逻辑便于实时监控和回测分析

策略风险

- 多重条件的严格要求可能导致错过部分潜在的交易机会

- 在震荡市场中可能产生频繁的交易信号,增加交易成本

- 参数的选择需要充分的市场经验和历史数据支持

- 在极端市场环境下,技术指标的有效性可能受到影响

风险控制建议: - 建议进行充分的参数优化和回测验证 - 考虑引入止损止盈机制 - 关注市场环境的变化,及时调整策略参数

策略优化方向

- 引入自适应参数机制,根据市场波动性动态调整指标参数

- 增加市场环境识别模块,在不同市场状态下采用不同的信号过滤规则

- 优化成交量过滤器,考虑引入成交量形态分析

- 加入价格形态识别功能,提供更多的反转确认信号

- 开发智能资金管理模块,优化持仓规模和风险控制

总结

该策略通过多重技术指标的协同配合,建立了一个相对完善的趋势反转交易系统。策略的核心优势在于其严格的信号过滤机制和灵活的参数调整空间。通过不断优化和完善,策略有望在各种市场环境下保持稳定的表现。在实际应用中,建议投资者根据自身的风险偏好和市场经验,对策略参数进行针对性调整。

策略源码

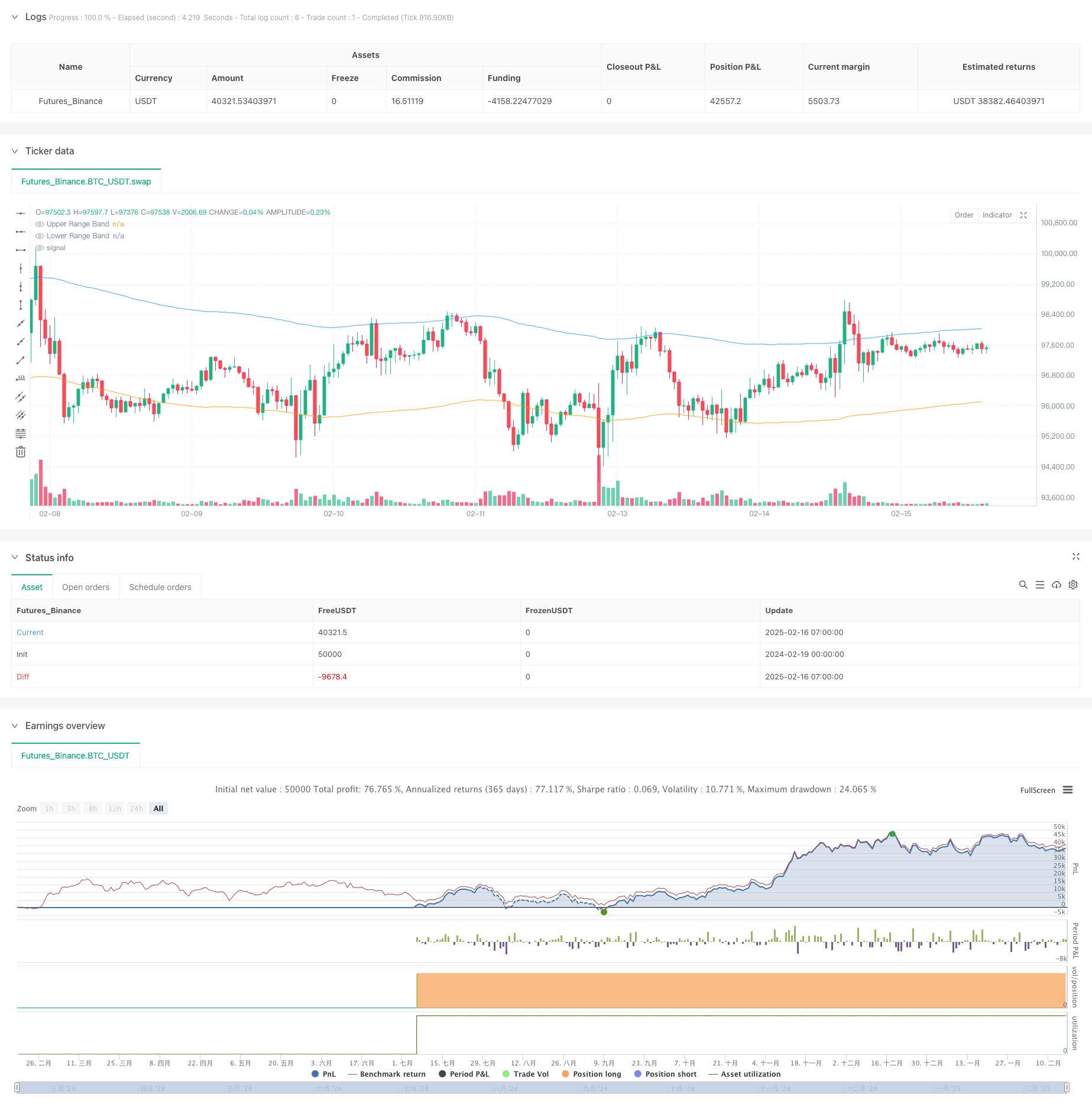

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("MACD & RSI with Range and Volume Filter", overlay=true)

// Inputs for MACD

fastLength = input.int(12, title="MACD Fast Length")

slowLength = input.int(26, title="MACD Slow Length")

signalLength = input.int(9, title="MACD Signal Length")

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(80, title="RSI Overbought Level")

rsiOversold = input.int(40, title="RSI Oversold Level")

// Inputs for Range Filter

rangePeriod = input.int(100, minval=1, title="Range Filter Period")

rangeMultiplier = input.float(3.0, minval=0.1, title="Range Filter Multiplier")

// Inputs for Volume Filter

volumeMA_Period = input.int(20, minval=1, title="Volume MA Period")

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Smooth Average Range

smoothRange(src, period, multiplier) =>

avgRange = ta.ema(math.abs(src - src[1]), period)

ta.ema(avgRange, period * 2 - 1) * multiplier

smoothedRange = smoothRange(close, rangePeriod, rangeMultiplier)

rangeFilter = ta.ema(close, rangePeriod)

upperBand = rangeFilter + smoothedRange

lowerBand = rangeFilter - smoothedRange

// Range Filter Conditions

priceAboveRange = close > upperBand

priceBelowRange = close < lowerBand

// Volume Filter

volumeMA = ta.sma(volume, volumeMA_Period)

highVolume = volume > volumeMA

// Buy and Sell Conditions with Range and Volume Filter

buyCondition = ta.crossover(macdLine, signalLine) and rsi < rsiOversold and priceBelowRange and highVolume

sellCondition = ta.crossunder(macdLine, signalLine) and rsi > rsiOverbought and priceAboveRange and highVolume

// Strategy Execution

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Alerts for Buy and Sell Signals

alertcondition(buyCondition, title="Buy Signal", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Signal", message="Sell Signal Triggered")

// Plot Buy and Sell Signals

plotshape(buyCondition, title="Buy Signal", text="Buy", style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0))

plotshape(sellCondition, title="Sell Signal", text="Sell", style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0))

// Plot Range Filter Bands

plot(upperBand, color=color.new(color.blue, 50), title="Upper Range Band")

plot(lowerBand, color=color.new(color.orange, 50), title="Lower Range Band")

相关推荐