概述

该策略是一个基于多周期分析的趋势跟踪交易系统,结合了指数移动平均线(EMA)和随机指标(Stochastic)来确定交易方向和入场时机。策略在15分钟周期确认趋势方向,并在1-5分钟周期寻找具体入场机会,通过严格的风险管理和分批获利来优化交易表现。

策略原理

策略采用多层级的交易条件验证机制: 1. 趋势确认:使用50周期EMA作为趋势方向判断的基准,价格在EMA之上视为上涨趋势,反之为下跌趋势 2. 入场条件:在确认趋势方向后,使用随机指标(14,3,3)寻找超买超卖机会,当随机指标低于30进入多头,高于70进入空头 3. 仓位管理:采用固定仓位0.02单位进行交易 4. 风险控制:基于ATR设置1.5倍波动率的止损,在行情达到目标价格50%时将止损提升至成本位 5. 获利方案:分两批进行止盈,第一批在1:1风险收益比时获利,第二批在1.5倍目标价获利

策略优势

- 多周期分析提高准确性:通过高低时间周期的配合,既保证了大趋势方向的准确性,又能够精确把握入场时机

- 完善的风险管理:采用基于市场波动率的动态止损方案,避免了固定止损可能带来的不适应性

- 灵活的获利方案:通过分批止盈的方式,既能锁定部分利润,又不会完全错过大行情

- 移动止损保护利润:在行情向有利方向发展时通过移动止损来保护已获得的利润

策略风险

- 震荡市场风险:在区间震荡行情中,可能频繁触发假信号导致连续止损

- 滑点风险:在行情剧烈波动时,实际成交价格可能与理论价格产生较大偏差

- 资金管理风险:固定仓位设置可能不适合所有资金规模的账户

- 参数敏感性:EMA和随机指标的参数设置对策略性能影响较大

策略优化方向

- 市场环境过滤:引入波动率指标或趋势强度指标,在不同市场环境下调整策略参数或暂停交易

- 动态仓位管理:根据账户资金规模和市场波动情况动态调整交易仓位

- 入场条件优化:增加价格形态或其他技术指标的确认,提高入场信号的可靠性

- 止盈止损优化:根据不同市场环境动态调整风险收益比,实现更灵活的资金管理

总结

该策略通过多周期分析和多重技术指标的配合,构建了一个较为完善的趋势跟踪交易系统。策略的核心优势在于其严格的风险管理和灵活的获利方案,但在实际应用中仍需要根据市场环境和资金规模进行适当的参数优化。通过建议的优化方向,策略有望在不同市场环境下获得更稳定的表现。

策略源码

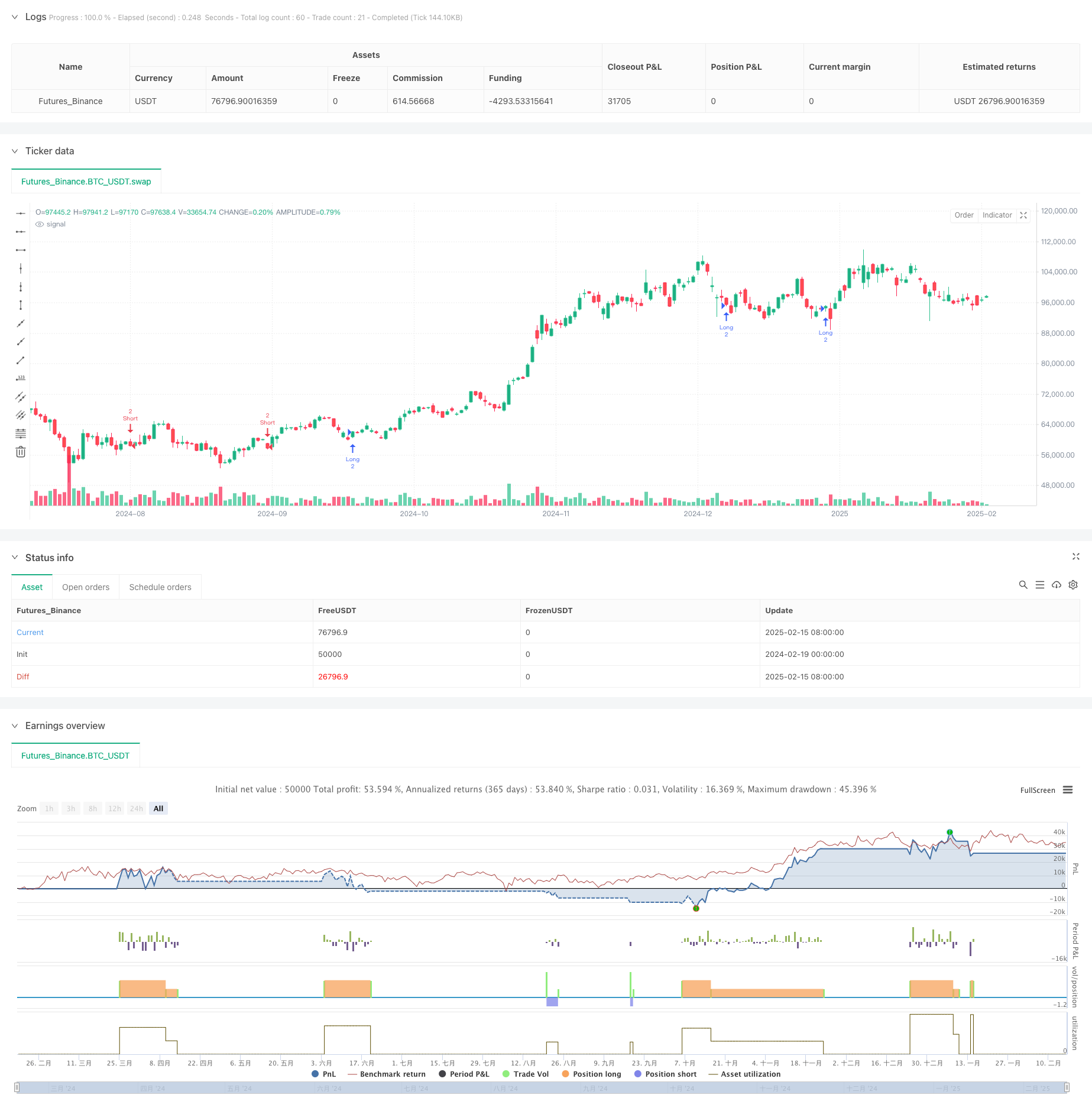

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("15-Min Trend Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Define EMA for trend confirmation

ema50 = ta.ema(close, 50)

trendLong = close > ema50

trendShort = close < ema50

// Stochastic settings

length = 14

smoothK = 3

smoothD = 3

stochK = ta.sma(ta.stoch(close, high, low, length), smoothK)

stochD = ta.sma(stochK, smoothD)

// Entry conditions

longCondition = stochK < 30 and trendLong

shortCondition = stochK > 70 and trendShort

// ATR-based stop-loss calculation

atrValue = ta.atr(14)

stopLossLong = close - (1.5 * atrValue)

stopLossShort = close + (1.5 * atrValue)

takeProfitLong = close + (2 * atrValue)

takeProfitShort = close - (2 * atrValue)

// Execute trades

if longCondition

strategy.entry("Long", strategy.long, qty=2)

strategy.exit("TP Long 1", from_entry="Long", qty=1, stop=stopLossLong, limit=takeProfitLong)

strategy.exit("TP Long 2", from_entry="Long", qty=1, stop=stopLossLong, limit=takeProfitLong * 1.5)

if shortCondition

strategy.entry("Short", strategy.short, qty=2)

strategy.exit("TP Short 1", from_entry="Short", qty=1, stop=stopLossShort, limit=takeProfitShort)

strategy.exit("TP Short 2", from_entry="Short", qty=1, stop=stopLossShort, limit=takeProfitShort * 1.5)

// Move SL to breakeven after 50% move to target

if strategy.position_size > 0

if strategy.position_avg_price != 0

moveToBELong = close >= (strategy.position_avg_price + (takeProfitLong - strategy.position_avg_price) * 0.5)

if moveToBELong

strategy.exit("BE Long", from_entry="Long", qty=1, stop=strategy.position_avg_price)

moveToBEShort = close <= (strategy.position_avg_price - (strategy.position_avg_price - takeProfitShort) * 0.5)

if moveToBEShort

strategy.exit("BE Short", from_entry="Short", qty=1, stop=strategy.position_avg_price)

相关推荐