概述

这是一个基于均值回归原理的交易策略,通过识别连续下跌和上涨K线形态来捕捉短期价格反转机会。策略的核心逻辑是在出现连续3根下跌K线后入场做多,在出现连续3根上涨K线后平仓出场。策略还可以选择性地结合EMA均线过滤器来提高交易质量。

策略原理

策略主要基于以下几个核心要素: 1. 连续K线计数器:分别统计连续上涨和下跌的K线数量 2. 入场条件:当连续出现指定数量(默认3根)的收盘价下跌K线时触发做多信号 3. 出场条件:当连续出现指定数量(默认3根)的收盘价上涨K线时触发平仓信号 4. EMA过滤器:可选择性地添加200周期指数移动平均线作为趋势过滤条件 5. 交易时间窗口:可以设定具体的交易起止时间来限制交易区间

策略优势

- 逻辑简单清晰:策略使用简单的K线计数方法,容易理解和实现

- 适应性强:可以应用于不同的时间周期和交易品种

- 参数灵活:连续K线数量、EMA周期等参数都可以根据需要调整

- 风险控制完善:通过时间窗口和趋势过滤等多重机制来控制风险

- 计算效率高:核心逻辑只需要比较相邻K线收盘价,运算负担小

策略风险

- 趋势市场风险:在强趋势市场中可能频繁遭遇假突破

- 参数敏感性:连续K线数量的设置对策略表现影响较大

- 滑点影响:在波动剧烈的市场中可能面临较大的滑点风险

- 假信号风险:连续K线形态可能受到市场噪音的干扰

- 止损缺失:策略未设置明确的止损机制,可能带来较大回撤

策略优化方向

- 添加止损机制:建议增加固定止损或追踪止损来控制风险

- 优化过滤条件:可以引入成交量、波动率等指标作为辅助过滤

- 动态参数调整:考虑根据市场状态动态调整连续K线数量要求

- 增加持仓管理:可以设计分批建仓和减仓机制提高收益

- 完善时间管理:针对不同时间段设置不同的交易参数

总结

这是一个设计合理的均值回归策略,通过捕捉短期价格超跌反弹机会来获取收益。策略的主要优势在于逻辑简单、适应性强,但在实际应用中需要注意控制风险,建议通过添加止损机制、优化过滤条件等方式来提升策略的稳定性。

策略源码

/*backtest

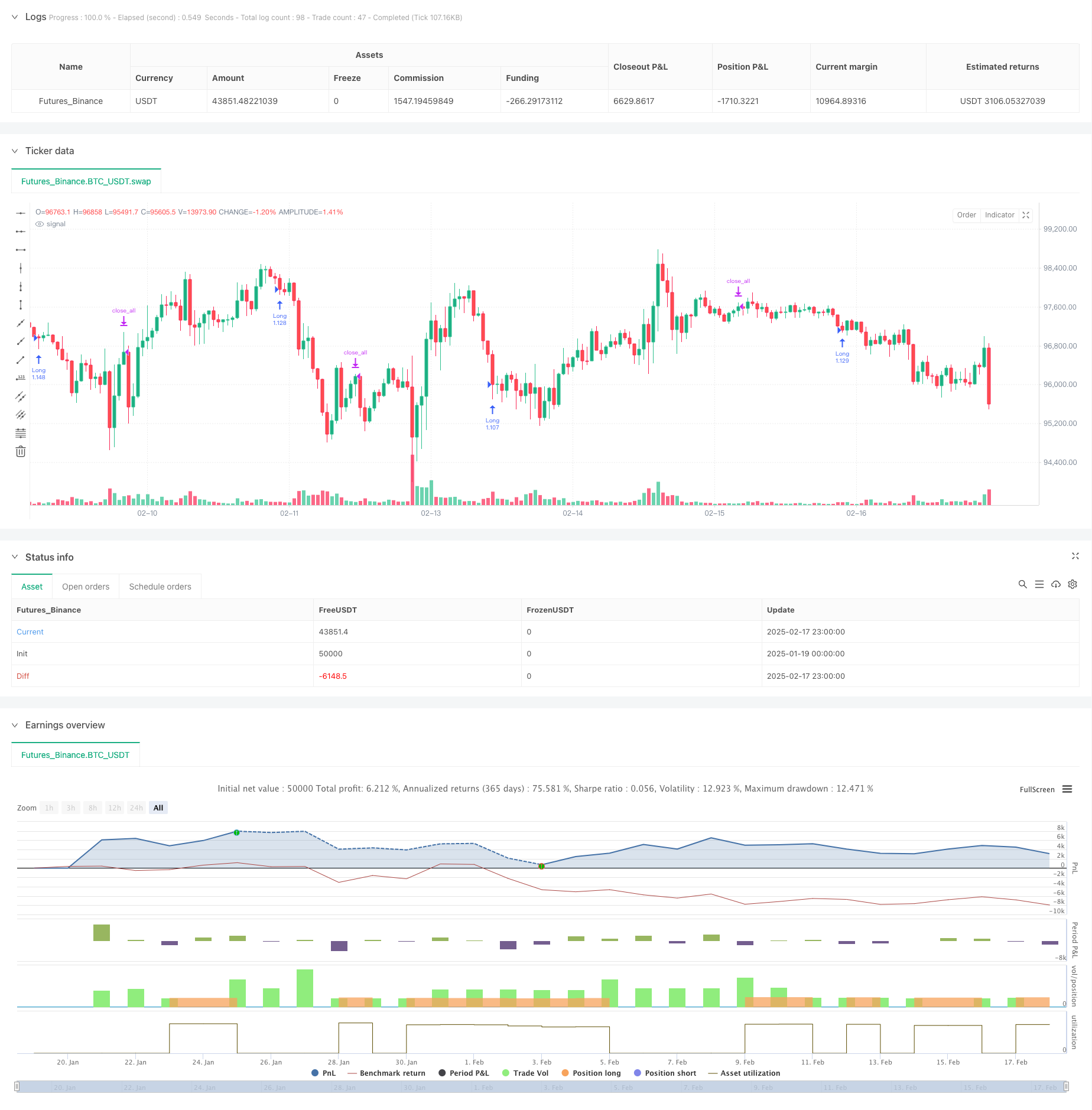

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("3 Down, 3 Up Strategy", overlay=true, initial_capital = 1000000, default_qty_value = 200, default_qty_type = strategy.percent_of_equity, process_orders_on_close = true, margin_long = 5, margin_short = 5, calc_on_every_tick = true)

//#region INPUTS SECTION

// ============================================

// Time Settings

// ============================================

startTimeInput = input(timestamp("1 Jan 2014"), "Start Time", group = "Time Settings")

endTimeInput = input(timestamp("1 Jan 2099"), "End Time", group = "Time Settings")

isWithinTradingWindow = true

// ============================================

// Strategy Settings

// ============================================

buyTriggerInput = input.int(3, "Consecutive Down Closes for Entry", minval = 1, group = "Strategy Settings")

sellTriggerInput = input.int(3, "Consecutive Up Closes for Exit", minval = 1, group = "Strategy Settings")

// ============================================

// EMA Filter Settings

// ============================================

useEmaFilter = input.bool(false, "Use EMA Filter", group = "Trend Filter")

emaPeriodInput = input.int(200, "EMA Period", minval = 1, group = "Trend Filter")

//#endregion

//#region INDICATOR CALCULATIONS

// ============================================

// Consecutive Close Counter

// ============================================

var int aboveCount = na

var int belowCount = na

aboveCount := close > close[1] ? (na(aboveCount) ? 1 : aboveCount + 1) : 0

belowCount := close < close[1] ? (na(belowCount) ? 1 : belowCount + 1) : 0

// ============================================

// Trend Filter Calculation

// ============================================

emaValue = ta.ema(close, emaPeriodInput)

//#endregion

//#region TRADING CONDITIONS

// ============================================

// Entry/Exit Logic

// ============================================

longCondition = belowCount >= buyTriggerInput and isWithinTradingWindow

exitCondition = aboveCount >= sellTriggerInput

// Apply EMA Filter if enabled

if useEmaFilter

longCondition := longCondition and close > emaValue

//#endregion

//#region STRATEGY EXECUTION

// ============================================

// Order Management

// ============================================

if longCondition

strategy.entry("Long", strategy.long)

if exitCondition

strategy.close_all()

//#endregion

相关推荐