概述

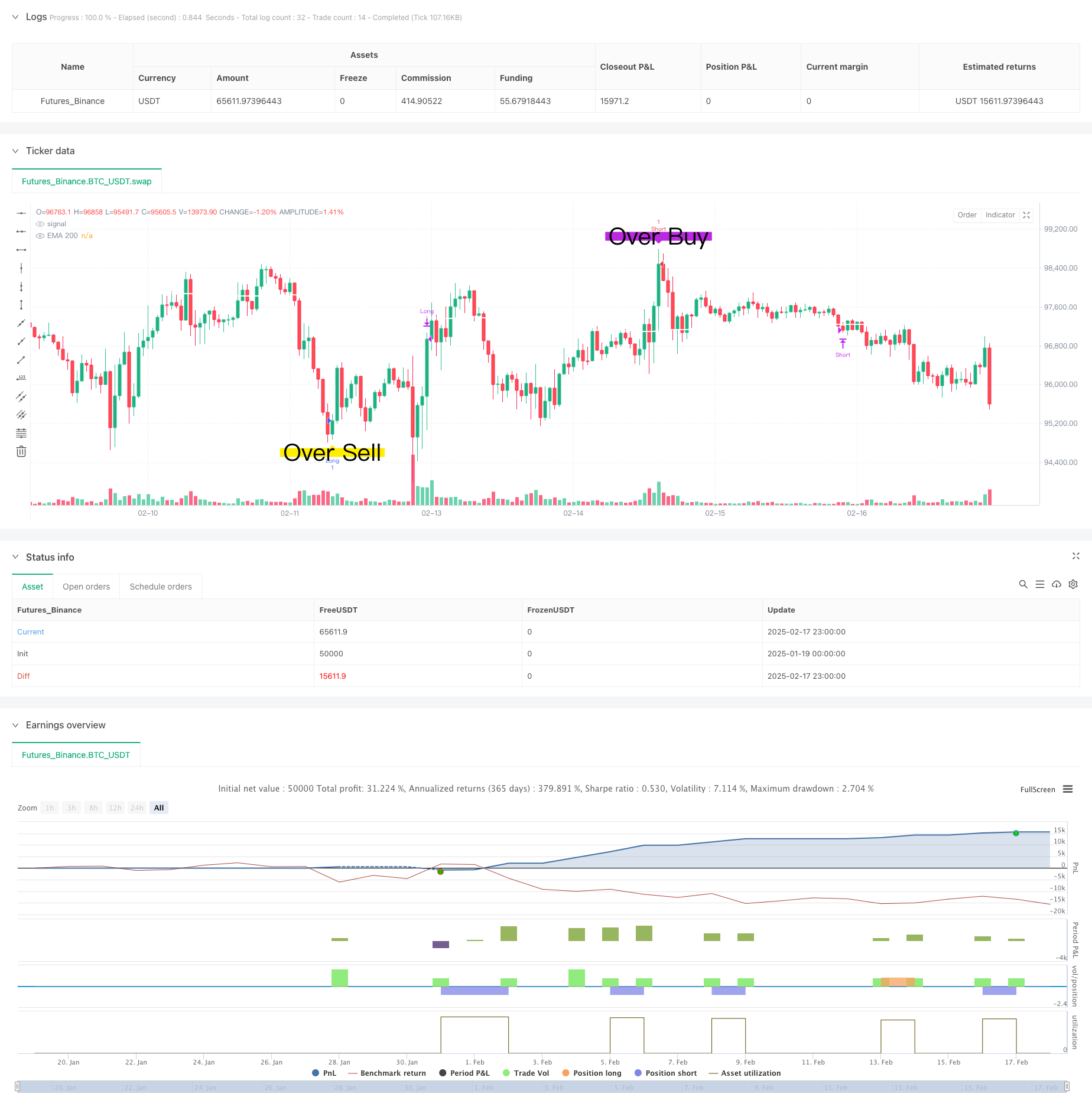

这是一个基于RSI和CCI双重技术指标的自适应交易策略。策略通过监控不同时间周期下的RSI和CCI指标的交叉状态,结合EMA均线趋势,构建了一个完整的交易系统。该策略具有自适应性强、信号稳定等特点,能够有效地捕捉市场超买超卖机会。

策略原理

策略的核心逻辑包括以下几个方面: 1. 时间周期自适应:根据不同的时间周期(1分钟到4小时)动态调整RSI和CCI的参数设置。 2. 双重指标确认:使用RSI(相对强弱指标)和CCI(顺势指标)的组合来过滤交易信号。当RSI和CCI同时满足特定条件时才会产生交易信号。 3. 信号持续性验证:通过设置最小持续时间(stayTimeFrames)来确保信号的稳定性。 4. 动态止盈止损:基于入场时的RSI和CCI水平设置动态的止盈止损点位。 5. 趋势确认:使用200周期EMA作为趋势参考。

策略优势

- 自适应性强:策略能够根据不同时间周期自动调整参数,适应性更强。

- 信号可靠性高:通过双重技术指标的交叉确认,显著提高了信号的可靠性。

- 风险控制完善:采用动态止盈止损机制,能够有效控制风险。

- 操作规则明确:入场和出场条件清晰,便于实际操作。

- 可扩展性好:策略框架灵活,可以根据需要添加新的过滤条件。

策略风险

- 参数敏感性:不同市场环境下最优参数可能存在差异。

- 横盘震荡风险:在市场震荡期间可能产生虚假信号。

- 滑点影响:高频交易可能面临滑点影响。

- 信号延迟:多重确认机制可能导致入场时机略有延迟。

- 市场环境依赖:在强趋势市场表现可能优于震荡市场。

策略优化方向

- 参数自适应:可以引入自适应参数优化机制,根据市场状态动态调整参数。

- 市场环境识别:添加市场环境识别模块,在不同市场状态下采用不同的交易策略。

- 波动率适应:引入波动率指标,根据波动率大小调整止盈止损参数。

- 信号过滤:增加更多技术指标和形态识别来过滤假信号。

- 风险管理:完善资金管理方案,增加持仓时间和仓位控制。

总结

该策略通过结合RSI和CCI指标的优势,构建了一个稳健的交易系统。策略的自适应特性和完善的风险控制机制使其具有良好的实用性。通过持续优化和完善,该策略有望在实际交易中取得更好的表现。建议交易者在实盘使用前进行充分的回测和参数优化。

策略源码

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI & CCI Strategy with Alerts", overlay=true)

// Detect current chart timeframe

tf = timeframe.period

// Define settings for different timeframes

rsiLength = tf == "1" ? 30 : tf == "5" ? 30 : tf == "15" ? 30 : tf == "30" ? 30 : 30 // Default

cciLength = tf == "1" ? 15 : tf == "5" ? 20 : tf == "15" ? 20 : tf == "30" ? 20 : 20 // Default

cciBuyThreshold = tf == "1" ? -100 : tf == "5" ? -100 : tf == "15" ? -100 : tf == "30" ? -100 : -100

cciSellThreshold = tf == "1" ? 100 : tf == "5" ? 100 : tf == "15" ? 100 : tf == "30" ? 100 : 100 // Default

stayTimeFrames = tf == "1" ? 1 : tf == "5" ? 1 : tf == "15" ? 1 : tf == "30" ? 1 : tf == "240" ? 1 : 2 // Default

stayTimeFramesOver =tf == "1" ? 1 : tf == "5" ? 2 : tf == "15" ? 2 : tf == "30" ? 3 : 2 // Default

// Calculate RSI & CCI

rsi = ta.rsi(close, rsiLength)

rsiOver = ta.rsi(close, 14)

cci = ta.cci(close, cciLength)

// EMA 50

ema200 = ta.ema(close, 200)

plot(ema200, color=color.rgb(255, 255, 255), linewidth=2, title="EMA 200")

// CCI candle threshold tracking

var int cciEntryTimeLong = na

var int cciEntryTimeShort = na

// Store entry time when CCI enters the zone

if (cci < cciBuyThreshold)

if na(cciEntryTimeLong)

cciEntryTimeLong := bar_index

else

cciEntryTimeLong := na

if (cci > cciSellThreshold)

if na(cciEntryTimeShort)

cciEntryTimeShort := bar_index

else

cciEntryTimeShort := na

// Confirming CCI has stayed in the threshold for required bars

cciStayedBelowNeg100 = not na(cciEntryTimeLong) and (bar_index - cciEntryTimeLong >= stayTimeFrames) and rsi >= 53

cciStayedAbove100 = not na(cciEntryTimeShort) and (bar_index - cciEntryTimeShort >= stayTimeFrames) and rsi <= 47

// CCI & RSI candle threshold tracking for Buy Over and Sell Over signals

var int buyOverEntryTime = na

var int sellOverEntryTime = na

// Track entry time when RSI and CCI conditions are met

if (rsiOver <= 31 and cci <= -120)

if na(buyOverEntryTime)

buyOverEntryTime := bar_index

else

buyOverEntryTime := na

if (rsiOver >= 69 and cci >= 120)

if na(sellOverEntryTime)

sellOverEntryTime := bar_index

else

sellOverEntryTime := na

// Confirm that conditions are met for the required stayTimeFrames

buyOverCondition = not na(buyOverEntryTime) and (bar_index - buyOverEntryTime >= stayTimeFramesOver)

sellOverCondition = not na(sellOverEntryTime) and (bar_index - sellOverEntryTime <= stayTimeFramesOver)

//Buy and sell for over bought or sell

conditionOverBuy = buyOverCondition

conditionOverSell = sellOverCondition

// Buy and sell conditions

buyCondition = cciStayedBelowNeg100

sellCondition = cciStayedAbove100

// // Track open positions

var bool isLongOpen = false

var bool isShortOpen = false

// // Strategy logic for backtesting

// if (buyCondition and not isLongOpen)

// strategy.entry("Long", strategy.long)

// isLongOpen := true

// isShortOpen := false

// if (sellCondition and not isShortOpen)

// strategy.entry("Short", strategy.short)

// isShortOpen := true

// isLongOpen := false

// // Close positions based on EMA 50

// if (isLongOpen and exitLongCondition)

// strategy.close("Long")

// isLongOpen := false

// if (isShortOpen and exitShortCondition)

// strategy.close("Short")

// isShortOpen := false

// Track RSI at position entry

var float entryRSILong = na

var float entryRSIShort = na

// Track CCI at position entry

var float entryCCILong = na

var float entryCCIShort = na

if (buyOverCondition and not isLongOpen)

strategy.entry("Long", strategy.long)

entryRSILong := rsi // Store RSI at entry

entryCCILong := cci

isLongOpen := true

isShortOpen := false

if (sellOverCondition and not isShortOpen)

strategy.entry("Short", strategy.short)

entryRSIShort := rsi // Store RSI at entry

entryCCIShort := cci // Stpre CCI at entry

isShortOpen := true

isLongOpen := false

exitLongRSICondition = isLongOpen and not na(entryRSILong) and rsi >= (entryRSILong + 12) or rsi <= (entryRSILong -8)

exitShortRSICondition = isShortOpen and not na(entryRSIShort) and rsi <= (entryRSIShort - 12) or rsi >= (entryRSIShort +8)

exitLongCCICondition = isLongOpen and not na(entryCCILong) and cci <= (entryCCILong -100)

exitShortCCICondition = isShortOpen and not na(entryCCIShort) and cci >= (entryCCIShort +100)

// Close positions based on EMA 50 or RSI change

if (isLongOpen and (exitLongRSICondition) or (exitLongCCICondition))

strategy.close("Long")

isLongOpen := false

entryRSILong := na

entryCCILong := na

isLongOpen := false

if (isShortOpen and (exitShortRSICondition) or (exitShortCCICondition))

strategy.close("Short")

isShortOpen := false

entryRSIShort := na

entryCCIShort := na

isShortOpen := false

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.large, title="Buy Signal", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.large, title="Sell Signal", text="SELL")

//Plot buy and sell OverBought

plotshape(conditionOverBuy, style=shape.labelup, location=location.belowbar, color=color.rgb(255, 238, 0), size=size.large, title="OverBuy Signal", text="Over Sell")

plotshape(conditionOverSell, style=shape.labeldown, location=location.abovebar, color=color.rgb(186, 40, 223), size=size.large, title="OverSell Signal", text="Over Buy")

// Alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell Signal Triggered")

相关推荐