概述

该策略是一个基于布林带突破和蜡烛线形态的趋势跟踪交易系统。策略通过识别连续三根突破布林带的蜡烛线,并结合收盘价在蜡烛线实体中的位置来确定交易信号。系统采用了固定的1:1风险收益比来管理每笔交易的止损和止盈。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用20周期的布林带作为主要指标,标准差倍数为2.0 2. 多头入场条件:连续三根K线收盘价突破上轨,且这三根K线都是阳线,收盘价都位于实体上半部分 3. 空头入场条件:连续三根K线收盘价突破下轨,且这三根K线都是阴线,收盘价都位于实体下半部分 4. 止损设置在最早那根信号K线的极值处 5. 基于1:1的风险收益比设置止盈位置

策略优势

- 采用多重确认机制,通过连续三根突破K线的形态要求,有效降低假突破的风险

- 结合收盘价在K线实体中的位置判断,增强了趋势确认的可靠性

- 使用固定的风险收益比进行仓位管理,便于风险控制

- 策略逻辑清晰,易于理解和执行

- 通过标记功能直观显示交易信号,便于回测分析

策略风险

- 在震荡市场中可能产生频繁的假信号

- 固定的风险收益比可能无法充分把握强趋势行情

- 连续三根K线的严格要求可能错过一些潜在的好机会

- 止损设置在信号K线极值处,在波动较大时止损位置可能过远 建议通过以下方式管理风险:

- 结合市场波动周期调整布林带参数

- 根据市场特征动态调整风险收益比

- 增加趋势确认指标

- 优化止损位置设置方法

策略优化方向

- 参数优化:

- 可以根据不同市场特征动态调整布林带周期和标准差倍数

- 考虑将三根K线的要求改为动态判断

- 信号优化:

- 增加趋势确认指标如ADX或趋势线

- 引入成交量确认机制

- 考虑加入摆动指标作为辅助

- 仓位管理优化:

- 实现动态的风险收益比设置

- 增加资金管理模块

- 考虑分批建仓和平仓机制

- 止损优化:

- 引入跟踪止损机制

- 基于ATR设置止损距离

- 考虑时间止损

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过布林带突破和蜡烛线形态的多重确认机制,有效降低了假信号风险。固定的风险收益比设置简化了交易管理,但也限制了策略的灵活性。通过优化参数设置、增加确认指标、改进仓位管理等方式,策略仍有较大的改进空间。整体而言,这是一个具有实用价值的基础策略框架,可以根据具体需求进行进一步完善。

策略源码

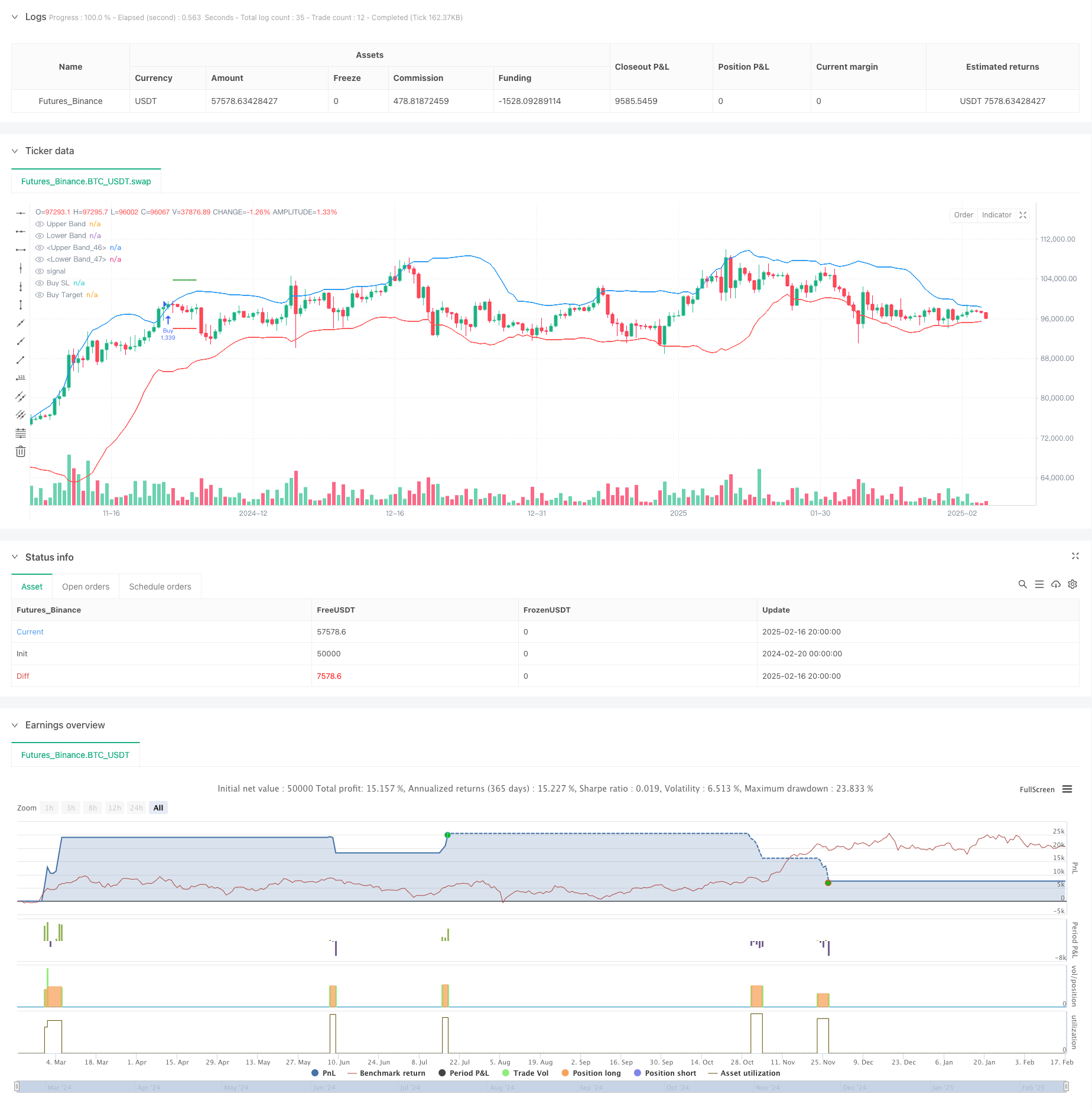

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-17 08:00:00

period: 12h

basePeriod: 12h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Bollinger Band Strategy (Close Near High/Low Relative to Half Range)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200, pyramiding=0)

// Bollinger Bands

length = input.int(20, "BB Length")

mult = input.float(2.0, "BB StdDev")

basis = ta.sma(close, length)

upper_band = basis + mult * ta.stdev(close, length)

lower_band = basis - mult * ta.stdev(close, length)

// Plot Bollinger Bands

plot(upper_band, "Upper Band", color.blue)

plot(lower_band, "Lower Band", color.red)

// Buy Condition:

// 1. Last 3 candles close above upper band AND close > open for all 3 candles

// 2. Close is in the top half of the candle's range (close > (high + low) / 2)

buyCondition = close[2] > upper_band[2] and close[1] > upper_band[1] and close > upper_band and close[2] > open[2] and close[2] > (high[2] + low[2]) / 2 and close[1] > open[1] and close[1] > (high[1] + low[1]) / 2 and close > open and close > (high + low) / 2

// Sell Condition:

// 1. Last 3 candles close below lower band AND close < open for all 3 candles

// 2. Close is in the bottom half of the candle's range (close < (high + low) / 2)

sellCondition = close[2] < lower_band[2] and close[1] < lower_band[1] and close < lower_band and close[2] < open[2] and close[2] < (high[2] + low[2]) / 2 and close[1] < open[1] and close[1] < (high[1] + low[1]) / 2 and close < open and close < (high + low) / 2

// Initialize variables

var float stop_loss = na

var float target_price = na

// Buy Logic

if buyCondition and strategy.position_size == 0

stop_loss := low[2] // Low of the earliest candle in the 3-candle sequence

target_price := close + (close - stop_loss) // Risk-to-reward 1:1

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Buy", "Buy", stop=stop_loss, limit=target_price)

label.new(bar_index, low, "▲", color=color.green, style=label.style_label_up, yloc=yloc.belowbar)

// Sell Logic

if sellCondition and strategy.position_size == 0

stop_loss := high[2] // High of the earliest candle in the 3-candle sequence

target_price := close - (stop_loss - close) // Risk-to-reward 1:1

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Sell", "Sell", stop=stop_loss, limit=target_price)

label.new(bar_index, high, "▼", color=color.red, style=label.style_label_down, yloc=yloc.abovebar)

// Plotting

plot(upper_band, "Upper Band", color.blue)

plot(lower_band, "Lower Band", color.red)

plot(strategy.position_size > 0 ? stop_loss : na, "Buy SL", color.red, 2, plot.style_linebr)

plot(strategy.position_size > 0 ? target_price : na, "Buy Target", color.green, 2, plot.style_linebr)

plot(strategy.position_size < 0 ? stop_loss : na, "Sell SL", color.red, 2, plot.style_linebr)

plot(strategy.position_size < 0 ? target_price : na, "Sell Target", color.green, 2, plot.style_linebr)

相关推荐