概述

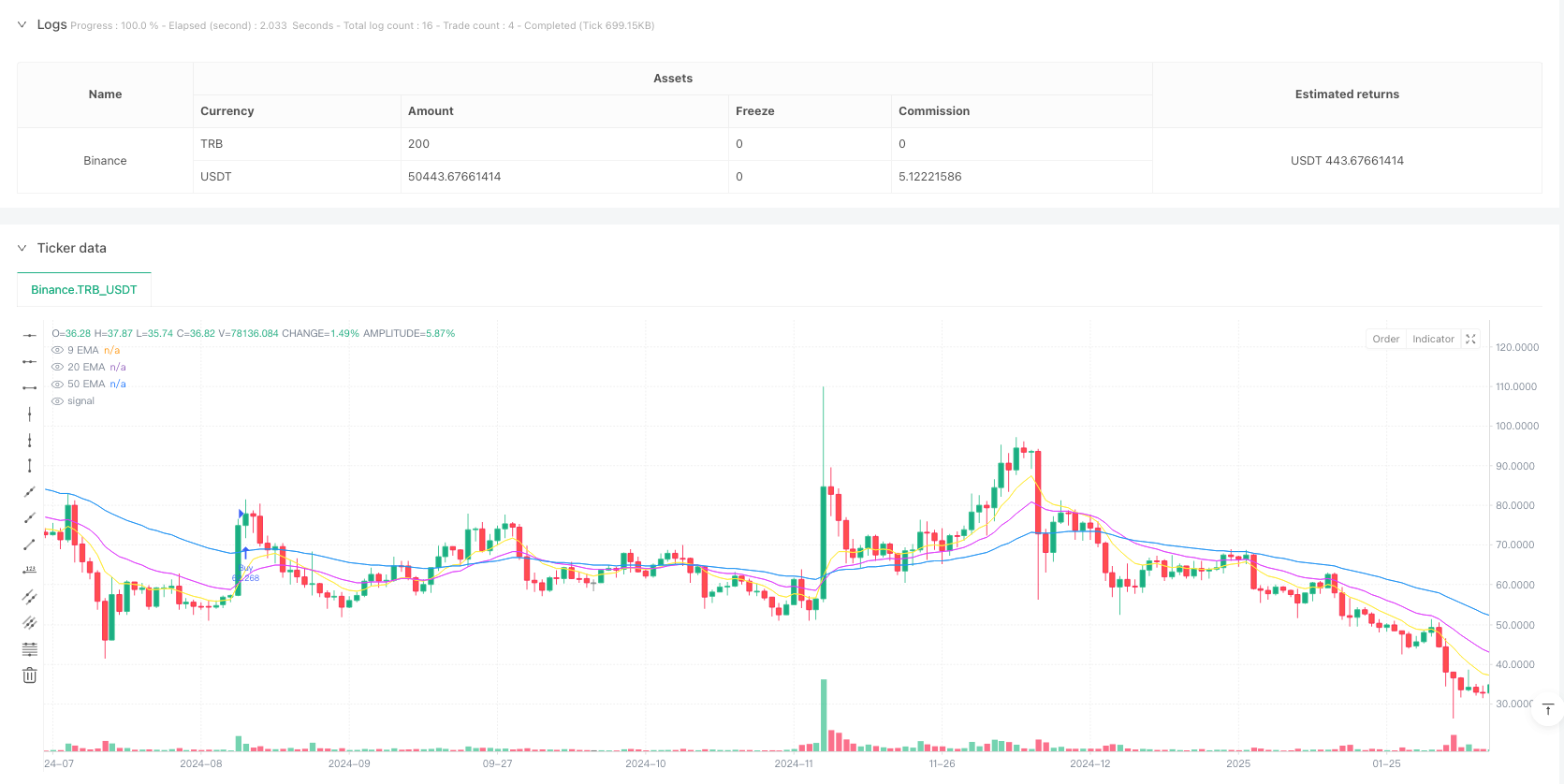

这是一个基于多均线趋势跟踪系统的加密货币交易策略,结合了RSI和ATR指标进行交易过滤和风险管理。该策略主要针对主流加密货币进行交易,通过设定每日交易频率限制和动态止盈止损来控制风险。策略采用9周期、20周期和50周期三条指数移动平均线(EMA)来判断趋势方向,并使用相对强弱指标(RSI)和平均真实波幅(ATR)作为辅助指标进行交易过滤。

策略原理

策略的核心交易逻辑包括以下几个关键部分: 1. 趋势判断:使用三条EMA(9/20/50)进行趋势方向判断,当短期EMA穿越中期EMA且价格位于长期EMA之上时,视为上升趋势成立;反之则视为下降趋势成立。 2. 交易过滤:使用RSI(14)进行超买超卖过滤,买入信号要求RSI在45-70之间,卖出信号要求RSI在30-55之间。 3. 趋势强度确认:要求价格与50周期EMA的距离大于1.1倍ATR,以确保趋势足够强劲。 4. 风险管理:根据不同加密货币的波动特性,设置2.5-3.2倍ATR的止损和3.5-5.0倍ATR的止盈。 5. 交易频率控制:每个交易日最多允许一笔交易,避免过度交易。

策略优势

- 动态风险管理:通过ATR动态调整止盈止损位置,适应加密货币市场高波动性的特点。

- 差异化处理:针对不同加密货币的波动特点设置不同的风险参数。

- 多重过滤机制:结合趋势、动量和波动性指标,提高交易质量。

- 交易频率限制:通过每日交易限制降低过度交易风险,特别适合加密货币市场的高波动特性。

- 资金管理合理:基于账户规模和风险水平动态计算交易规模,保护资金安全。

策略风险

- 趋势反转风险:在加密货币市场剧烈波动时可能承受较大损失。

- 滑点风险:在流动性不足时可能面临较大滑点。

- 交易机会限制:每日交易次数限制可能错过快速市场中的机会。

- 参数敏感性:多个指标参数的设置会影响策略表现,需要定期优化。

- 市场环境依赖:策略在趋势市场表现较好,但在震荡市场可能产生虚假信号。

策略优化方向

- 引入市场波动周期分析:可以根据加密货币市场的不同波动周期动态调整参数。

- 优化交易时间过滤:增加基于全球主要交易时段的过滤条件。

- 完善出场机制:可以增加移动止损或者基于市场情绪的动态出场机制。

- 增加交易规模管理:可以根据市场波动率动态调整交易规模。

- 加入市场情绪指标:引入链上数据或社交媒体情绪指标来增强交易过滤。

总结

该策略通过多重技术指标的综合运用,实现了相对稳健的加密货币交易系统。通过差异化的风险参数设置和严格的交易频率控制,较好地平衡了收益和风险。策略的核心优势在于其动态的风险管理机制和完善的过滤系统,但同时也需要注意加密货币市场特有的高波动性和流动性风险。通过持续优化和完善,该策略有望在不同市场环境下都能保持稳定的表现。

策略源码

/*backtest

start: 2015-02-22 00:00:00

end: 2025-02-18 17:23:25

period: 1h

basePeriod: 1h

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © buffalobillcody

//@version=6

strategy("Backtest Last 2880 Baars Filers and Exits", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2, backtest_fill_limits_assumption=0)

// Define EMAs

shortEMA = ta.ema(close, 9)

longEMA = ta.ema(close, 20)

refEMA = ta.ema(close, 50)

// **Force Strategy to Trade on Historical Bars**

barLimit = bar_index > 10 // Allow trading on past bars

allowTrade = strategy.opentrades == 0 or barLimit // Enable first trade on history

// **Define ATR for Stop-Loss & Take-Profit**

atrLength = 14

atrValue = ta.atr(atrLength)

atr50 = ta.sma(atrValue, 50) // 50-period ATR average

// **Relaxed RSI Filters (More Trades Allowed)**

rsi = ta.rsi(close, 14)

rsiFilterBuy = rsi > 45 and rsi < 70

rsiFilterSell = rsi < 55 and rsi > 30

// **Reduce Trend Filter - Allow Smaller Price Movement**

minDistance = atrValue * 1.1

isTrending = math.abs(close - refEMA) > minDistance

// **Allow Trading in All Conditions (No ATR Filter)**

atrFilter = true

// **Allow Flat EMA Slopes - Increase Trade Frequency**

emaSlope = ta.linreg(refEMA, 5, 0) > -0.2

emaSlopeSell = ta.linreg(refEMA, 5, 0) < 0.2

// **Trade Counter: Allow 1 Trade Per Day**

var int dailyTradeCount = 0

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// **ATR-Based Stop-Loss & Take-Profit Per Pair**

atrSL = switch syminfo.ticker

"EURUSD" => 3.0 * atrValue,

"USDJPY" => 2.5 * atrValue,

"GBPUSD" => 3.0 * atrValue,

"AUDUSD" => 3.2 * atrValue,

"GBPJPY" => 3.0 * atrValue,

=> 2.5 * atrValue

atrTP = switch syminfo.ticker

"EURUSD" => 3.8 * atrValue,

"USDJPY" => 3.5 * atrValue,

"GBPUSD" => 4.0 * atrValue,

"AUDUSD" => 4.0 * atrValue,

"GBPJPY" => 5.0 * atrValue,

=> 3.5 * atrValue

// **Ensure Trade Size is Not Zero**

riskPerTrade = 2

accountSize = strategy.equity

tradeSize = (accountSize * (riskPerTrade / 100)) / atrSL

tradeSize := tradeSize < 1 ? 1 : tradeSize // Minimum lot size of 1

// **Buy/Sell Conditions (Now More Trades Will Trigger)**

buyCondition = ta.crossover(shortEMA, longEMA) and rsiFilterBuy and close > refEMA and close > longEMA and isTrending and emaSlope and allowTrade and dailyTradeCount < 1

sellCondition = ta.crossunder(shortEMA, longEMA) and rsiFilterSell and close < refEMA and close < longEMA and isTrending and emaSlopeSell and allowTrade and dailyTradeCount < 1

// **Execute Trades**

if buyCondition

strategy.entry("Buy", strategy.long, qty=tradeSize)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=close + atrTP, stop=close - atrSL)

label.new(x=bar_index, y=low, text="BUY", color=color.green, textcolor=color.white, size=size.small, style=label.style_label_down)

alert("BUY", alert.freq_once_per_bar_close)

dailyTradeCount := dailyTradeCount + 1

if sellCondition

strategy.entry("Sell", strategy.short, qty=tradeSize)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", limit=close - atrTP, stop=close + atrSL)

label.new(x=bar_index, y=high, text="SELL", color=color.red, textcolor=color.white, size=size.small, style=label.style_label_up)

alert("SELL", alert.freq_once_per_bar_close)

dailyTradeCount := dailyTradeCount + 1

// **Plot Indicators**

plot(shortEMA, color=color.yellow, title="9 EMA")

plot(longEMA, color=color.fuchsia, title="20 EMA")

plot(refEMA, color=color.blue, title="50 EMA")

相关推荐