动态波云趋势ATR止损策略

Ichimoku Cloud ATR Senkou Span CHIKOU SPAN SMA

创建日期:

2025-02-19 17:04:21

最后修改:

2025-02-27 17:54:39

复制:

1

点击次数:

489

概述

该策略是一个结合了一目均衡图(Ichimoku Cloud)和真实波动幅度均值(ATR)的完整交易系统。它通过云图组件识别市场趋势,同时利用ATR动态调整止损位置,实现了趋势跟踪和风险管理的有机结合。策略融合了动量和波动率两个维度的市场信息,为交易决策提供了全面的分析框架。

策略原理

策略的核心逻辑建立在一目均衡图的五条线和ATR指标之上。系统通过转换线(Tenkan-Sen)和基准线(Kijun-Sen)的交叉来触发交易信号,同时要求价格位于云层(Senkou Span A和B)的正确一侧,并得到延迟线(Chikou Span)的确认。具体来说: - 做多条件:转换线上穿基准线,价格在云层之上,延迟线在当前收盘价之上 - 做空条件:转换线下穿基准线,价格在云层之下,延迟线在当前收盘价之下 - 止损设置:通过ATR的倍数动态调整,默认为1.5倍ATR - 出场条件:反向的交叉信号或延迟线位置改变

策略优势

- 多维度确认:结合了趋势、动量和波动率多个维度的市场信息,提高了信号的可靠性

- 动态风险管理:基于ATR的止损设置能够根据市场波动性自动调整,避免了固定止损的缺陷

- 系统化运作:策略规则明确,能够保持交易的一致性和纪律性

- 视觉直观:通过云图的可视化展示,交易者能够直观理解市场结构

- 适应性强:各项参数可调,能够适应不同市场环境

策略风险

- 滞后性风险:一目均衡图指标本身具有一定滞后性,可能导致入场时机偏后

- 震荡市风险:在横盘震荡市场中可能产生假突破信号

- 参数敏感性:不同时间周期的参数设置会显著影响策略表现

- 止损幅度:ATR倍数的选择需要权衡保护和盈利空间

- 信号频率:严格的入场条件可能导致交易机会相对较少

策略优化方向

- 引入趋势强度过滤:可以添加ADX等指标衡量趋势强度,过滤弱趋势环境

- 优化止损机制:可以考虑将止损位设在云层边缘或重要支撑/阻力位

- 增加时间过滤:避开重要经济数据公布等高波动期

- 加入成交量确认:将成交量作为信号确认的补充条件

- 开发部分仓位管理:根据信号强度和市场环境调整持仓比例

总结

动态波云趋势ATR止损策略是一个融合了经典技术分析工具的完整交易系统。它通过一目均衡图的多重确认机制识别趋势,并利用ATR进行动态风险控制,为交易者提供了一个系统化的决策框架。虽然策略存在一定的滞后性和参数敏感性问题,但通过合理的优化和风险管理,能够在趋势市场中获得稳定的表现。策略的可视化特性和清晰的规则使其特别适合想要践行系统化交易的投资者。

策略源码

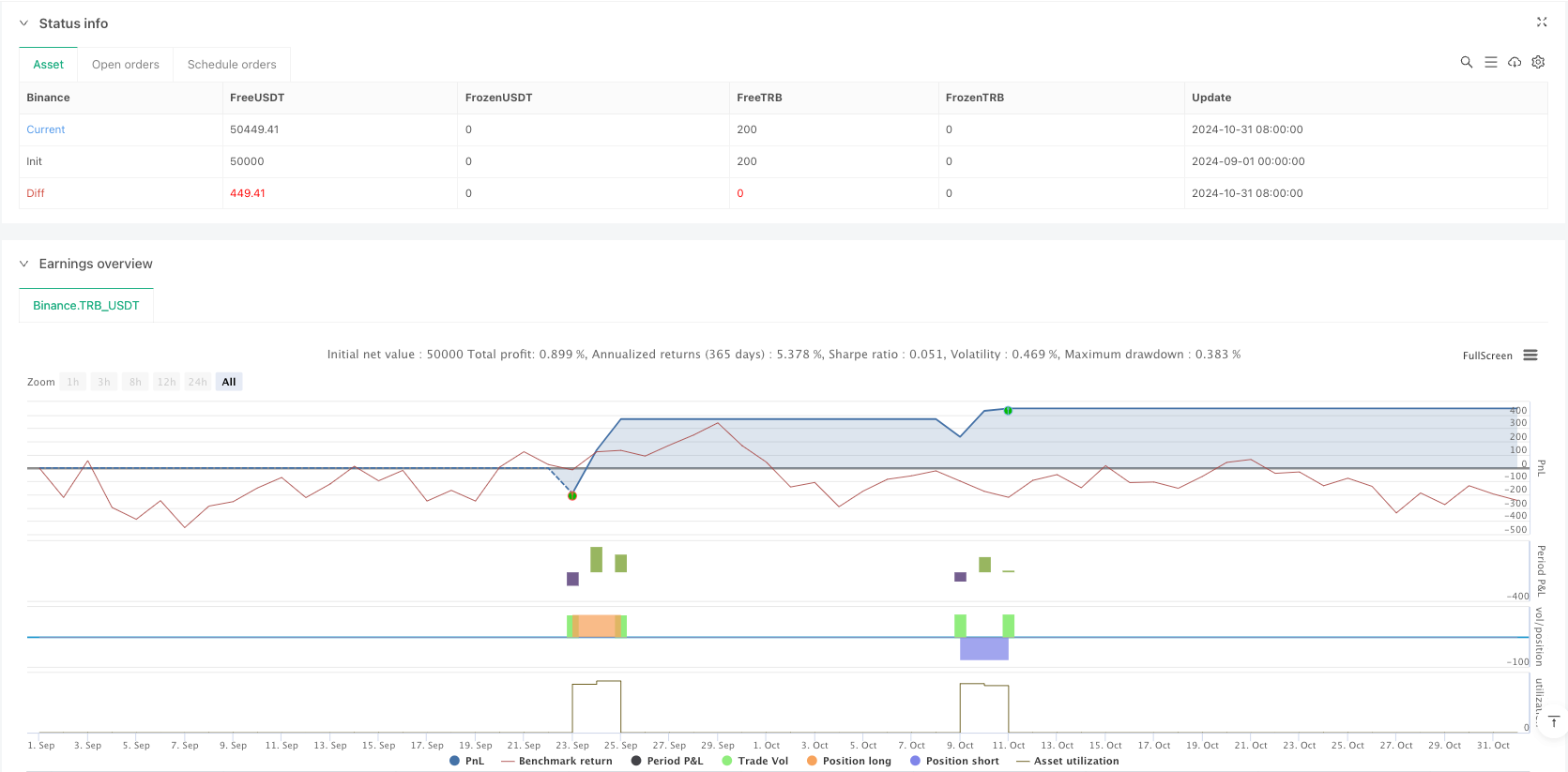

/*backtest

start: 2024-09-01 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud + ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

conversionPeriods = input.int(9, title="Tenkan-sen Period", minval=1)

basePeriods = input.int(26, title="Kijun-sen Period", minval=1)

laggingSpan2Periods = input.int(52, title="Senkou Span B Period", minval=1)

displacement = input.int(26, title="Displacement", minval=1)

atrLength = input.int(14, title="ATR Period", minval=1)

atrMultiplier = input.float(1.5, title="ATR Multiplier for Stop-Loss", minval=0.1, step=0.1)

// === Indicator Calculations ===

// Ichimoku Cloud

tenkan = (ta.highest(high, conversionPeriods) + ta.lowest(low, conversionPeriods)) / 2

kijun = (ta.highest(high, basePeriods) + ta.lowest(low, basePeriods)) / 2

senkouSpanA = ta.sma((tenkan + kijun) / 2, 1)

senkouSpanB = (ta.highest(high, laggingSpan2Periods) + ta.lowest(low, laggingSpan2Periods)) / 2

chikouSpan = close[displacement]

// ATR

atr = ta.atr(atrLength)

// === Entry Conditions ===

longCondition = ta.crossover(tenkan, kijun) and close > senkouSpanA and close > senkouSpanB and chikouSpan > close

shortCondition = ta.crossunder(tenkan, kijun) and close < senkouSpanA and close < senkouSpanB and chikouSpan < close

// === Entry Signals with Stop-Loss ===

if (longCondition)

longStop = close - (atrMultiplier * atr)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longStop)

if (shortCondition)

shortStop = close + (atrMultiplier * atr)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortStop)

// === Exit Conditions ===

exitLongCondition = ta.crossunder(tenkan, kijun) or chikouSpan < close

exitShortCondition = ta.crossover(tenkan, kijun) or chikouSpan > close

if (exitLongCondition)

strategy.close("Long")

if (exitShortCondition)

strategy.close("Short")

// === Plotting Indicators on the Chart ===

// Ichimoku Cloud

plot(senkouSpanA, color=color.green, title="Senkou Span A")

plot(senkouSpanB, color=color.red, title="Senkou Span B")

fill(plot(senkouSpanA, color=color.green), plot(senkouSpanB, color=color.red), color=close > senkouSpanA ? color.new(color.green, 90) : color.new(color.red, 90), title="Ichimoku Cloud")

// Tenkan-sen and Kijun-sen

plot(tenkan, color=color.blue, title="Tenkan-sen")

plot(kijun, color=color.red, title="Kijun-sen")

// Chikou Span

plot(chikouSpan, color=color.purple, title="Chikou Span", offset=-displacement)

// ATR (hidden)

plot(atr, color=color.orange, title="ATR", linewidth=1, display=display.none)

// === Signal Visualization ===

// Markers for Long and Short entries

plotshape(series=longCondition, title="Long Entry", location=location.belowbar, color=color.green, style=shape.labelup, text="Long")

plotshape(series=shortCondition, title="Short Entry", location=location.abovebar, color=color.red, style=shape.labeldown, text="Short")

// Markers for Long and Short exits

plotshape(series=exitLongCondition, title="Long Exit", location=location.abovebar, color=color.red, style=shape.labeldown, text="Exit Long")

plotshape(series=exitShortCondition, title="Short Exit", location=location.belowbar, color=color.green, style=shape.labelup, text="Exit Short")

相关推荐