双指标动态趋势交易策略:基于RSI与MACD的多维技术分析系统

RSI MACD OB(Overbought) OS(Oversold) TA(Technical Analysis)

创建日期:

2025-02-19 17:52:18

最后修改:

2025-02-27 17:53:45

复制:

4

点击次数:

470

概述

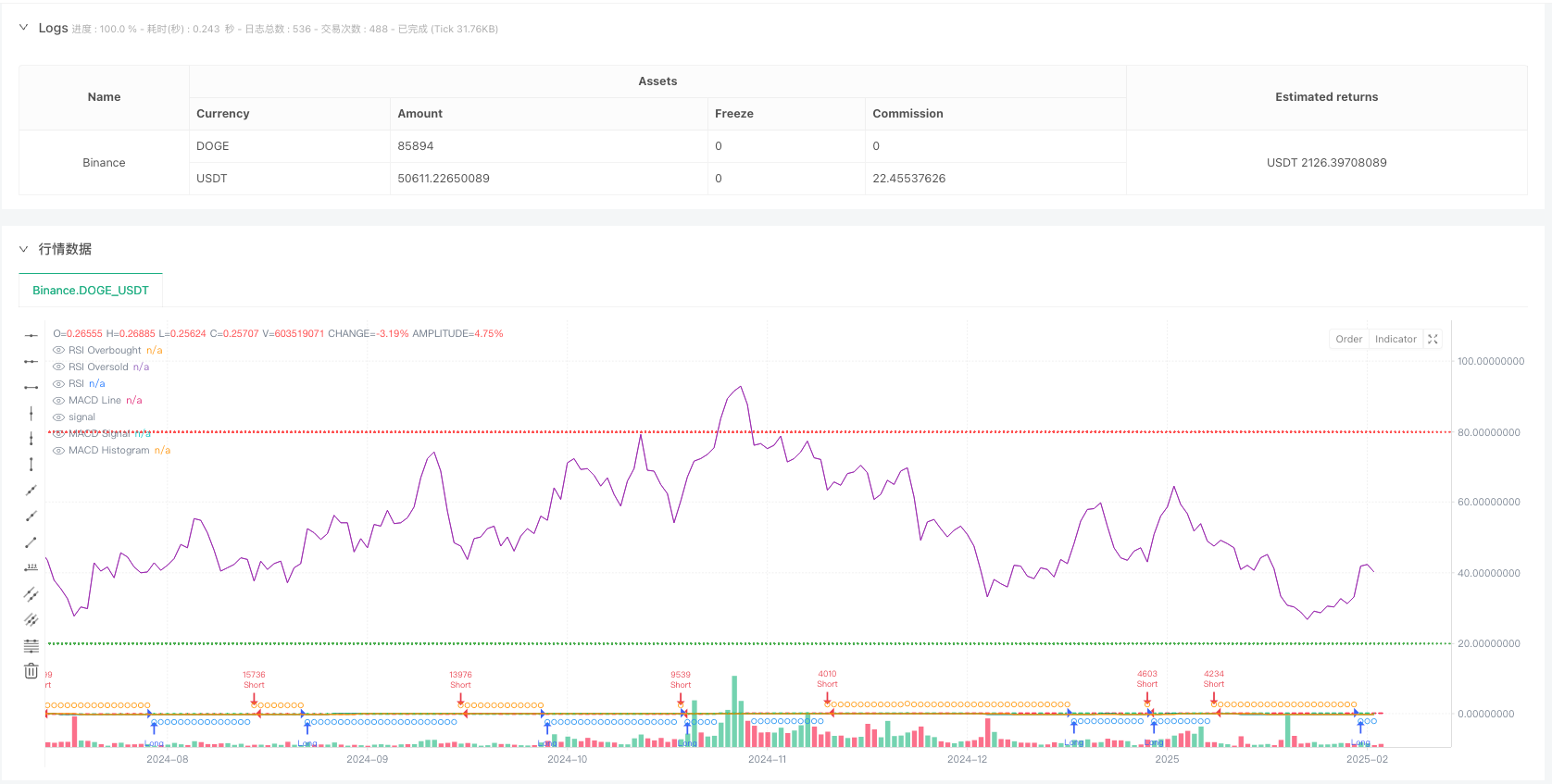

这是一个基于RSI和MACD双重技术指标的自动化交易策略。该策略通过结合超买超卖信号与趋势确认来识别潜在的交易机会,实现对市场的精准把握。策略采用百分比仓位管理,并内置了防滑点机制,具有较强的实用性和适应性。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用相对强弱指标(RSI)进行超买超卖判断,参数设置为14周期,超买值80,超卖值20 2. 运用MACD(12,26,9)进行趋势确认,通过MACD线与信号线的交叉识别趋势变化 3. 交易信号的产生需同时满足RSI和MACD的条件: - 做多条件:RSI未达超买 + MACD线在信号线上方 - 做空条件:RSI未达超卖 + MACD线在信号线下方 4. 采用账户权益的3%作为每次交易的仓位大小,并限制了同向交易的重复建仓

策略优势

- 双重技术指标的配合使用大大降低了假信号的风险,提高了交易的可靠性

- 百分比仓位管理方式有助于资金的动态调整,更好地控制风险

- 内置的防滑点机制(3个点位)增强了策略在实盘中的适应性

- 策略支持做多做空双向交易,可以充分把握市场机会

- 交易时间段可自定义,便于根据不同市场特点进行调整

策略风险

- RSI和MACD都属于滞后指标,在快速波动的市场中可能反应不够及时

- 固定的超买超卖阈值在不同市场环境下可能需要调整

- 3%的固定仓位在某些情况下可能偏大或偏小

- 没有设置止损止盈条件,可能导致盈利回吐或损失扩大

- 双指标的严格条件可能会错过一些潜在的交易机会

策略优化方向

- 引入自适应的RSI阈值,根据市场波动度动态调整超买超卖判断标准

- 增加止损止盈机制,建议基于ATR或波动率设置动态止损位

- 优化仓位管理系统,可考虑根据市场波动性和账户净值变化动态调整仓位大小

- 添加市场环境过滤器,在不同市场条件下调整策略参数或暂停交易

- 考虑引入成交量指标作为辅助确认,提高信号的可靠性

总结

该策略通过RSI和MACD的协同作用,构建了一个相对稳健的交易系统。虽然存在一定的滞后性风险,但通过合理的风险控制和参数优化,策略仍具有较好的实用价值。建议在实盘应用前进行充分的回测,并根据具体市场特点进行针对性优化。

策略源码

//@version=6

strategy("Debugging Demo GPT",

overlay=true,

initial_capital=100,

default_qty_type=strategy.percent_of_equity,

default_qty_value=3,

pyramiding=1,

calc_on_order_fills=true,

calc_on_every_tick=true,

slippage=3)

// -----------------------------------------------------------------------

// (1) Inputs: Start and End Date

// -----------------------------------------------------------------------

// -----------------------------------------------------------------------

// (2) Indicators (RSI, MACD)

// -----------------------------------------------------------------------

// === RSI ===

rsiLen = input.int(14, "RSI Length")

rsiOB = input.int(80, "RSI Overbought")

rsiOS = input.int(20, "RSI Oversold")

rsiVal = ta.rsi(close, rsiLen)

// === MACD ===

fastLen = input.int(12, "MACD Fast Length")

slowLen = input.int(26, "MACD Slow Length")

sigLen = input.int(9, "MACD Signal Length")

[macdLine, sigLine, histLine] = ta.macd(close, fastLen, slowLen, sigLen)

// -----------------------------------------------------------------------

// (3) Trading Logic: LONG/SHORT Filters

// -----------------------------------------------------------------------

bool rsiLongOk = (rsiVal < rsiOB)

bool rsiShortOk = (rsiVal > rsiOS)

bool macdLongOk = (macdLine > sigLine)

bool macdShortOk = (macdLine < sigLine)

bool longCondition = rsiLongOk and macdLongOk

bool shortCondition = rsiShortOk and macdShortOk

// -----------------------------------------------------------------------

// (4) Entry Conditions

// -----------------------------------------------------------------------

// Debugging: Visualizing the conditions

plotshape(series=longCondition, location=location.belowbar, color=color.blue, style=shape.circle, title="LongCondition", size=size.tiny)

plotshape(series=shortCondition, location=location.abovebar, color=color.orange, style=shape.circle, title="ShortCondition", size=size.tiny)

// Entries only when all conditions are met

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// -----------------------------------------------------------------------

// (5) Plotting for Visualization

// -----------------------------------------------------------------------

// RSI Plots

hline(rsiOB, "RSI Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOS, "RSI Oversold", color=color.green, linestyle=hline.style_dotted)

plot(rsiVal, title="RSI", color=color.purple)

// MACD Plots

plot(macdLine, color=color.teal, title="MACD Line")

plot(sigLine, color=color.orange, title="MACD Signal")

plot(histLine, style=plot.style_histogram, color=(histLine >= 0 ? color.lime : color.red), title="MACD Histogram")

相关推荐