概述

这是一个结合了布林带(Bollinger Bands)、移动平均线离散度(MACD)和成交量分析的高频交易策略系统。该策略通过识别价格在布林带上下轨的突破和回归,结合MACD动量指标和成交量确认,来捕捉市场的反转机会。系统设置了每日最大交易次数限制,并配备了完善的风险管理机制。

策略原理

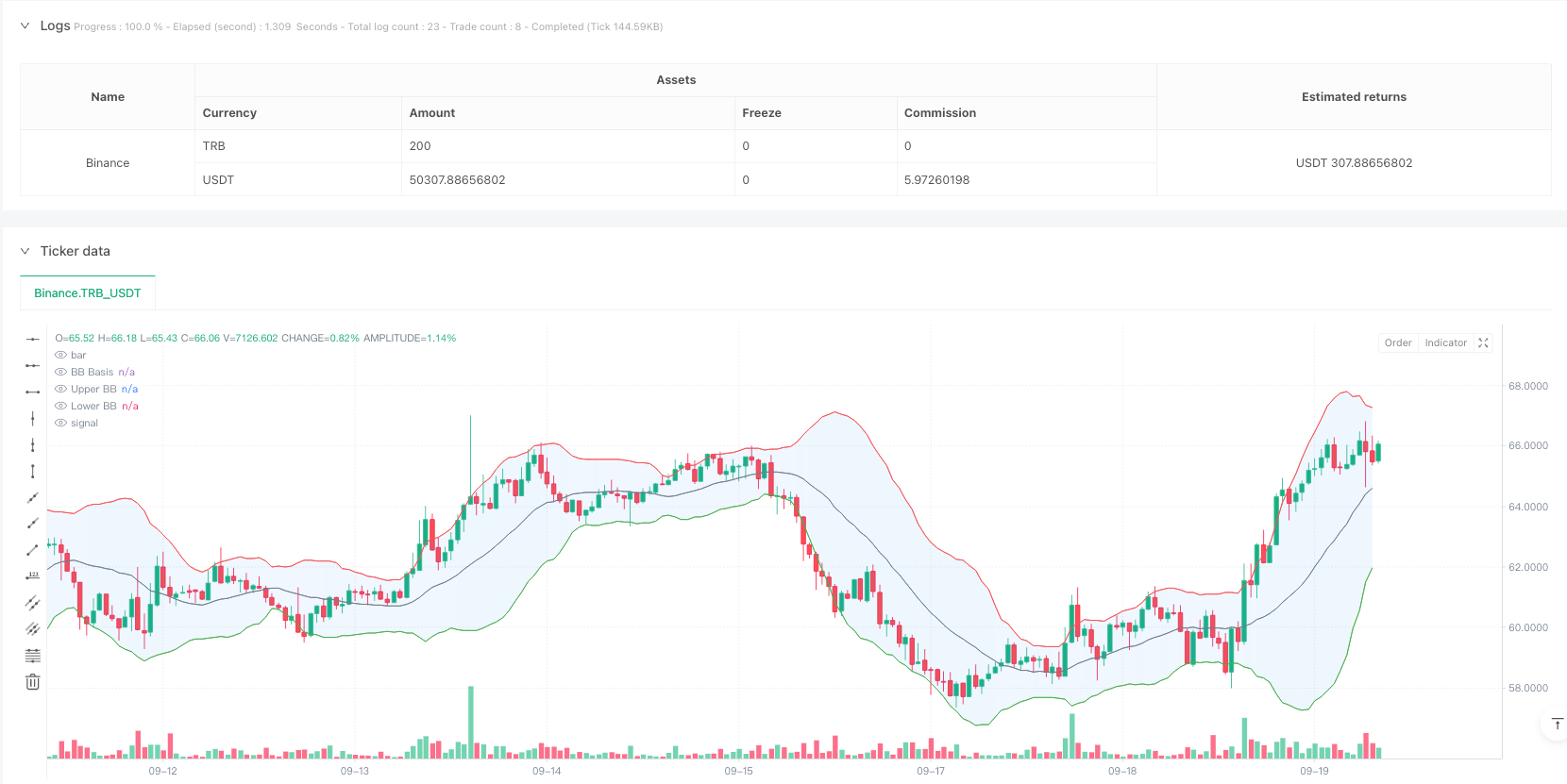

策略主要基于以下三个核心指标组合: 1. 布林带指标:使用20周期的简单移动平均线(SMA)作为中轨,标准差乘数为2.0计算上下轨。当价格突破布林带后回归时,系统会发出潜在的交易信号。 2. MACD指标:采用标准参数设置(12,26,9),用于确认价格趋势动量。当MACD线位于信号线上方时确认做多信号,位于信号线下方时确认做空信号。 3. 成交量分析:使用20周期移动平均确认成交量,要求信号出现时的成交量至少达到平均水平,以确保市场参与度。

策略优势

- 多重信号确认:通过布林带、MACD和成交量三重验证,显著提高了交易信号的可靠性。

- 可视化设计:系统提供丰富的图表指示,包括布林带填充、信号标记和背景颜色变化,便于交易者快速识别交易机会。

- 风险控制完善:实施了固定止损和获利目标,并限制每日最大交易次数,有效控制风险敞口。

- 系统化操作:策略提供了清晰的入场和出场条件,减少了主观判断带来的不确定性。

策略风险

- 市场波动风险:在高波动市场中,可能出现虚假突破信号,导致交易损失。

- 滑点风险:高频交易环境下,可能面临较大的滑点成本,影响实际收益。

- 流动性风险:成交量条件可能在市场流动性不足时限制交易机会。

- 系统性风险:固定的参数设置可能无法适应市场条件的剧烈变化。

策略优化方向

- 参数动态优化:可引入自适应参数调整机制,使布林带和MACD参数能够根据市场条件自动调整。

- 市场周期识别:增加市场周期判断模块,在不同市场周期下采用不同的交易策略。

- 风险管理优化:可考虑引入动态止损机制,根据市场波动性调整止损位置。

- 信号过滤增强:增加趋势强度过滤器,避免在横盘市场产生过多交易信号。

总结

该策略通过布林带反转信号、MACD趋势确认和成交量验证的组合,构建了一个完整的交易系统。系统的可视化设计和严格的风险控制使其特别适合日内交易。虽然存在一定的市场风险,但通过持续优化和参数调整,策略有望在不同市场环境下保持稳定表现。

策略源码

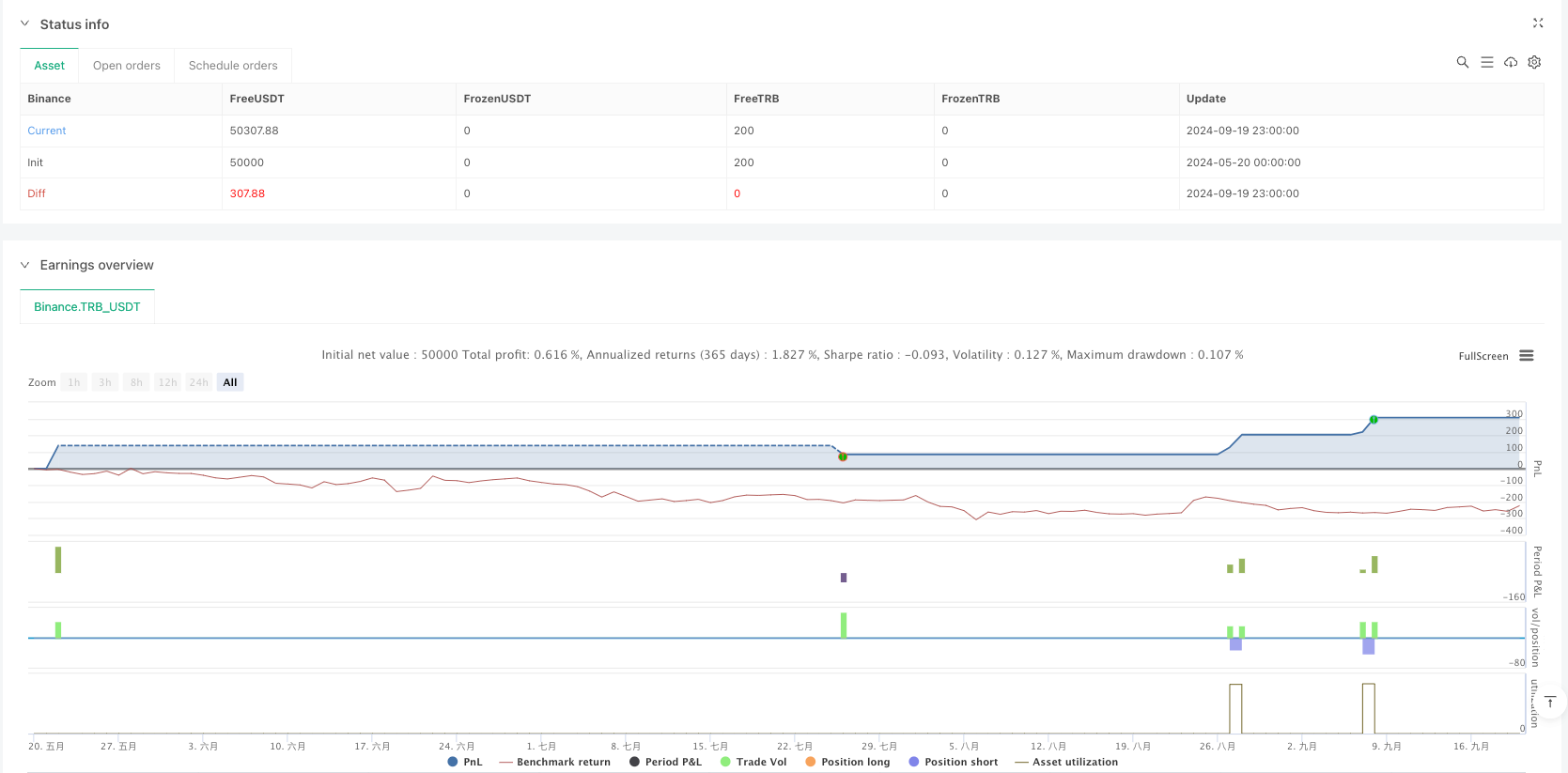

/*backtest

start: 2024-05-20 00:00:00

end: 2024-09-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

// Bollinger Bounce Reversal Strategy - Visual Edition

//

// Description:

// This strategy seeks to capture reversal moves at extreme price levels (“bounce points”) using Bollinger Bands.

// A long entry is triggered when the price, after being below the lower Bollinger Band, crosses upward above it,

// provided that the MACD line is above its signal line (indicating bullish momentum) and volume is strong.

// Conversely, a short entry is triggered when the price, after being above the upper Bollinger Band, crosses downward

// below it, with the MACD line below its signal line and high volume.

// To help avoid overtrading, the strategy limits entries to a maximum of 5 trades per day.

// Risk management is applied via fixed stop‑loss and take‑profit orders.

// This version overlays many visual cues on the chart: filled Bollinger Bands, signal markers, background colors,

// and an on‑chart information table displaying key values.

//

// Backtesting Parameters:

// • Initial Capital: $10,000

// • Commission: 0.1% per trade

// • Slippage: 1 tick per bar

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and provided solely for educational

// purposes. Please backtest and paper trade under your own conditions before live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Bollinger Bounce Reversal Strategy - Visual Edition", overlay=true, initial_capital=10000,

default_qty_type=strategy.percent_of_equity, default_qty_value=5,

commission_type=strategy.commission.percent, commission_value=0.1, slippage=1)

// ─── INPUTS ─────────────────────────────────────────────────────────────

bbPeriod = input.int(20, "Bollinger Bands Period", minval=1)

bbStd = input.float(2.0, "BB StdDev Multiplier", step=0.1)

macdFast = input.int(12, "MACD Fast Length", minval=1)

macdSlow = input.int(26, "MACD Slow Length", minval=1)

macdSignal = input.int(9, "MACD Signal Length", minval=1)

volAvgPeriod = input.int(20, "Volume MA Period", minval=1)

volFactor = input.float(1.0, "Volume Spike Factor", step=0.1) // Volume must be >= volAvg * factor

stopLossPerc = input.float(2.0, "Stop Loss (%)", step=0.1) * 0.01

takeProfitPerc = input.float(4.0, "Take Profit (%)", step=0.1) * 0.01

// ─── CALCULATIONS ─────────────────────────────────────────────────────────

basis = ta.sma(close, bbPeriod)

dev = bbStd * ta.stdev(close, bbPeriod)

upperBB = basis + dev

lowerBB = basis - dev

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

volAvg = ta.sma(volume, volAvgPeriod)

// ─── VISUALS: Bollinger Bands & Fill ───────────────────────────────────────

pBasis = plot(basis, color=color.gray, title="BB Basis")

pUpper = plot(upperBB, color=color.red, title="Upper BB")

pLower = plot(lowerBB, color=color.green, title="Lower BB")

fill(pUpper, pLower, color=color.new(color.blue, 90), title="BB Fill")

// ─── DAILY TRADE LIMIT ─────────────────────────────────────────────────────

// Reset the daily trade count at the start of each new day; limit entries to 5 per day.

var int tradesToday = 0

if ta.change(time("D"))

tradesToday := 0

// ─── SIGNAL LOGIC ─────────────────────────────────────────────────────────

// Define a "bounce" signal:

// For a long signal, require that the previous bar was below the lower band and the current bar crosses above it,

// the MACD line is above its signal, and volume is high.

longSignal = (close[1] < lowerBB and close > lowerBB) and (macdLine > signalLine) and (volume >= volFactor * volAvg)

// For a short signal, require that the previous bar was above the upper band and the current bar crosses below it,

// the MACD line is below its signal, and volume is high.

shortSignal = (close[1] > upperBB and close < upperBB) and (macdLine < signalLine) and (volume >= volFactor * volAvg)

// Plot visual signal markers on the chart.

plotshape(longSignal, title="Long Signal", style=shape.labelup, location=location.belowbar, color=color.green, text="Long", size=size.small)

plotshape(shortSignal, title="Short Signal", style=shape.labeldown, location=location.abovebar, color=color.red, text="Short", size=size.small)

// Change background color on signal bars for an extra cue.

bgcolor(longSignal ? color.new(color.green, 80) : shortSignal ? color.new(color.red, 80) : na, title="Signal BG")

// Only enter trades if fewer than 5 have been taken today.

if longSignal and (tradesToday < 5)

strategy.entry("Long", strategy.long)

tradesToday += 1

if shortSignal and (tradesToday < 5)

strategy.entry("Short", strategy.short)

tradesToday += 1

// ─── RISK MANAGEMENT: STOP-LOSS & TAKE-PROFIT ─────────────────────────────

// For long positions: set stop loss and take profit relative to the entry price.

if strategy.position_size > 0

strategy.exit("Long Exit", "Long", stop=strategy.position_avg_price*(1 - stopLossPerc), limit=strategy.position_avg_price*(1 + takeProfitPerc))

// For short positions: set stop loss and take profit relative to the entry price.

if strategy.position_size < 0

strategy.exit("Short Exit", "Short", stop=strategy.position_avg_price*(1 + stopLossPerc), limit=strategy.position_avg_price*(1 - takeProfitPerc))

相关推荐