概述

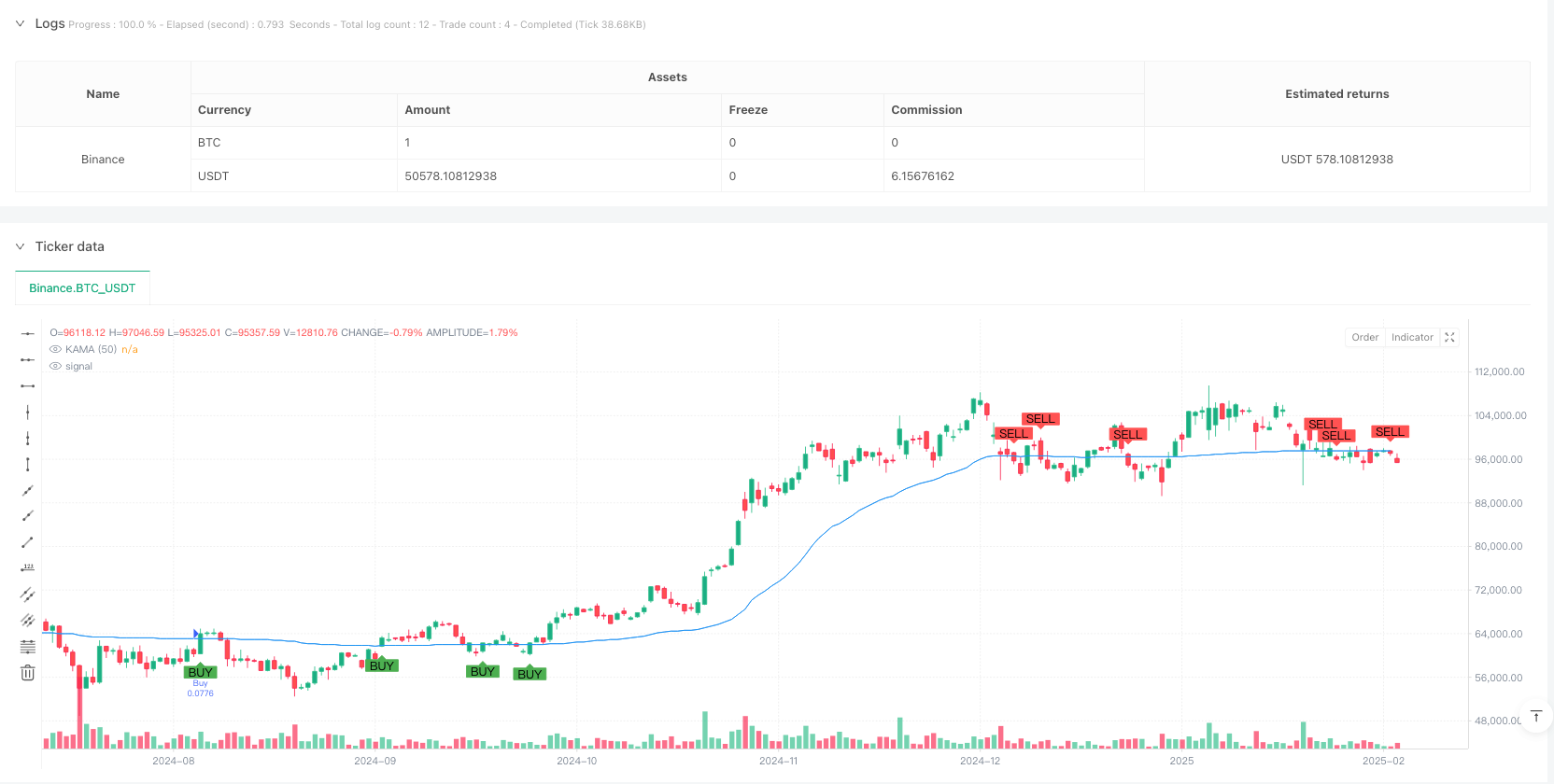

该策略是一个基于考夫曼自适应移动平均线(KAMA)和MACD的趋势跟踪系统。它通过将KAMA作为主要趋势判断指标,结合MACD作为动量确认指标,实现了对市场趋势的智能跟踪和交易时机的精准把握。该策略在4小时时间框架上运行,采用动态止损和获利目标来管理风险。

策略原理

策略的核心逻辑基于以下几个关键组件: 1. KAMA计算:使用50周期的KAMA作为主要趋势指标,通过效率比率动态调整平滑系数,使移动平均线能够更好地适应市场条件。 2. MACD确认:采用较慢设置(26,52,18)的MACD作为趋势确认工具,确保交易方向与整体动量一致。 3. ATR止损:使用14周期ATR的3倍作为动态止损和获利目标的计算基础。 4. 交易规则: - 做多条件:价格上穿KAMA且MACD处于看涨状态 - 平仓条件:价格下穿KAMA且MACD处于看跌状态 - 风险管理:基于ATR设置动态止损和获利目标

策略优势

- 自适应性强:KAMA能够根据市场效率自动调整灵敏度,在不同市场环境下保持良好表现。

- 信号可靠:结合MACD确认显著降低了假突破的风险。

- 风险管理完善:采用基于波动率的动态止损和获利目标,使风险管理更具适应性。

- 参数优化空间大:关键参数可根据不同市场特征进行调整。

策略风险

- 趋势反转风险:在剧烈波动市场中可能出现较多假信号。

- 滞后性风险:KAMA和MACD都具有一定滞后性,可能错过最佳入场时机。

- 参数敏感性:不同市场条件下可能需要调整参数以保持策略效果。

- 交易成本影响:频繁交易可能导致较高交易成本。

策略优化方向

- 引入市场波动率过滤器,在高波动率环境下调整策略参数或暂停交易。

- 增加成交量分析指标,提高趋势判断的准确性。

- 优化MACD参数设置,使其更适合4小时时间框架。

- 实现自适应止损倍数,根据市场波动性动态调整ATR乘数。

- 加入时间过滤器,避免在市场低流动性时段交易。

总结

这是一个将经典技术指标KAMA与MACD创新性结合的趋势跟踪策略。通过自适应性移动平均线和动量确认的配合,以及完善的风险管理系统,该策略具有较强的实用性和稳定性。虽然存在一定的滞后性和参数敏感性风险,但通过建议的优化方向可以进一步提升策略的稳健性和盈利能力。

策略源码

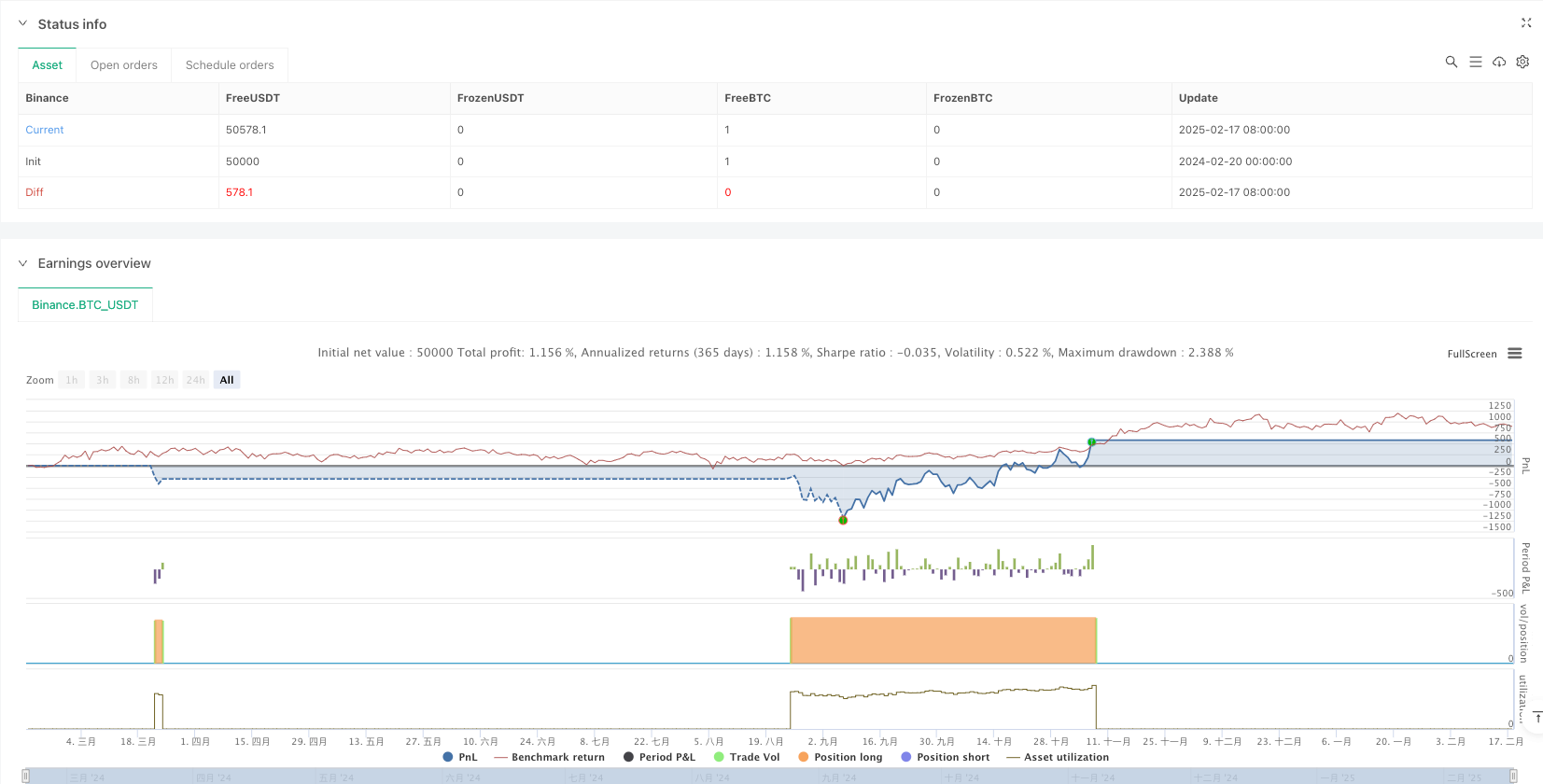

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mckat

//@version=5

strategy("4-Hour KAMA Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

ama_length = input.int(50, title="KAMA Length for 4H")

fast_length = input.int(3, title="KAMA Fast Length")

slow_length = input.int(30, title="KAMA Slow Length")

atr_length = input.int(14, title="ATR Length")

atr_mult = input.float(3.0, title="ATR Multiplier for Stop-Loss & Take-Profit")

// === KAMA Calculation ===

var float kama = na

price_change = math.abs(close - close[ama_length])

volatility_sum = 0.0

for i = 0 to ama_length - 1

volatility_sum := volatility_sum + math.abs(close[i] - close[i + 1])

efficiency_ratio = price_change / volatility_sum

smoothing_constant = math.pow(efficiency_ratio * (2 / (fast_length + 1) - 2 / (slow_length + 1)) + 2 / (slow_length + 1), 2)

kama := na(kama[1]) ? close : kama[1] + smoothing_constant * (close - kama[1])

// Plot KAMA

plot(kama, color=color.blue, title="KAMA (50)")

// === ATR for Stop-Loss and Take-Profit ===

atr = ta.atr(atr_length)

stop_loss = close - atr * atr_mult

take_profit = close + atr * atr_mult

// === MACD for Momentum Confirmation (Slow Settings for 4H) ===

[macd_line, signal_line, _] = ta.macd(close, 26, 52, 18)

macd_bullish = macd_line > signal_line

macd_bearish = macd_line < signal_line

// === Entry and Exit Conditions ===

buy_condition = ta.crossover(close, kama) and macd_bullish

sell_condition = ta.crossunder(close, kama) and macd_bearish

// === Execute Trades ===

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sell_condition)

strategy.close("Buy")

// === Dynamic Stop-Loss and Take-Profit ===

strategy.exit("Exit", "Buy", stop=stop_loss, limit=take_profit)

// === Plot Signals ===

plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

相关推荐