概述

这是一个基于多重移动均线交叉信号的量化交易策略。策略采用开盘价和收盘价的移动均线交叉作为交易信号,并支持多种移动均线类型,包括SMMA、EMA、DEMA等。策略具有高度的可配置性,可以根据不同的市场环境和交易需求进行参数优化。

策略原理

策略的核心是通过监测开盘价移动均线和收盘价移动均线的交叉来识别市场趋势的转换点。当收盘价均线上穿开盘价均线时,产生做多信号;当收盘价均线下穿开盘价均线时,产生做空信号。策略支持多个时间周期的回测,并提供止盈止损功能来管理风险。

策略优势

- 灵活的均线选择:支持11种不同类型的移动均线,可以根据不同市场特征选择最适合的均线类型。

- 完善的风险管理:内置止盈止损机制,可以有效控制每笔交易的风险。

- 多周期适配:支持从分钟到月度等多个时间周期,并可以通过参数调整进行周期倍数的优化。

- 可视化支持:提供趋势颜色标记功能,便于直观理解市场走势。

策略风险

- 滞后性风险:移动均线本质上是滞后指标,在剧烈波动的市场中可能产生滞后信号。

- 震荡市风险:在横盘震荡市场中,频繁的交叉信号可能导致过度交易。

- 参数依赖:策略效果严重依赖于参数的选择,不同市场环境可能需要不同的参数组合。

策略优化方向

- 信号过滤:可以添加成交量、波动率等辅助指标来过滤假信号。

- 动态参数:引入自适应参数机制,根据市场状态动态调整均线周期和类型。

- 仓位管理:优化仓位管理系统,根据市场波动性和趋势强度动态调整持仓比例。

总结

该策略通过多重移动均线的交叉信号捕捉市场趋势的转换点,具有较强的可配置性和风险管理能力。通过合理的参数优化和信号过滤,可以在不同的市场环境中保持稳定的表现。策略的成功关键在于选择合适的均线类型和参数组合,以及建立有效的风险控制机制。

策略源码

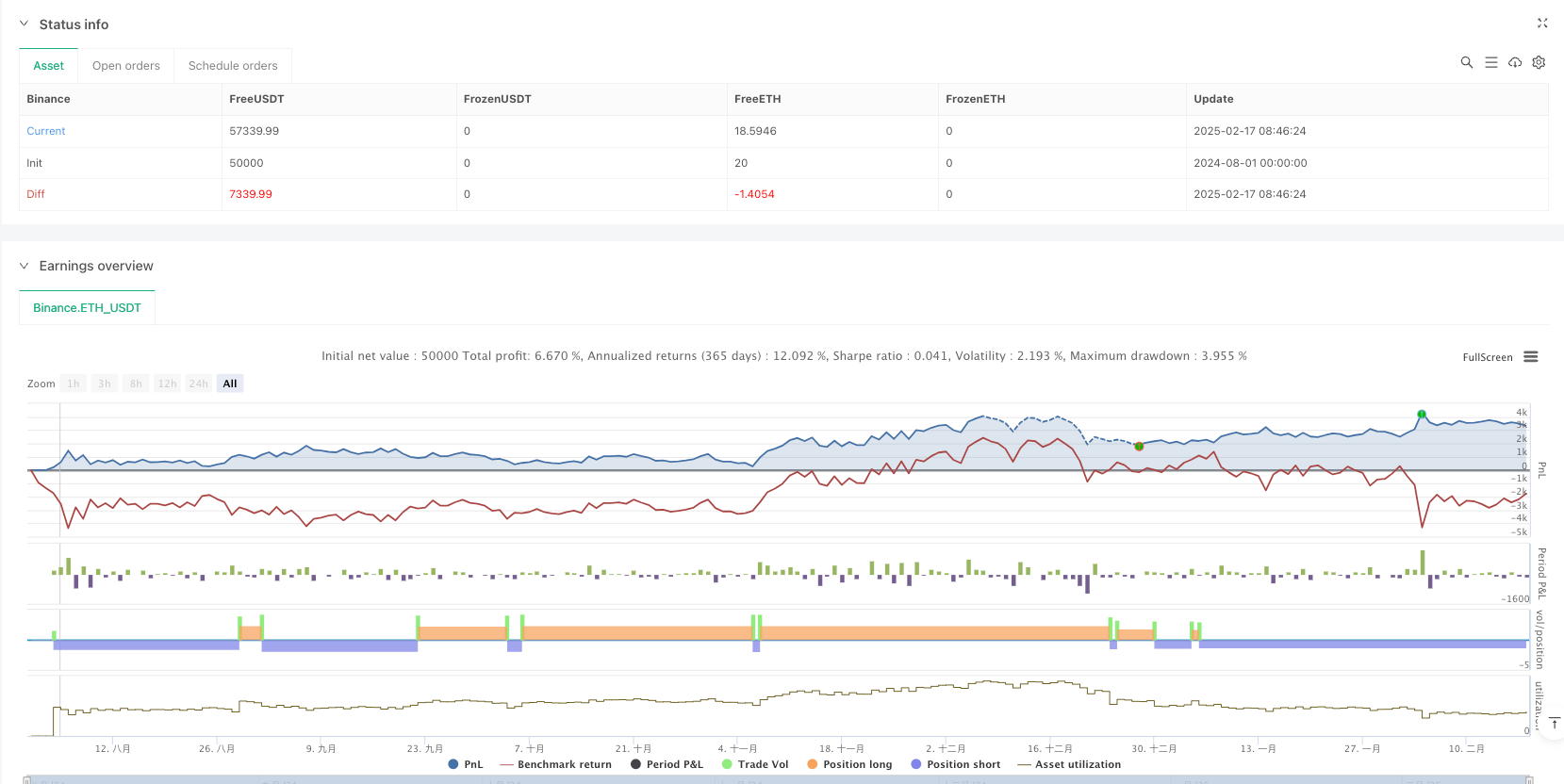

/*backtest

start: 2024-08-01 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Open Close Cross Strategy v6",

overlay=true,

pyramiding=0,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

calc_on_every_tick=false)

// === INPUTS ===

var bool useRes = input.bool(true, "Use Alternate Resolution?")

var int intRes = input.int(3, "Multiplier for Alternate Resolution")

var string basisType = input.string("SMMA", "MA Type: ", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "HullMA", "LSMA", "ALMA", "SSMA", "TMA"])

var int basisLen = input.int(8, "MA Period", minval=1)

var int offsetSigma = input.int(6, "Offset for LSMA / Sigma for ALMA", minval=0)

var float offsetALMA = input.float(0.85, "Offset for ALMA", minval=0, step=0.01)

var bool scolor = input.bool(false, "Show coloured Bars to indicate Trend?")

var int delayOffset = input.int(0, "Delay Open/Close MA (Forces Non-Repainting)", minval=0, step=1)

var string tradeType = input.string("BOTH", "What trades should be taken : ", options=["LONG", "SHORT", "BOTH", "NONE"])

var float slPoints = input.float(0, "Initial Stop Loss Points (zero to disable)", minval=0)

var float tpPoints = input.float(0, "Initial Target Profit Points (zero for disable)", minval=0)

var int ebar = input.int(10000, "Number of Bars for Back Testing", minval=0)

var bool dummy = input.bool(false, "- SET to ZERO for Daily or Longer Timeframes")

// Определение таймфрейма для alternate resolution

getAlternateResolution() =>

timeframe.ismonthly ? str.tostring(timeframe.multiplier * intRes) + "M" :

timeframe.isweekly ? str.tostring(timeframe.multiplier * intRes) + "W" :

timeframe.isdaily ? str.tostring(timeframe.multiplier * intRes) + "D" :

timeframe.isintraday ? str.tostring(timeframe.multiplier * intRes) : "60"

stratRes = getAlternateResolution()

// === MA Functions ===

variant(type, src, len, offSig, offALMA) =>

float result = switch type

"EMA" => ta.ema(src, len)

"DEMA" => 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

"TEMA" => 3 * (ta.ema(src, len) - ta.ema(ta.ema(src, len), len)) + ta.ema(ta.ema(ta.ema(src, len), len), len)

"WMA" => ta.wma(src, len)

"VWMA" => ta.vwma(src, len)

"SMMA" => ta.sma(src, len) // Упрощенная версия SMMA

"HullMA" => ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

"LSMA" => ta.linreg(src, len, offSig)

"ALMA" => ta.alma(src, len, offALMA, offSig)

"TMA" => ta.sma(ta.sma(src, len), len)

"SSMA" =>

a1 = math.exp(-1.414 * math.pi / len)

b1 = 2 * a1 * math.cos(1.414 * math.pi / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

c1 * (src + nz(src[1])) / 2 + c2 * nz(ta.sma(src, len)[1]) + c3 * nz(ta.sma(src, len)[2])

=> ta.sma(src, len)

// === Series Setup ===

closeSeries = variant(basisType, close[delayOffset], basisLen, offsetSigma, offsetALMA)

openSeries = variant(basisType, open[delayOffset], basisLen, offsetSigma, offsetALMA)

// Get Alternate resolution Series

closeSeriesAlt = useRes ? request.security(syminfo.tickerid, stratRes, closeSeries, barmerge.gaps_off, barmerge.lookahead_on) : closeSeries

openSeriesAlt = useRes ? request.security(syminfo.tickerid, stratRes, openSeries, barmerge.gaps_off, barmerge.lookahead_on) : openSeries

// === Plotting ===

color trendColor = closeSeriesAlt > openSeriesAlt ? color.green : color.red

color barColor = closeSeries > openSeriesAlt ? color.new(color.lime, 0) : color.new(color.red, 0)

// Перемещаем barcolor в глобальную область видимости

barcolor(scolor ? barColor : na)

var closePlot = plot(closeSeriesAlt, "Close Series", trendColor, 2, plot.style_line)

var openPlot = plot(openSeriesAlt, "Open Series", trendColor, 2, plot.style_line)

fill(closePlot, openPlot, color=trendColor)

// === Trade Conditions ===

xlong = ta.crossover(closeSeriesAlt, openSeriesAlt)

xshort = ta.crossunder(closeSeriesAlt, openSeriesAlt)

longCond = xlong

shortCond = xshort

// === Strategy Logic ===

float tp = tpPoints > 0 ? tpPoints : na

float sl = slPoints > 0 ? slPoints : na

var int lastPositionType = 0 // 1 для long, -1 для short, 0 для нет позиции

if ebar == 0 or (timenow - time) / (timeframe.multiplier * 60000) <= ebar and tradeType != "NONE"

// Закрытие позиций

if lastPositionType == 1 and shortCond

strategy.close("long")

lastPositionType := 0

label.new(bar_index, high, "Exit Long", color=color.red, style=label.style_label_down, textcolor=color.white)

if lastPositionType == -1 and longCond

strategy.close("short")

lastPositionType := 0

label.new(bar_index, low, "Exit Short", color=color.green, style=label.style_label_up, textcolor=color.white)

// Открытие новых позиций

if longCond and tradeType != "SHORT" and lastPositionType == 0

strategy.entry("long", strategy.long)

lastPositionType := 1

label.new(bar_index, low, "Long", color=color.green, style=label.style_label_up, textcolor=color.white)

if shortCond and tradeType != "LONG" and lastPositionType == 0

strategy.entry("short", strategy.short)

lastPositionType := -1

label.new(bar_index, high, "Short", color=color.red, style=label.style_label_down, textcolor=color.white)

// Take Profit и Stop Loss

if lastPositionType != 0

strategy.exit("TP/SL", profit=tp, loss=sl)

相关推荐