概述

该策略是一个结合了高斯加权移动平均通道和随机相对强弱指数(Stochastic RSI)的趋势跟踪交易系统。策略通过高斯加权方法构建价格通道,并结合随机RSI指标的交叉信号来确定入场和出场时机,实现对趋势的把握和动量的确认。该策略具有良好的数学基础,能够有效地过滤市场噪音,捕捉主要趋势。

策略原理

策略的核心逻辑包含两个主要部分: 1. 高斯通道系统:使用高斯加权移动平均(GWMA)和高斯加权标准差(GWSD)构建价格通道。GWMA赋予近期数据更大的权重,使得均线对价格变化的反应更加敏感。通道上下轨通过将GWSD乘以倍数因子来确定。

- 随机RSI系统:将传统RSI指标进行随机化处理,计算K值和D值。这种处理方式可以更好地识别超买超卖区域,提供更准确的动量信号。

交易信号的产生基于以下条件: - 做多入场:价格收盘价突破高斯通道上轨且随机RSI的K线上穿D线 - 平仓信号:价格收盘价跌破高斯通道上轨

策略优势

- 数学基础扎实:采用高斯加权方法构建价格通道,相比简单移动平均具有更好的理论基础。

- 信号可靠性高:结合价格突破和动量确认的双重验证机制,能够有效降低虚假信号。

- 自适应性强:高斯加权方法能够根据市场波动自动调整通道宽度。

- 风险控制完善:通过资金管理和佣金设置,实现了对交易成本和风险的有效控制。

策略风险

- 趋势依赖性:在震荡市场中可能产生频繁的虚假信号,导致过度交易。

- 滞后性影响:由于使用了多重均线平滑,可能在趋势转折点出现信号滞后。

- 参数敏感性:策略效果受参数设置影响较大,需要仔细优化各项参数。

策略优化方向

- 市场环境识别:添加市场环境判断机制,在不同市场状态下使用不同的参数设置。

- 止损优化:引入动态止损机制,如基于ATR或波动率的自适应止损。

- 信号过滤:增加成交量确认或其他技术指标作为辅助过滤条件。

- 资金管理:实现更灵活的仓位管理策略,根据信号强度动态调整持仓比例。

总结

该策略通过结合高斯通道和随机RSI指标,构建了一个具有扎实数学基础的趋势跟踪系统。策略在趋势明显的市场中表现优异,但需要注意参数优化和市场环境的适应性。通过实施建议的优化措施,可以进一步提升策略的稳定性和盈利能力。

策略源码

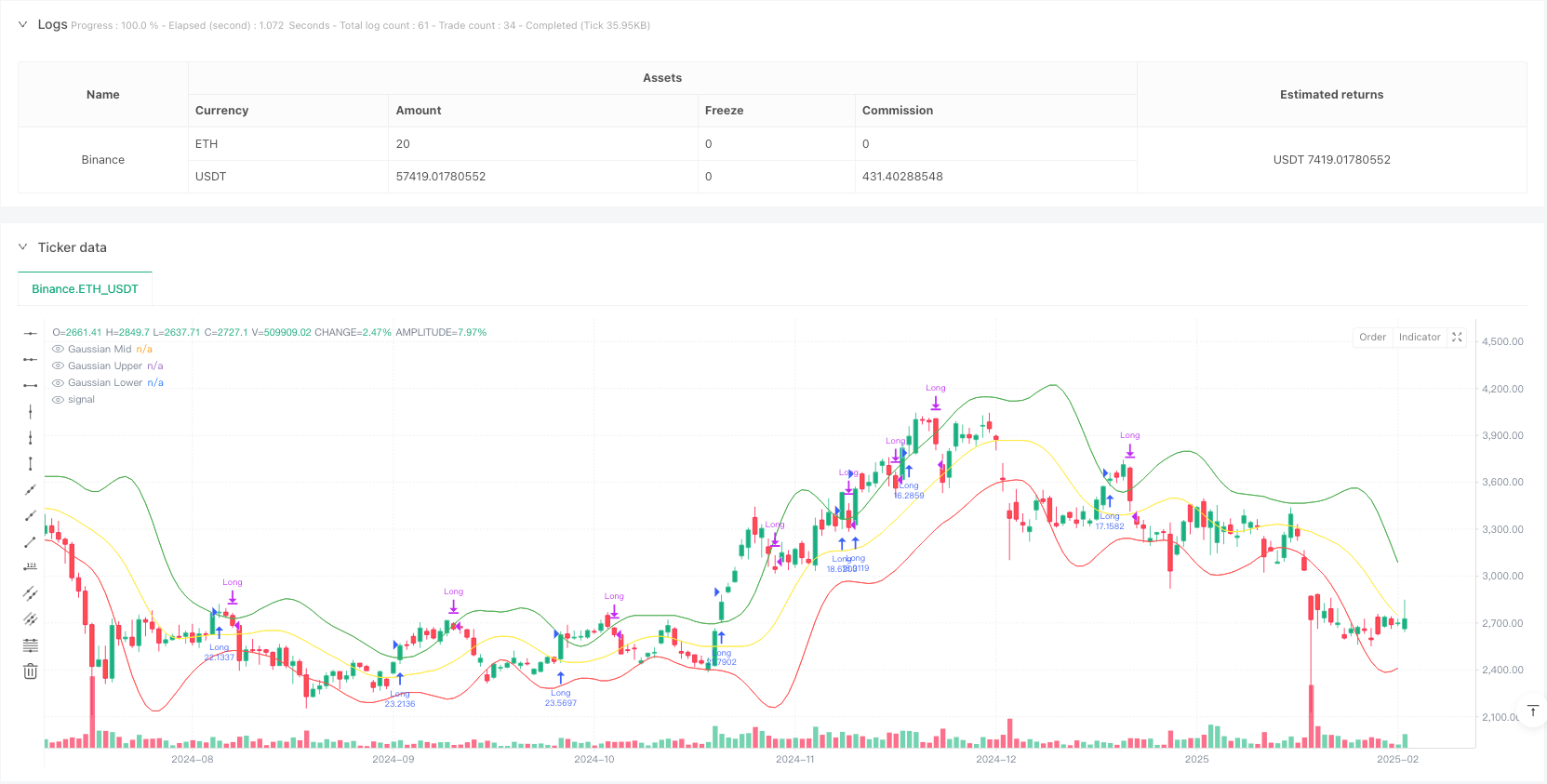

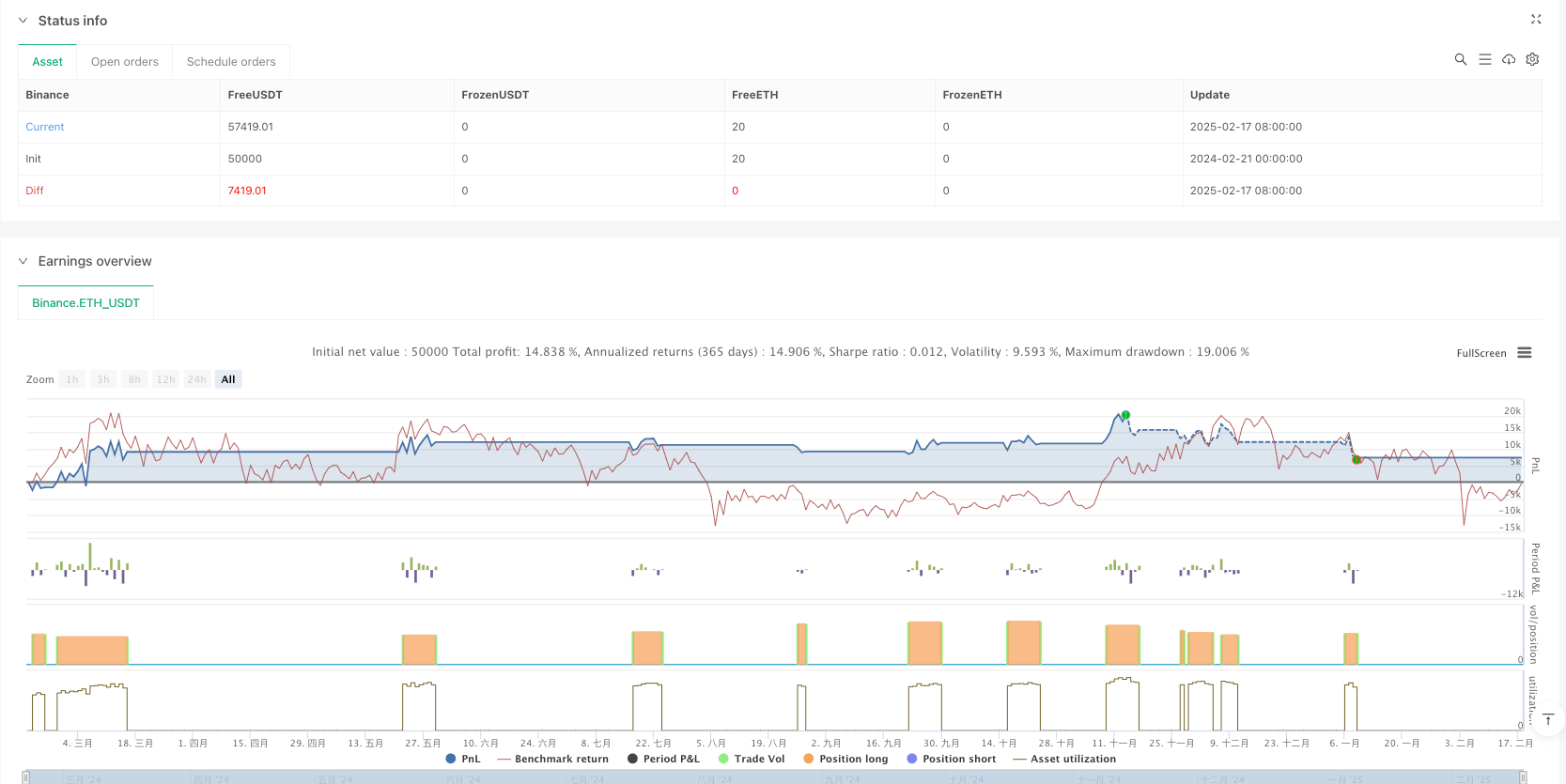

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Gaussian Channel + Stoch RSI Strategy", overlay=true, margin_long=100, margin_short=100, initial_capital=100000, commission_type=strategy.commission.percent, commission_value=0.1, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding=1)

// User Inputs

length = input.int(20, "Gaussian Length", minval=5)

multiplier = input.float(2.0, "Channel Multiplier", step=0.1)

rsiLength = input.int(14, "RSI Length", minval=1)

stochLength= input.int(14, "Stoch RSI Length", minval=1)

kLength = input.int(3, "Stoch K Smoothing", minval=1)

dLength = input.int(3, "Stoch D Smoothing", minval=1)

// Gaussian Weighted Moving Average Function

f_gaussian(source, length) =>

half = (length - 1) / 2.0

sum = 0.0

norm = 0.0

// Gaussian standard deviation chosen as length/6 for a smooth curve

denom = (length / 6.0) * (length / 6.0)

for i = 0 to length - 1

x = i - half

w = math.exp(-(x * x) / (2 * denom))

sum += source[i] * w

norm += w

sum / norm

// Gaussian Weighted Standard Deviation Function

f_gaussian_std(source, length) =>

half = (length - 1) / 2.0

gavg = f_gaussian(source, length)

sum = 0.0

norm = 0.0

denom = (length / 6.0) * (length / 6.0)

for i = 0 to length - 1

x = i - half

w = math.exp(-(x * x)/(2*denom))

diff = source[i] - gavg

sum += diff * diff * w

norm += w

math.sqrt(sum/norm)

// Compute Gaussian Channel

gaussMid = f_gaussian(close, length)

gaussStd = f_gaussian_std(close, length)

gaussUpper = gaussMid + gaussStd * multiplier

gaussLower = gaussMid - gaussStd * multiplier

// Stochastic RSI Calculation

rsi = ta.rsi(close, rsiLength)

rsiLowest = ta.lowest(rsi, stochLength)

rsiHighest = ta.highest(rsi, stochLength)

stoch = 100 * (rsi - rsiLowest) / math.max(rsiHighest - rsiLowest, 1e-10)

k = ta.sma(stoch, kLength)

d = ta.sma(k, dLength)

// Conditions

// Long entry: Price closes above upper Gaussian line AND Stoch RSI K > D (stochastic is "up")

longCondition = close > gaussUpper and k > d

// Exit condition: Price closes below upper Gaussian line

exitCondition = close < gaussUpper

// Only trade in the specified date range

inDateRange = time >= timestamp("2018-01-01T00:00:00") and time < timestamp("2069-01-01T00:00:00")

// Submit Orders

if inDateRange

if longCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if exitCondition and strategy.position_size > 0

strategy.close("Long")

// Plot Gaussian Channel

plot(gaussMid, "Gaussian Mid", color=color.new(color.yellow, 0))

plot(gaussUpper, "Gaussian Upper", color=color.new(color.green, 0))

plot(gaussLower, "Gaussian Lower", color=color.new(color.red, 0))

相关推荐