概述

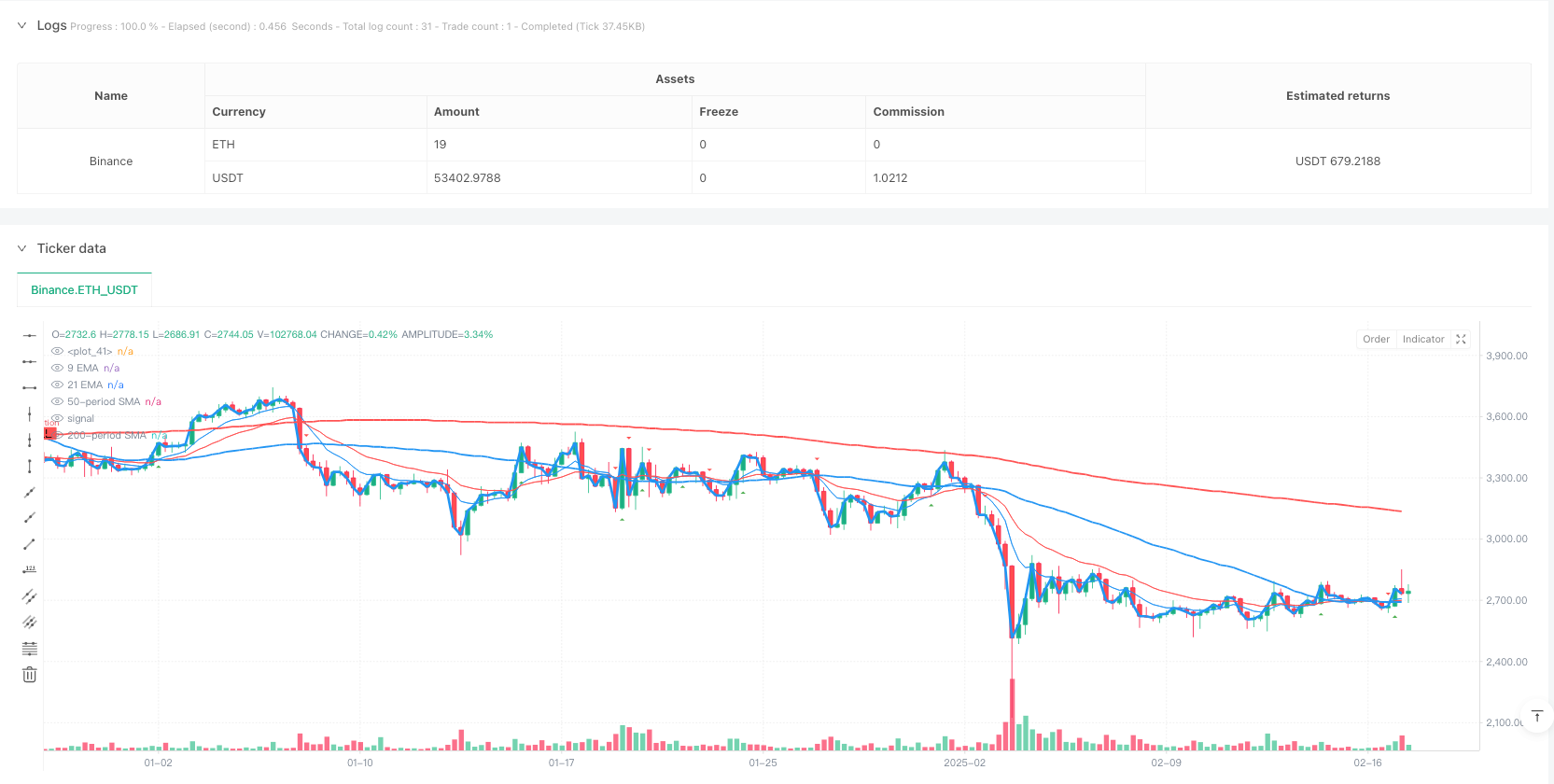

本策略是一个基于多重均线组合的趋势反转交易系统,结合了9周期、21周期、50周期和200周期的移动平均线,通过识别均线交叉信号来捕捉市场趋势的转折点。策略整合了短期和长期均线的优势,既能及时捕捉市场动量的变化,又能有效过滤虚假信号。

策略原理

策略的核心逻辑建立在多重时间框架的均线交叉系统之上。具体来说: 1. 使用50周期和200周期的简单移动平均线(SMA)作为主要趋势判断指标 2. 运用9周期和21周期的指数移动平均线(EMA)作为短期信号确认 3. 通过设定回溯期(lookback)和阈值(threshold)参数来优化信号质量 4. 结合关键价位支撑位和阻力位的判断,通过数据透视算法识别重要价格水平 当短期均线向上穿越长期均线时,系统发出做多信号;反之则发出做空信号。

策略优势

- 信号系统的可靠性:通过多重均线的交叉确认,显著降低了虚假信号的风险

- 趋势把握的及时性:短期均线的引入使策略能够快速响应市场变化

- 风险控制的全面性:支撑位和阻力位的识别有助于合理设置止损止盈位置

- 参数优化的灵活性:可根据不同市场环境调整回溯期和阈值参数

- 可视化效果的直观性:系统提供清晰的图形界面,便于交易决策

策略风险

- 震荡市场风险:在横盘整理阶段可能产生频繁的虚假信号

- 滞后性风险:移动平均线本质上是滞后指标,可能错过最佳入场时机

- 参数敏感性:不同参数组合可能导致策略表现差异较大

- 市场环境依赖:策略在趋势明显的市场中表现更好,而在剧烈波动时期可能表现欠佳

策略优化方向

- 引入量能指标:考虑将成交量作为信号确认的辅助指标

- 优化信号过滤:设计更严格的信号确认机制,如要求信号持续一定时间

- 动态参数调整:开发自适应参数系统,根据市场状态自动调整参数

- 完善风险控制:增加动态止损机制,保护已有盈利

- 加入市场环境判断:结合波动率指标,在不同市场环境下采用不同的参数设置

总结

该策略通过多重均线系统的协同作用,实现了对市场趋势转折点的有效识别。策略设计注重实用性和可操作性,通过参数的灵活调整可以适应不同的市场环境。虽然存在一定的局限性,但通过持续优化和完善,策略的整体表现具有较好的发展潜力。

策略源码

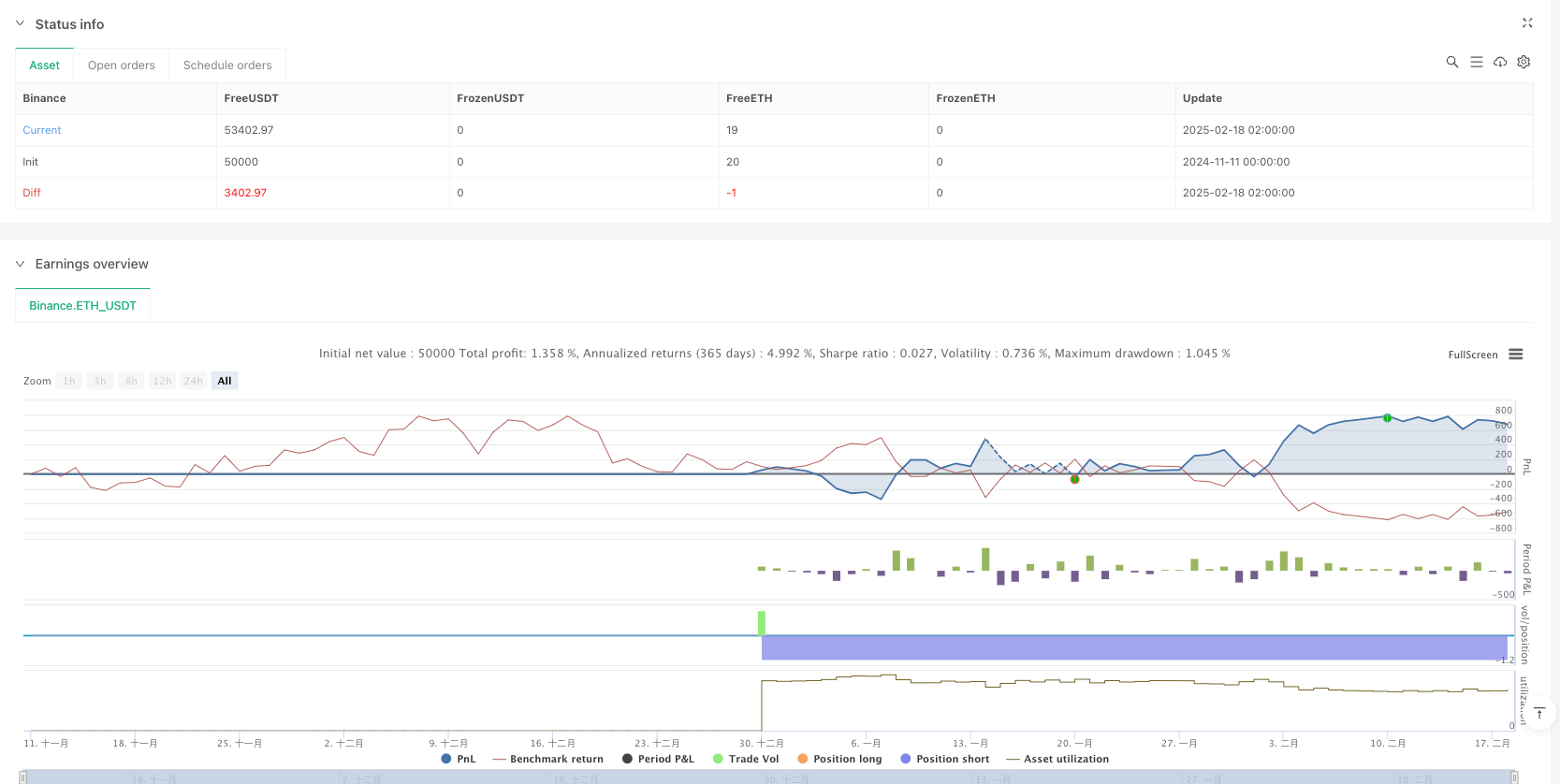

/*backtest

start: 2024-11-11 00:00:00

end: 2025-02-18 08:00:00

period: 6h

basePeriod: 6h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

//indicator("9/21 EMA Support & Resistance By DSW", overlay=true)

//indicator("Thick and Colorful Line", overlay=true)

// Define the price data

price = close

//@version=6

strategy("9/21/50/200 By DSW Trend Reversal for Options", overlay=true)

// Define the moving averages

short_term_sma = ta.sma(close, 50) // 50-period SMA

long_term_sma = ta.sma(close, 200) // 200-period SMA

// Plot the moving averages

plot(short_term_sma, color=color.blue, linewidth=2, title="50-period SMA")

plot(long_term_sma, color=color.red, linewidth=2, title="200-period SMA")

// Detect crossovers

bullish_reversal = ta.crossover(short_term_sma, long_term_sma) // Short-term SMA crosses above long-term SMA

bearish_reversal = ta.crossunder(short_term_sma, long_term_sma) // Short-term SMA crosses below long-term SMA

// Plot signals on the chart

plotshape(bullish_reversal, title="Bullish Reversal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(bearish_reversal, title="Bearish Reversal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy to buy or sell based on the crossovers

if bullish_reversal

strategy.entry("Buy Option", strategy.long) // Buy Call for a bullish reversal

if bearish_reversal

strategy.entry("Sell Option", strategy.short) // Buy Put for a bearish reversal

// Define the color and line thickness

line_color = color.new(color.blue, 0) // You can change this to any color you like

line_width = 3 // This controls the thickness of the line

// Plot the line

plot(price, color=line_color, linewidth=line_width)

// Input parameters

lookback = input.int(10, "Lookback Period")

threshold = input.float(0.5, "Threshold", minval=0, maxval=100, step=0.1)

// Calculate EMAs

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

// Plot EMAs

plot(ema9, color=color.blue, title="9 EMA")

plot(ema21, color=color.red, title="21 EMA")

// Function to find pivot highs and lows

pivotHigh = ta.pivothigh(high, lookback, lookback)

pivotLow = ta.pivotlow(low, lookback, lookback)

// EMA Crossover

crossover = ta.crossover(ema9, ema21)

crossunder = ta.crossunder(ema9, ema21)

// Plot crossover signals

plotshape(crossover, title="Bullish Crossover", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Plot bearish crossover signals

plotshape(crossunder, title="Bearish Crossover", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Alert conditions

if crossover

alert("Bullish EMA Crossover", alert.freq_once_per_bar)

if crossunder

alert("Bearish EMA Crossover", alert.freq_once_per_bar)

相关推荐