概述

该策略是一个基于1/2/4周期简单移动平均线(SMA)交叉信号的交易系统。通过观察短周期和中周期均线对长周期均线的同向穿越来捕捉市场趋势的转折点,实现趋势跟踪和及时止损。策略设计简洁高效,易于理解和实施。

策略原理

策略核心是利用三条不同周期(1/2/4)的简单移动平均线,通过判断短周期(1期)和中周期(2期)均线是否同时向上穿越长周期(4期)均线来确定买入信号;反之,当短周期和中周期均线同时向下穿越长周期均线时产生卖出信号。这种多重确认机制可以有效降低虚假信号,提高交易的准确性。具体实现上,使用ta.crossover()和ta.crossunder()函数检测均线交叉,当买入条件满足时开立多头仓位,当卖出条件满足时平仓并开立空头仓位。

策略优势

- 信号确认机制完善:要求两条均线同时穿越,大大减少了虚假信号

- 计算逻辑简单:仅使用简单移动平均线,运算量小,执行效率高

- 参数设置灵活:均线周期可根据不同市场特征进行调整

- 双向交易:同时支持做多和做空,可以充分把握市场机会

- 止损机制清晰:反向信号出现即止损,控制风险效果明确

策略风险

- 震荡市场风险:在横盘震荡行情下可能频繁产生假突破信号

- 滞后性风险:移动平均线本身具有滞后性,可能错过最佳入场时机

- 价格跳空风险:当价格出现跳空时,可能导致止损点位执行效果不理想

- 参数敏感性:不同周期参数组合的效果差异较大,需要充分测试

策略优化方向

- 引入成交量指标:结合成交量变化验证突破的有效性

- 添加趋势过滤:设计趋势判断模块,在主趋势方向上进行交易

- 优化止损机制:可以考虑引入追踪止损或基于波动率的动态止损

- 增加仓位管理:根据信号强度和市场波动率动态调整仓位大小

- 设计信号确认:增加价格形态、技术指标等辅助确认机制

总结

该策略通过多重移动平均线的交叉来捕捉市场趋势,设计理念清晰,实现方式简单有效。虽然存在一定的滞后性和假信号风险,但通过合理的参数优化和附加指标的补充,可以构建出一个较为完善的交易系统。策略的可扩展性强,适合作为基础框架进行进一步的优化和完善。

策略源码

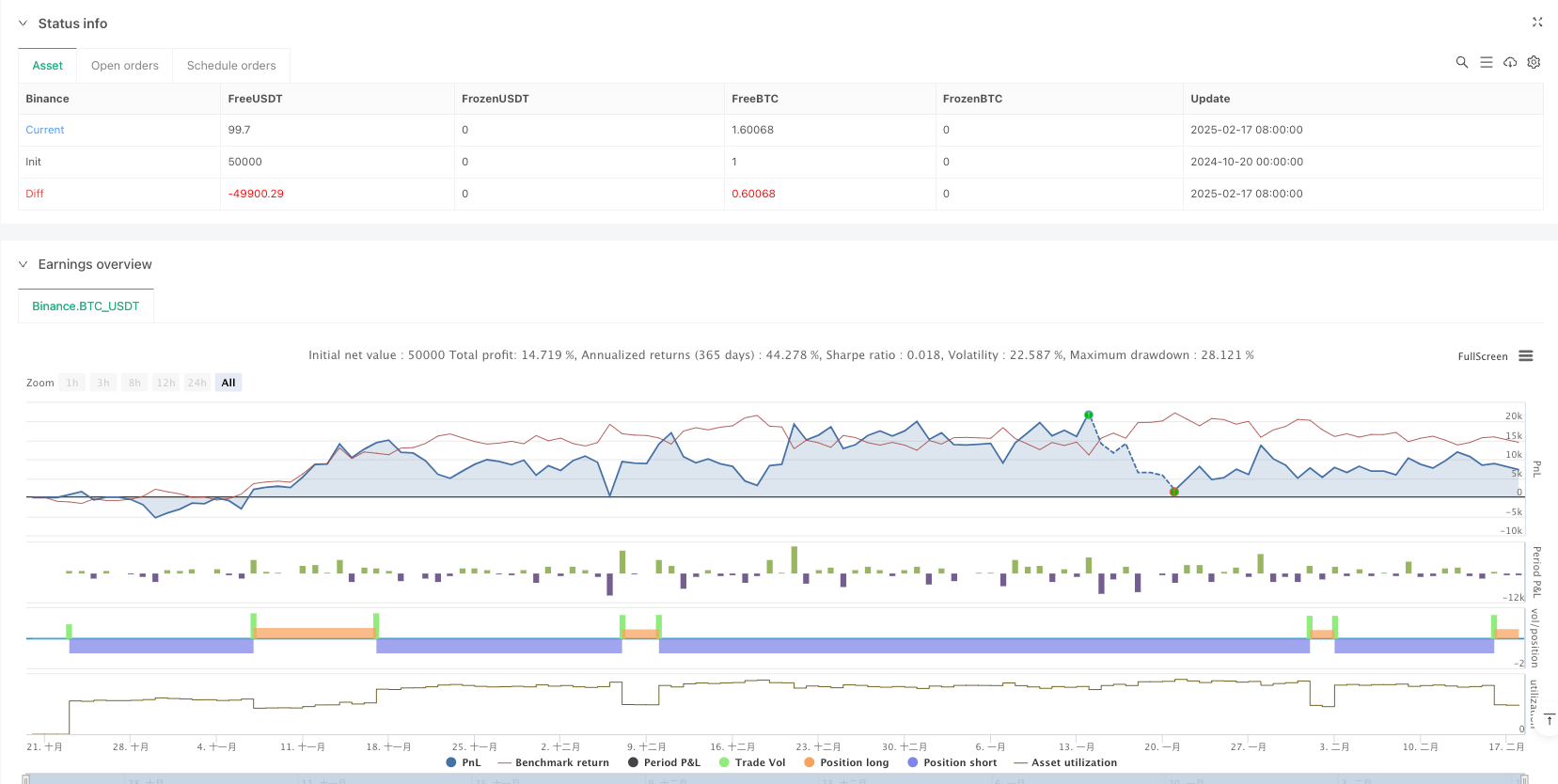

/*backtest

start: 2024-10-20 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("1/2/4 Moving Average STR 1.0.0", overlay=true)

o_length = input(1, title="1 Closed")

t_length = input(2, title="2 Closed")

f_length = input(4, title="4 Closed")

// Calculate the simple moving averages.

ma_o = ta.sma(close, o_length)

ma_t = ta.sma(close, t_length)

ma_f = ta.sma(close, f_length)

// Plot the moving averages on the chart.

plot(ma_o, color=color.green, title="1 MA")

plot(ma_t, color=color.red, title="2 MA")

plot(ma_f, color=color.blue, title="4 MA")

// Assign the crossover and crossunder results to global variables.

crossover_o = ta.crossover(ma_o, ma_f)

crossover_t = ta.crossover(ma_t, ma_f)

crossunder_o = ta.crossunder(ma_o, ma_f)

crossunder_t = ta.crossunder(ma_t, ma_f)

// Generate signals based on the global crossover variables.

// Buy signal: both 1 and 2 SMAs cross over the 4 SMA on the same bar.

buy_signal = crossover_o and crossover_t

// Sell signal: both 1 and 2 SMAs cross under the 4 SMA on the same bar.

sell_signal = crossunder_o and crossunder_t

// Enter trades based on the signals.

// For a long position, enter on a buy signal and exit when a sell signal occurs.

if buy_signal

strategy.entry("Long", strategy.long)

if sell_signal

strategy.close("Long")

// For a short position, enter on a sell signal and exit when a buy signal occurs.

if sell_signal

strategy.entry("Short", strategy.short)

if buy_signal

strategy.close("Short")

相关推荐