基于Granville与MACD多重信号确认的趋势跟踪交易策略

EMA MACD GC(Golden Cross) SL(Stop Loss) TP(Take Profit)

创建日期:

2025-02-20 11:38:15

最后修改:

2025-02-27 17:46:54

复制:

3

点击次数:

396

概述

本策略是一个结合了Granville趋势反转理论与MACD指标的多重信号确认交易系统。策略的核心思想是通过价格与均线的关系判断潜在的趋势反转,并使用MACD指标的多重信号验证来确保交易的可靠性。这种方法不仅能够有效地识别趋势的起点,还能通过多重确认机制来降低虚假信号的风险。

策略原理

策略的执行流程分为四个关键步骤: 1. Granville反转信号确认:监测价格是否从EMA均线下方突破到上方,这表明可能出现趋势反转。 2. MACD首次金叉确认:在Granville反转信号出现后,等待MACD指标出现金叉,这是趋势转向的第二重确认。 3. MACD突破验证:确认MACD线突破首次金叉时的高点,这表明上升动能在持续增强。 4. MACD二次回踩:等待MACD在突破后回踩并再次上穿信号线,这是最终的入场信号。

止盈止损设置采用了基于反转K线波幅的动态调整方法,将止损设置在反转K线低点,止盈设置为反转K线波幅的1.618倍,这符合斐波那契扩展原理。

策略优势

- 多重确认机制:通过结合价格行为、趋势指标和动量指标,大大降低了虚假信号的风险。

- 动态风险管理:基于市场实际波动设置止盈止损,使风险管理更具适应性。

- 趋势持续性验证:通过MACD的多重信号确认,提高了捕捉持续性趋势的准确度。

- 自适应性强:策略参数可根据不同市场条件和时间周期进行优化调整。

策略风险

- 信号滞后性:多重确认机制可能导致入场时机相对滞后,影响部分潜在收益。

- 区间市场表现:在横盘整理市场中,频繁的假突破可能导致连续止损。

- 过度依赖技术指标:在市场情绪剧烈波动时,纯技术分析可能失效。

- 参数敏感性:不同市场环境下可能需要频繁调整参数以保持策略有效性。

策略优化方向

- 市场环境分类:引入波动率指标,在不同市场环境下使用不同的参数配置。

- 入场时机优化:可以考虑在MACD二次回踩时增加成交量确认,提高信号可靠性。

- 止盈止损动态调整:可以根据市场波动率动态调整止盈止损倍数。

- 增加市场情绪因子:结合市场情绪指标,在极端情绪时期调整策略激进程度。

总结

该策略通过结合经典的技术分析理论和现代量化交易方法,构建了一个相对完整的交易系统。多重信号确认机制提供了较好的交易可靠性,动态的风险管理方法也使策略具有良好的适应性。虽然存在一定的滞后性问题,但通过持续优化和参数调整,策略仍具有较好的实用价值和发展潜力。

策略源码

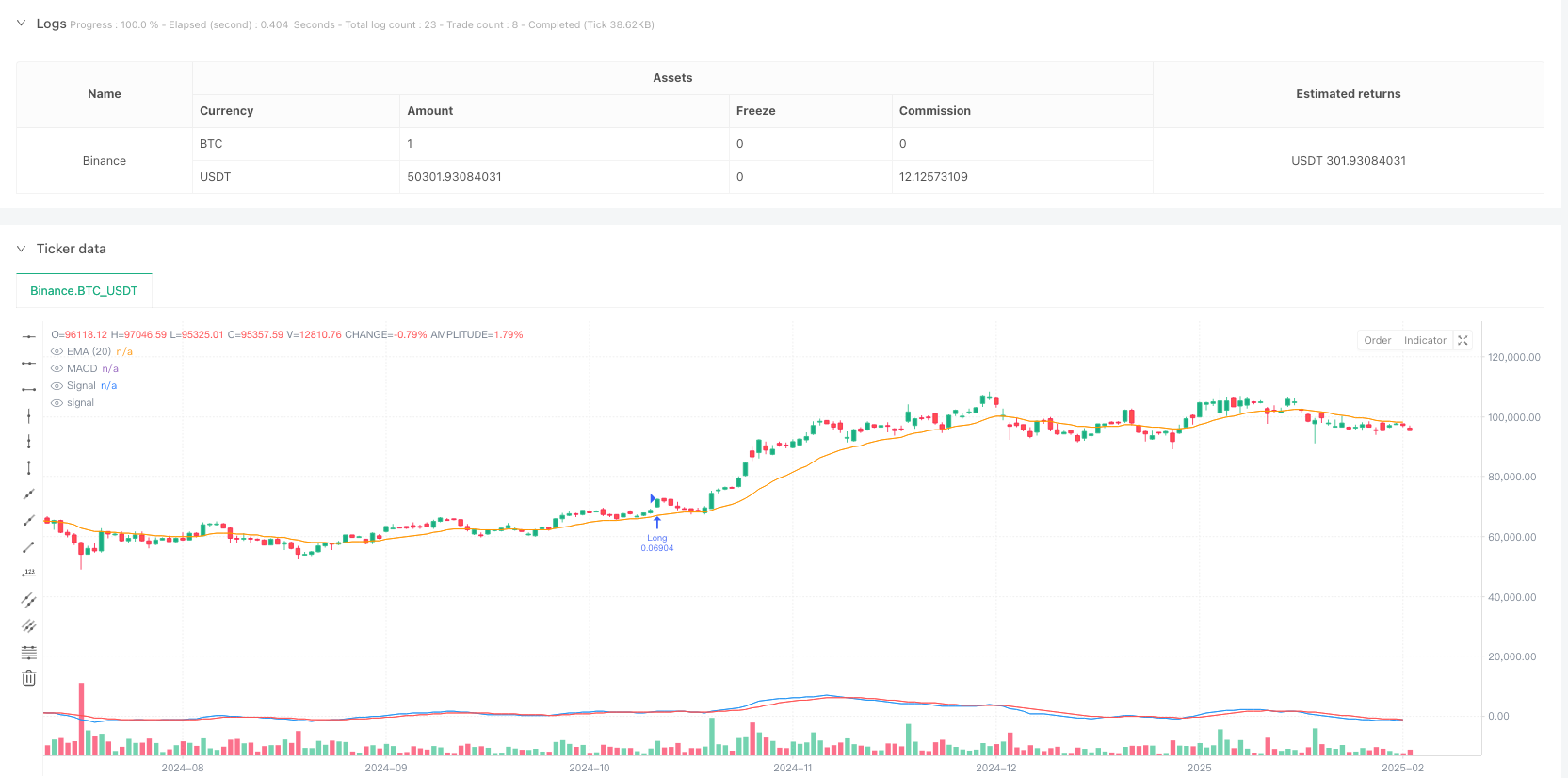

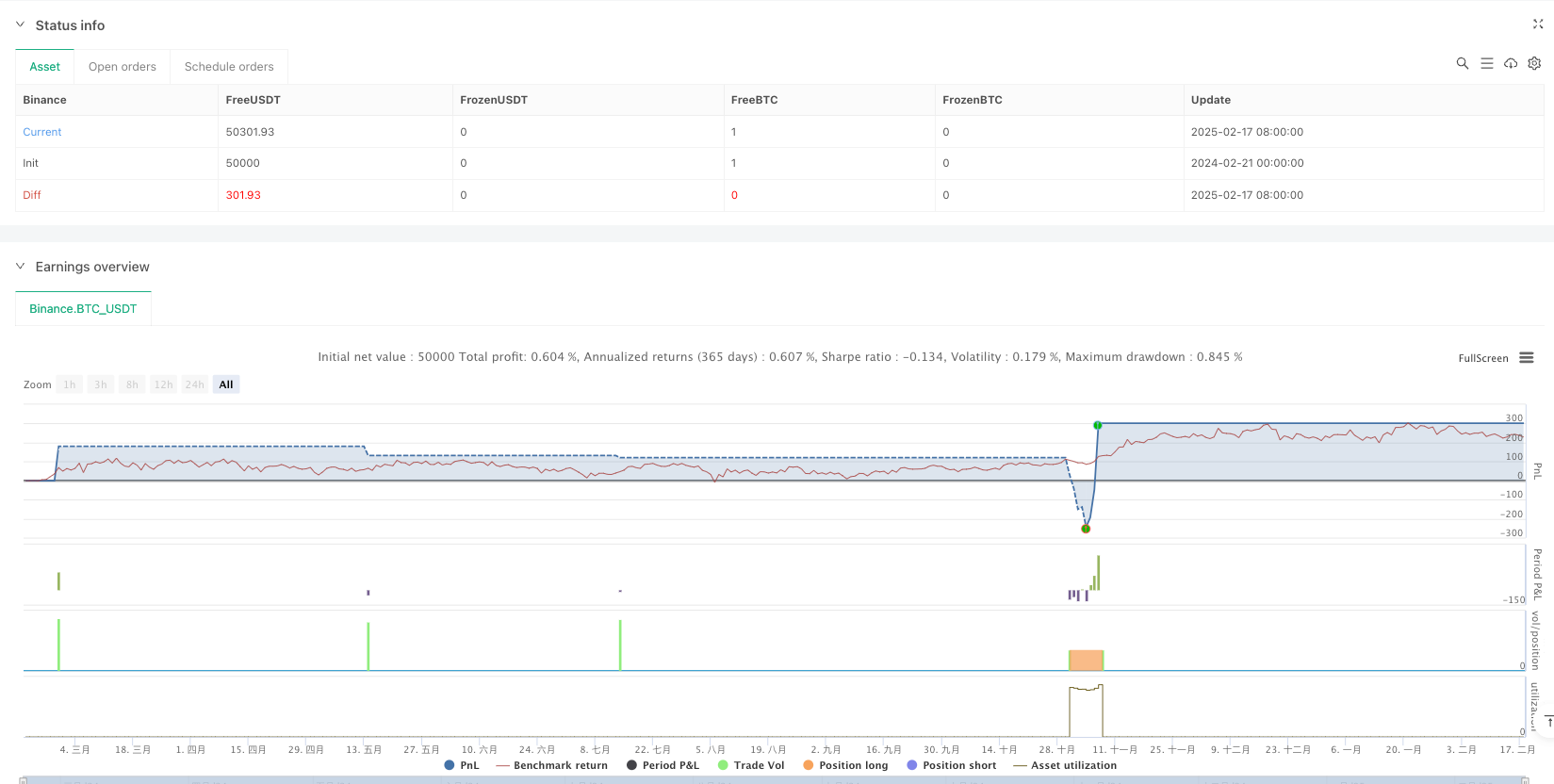

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Granville + MACD Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ■ Parameter Settings

emaPeriod = input.int(20, "EMA Period for Granville", minval=1)

fastLen = input.int(12, "MACD Fast Period", minval=1)

slowLen = input.int(26, "MACD Slow Period", minval=1)

signalLen = input.int(9, "MACD Signal Period", minval=1)

// ■ Calculate EMA (for Granville reversal detection)

ema_val = ta.ema(close, emaPeriod)

// ■ Granville Reversal Detection (e.g., price crosses above EMA from below)

granvilleReversal = ta.crossover(close, ema_val)

// ■ Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLen, slowLen, signalLen)

// ■ State management variables (to manage state transitions)

var bool granvilleDone = false // Reversal bar confirmed flag

var float granvilleLow = na // Low of the reversal bar (used for SL)

var float granvilleRange = na // Range of the reversal bar (used for TP calculation)

var bool macdGC_done = false // First MACD Golden Cross confirmed

var int goldenCrossBar = na // Bar index of the first MACD Golden Cross

var float initialMacdHigh = na // MACD value at the Golden Cross (used for break detection)

var bool breakoutDone = false // MACD line breaks the initial Golden Cross MACD value

// ■ (1) Granville Reversal Detection

if granvilleReversal

granvilleDone := true

granvilleLow := low // Low of the reversal bar (SL)

granvilleRange := high - low // Range of the reversal bar (used for TP calculation)

// Reset MACD-related states

macdGC_done := false

breakoutDone := false

initialMacdHigh := na

goldenCrossBar := na

// ■ (2) MACD Golden Cross (first signal) detection

if granvilleDone and (not macdGC_done) and ta.crossover(macdLine, signalLine)

macdGC_done := true

goldenCrossBar := bar_index

initialMacdHigh:= macdLine

// ■ (3) Check if MACD line breaks the initial MACD value at the Golden Cross

if macdGC_done and (not breakoutDone) and (macdLine > initialMacdHigh)

breakoutDone := true

// ■ (4) When MACD retests and crosses above the signal line again, it's the entry timing

// ※ Check for a crossover after the first Golden Cross bar

entryCondition = granvilleDone and macdGC_done and breakoutDone and (bar_index > goldenCrossBar) and ta.crossover(macdLine, signalLine)

// ■ TP and SL settings at entry

if entryCondition

entryPrice = close

tpPrice = entryPrice + granvilleRange * 1.618

slPrice = granvilleLow

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=slPrice, limit=tpPrice)

// Reset states after entry (for the next entry)

granvilleDone := false

macdGC_done := false

breakoutDone := false

initialMacdHigh := na

goldenCrossBar := na

// ■ Plotting (for reference)

// Display the EMA on the price chart (with fixed title)

plot(ema_val, color=color.orange, title="EMA (20)")

// Plot MACD and Signal in a separate window (with fixed titles)

plot(macdLine, color=color.blue, title="MACD")

plot(signalLine, color=color.red, title="Signal")

相关推荐