概述

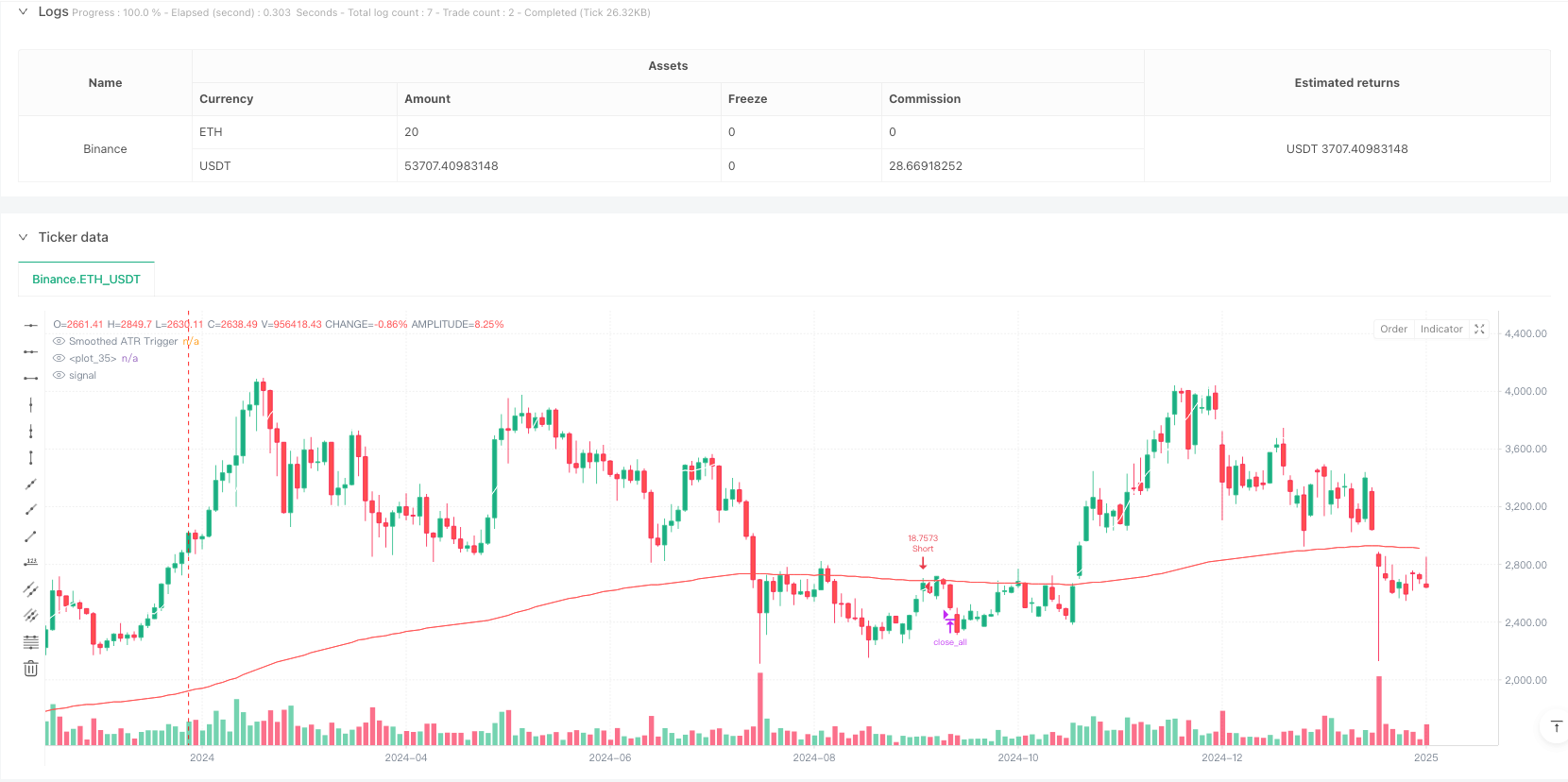

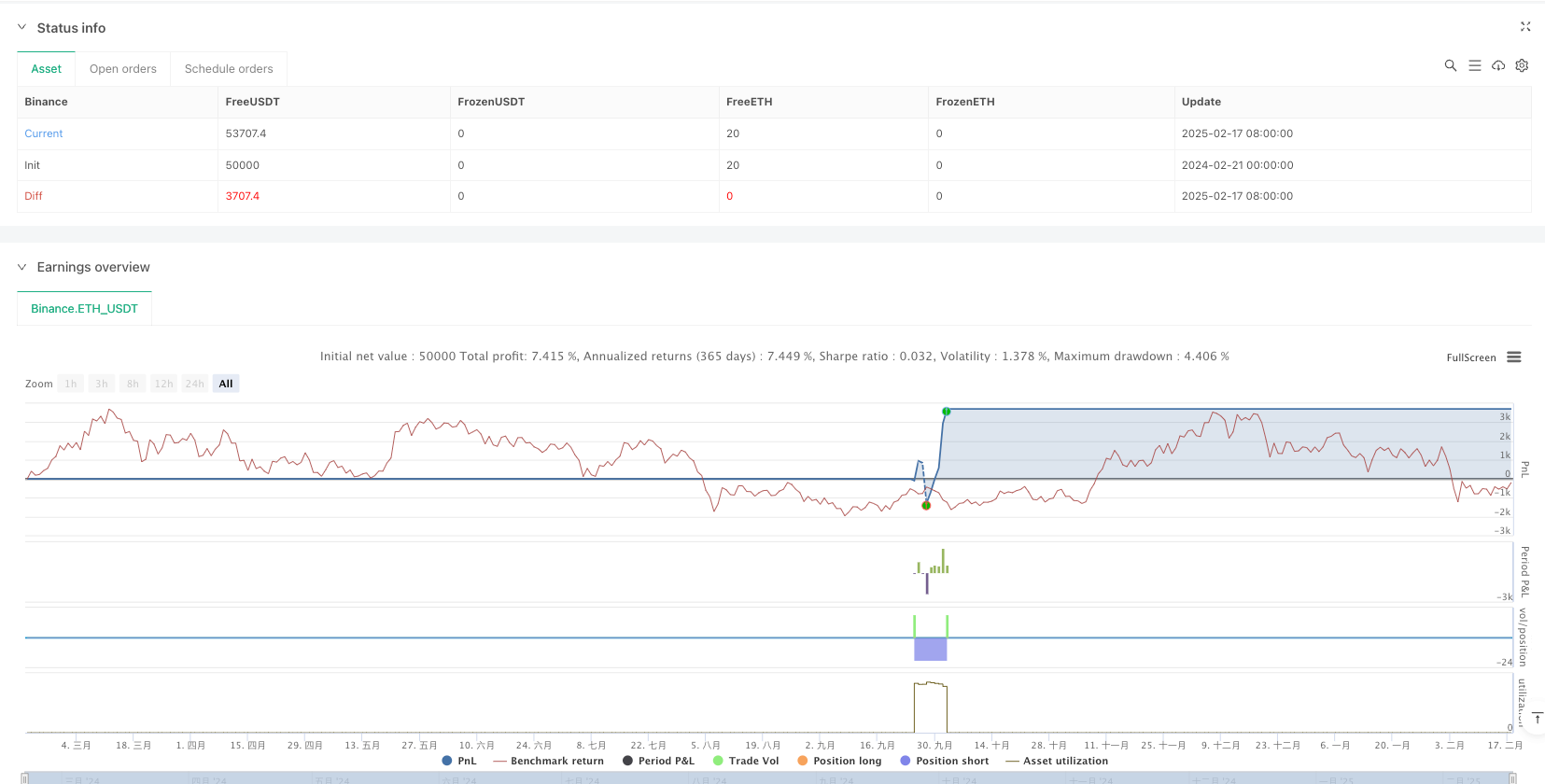

该策略是一个基于ATR(平均真实波幅)的做空反转交易系统,主要通过计算动态ATR阈值来识别价格过度延伸的机会。策略整合了多重技术指标,包括ATR、EMA和SMA,形成了一个完整的交易决策框架。当价格突破ATR动态阈值且满足EMA过滤条件时,系统会寻找做空机会,旨在捕捉价格回归均值的走势。

策略原理

策略的核心逻辑基于以下几个关键步骤: 1. 通过设定期间(默认20)计算ATR值,反映市场波动性 2. 将ATR与自定义乘数相乘并叠加到收盘价上,构建原始阈值 3. 对原始阈值应用简单移动平均(SMA)进行平滑处理,降低噪音 4. 当收盘价突破平滑后的ATR信号触发线,且处于指定交易时间窗口内时,生成做空信号 5. 如启用EMA过滤器,则收盘价需要位于200周期EMA下方才执行做空 6. 当收盘价跌破前一根K线的最低价时,触发平仓信号

策略优势

- 适应性强 - 通过ATR动态调整阈值,能够适应不同市场环境下的波动性变化

- 风险控制完善 - 整合了时间窗口、趋势过滤和动态阈值等多重风险控制机制

- 参数灵活 - 提供多个可调参数,包括ATR周期、乘数和平滑周期,便于策略优化

- 执行明确 - 入场和出场条件清晰,减少主观判断带来的不确定性

- 系统化程度高 - 基于量化指标构建,可实现完全自动化交易

策略风险

- 市场反转风险 - 在强势上涨市场中,反转做空策略可能面临持续亏损

- 参数敏感性 - ATR周期和乘数的选择对策略表现影响较大,需要持续优化

- 滑点影响 - 在市场流动性不足时,可能面临执行价格偏离的风险

- 趋势依赖 - EMA过滤条件可能导致错过部分盈利机会

- 资金管理风险 - 需要合理设置仓位规模,避免单笔交易风险过大

策略优化方向

- 引入多重时间周期分析 - 通过对不同时间周期的趋势确认,提高交易信号的可靠性

- 优化出场机制 - 可以考虑添加追踪止损或基于ATR的动态止损

- 增加量能指标 - 结合成交量分析,提高入场时机的准确性

- 完善风险控制 - 加入每日止损和最大回撤限制等风险管理措施

- 动态参数调整 - 根据市场状态自适应调整ATR参数和乘数

总结

这是一个设计完善的做空策略,通过ATR动态阈值和EMA趋势过滤建立了可靠的交易系统。策略的优势在于其适应性强且风险控制完善,但同时也需要注意市场环境变化带来的风险。通过持续优化和完善风险管理,该策略有望在不同市场环境下保持稳定表现。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("[SHORT ONLY] ATR Sell the Rip Mean Reversion Strategy", overlay=true, initial_capital = 1000000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, process_orders_on_close = true, margin_long = 5, margin_short = 5, calc_on_every_tick = true, fill_orders_on_standard_ohlc = true)

//#region INPUTS SECTION

// ============================================

// ============================================

// Strategy Settings

// ============================================

atrPeriod = input.int(title="ATR Period", defval=20, minval=1, group="Strategy Settings")

atrMultInput = input.float(title='ATR Multiplier', defval=1.0, step=0.25, group="Strategy Settings")

smoothPeriodInput = input.int(title='Smoothing Period', defval=10, minval=1, group="Strategy Settings")

//#endregion

// ============================================

// EMA Filter Settings

// ============================================

useEmaFilter = input.bool(true, "Use EMA Filter", group="Trend Filter")

emaPeriodInput = input.int(200, "EMA Period", minval=1, group="Trend Filter")

//#region INDICATOR CALCULATIONS

// ============================================

// Calculate ATR Signal Trigger

// ============================================

atrValue = ta.atr(atrPeriod)

atrThreshold = close + atrValue * atrMultInput

signalTrigger = ta.sma(atrThreshold, smoothPeriodInput)

plot(signalTrigger, title="Smoothed ATR Trigger", color=color.white)

// ============================================

// Trend Filter

// ============================================

ma200 = ta.ema(close, emaPeriodInput)

plot(ma200, color=color.red, force_overlay=true)

//#region TRADING CONDITIONS

// ============================================

// Entry/Exit Logic

// ============================================

shortCondition = close>signalTrigger

exitCondition = close<low[1]

// Apply EMA Filter if enabled

if useEmaFilter

shortCondition := shortCondition and close < ma200

//#endregion

if shortCondition

strategy.entry("Short", strategy.short)

if exitCondition

strategy.close_all()

相关推荐