概述

该策略是一个结合了随机相对强弱指标(SRSI)和移动平均趋同/发散指标(MACD)的动态交易系统。它通过ATR指标动态调整止损和止盈点位,实现了风险的智能化管理。该策略的核心在于通过多重技术指标的交叉确认来产生交易信号,同时结合市场波动性进行仓位管理。

策略原理

策略的运作基于以下几个核心机制: 1. 通过计算SRSI指标中的K线与D线之差,以及K线与归一化MACD之差来判断市场走势 2. 买入条件需同时满足:K-D差值为正,K-MACD差值为正,且MACD不处于下降趋势 3. 卖出条件需同时满足:K-D差值为负,K-MACD差值为负,且MACD不处于上升趋势 4. 使用ATR乘以风险系数来动态计算止损和止盈距离,根据市场波动性自适应调整

策略优势

- 多重信号确认机制显著提高了交易的可靠性,避免了单一指标可能带来的虚假信号

- 动态的止损止盈设置能够根据市场波动情况自动调整,提供了更好的风险收益比

- 策略具有良好的适应性,可以在不同的市场环境下保持稳定表现

- 参数可调节性强,允许交易者根据个人风险偏好进行优化

策略风险

- 在震荡市场中可能产生过多的交易信号,导致频繁进出市场

- 多重指标的使用可能导致信号滞后,在快速变化的市场中错过最佳入场时机

- ATR基于历史波动率计算,在市场波动率突变时可能无法及时适应

- 需要合理设置风险系数,过大或过小都可能影响策略效果

策略优化方向

- 增加趋势过滤器,在震荡市和趋势市采用不同的信号确认标准

- 引入成交量指标作为辅助确认,提高信号的可靠性

- 优化止损止盈的计算方法,可考虑结合支撑阻力位

- 加入市场波动率预测模型,提前调整风险参数

- 考虑在不同时间周期上进行信号确认,增加策略的稳健性

总结

该策略通过结合SRSI和MACD的优势,构建了一个稳健的交易系统。动态风险管理机制使其具有良好的适应性,但仍需要交易者根据实际市场情况进行参数优化。策略的成功运行需要对市场有深入的理解,并结合个人的风险承受能力来进行合理的仓位管理。

策略源码

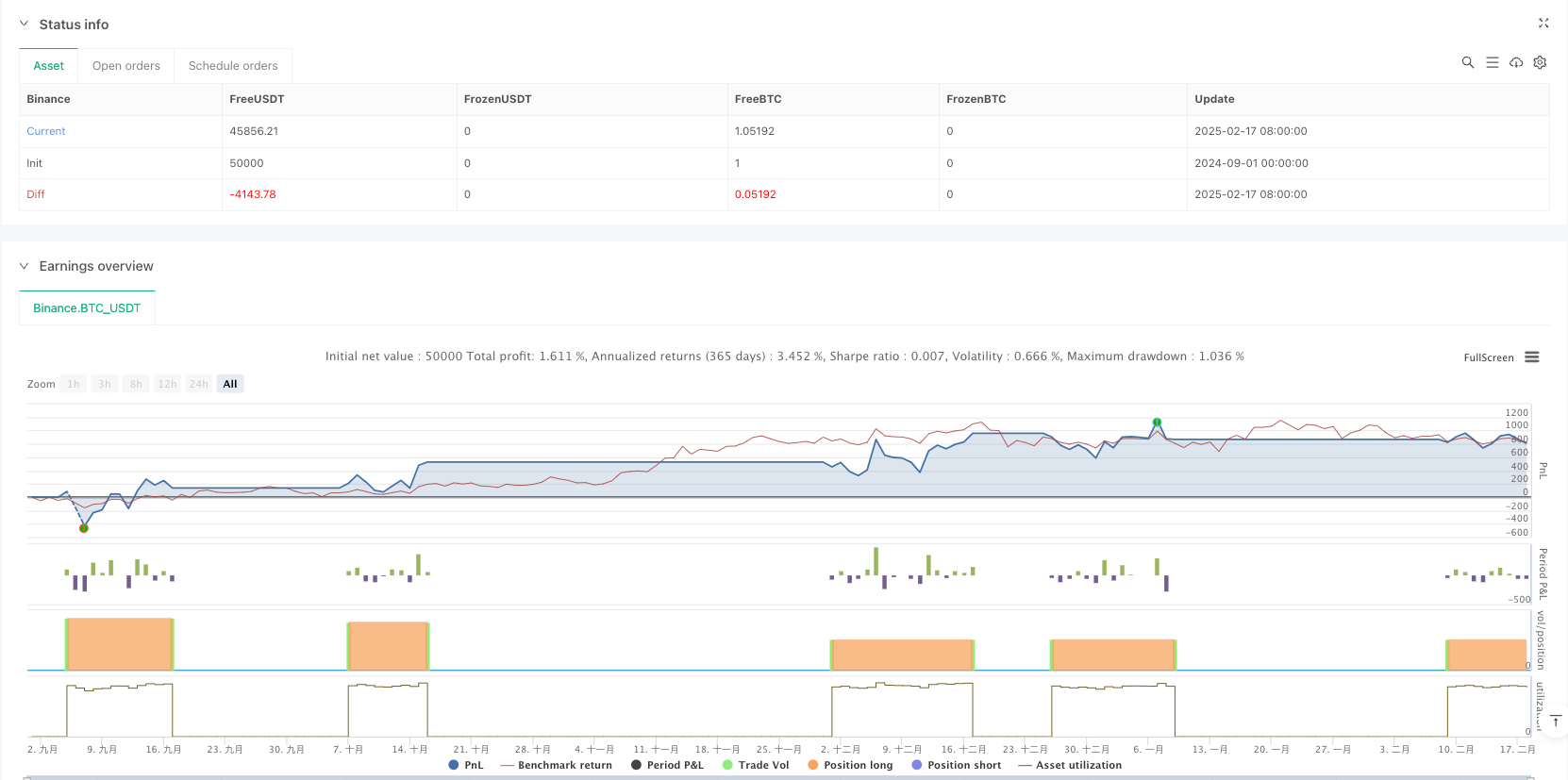

/*backtest

start: 2024-09-01 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(title="SRSI + MACD Strategy with Dynamic Stop-Loss and Take-Profit", shorttitle="SRSI + MACD Strategy", overlay=false, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// User Inputs

smoothK = input.int(3, "K", minval=1)

smoothD = input.int(3, "D", minval=1)

lengthRSI = input.int(16, "RSI Length", minval=1)

lengthStoch = input.int(16, "Stochastic Length", minval=1)

src = input(close, title="RSI Source")

enableStopLoss = input.bool(true, "Enable Stop-Loss")

enableTakeProfit = input.bool(true, "Enable Take-Profit")

riskFactor = input.float(2.5, "Risk Factor", minval=0.1, step=1)

// Calculate K and D lines

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

differenceKD = k - d

// Calculate MACD and normalization

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

lowestK = ta.lowest(k, lengthRSI)

highestK = ta.highest(k, lengthRSI)

normalizedMacd = (macdLine - ta.lowest(macdLine, lengthRSI)) / (ta.highest(macdLine, lengthRSI) - ta.lowest(macdLine, lengthRSI)) * (highestK - lowestK) + lowestK

differenceKMacd = k - normalizedMacd

// Sum both differences for a unique display

differenceTotal = (differenceKD + differenceKMacd) / 2

// Check if MACD is falling or rising

isMacdFalling = ta.falling(macdLine, 1)

isMacdRising = ta.rising(macdLine, 1)

// Check if K is falling or rising

isKFalling = ta.falling(k, 1)

isKdRising = ta.rising(k, 1)

// Calculate ATR and dynamic levels

atrValue = ta.atr(14)

stopLossDistance = atrValue * riskFactor

takeProfitDistance = atrValue * riskFactor

// Variables for stop-loss and take-profit levels

var float longStopPrice = na

var float longTakeProfitPrice = na

// Buy and sell conditions with differenceKD added

buyCondition = ((differenceTotal > 0 or differenceKD > 0) and (isKdRising or isMacdRising) and k < 20 )

sellCondition = ((differenceTotal <= 0 or differenceKD <= 0) and (isKFalling or isMacdFalling) and k > 80)

// Execute strategy orders with conditional stop-loss and take-profit

if buyCondition and strategy.position_size == 0

strategy.entry("Buy", strategy.long)

if strategy.position_size > 0

longStopPrice := strategy.position_avg_price - stopLossDistance

longTakeProfitPrice := strategy.position_avg_price + takeProfitDistance

if enableStopLoss or enableTakeProfit

strategy.exit("Sell/Exit", "Buy", stop=(enableStopLoss ? longStopPrice : na), limit=(enableTakeProfit ? longTakeProfitPrice : na))

if sellCondition

strategy.close("Buy")

// Hide lines when position is closed

stopLossToPlot = strategy.position_size > 0 ? longStopPrice : na

takeProfitToPlot = strategy.position_size > 0 ? longTakeProfitPrice : na

// Plot stop-loss and take-profit lines only when long positions are active

plot(enableStopLoss ? stopLossToPlot : na, title="Stop-Loss", color=color.yellow, linewidth=1, style=plot.style_linebr, offset=0, force_overlay=true)

plot(enableTakeProfit ? takeProfitToPlot : na, title="Take-Profit", color=color.yellow, linewidth=1, style=plot.style_linebr, offset=0, force_overlay=true)

// Plot the MACD and candles

plot(normalizedMacd, "Normalized MACD", color=color.new(color.purple, 0), linewidth=1, display=display.all)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

// New candle based on the sum of differences

plotcandle(open=0, high=differenceTotal, low=0, close=differenceTotal, color=(differenceTotal > 0 ? color.new(color.green, 60) : color.new(color.red, 60)), title="K-D + MACD Candles")

相关推荐