概述

该策略是一个结合了多重指标的趋势跟踪系统,主要通过识别价格突破、成交量确认和均线系统配合来捕捉市场趋势性机会。策略通过监控价格对近期高点/低点的突破、交易量的显著放大以及多条指数移动平均线(EMA)的排列来确定交易信号。同时,策略还包含了一个创新性的窄幅整理识别机制,用于捕捉潜在的做空机会。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 价格突破系统:监测价格对过去20个周期高点/低点的突破情况 2. 成交量确认:要求突破时的成交量至少是过去20个周期平均成交量的2倍 3. 均线系统:使用30/50/200周期的EMA构建趋势确认体系 4. 做多条件:价格突破新高、成交量放大、价格站上200EMA、短期均线位于中期均线之上且中期均线位于长期均线之上 5. 做空条件:包含两种入场机制: - 传统突破做空:价格突破新低、成交量放大、均线空头排列且200EMA向下倾斜 - 窄幅整理做空:价格在中期均线下方形成窄幅整理,整理幅度小于ATR的0.5倍

策略优势

- 多重确认机制:通过价格突破、成交量和均线三重确认,提高信号可靠性

- 灵活的做空机制:提供两种独立的做空入场方式,增加交易机会

- 自适应性强:通过ATR来定义窄幅整理,使策略能够适应不同的市场波动环境

- 风险控制完善:使用200EMA作为止损参考,提供清晰的退出机制

- 参数可调整性:关键参数都可以根据不同市场特征进行优化

策略风险

- 假突破风险:市场可能出现假突破,导致错误信号

- 滑点风险:在成交量剧增的突破时刻,可能面临较大滑点

- 趋势反转风险:在强势趋势市场中,使用均线止损可能导致过早退出

- 参数敏感性:策略表现对参数设置较为敏感,需要谨慎优化

- 市场环境依赖:在震荡市场中可能产生频繁的假信号

策略优化方向

- 引入趋势强度过滤:可以添加ADX等趋势强度指标,过滤弱趋势环境下的信号

- 优化止损机制:可以引入基于ATR的动态止损,提高止损的灵活性

- 完善仓位管理:根据突破强度和市场波动性动态调整持仓规模

- 增加时间过滤:添加日内时间过滤,避免在波动性较大的开盘和收盘时段交易

- 引入市场环境分类:根据不同的市场环境(趋势/震荡)动态调整策略参数

总结

多重趋势突破动量交易策略是一个综合性的趋势跟踪系统,通过多重技术指标的配合使用,在保证信号可靠性的同时提供了灵活的交易机会。策略的创新之处在于结合了传统的突破交易方法和新型的窄幅整理识别机制,使其能够适应不同的市场环境。虽然存在一定的风险,但通过合理的参数优化和风险管理措施,策略有望在趋势性市场中获得稳定表现。

策略源码

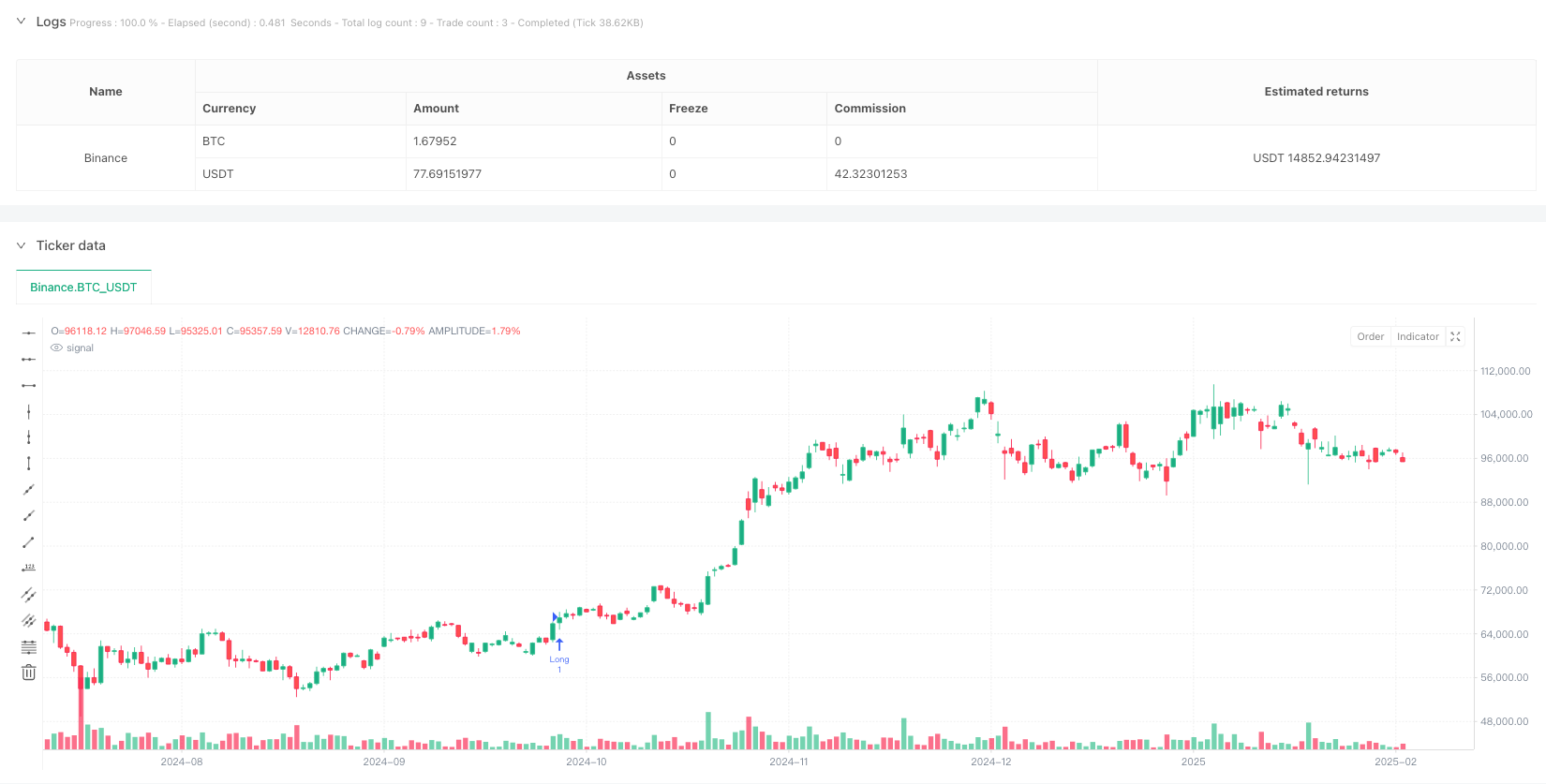

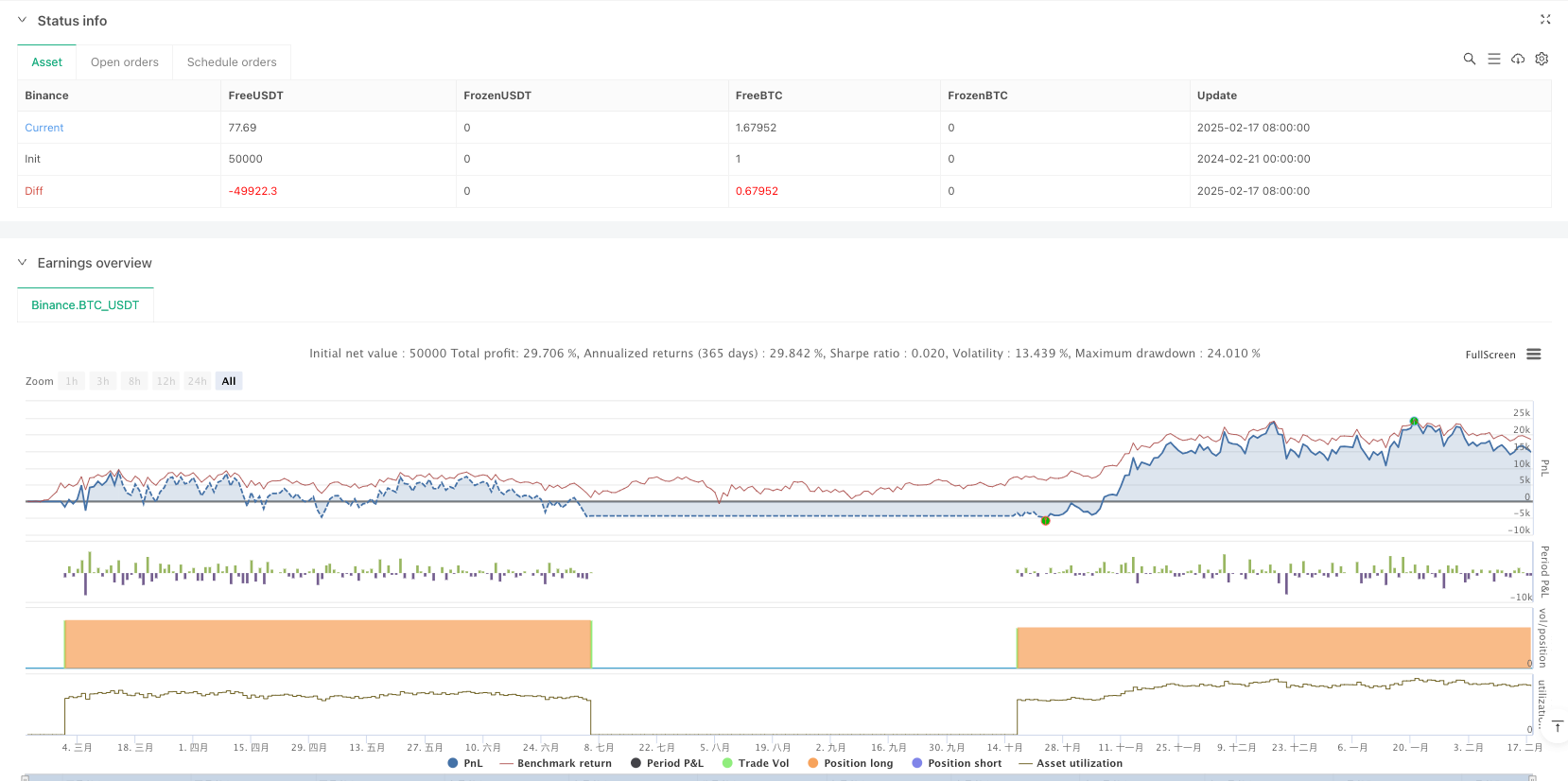

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Breakout Strategy (Long & Short) + Slope of 200 EMA", overlay=true)

// -------------------

// 1. Settings

// -------------------

breakout_candles = input.int(20, title="Number of Candles for Breakout")

range_candles = input.int(10, title="Number of Candles for Previous Range")

ema_long_period = input.int(200, title="Long EMA Period")

ema_medium_period = input.int(50, title="Medium EMA Period")

ema_short_period = input.int(30, title="Short EMA Period")

// Checkbox to allow/disallow short positions

allowShort = input.bool(true, title="Allow Short Positions")

// Inputs for the new Narrow Consolidation Short setup

consolidationBars = input.int(10, "Consolidation Bars", minval=1)

narrowThreshInAtr = input.float(0.5,"Narrowness (ATR Mult.)",minval=0.0)

atrLength = input.int(14, "ATR Length for Range")

// -------------------

// 2. Calculations

// -------------------

breakout_up = close > ta.highest(high, breakout_candles)[1]

breakout_down = close < ta.lowest(low, breakout_candles)[1]

prev_range_high = ta.highest(high, range_candles)[1]

prev_range_low = ta.lowest(low, range_candles)[1]

ema_long = ta.ema(close, ema_long_period)

ema_medium = ta.ema(close, ema_medium_period)

ema_short = ta.ema(close, ema_short_period)

average_vol = ta.sma(volume, breakout_candles)

volume_condition = volume > 2 * average_vol

// 200 EMA sloping down?

ema_long_slope_down = ema_long < ema_long[1]

// For the Narrow Consolidation Short

rangeHigh = ta.highest(high, consolidationBars)

rangeLow = ta.lowest(low, consolidationBars)

rangeSize = rangeHigh - rangeLow

atrValue = ta.atr(atrLength)

// Condition: Price range is "narrow" if it's less than (ATR * threshold)

narrowConsolidation = rangeSize < (atrValue * narrowThreshInAtr)

// Condition: All bars under Medium EMA if the highest difference (high - ema_medium) in last N bars is < 0

allBelowMedium = ta.highest(high - ema_medium, consolidationBars) < 0

// -------------------

// 3. Long Entry

// -------------------

breakout_candle_confirmed_long = ta.barssince(breakout_up) <= 3

long_condition = breakout_candle_confirmed_long

and volume_condition

and close > prev_range_high

and close > ema_long

and ema_short > ema_medium

and ema_medium > ema_long

and strategy.opentrades == 0

if long_condition

strategy.entry("Long", strategy.long)

// -------------------

// 4. Short Entries

// -------------------

// (A) Original breakout-based short logic

breakout_candle_confirmed_short = ta.barssince(breakout_down) <= 3

short_condition_breakout = breakout_candle_confirmed_short

and volume_condition

and close < prev_range_low

and close < ema_long

and ema_short < ema_medium

and ema_medium < ema_long

and ema_long_slope_down

and strategy.opentrades == 0

// (B) NEW: Narrow Consolidation Short

short_condition_consolidation = narrowConsolidation

and allBelowMedium

and strategy.opentrades == 0

// Combine them: if either short scenario is valid, go short

short_condition = (short_condition_breakout or short_condition_consolidation) and allowShort

if short_condition

// Use a different order ID if you want to distinguish them

// but "Short" is fine for a single position

strategy.entry("Short", strategy.short)

// -------------------

// 5. Exits

// -------------------

if strategy.position_size > 0 and close < ema_long

strategy.close("Long", qty_percent=100)

if strategy.position_size < 0 and close > ema_long

strategy.close("Short", qty_percent=100)

// ======================================================================

// 5. ADDITIONAL PARTIAL EXITS / STOPS

// ======================================================================

// You can add partial exits for shorts or longs similarly.

// For example:

// if strategy.position_size < 0 and close > stop_level_for_short

// strategy.close("Short", qty_percent=50)

相关推荐