概述

该策略是一个基于ATR(平均真实波幅)动态追踪止损的趋势跟踪系统。它结合了EMA均线作为趋势过滤器,并通过调整灵敏度参数和ATR周期来控制信号的生成。系统不仅支持做多,还支持做空交易,并具有完善的获利管理机制。

策略原理

- 使用ATR指标计算价格波动幅度,并根据设定的灵敏度系数(Key Value)确定追踪止损距离

- 通过EMA均线判断市场趋势方向,只在价格位于均线之上开多单,位于均线之下开空单

- 当价格突破追踪止损线且符合趋势方向时,触发交易信号

- 系统采用分段获利方式管理持仓:

- 获利20%-50%时,将止损提升至成本价保本

- 获利50%-80%时,部分获利了结并收紧止损位

- 获利80%-100%时,进一步收紧止损位保护利润

- 获利超过100%时,全部平仓获利

策略优势

- 动态追踪止损可以有效跟踪趋势,在保护利润的同时不会过早离场

- EMA趋势过滤有效降低了假突破带来的风险

- 分段获利机制既保证了收益兑现,又给予趋势充分发展空间

- 支持做多做空双向交易,可以充分把握市场机会

- 参数可调节性强,适应不同市场环境

策略风险

- 在震荡市场中可能频繁交易导致损失

- 趋势反转初期可能产生较大回撤

- 参数设置不当可能影响策略表现 风险控制建议:

- 建议在明显趋势市场使用

- 谨慎选择参数,可通过回测优化

- 设置最大回撤限制

- 考虑增加市场环境过滤条件

策略优化方向

- 增加市场环境识别机制,在不同市场条件下使用不同参数

- 引入成交量等辅助指标增强信号可靠性

- 优化获利管理机制,根据波动率动态调整获利目标

- 增加时间过滤,避免在不利时段交易

- 考虑加入波动率过滤,在过度波动时降低交易频率

总结

这是一个结构完整、逻辑清晰的趋势跟踪系统。通过ATR动态跟踪和EMA趋势过滤的结合,在把握趋势的同时较好地控制了风险。分段获利机制的设计也体现了成熟的交易思维。策略具有较强的实用性和可扩展性,通过持续优化和完善,有望获得更好的交易效果。

策略源码

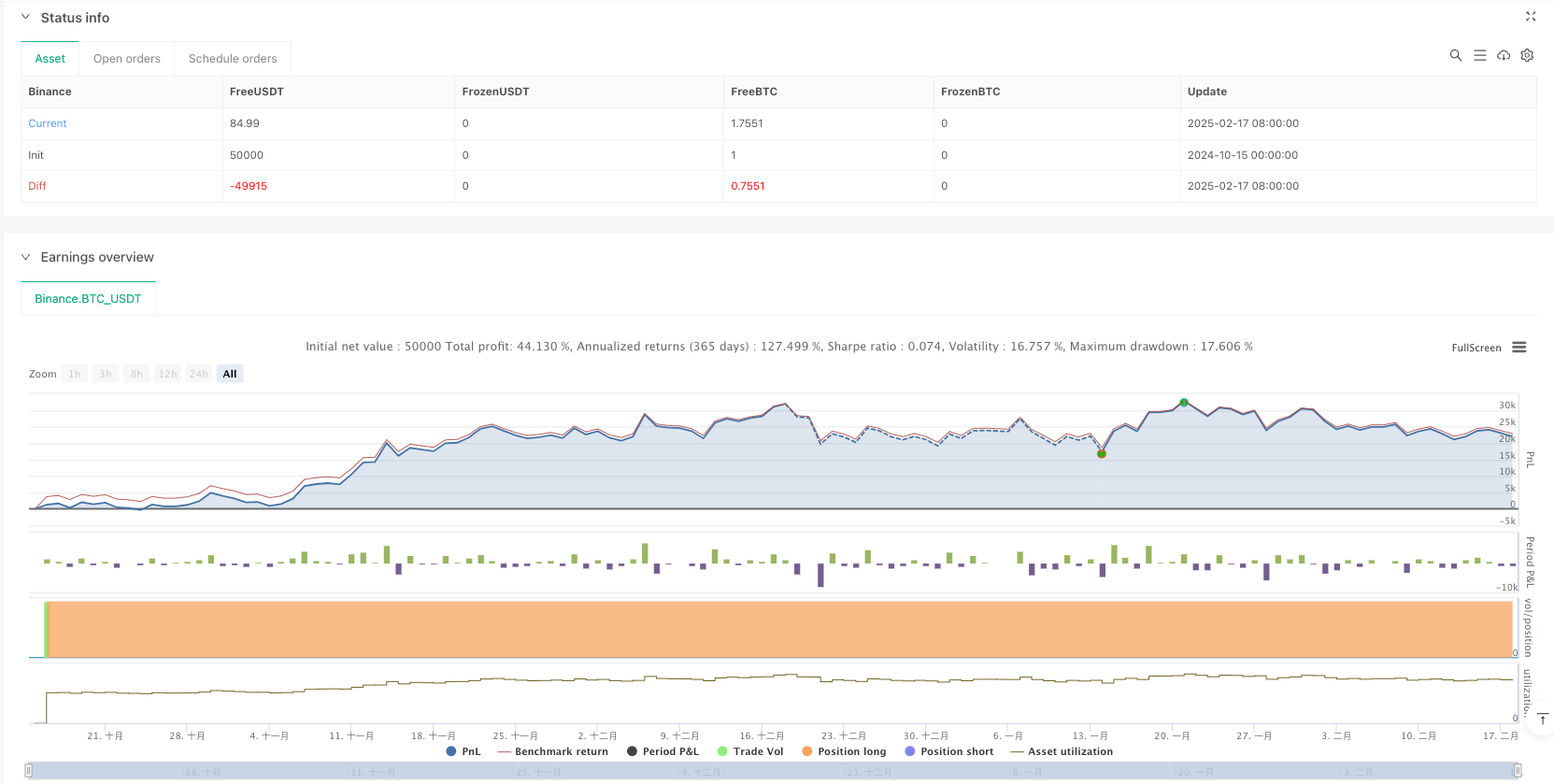

/*backtest

start: 2024-10-15 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced UT Bot with Long & Short Trades", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input Parameters

keyvalue = input.float(1.1, title="Key Value (Sensitivity)", step=0.1)

atrperiod = input.int(200, title="ATR Period")

emaPeriod = input.int(50, title="EMA Period")

roi_close = input.float(100, title="Close Trade at ROI (%)", step=1)

// ATR Calculation

src = close

xATR = ta.atr(atrperiod)

nLoss = keyvalue * xATR

// EMA for Trend Filtering

ema = ta.ema(src, emaPeriod)

// Trailing Stop Logic

var float xATRTrailingStop = na

if na(xATRTrailingStop)

xATRTrailingStop := src - nLoss

if src > nz(xATRTrailingStop[1]) and src[1] > nz(xATRTrailingStop[1])

xATRTrailingStop := math.max(nz(xATRTrailingStop[1]), src - nLoss)

else if src < nz(xATRTrailingStop[1]) and src[1] < nz(xATRTrailingStop[1])

xATRTrailingStop := math.min(nz(xATRTrailingStop[1]), src + nLoss)

else

xATRTrailingStop := src > nz(xATRTrailingStop[1]) ? src - nLoss : src + nLoss

// Buy/Sell Signal with Trend Filter

buySignal = ta.crossover(src, xATRTrailingStop) and src > ema

sellSignal = ta.crossunder(src, xATRTrailingStop) and src < ema

// Strategy Logic: Long Trades

if buySignal and strategy.position_size <= 0

strategy.entry("Buy", strategy.long)

if sellSignal and strategy.position_size > 0

strategy.close("Buy")

// Strategy Logic: Short Trades

if sellSignal and strategy.position_size >= 0

strategy.entry("Sell", strategy.short)

if buySignal and strategy.position_size < 0

strategy.close("Sell")

// ROI Calculation for Both Long and Short Trades

var float entryPrice = na

var bool isLong = na

if strategy.position_size > 0

entryPrice := strategy.opentrades.entry_price(0)

isLong := true

if strategy.position_size < 0

entryPrice := strategy.opentrades.entry_price(0)

isLong := false

// Calculate current profit

currentProfit = isLong ? (close - entryPrice) / entryPrice * 100 : (entryPrice - close) / entryPrice * 100

// Enhanced ROI Management

if strategy.position_size > 0 // Long Position

if currentProfit >= 20 and currentProfit < 50

stopLevel = entryPrice // Breakeven

strategy.exit("TSL Breakeven", from_entry="Buy", stop=stopLevel)

if currentProfit >= 50 and currentProfit < 80

stopLevel = entryPrice * 1.30 // 30% ROI

strategy.exit("TSL 30%", from_entry="Buy", stop=stopLevel)

strategy.close("Partial Profit", qty_percent=50) // Take 50% profit

if currentProfit >= 80 and currentProfit < roi_close

stopLevel = entryPrice * 1.60 // 60% ROI

strategy.exit("TSL 60%", from_entry="Buy", stop=stopLevel)

if currentProfit >= roi_close

strategy.close("Full Exit at 100% ROI")

if strategy.position_size < 0 // Short Position

if currentProfit >= 20 and currentProfit < 50

stopLevel = entryPrice // Breakeven

strategy.exit("TSL Breakeven", from_entry="Sell", stop=stopLevel)

if currentProfit >= 50 and currentProfit < 80

stopLevel = entryPrice * 0.70 // 30% ROI (Short stop)

strategy.exit("TSL 30%", from_entry="Sell", stop=stopLevel)

strategy.close("Partial Profit", qty_percent=50) // Take 50% profit

if currentProfit >= 80 and currentProfit < roi_close

stopLevel = entryPrice * 0.40 // 60% ROI (Short stop)

strategy.exit("TSL 60%", from_entry="Sell", stop=stopLevel)

if currentProfit >= roi_close

strategy.close("Full Exit at 100% ROI")

// Plotting

plot(xATRTrailingStop, color=buySignal ? color.green : sellSignal ? color.red : color.gray, title="Trailing Stop")

plot(ema, color=color.blue, title="EMA Trend Filter")

plotshape(buySignal, title="Buy Signal", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy")

plotshape(sellSignal, title="Sell Signal", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell")

相关推荐