概述

本策略是一个基于多重技术形态识别的高级交易系统,综合了蜡烛图形态分析和突破交易原理。策略能够识别并交易多种经典的蜡烛图形态,包括十字星形态(Doji)、锤子线(Hammer)和针形态(Pin Bar),同时结合双蜡烛确认系统来增强交易信号的可靠性。

策略原理

策略的核心逻辑建立在以下几个关键要素之上: 1. 形态识别系统 - 通过精确的数学计算来识别三种关键的蜡烛图形态:十字星、锤子线和针形态。每种形态都有其独特的识别标准,如实体与影线的比例关系。 2. 突破确认机制 - 采用双蜡烛确认系统,要求第二根蜡烛线突破前一根蜡烛线的高点(做多)或低点(做空),以减少虚假信号。 3. 目标价位确定 - 使用可调整的回溯期(默认20个周期)来确定最近的高点或低点作为目标价位,使策略具有动态适应性。

策略优势

- 多重形态识别 - 通过同时监控多个技术形态,显著增加了潜在的交易机会。

- 信号确认机制 - 双蜡烛确认系统有效降低了虚假信号的风险。

- 可视化交易区间 - 使用颜色框来标示交易区间,使交易目标更加直观。

- 灵活的参数调整 - 可根据不同市场条件调整回溯期等参数。

策略风险

- 市场波动风险 - 在高波动期间可能产生虚假突破信号。

- 滑点风险 - 在流动性较差的市场中,实际成交价可能与信号价格存在较大偏差。

- 趋势反转风险 - 在强趋势市场中,反转信号可能导致较大损失。

优化方向

- 引入成交量确认 - 建议在形态识别系统中加入成交量分析,以提高信号的可靠性。

- 动态止损机制 - 可以基于ATR或波动率来设置动态止损位。

- 市场环境过滤 - 添加趋势强度指标,在强趋势期间过滤掉反转信号。

- 时间框架优化 - 考虑在多个时间框架上进行信号确认。

总结

该策略通过结合多重技术形态分析和突破交易原理,建立了一个完整的交易系统。其优势在于信号的多维度确认和灵活的参数调整,但同时也需要注意市场波动和流动性风险。通过建议的优化方向,策略的稳定性和可靠性还可以进一步提升。

策略源码

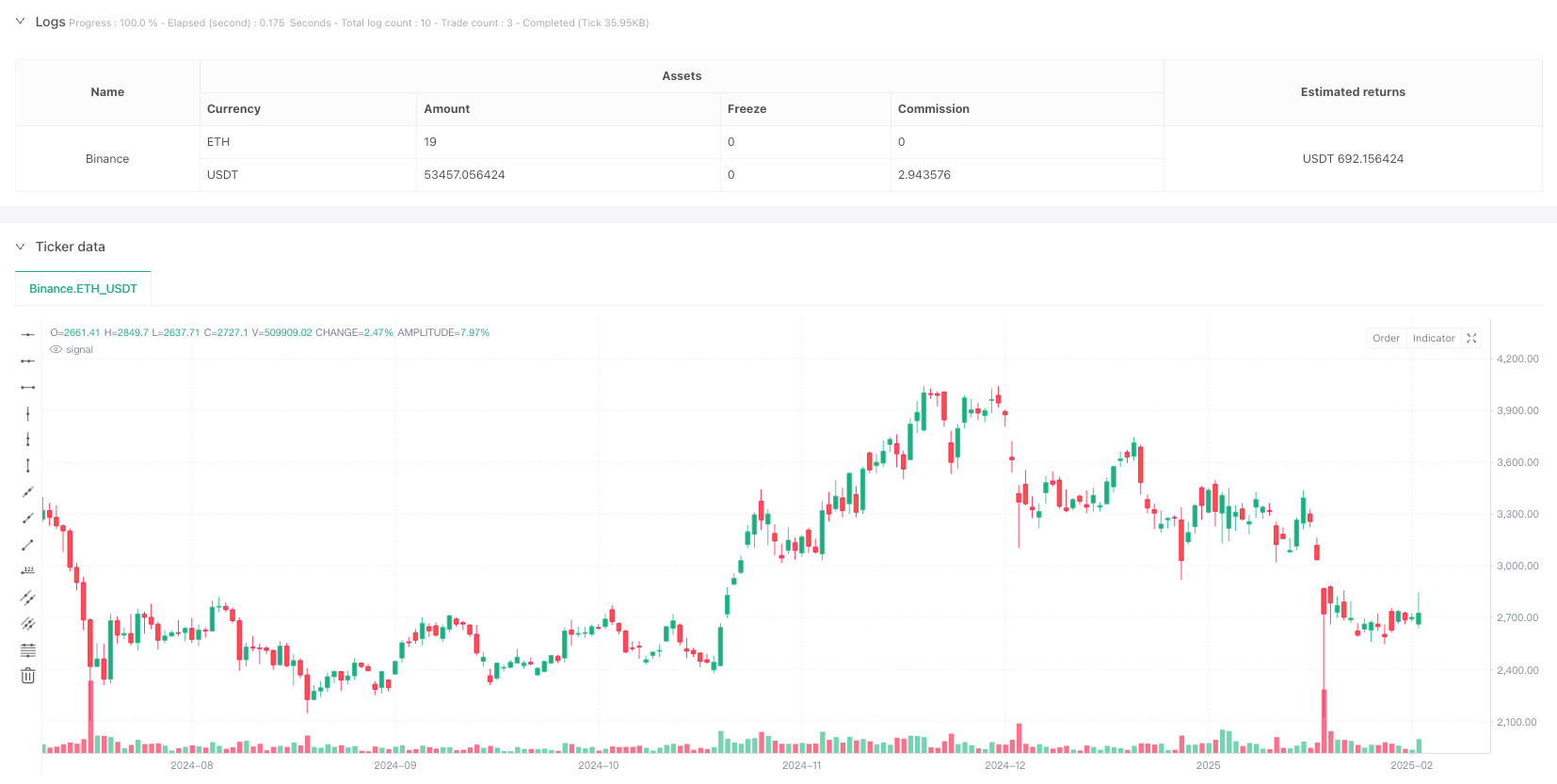

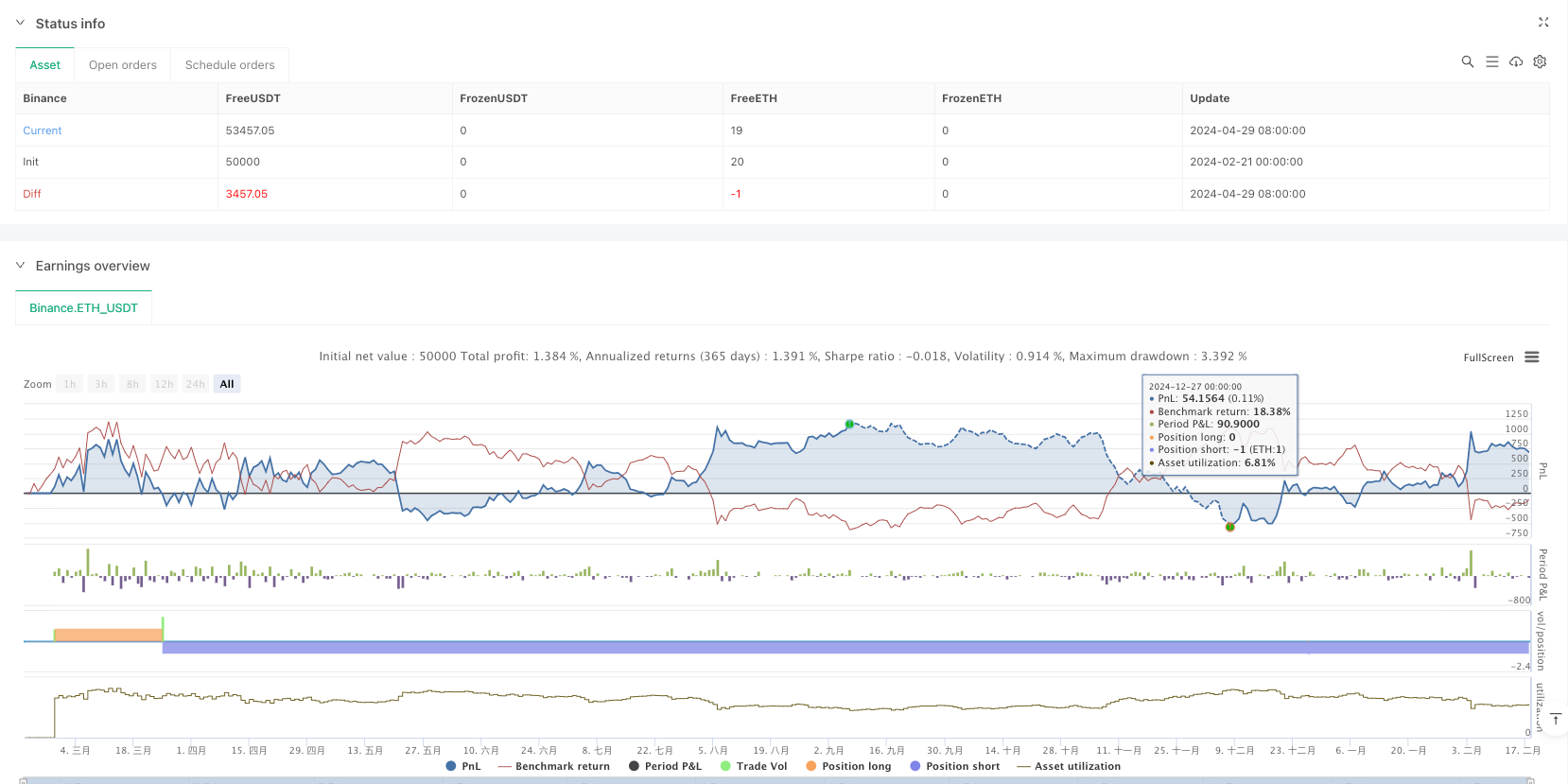

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Target(Made by Karan)", overlay=true)

// Input for lookback period

lookbackPeriod = input.int(20, title="Lookback Period for Recent High/Low", minval=1)

// --- Pattern Identification Functions ---

// Identify Doji pattern

isDoji(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize <= rangeSize * 0.1 // Small body compared to total range

// Identify Hammer pattern

isHammer(open, high, low, close) =>

bodySize = math.abs(close - open)

lowerShadow = open - low

upperShadow = high - close

bodySize <= (high - low) * 0.3 and lowerShadow > 2 * bodySize and upperShadow <= bodySize * 0.3 // Long lower shadow, small upper shadow

// Identify Pin Bar pattern

isPinBar(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

upperShadow = high - math.max(open, close)

lowerShadow = math.min(open, close) - low

(upperShadow > bodySize * 2 and lowerShadow < bodySize) or (lowerShadow > bodySize * 2 and upperShadow < bodySize) // Long shadow on one side

// --- Candle Breakout Logic ---

// Identify the first green candle (Bullish)

is_first_green_candle = close > open

// Identify the breakout above the high of the first green candle

breakout_green_candle = ta.crossover(close, high[1]) and is_first_green_candle[1]

// Identify the second green candle confirming the breakout

second_green_candle = close > open and breakout_green_candle[1]

// Find the recent high (for the target)

recent_high = ta.highest(high, lookbackPeriod) // Use adjustable lookback period

// Plot the green rectangle box if the conditions are met and generate buy signal

var float start_price_green = na

var float end_price_green = na

if second_green_candle

start_price_green := low[1] // Low of the breakout green candle

end_price_green := recent_high // The most recent high in the lookback period

strategy.entry("Buy", strategy.long) // Buy signal

// --- Red Candle Logic ---

// Identify the first red candle (Bearish)

is_first_red_candle = close < open

// Identify the breakdown below the low of the first red candle

breakdown_red_candle = ta.crossunder(close, low[1]) and is_first_red_candle[1]

// Identify the second red candle confirming the breakdown

second_red_candle = close < open and breakdown_red_candle[1]

// Find the recent low (for the target)

recent_low = ta.lowest(low, lookbackPeriod) // Use adjustable lookback period

// Plot the red rectangle box if the conditions are met and generate sell signal

var float start_price_red = na

var float end_price_red = na

if second_red_candle

start_price_red := high[1] // High of the breakout red candle

end_price_red := recent_low // The most recent low in the lookback period

strategy.entry("Sell", strategy.short) // Sell signal

// --- Pattern Breakout Logic for Doji, Hammer, Pin Bar ---

// Detect breakout of Doji, Hammer, or Pin Bar patterns

var float start_price_pattern = na

var float end_price_pattern = na

// Check for Doji breakout

if isDoji(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Doji

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Doji", strategy.long) // Buy signal for Doji breakout

// Check for Hammer breakout

if isHammer(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Hammer

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Hammer", strategy.long) // Buy signal for Hammer breakout

// Check for Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Pin Bar

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Pin Bar", strategy.long) // Buy signal for Pin Bar breakout

// Check for bearish Doji breakout

if isDoji(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Doji

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Doji", strategy.short) // Sell signal for Doji breakdown

// Check for bearish Hammer breakout

if isHammer(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Hammer

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Hammer", strategy.short) // Sell signal for Hammer breakdown

// Check for bearish Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Pin Bar

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Pin Bar", strategy.short) // Sell signal for Pin Bar breakdown

// Optional: Plot shapes for the green sequence of candles

plotshape(series=is_first_green_candle, location=location.belowbar, color=color.green, style=shape.labelup, text="1st Green")

plotshape(series=breakout_green_candle, location=location.belowbar, color=color.blue, style=shape.labelup, text="Breakout")

plotshape(series=second_green_candle, location=location.belowbar, color=color.orange, style=shape.labelup, text="2nd Green")

// Optional: Plot shapes for the red sequence of candles

plotshape(series=is_first_red_candle, location=location.abovebar, color=color.red, style=shape.labeldown, text="1st Red")

plotshape(series=breakdown_red_candle, location=location.abovebar, color=color.blue, style=shape.labeldown, text="Breakdown")

plotshape(series=second_red_candle, location=location.abovebar, color=color.orange, style=shape.labeldown, text="2nd Red")

相关推荐