双均线交叉结合RSI强弱过滤交易策略 | Dual Moving Average Crossover with RSI Strength Filter Trading Strategy

概述

本策略是一个结合了双均线交叉和RSI指标过滤的交易系统。策略使用5周期指数移动平均线(EMA5)和10周期简单移动平均线(SMA10)作为主要趋势判断工具,同时引入14周期相对强弱指数(RSI14)作为交易信号过滤器,通过严格的入场和出场条件来提高交易的准确性。

策略原理

策略的核心逻辑基于两个关键技术指标的配合: 1. 双均线系统: EMA5与SMA10的交叉用于捕捉趋势变化 - 当EMA5向上穿越SMA10时,产生做多信号 - 当EMA5向下穿越SMA10时,产生做空信号 2. RSI过滤系统: - 做多条件要求RSI14数值大于60 - 做空条件要求RSI14数值小于50 - 价格必须突破RSI相应水平以确认交易信号

策略优势

信号确认机制完善

- 通过双均线交叉提供初始信号

- 使用RSI过滤器进行二次确认

- 要求价格突破RSI关键水平作为最终确认

风险控制有效

- 设置了明确的入场和出场条件

- 采用反向信号自动平仓机制

- RSI指标过滤掉潜在的虚假信号

策略逻辑清晰

- 指标组合简单易懂

- 交易规则明确具体

- 便于调整和优化

策略风险

震荡市场风险

- 频繁的均线交叉可能导致过度交易

- 在横盘市场中可能产生误导性信号

- 建议在明确趋势中使用

滞后性风险

- 移动平均线本身具有滞后性

- RSI确认可能导致错过部分行情

- 需要在及时性和准确性之间找到平衡

参数敏感性

- 均线周期设置影响信号频率

- RSI阈值设置影响过滤效果

- 不同市场环境可能需要不同参数

策略优化方向

引入趋势强度过滤

- 增加ADX指标判断趋势强度

- 在强趋势中采用更宽松的RSI过滤条件

- 在弱趋势中提高过滤条件严格性

优化参数自适应

- 根据市场波动率动态调整均线周期

- 基于市场环境自动调整RSI阈值

- 引入自适应算法优化参数选择

完善风险管理

- 增加止损止盈机制

- 实现仓位管理功能

- 添加交易成本考虑

总结

该策略通过结合双均线交叉和RSI过滤器,构建了一个相对完善的交易系统。策略的主要优势在于其信号确认机制和风险控制措施,但也存在一些固有的局限性。通过建议的优化方向,策略有望在实际交易中取得更好的表现。特别是在趋势明确的市场环境下,该策略的表现可能会更加稳定。

策略源码

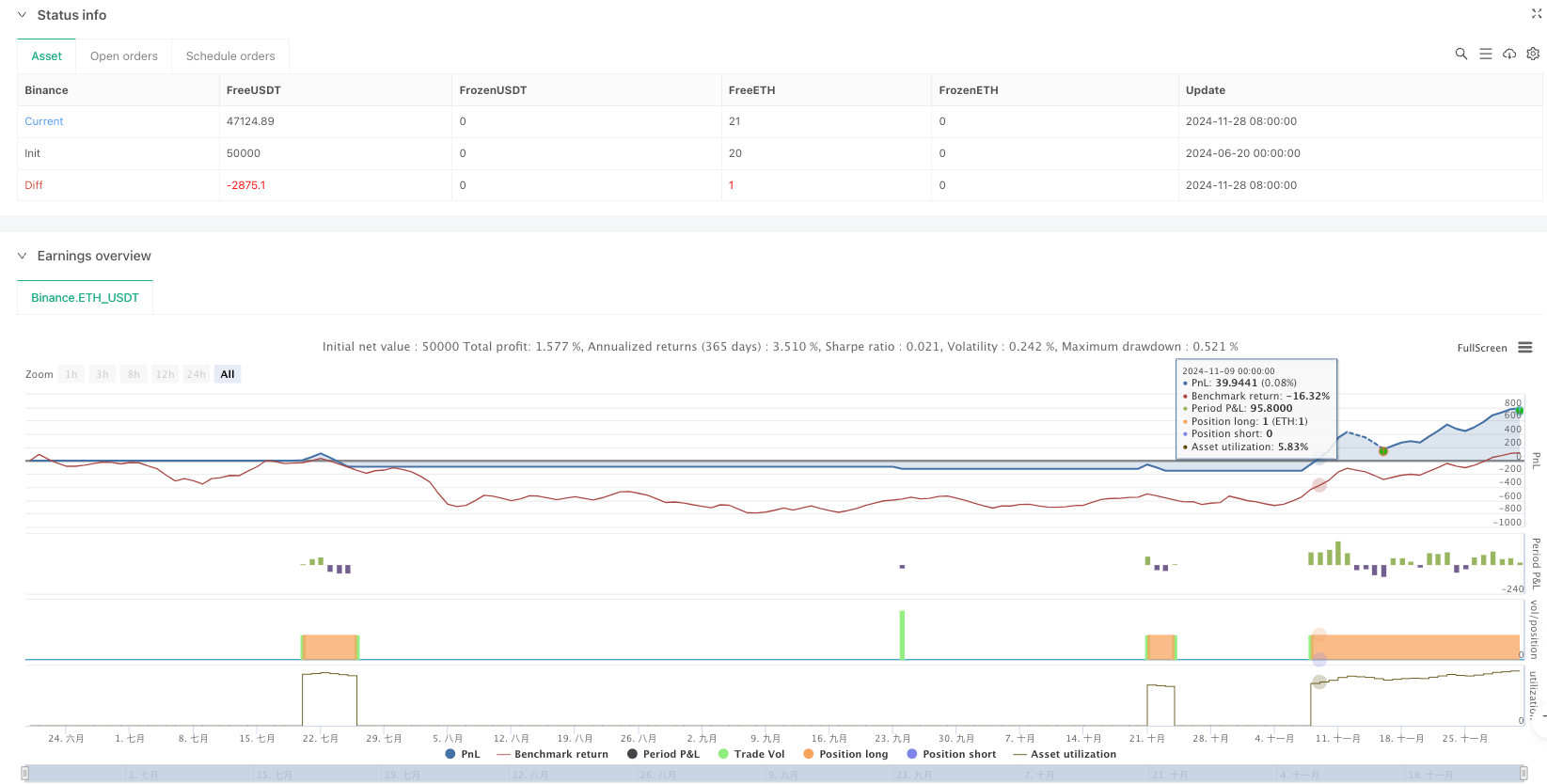

/*backtest

start: 2024-06-20 00:00:00

end: 2024-12-01 00:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA and SMA Crossover with RSI14 Filtering", overlay=true)

// Define parameters for EMA, SMA, and RSI

ema5_length = 5

sma10_length = 10

rsi14_length = 14

rsi60_level = 60

rsi50_level = 50

// Calculate EMAs, SMAs, and RSI

ema5 = ta.ema(close, ema5_length)

sma10 = ta.sma(close, sma10_length)

rsi14 = ta.rsi(close, rsi14_length)

// Define Crossover Conditions

positive_crossover = ta.crossover(ema5, sma10)

negative_crossover = ta.crossunder(ema5, sma10)

// Define RSI filter conditions

rsi_above_60 = rsi14 > rsi60_level

rsi_below_50 = rsi14 < rsi50_level

// Condition: price below 60 on RSI 14 and later crosses above for Buy

price_below_rsi60 = close < rsi14

price_above_rsi60 = close > rsi14

// Condition: price above 50 on RSI 14 and later crosses below for Sell

price_above_rsi50 = close > rsi14

price_below_rsi50 = close < rsi14

// Trading logic

var bool active_buy_trade = false

var bool active_sell_trade = false

// Buy Condition: EMA 5 crosses above SMA 10 and RSI 14 crosses above 60

if (positive_crossover and not active_buy_trade)

if (price_below_rsi60)

// Wait for price to cross above RSI 60

if (price_above_rsi60)

strategy.entry("Buy", strategy.long)

active_buy_trade := true

else

strategy.entry("Buy", strategy.long)

active_buy_trade := true

// Sell Condition: EMA 5 crosses below SMA 10 and RSI 14 crosses below 50

if (negative_crossover and not active_sell_trade)

if (price_above_rsi50)

// Wait for price to cross below RSI 50

if (price_below_rsi50)

strategy.entry("Sell", strategy.short)

active_sell_trade := true

else

strategy.entry("Sell", strategy.short)

active_sell_trade := true

// Exit Buy Condition: Reverse Signal (EMA crosses below SMA or RSI crosses below 50)

if (active_buy_trade and (negative_crossover or rsi14 < rsi50_level))

strategy.close("Buy")

active_buy_trade := false

// Exit Sell Condition: Reverse Signal (EMA crosses above SMA or RSI crosses above 60)

if (active_sell_trade and (positive_crossover or rsi14 > rsi60_level))

strategy.close("Sell")

active_sell_trade := false

// Plotting EMAs, SMAs, and RSI 14 on the chart

plot(ema5, color=color.blue, linewidth=2, title="EMA 5")

plot(sma10, color=color.red, linewidth=2, title="SMA 10")

hline(rsi60_level, "RSI 60", color=color.gray, linestyle=hline.style_dotted)

hline(rsi50_level, "RSI 50", color=color.gray, linestyle=hline.style_dotted)

plot(rsi14, color=color.green, linewidth=1, title="RSI 14")

相关推荐