概述

本策略是一个结合了钱德动量振荡器(CMO)和布林带(Bollinger Bands)的高级量化交易系统。它通过分析价格波动性和动量指标来识别市场的超买超卖状态,从而产生精确的交易信号。该策略利用了动量反转和价格通道突破的双重验证机制,有效提高了交易的可靠性。

策略原理

策略的核心逻辑基于以下几个关键组件: 1. 布林带系统: 使用20周期移动平均线作为中轨,标准差倍数为2.0,形成上下轨道。这一设置能够有效捕捉价格的波动范围和突破方向。 2. CMO指标系统: 采用14周期设置,超买阈值为50,超卖阈值为-50。该指标通过计算上涨和下跌动量的差值来衡量市场力量对比。 3. 交易信号生成机制: - 做多条件: 价格下穿布林带下轨且CMO低于超卖阈值 - 做空条件: 价格上穿布林带上轨且CMO高于超买阈值 - 平仓机制: 价格穿越布林带中轨或动量指标达到相反的极值区域

策略优势

- 多维度确认: 通过价格和动量的双重验证,显著降低了假突破带来的风险。

- 自适应性强: 布林带能够根据市场波动性自动调整交易区间,适应不同市场环境。

- 风险控制完善: 使用布林带中轨作为止损参考,提供了客观的风险控制标准。

- 参数可调性高: 允许交易者根据不同市场特征调整布林带和CMO的参数,优化策略表现。

策略风险

- 震荡市风险: 在横盘整理市场中可能产生频繁的假信号。 建议对策: 增加过滤条件,如要求价格突破幅度达到一定阈值。

- 趋势反转风险: 强势趋势中的反转信号可能导致过早退出。 建议对策: 结合趋势指标,仅在主趋势方向交易。

- 参数敏感性: 不同参数设置可能导致策略表现差异较大。 建议对策: 通过历史数据回测优化参数组合。

策略优化方向

- 动态参数调整: 引入自适应机制,根据市场波动率动态调整布林带的标准差倍数。

- 信号强度分级: 建立信号评分系统,根据突破强度和动量水平调整持仓比例。

- 市场环境分类: 增加市场环境识别模块,在不同市场状态下使用不同的参数组合。

- 止盈优化: 开发基于波动率的动态止盈机制,提高策略的盈利能力。

总结

该策略通过布林带和CMO的协同作用,构建了一个完整的交易系统。策略在保持操作客观性的同时,通过多重确认机制提高了交易的可靠性。通过合理的参数设置和风险控制,策略展现出良好的实用性和可扩展性。进一步优化空间主要集中在动态适应性和精细化管理方面。

策略源码

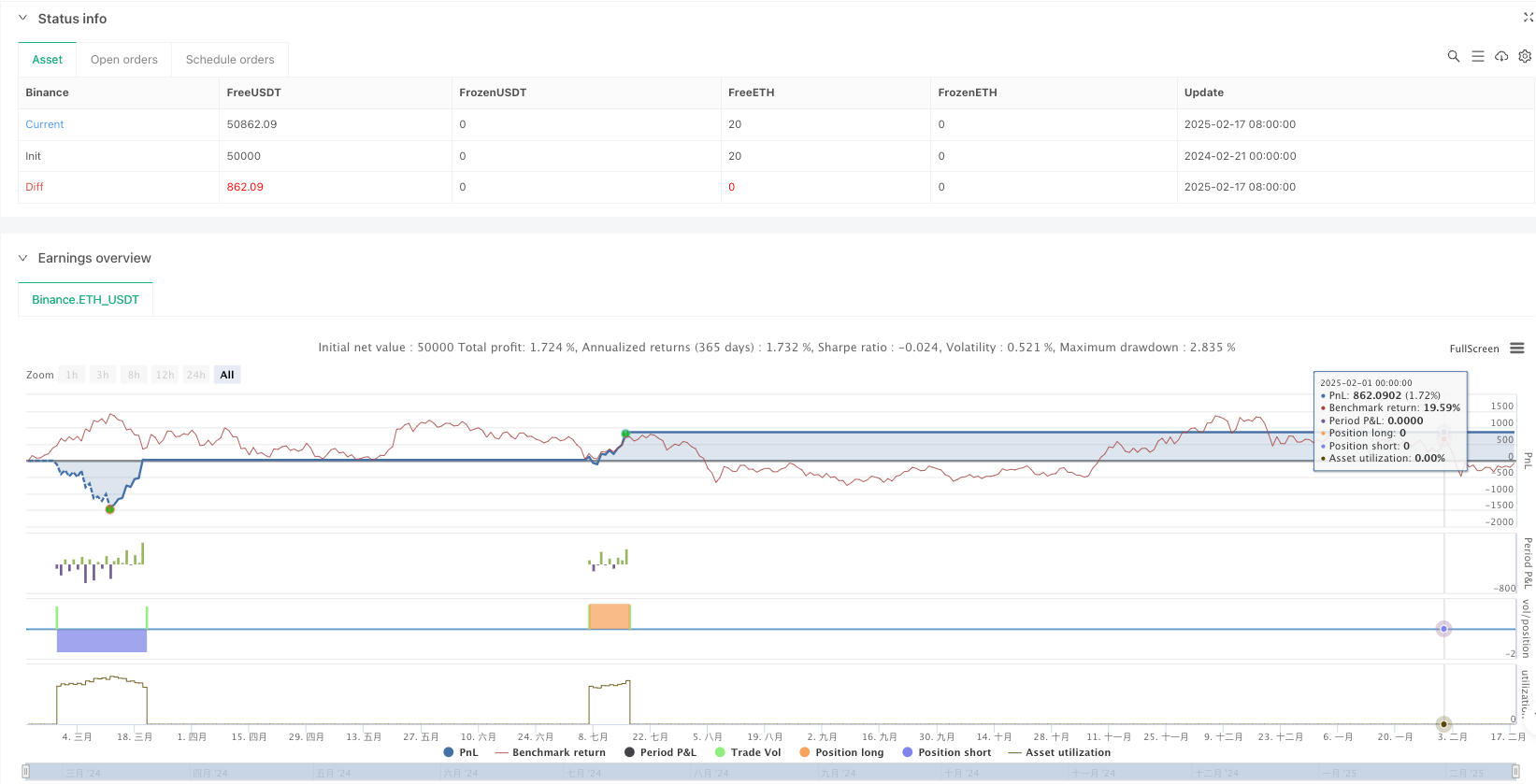

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Chande Momentum Oscillator + Bollinger Bands Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Bollinger Bands Parameters

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Std Dev")

basis = ta.sma(close, bbLength)

upper = basis + bbStdDev * ta.stdev(close, bbLength)

lower = basis - bbStdDev * ta.stdev(close, bbLength)

// Chande Momentum Oscillator Parameters

cmoLength = input.int(14, title="CMO Length")

cmoOverbought = input.float(50, title="CMO Overbought Level")

cmoOversold = input.float(-50, title="CMO Oversold Level")

cmo = ta.cmo(close, cmoLength)

// Plot Bollinger Bands

plot(basis, color=color.orange, title="Bollinger Basis")

p1 = plot(upper, color=color.blue, title="Bollinger Upper")

p2 = plot(lower, color=color.blue, title="Bollinger Lower")

fill(p1, p2, color=color.blue, transp=90, title="Bollinger Fill")

// Plot CMO

hline(cmoOverbought, "Overbought", color=color.red)

hline(cmoOversold, "Oversold", color=color.green)

plot(cmo, color=color.purple, title="CMO")

// Buy Condition: Price crosses below lower Bollinger Band and CMO is oversold

longCondition = ta.crossunder(close, lower) and cmo < cmoOversold

if (longCondition)

strategy.entry("Long", strategy.long)

// Sell Condition: Price crosses above upper Bollinger Band and CMO is overbought

shortCondition = ta.crossover(close, upper) and cmo > cmoOverbought

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Long: Price crosses above basis or CMO is overbought

exitLong = ta.crossover(close, basis) or cmo > cmoOverbought

if (exitLong)

strategy.close("Long")

// Exit Short: Price crosses below basis or CMO is oversold

exitShort = ta.crossunder(close, basis) or cmo < cmoOversold

if (exitShort)

strategy.close("Short")

相关推荐