概述

该策略是一个结合了传统技术分析和现代人工智能方法的趋势跟踪系统。它主要利用指数移动平均线(EMA)和简单移动平均线(SMA)作为趋势过滤器,同时引入预测模型来优化入场时机。策略专门针对日线级别进行了优化,旨在捕捉中长期市场趋势。

策略原理

策略的核心逻辑包含三个主要组成部分: 1. 趋势判断系统 - 使用200周期的EMA和SMA作为主要趋势过滤器,通过价格与均线的位置关系判断当前趋势方向 2. 预测模块 - 采用可扩展的预测组件,目前使用模拟预测,后续可替换为机器学习模型 3. 仓位管理 - 设定固定的4根K线持仓周期,用于控制持仓时间和风险

交易信号的产生需要同时满足趋势方向和预测信号的一致性,即: - 多头信号:价格位于EMA和SMA之上,且预测值为正 - 空头信号:价格位于EMA和SMA之下,且预测值为负

策略优势

- 结构清晰 - 策略逻辑简单直观,易于理解和维护

- 风险可控 - 通过固定持仓周期和双重均线过滤有效控制风险

- 可扩展性强 - 预测模块设计灵活,可以根据需求接入不同的预测模型

- 适应性好 - 参数可调整,能够适应不同市场环境

- 操作频率适中 - 日线级别的操作降低了交易成本和心理压力

策略风险

- 趋势反转风险 - 在趋势转折点可能出现连续亏损

- 参数敏感性 - 均线周期和持仓周期的选择对策略表现影响较大

- 模型依赖性 - 预测模块的准确性直接影响策略效果

- 滑点影响 - 日线级别的操作可能面临较大滑点

- 市场环境依赖 - 在震荡市场中表现可能不佳

策略优化方向

- 预测模型升级 - 引入机器学习模型替代现有的随机预测

- 动态持仓周期 - 根据市场波动率动态调整持仓时间

- 止损优化 - 增加动态止损机制提高风险控制能力

- 仓位管理 - 引入基于波动率的仓位管理系统

- 多维度过滤 - 增加成交量、波动率等辅助指标

总结

该策略通过结合传统技术分析和现代预测方法,构建了一个稳健的趋势跟踪系统。其主要优势在于逻辑清晰、风险可控和较强的可扩展性。通过策略优化,特别是在预测模型和风险控制方面的改进,有望进一步提升策略的稳定性和盈利能力。策略适合追求中长期稳定收益的投资者使用。

策略源码

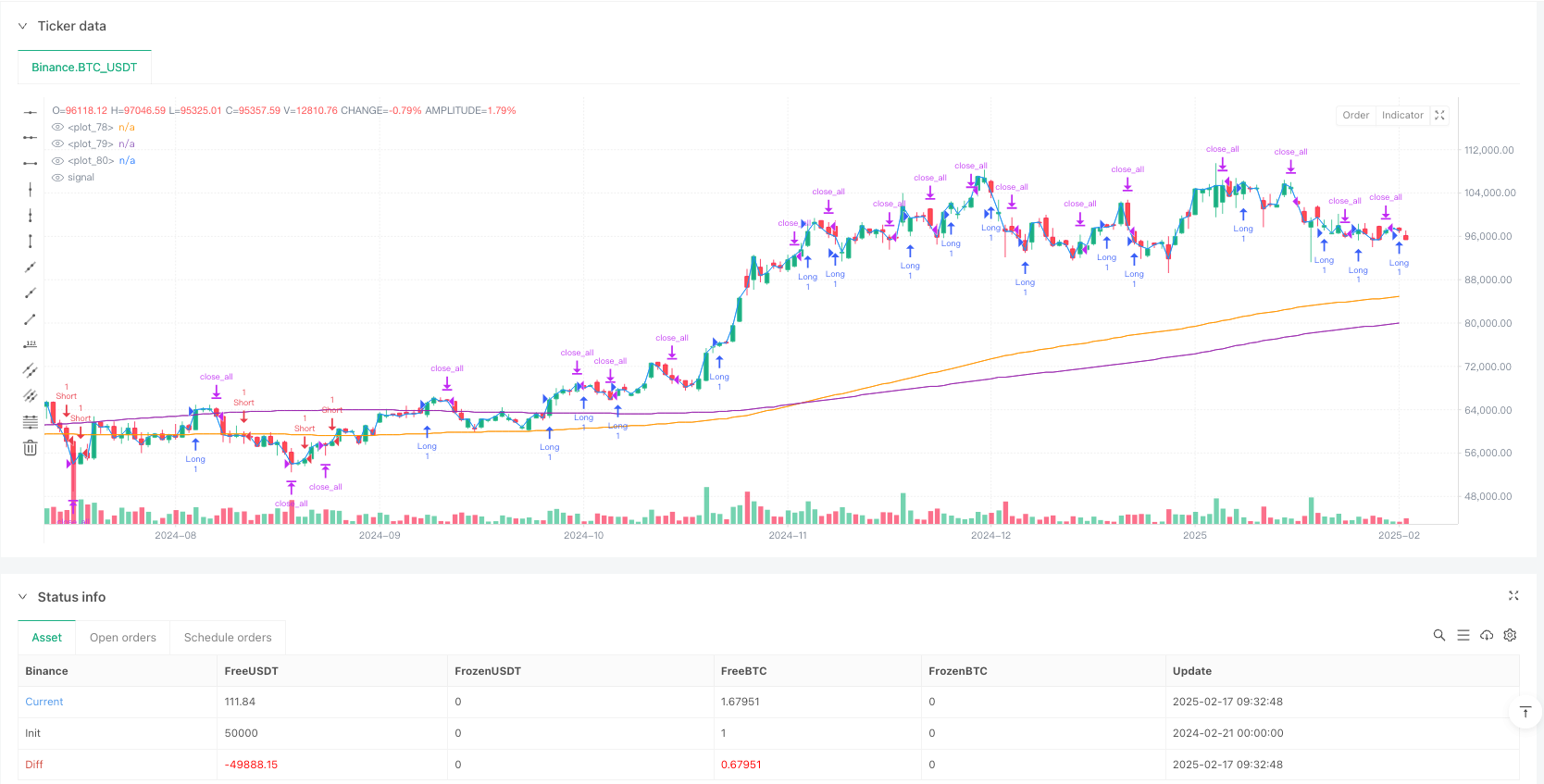

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("My Strategy", overlay=true)

// Parameters (adjust as needed)

neighborsCount = 8

maxBarsBack = 2000

featureCount = 5

useDynamicExits = true

useEmaFilter = true

emaPeriod = 200

useSmaFilter = true

smaPeriod = 200

// Moving Average Calculations

ema = ta.ema(close, emaPeriod)

sma = ta.sma(close, smaPeriod)

// Trend Conditions

isEmaUptrend = close > ema

isEmaDowntrend = close < ema

isSmaUptrend = close > sma

isSmaDowntrend = close < sma

// Model Prediction (Replace with your real model)

// Here a simulation is used, replace it with real predictions

prediction = math.random() * 2 - 1 // Random value between -1 and 1

// Entry Signals

isNewBuySignal = prediction > 0 and isEmaUptrend and isSmaUptrend

isNewSellSignal = prediction < 0 and isEmaDowntrend and isSmaDowntrend

// Exit Signals

var int barsHeld = 0

var bool in_position = false

var int entry_bar = 0

if isNewBuySignal and not in_position

in_position := true

entry_bar := bar_index

barsHeld := 1

else if isNewSellSignal and not in_position

in_position := true

entry_bar := bar_index

barsHeld := 1

else if in_position

barsHeld := barsHeld + 1

if barsHeld == 4

in_position := false

endLongTradeStrict = barsHeld == 4 and isNewBuySignal[1]

endShortTradeStrict = barsHeld == 4 and isNewSellSignal[1]

// Backtest Logic

var float totalProfit = 0

var float entryPrice = na

var int tradeDirection = 0

if isNewBuySignal and tradeDirection <= 0

entryPrice := close

tradeDirection := 1

strategy.entry("Long", strategy.long)

if isNewSellSignal and tradeDirection >= 0

entryPrice := close

tradeDirection := -1

strategy.entry("Short", strategy.short)

if (endLongTradeStrict and tradeDirection == 1) or (endShortTradeStrict and tradeDirection == -1)

exitPrice = close

profit = (exitPrice - entryPrice) / entryPrice

if tradeDirection == -1

profit := (entryPrice - exitPrice) / entryPrice

totalProfit := totalProfit + profit

tradeDirection := 0

strategy.close_all()

plot(close, color=color.blue)

plot(ema, color=color.orange)

plot(sma, color=color.purple)

相关推荐