概述

该策略是一个结合了双均线交叉信号和动态风险管理的交易系统。通过短期和长期移动平均线的交叉来产生交易信号,同时利用ATR指标动态调整止损和获利点位,并引入时间过滤和冷却期来优化交易质量。该策略还包含了风险收益比和每笔交易风险百分比的管理机制。

策略原理

策略主要基于以下几个核心组件: 1. 信号生成系统采用短期(10周期)和长期(100周期)简单移动平均线的交叉来触发交易。当短期均线向上穿越长期均线时产生做多信号,反之产生做空信号。 2. 风险管理系统使用14周期ATR乘以1.5倍系数来设置动态止损距离,获利目标则是止损距离的2倍(可调整的风险收益比)。 3. 时间过滤器允许用户设定交易的具体时间段,仅在指定时间范围内执行交易。 4. 交易冷却期机制设置10个周期的等待时间,防止过度交易。 5. 每笔交易的风险控制在账户的1%(可调整)。

策略优势

- 动态风险管理: 使用ATR指标自适应市场波动性,在不同市场环境下自动调整止损和获利距离。

- 完整的风险控制: 通过设定风险收益比和每笔交易风险比例,实现系统化的资金管理。

- 灵活的时间管理: 可以根据不同市场的交易时段特点调整交易时间。

- 防过度交易: 冷却期机制有效避免在剧烈波动时期产生过多交易信号。

- 可视化效果: 在图表上清晰显示交易信号和移动平均线,便于分析和优化。

策略风险

- 趋势反转风险: 在震荡市场中可能产生虚假突破信号,导致连续止损。

- 参数敏感性: 移动平均线周期、ATR倍数等参数的选择会显著影响策略表现。

- 时间过滤器设置不当可能错过重要交易机会。

- 固定的风险收益比在不同市场环境下可能不够灵活。

策略优化方向

- 引入趋势强度过滤器: 可以添加ADX或类似指标来判断趋势强度,仅在强趋势期间交易。

- 动态调整风险收益比: 根据市场波动性或趋势强度自动调整风险收益比。

- 增加成交量分析: 将成交量作为信号确认的补充指标。

- 优化冷却期机制: 使冷却期长度根据市场波动性动态调整。

- 加入市场环境分类: 在不同的市场环境下使用不同的参数组合。

总结

该策略通过结合经典的技术分析方法和现代风险管理理念,构建了一个完整的交易系统。其核心优势在于动态风险管理和多重过滤机制,但仍需要在实际应用中根据具体市场特点进行参数优化。策略的成功运行需要交易者深入理解各个组件的作用,并根据市场变化及时调整参数。通过建议的优化方向,策略有望在不同市场环境下获得更稳定的表现。

策略源码

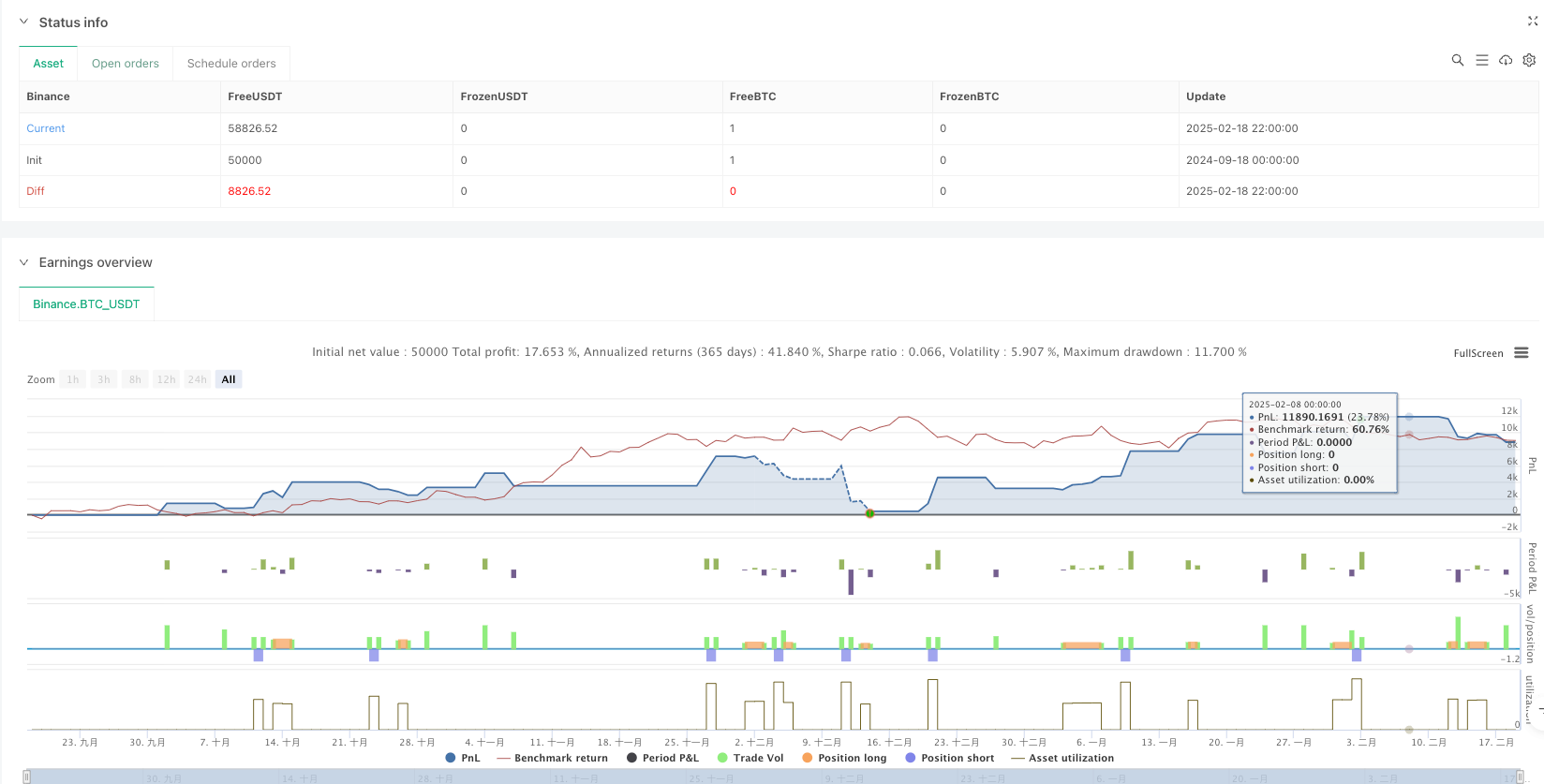

/*backtest

start: 2024-09-18 00:00:00

end: 2025-02-19 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Profitable Moving Average Crossover Strategy", shorttitle="Profitable MA Crossover", overlay=true)

// Input parameters for the moving averages

shortPeriod = input.int(10, title="Short Period", minval=1)

longPeriod = input.int(100, title="Long Period", minval=1)

// Input parameters for time filter

startHour = input.int(0, title="Start Hour (UTC)", minval=0, maxval=23)

startMinute = input.int(0, title="Start Minute (UTC)", minval=0, maxval=59)

endHour = input.int(23, title="End Hour (UTC)", minval=0, maxval=23)

endMinute = input.int(59, title="End Minute (UTC)", minval=0, maxval=59)

// Cooldown period input (bars)

cooldownBars = input.int(10, title="Cooldown Period (Bars)", minval=1)

// Risk management inputs

riskRewardRatio = input.float(2, title="Risk-Reward Ratio", minval=1)

riskPercent = input.float(1, title="Risk Per Trade (%)", minval=0.1)

// ATR settings

atrLength = input.int(14, title="ATR Length")

atrMultiplier = input.float(1.5, title="ATR Multiplier for Stop-Loss and Take-Profit")

// Calculate the moving averages

shortMA = ta.sma(close, shortPeriod)

longMA = ta.sma(close, longPeriod)

// Plot the moving averages

plot(shortMA, color=color.blue, title="Short MA")

plot(longMA, color=color.red, title="Long MA")

// Calculate ATR for dynamic stop-loss and take-profit

atr = ta.atr(atrLength)

stopLossOffset = atr * atrMultiplier

takeProfitOffset = stopLossOffset * riskRewardRatio

// Identify the crossover points

bullishCross = ta.crossover(shortMA, longMA)

bearishCross = ta.crossunder(shortMA, longMA)

// Get the current bar's time in UTC

currentTime = na(time("1", "UTC")) ? na : timestamp("UTC", year, month, dayofmonth, hour, minute)

// Define the start and end time in seconds from the start of the day

startTime = timestamp("UTC", year, month, dayofmonth, startHour, startMinute)

endTime = timestamp("UTC", year, month, dayofmonth, endHour, endMinute)

// Check if the current time is within the valid time range

isTimeValid = (currentTime >= startTime) and (currentTime <= endTime)

// Functions to check cooldown

var int lastSignalBar = na

isCooldownActive = (na(lastSignalBar) ? false : (bar_index - lastSignalBar) < cooldownBars)

// Handle buy signals

if (bullishCross and isTimeValid and not isCooldownActive)

entryPrice = close

stopLossBuy = entryPrice - stopLossOffset

takeProfitBuy = entryPrice + takeProfitOffset

strategy.entry("Buy", strategy.long)

strategy.exit("TakeProfit/StopLoss", "Buy", stop=stopLossBuy, limit=takeProfitBuy)

lastSignalBar := bar_index

// Handle sell signals

if (bearishCross and isTimeValid and not isCooldownActive)

entryPrice = close

stopLossSell = entryPrice + stopLossOffset

takeProfitSell = entryPrice - takeProfitOffset

strategy.entry("Sell", strategy.short)

strategy.exit("TakeProfit/StopLoss", "Sell", stop=stopLossSell, limit=takeProfitSell)

lastSignalBar := bar_index

// Plot signals on the chart

plotshape(series=bullishCross and isTimeValid and not isCooldownActive, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy", title="Buy Signal", textcolor=color.white)

plotshape(series=bearishCross and isTimeValid and not isCooldownActive, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell", title="Sell Signal", textcolor=color.white)

// Strategy performance tracking

strategy.close("Buy", when=not isTimeValid)

strategy.close("Sell", when=not isTimeValid)

相关推荐