概述

本策略是一个基于随机指标(Stochastic Oscillator)的多时间框架波段交易系统。它通过结合当前时间框架和更高时间框架的随机指标信号来确定交易机会,并使用动态止盈止损来管理风险。该策略适用于波动性较大的市场,通过捕捉价格的短期波动来获取收益。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用随机指标在两个时间框架(当前和更高级别)上进行信号确认 2. 在超买超卖区域寻找交叉信号 3. 买入条件:当前时间框架K线上穿D线,且K值<20;更高时间框架K值<20且K>D 4. 卖出条件:当前时间框架K线下穿D线,且K值>80;更高时间框架K值>80且K 5. 采用基于入场价格的动态止盈止损系统,止盈止损倍数可调

策略优势

- 多时间框架信号确认提高了交易的可靠性,有效降低了虚假信号

- 在超买超卖区域进行交易,增加了趋势反转的概率

- 动态止盈止损系统可以根据市场波动自动调整,提高了资金管理的灵活性

- 图形界面直观显示交易信号和止盈止损位置,便于交易者理解和操作

- 策略参数可调,适应不同市场环境

策略风险

- 在剧烈波动市场中可能出现止损频繁的情况

- 双重时间框架确认可能导致错过一些交易机会

- 固定倍数的止盈止损可能不适合所有市场环境

- 在趋势强劲时可能过早止盈

- 需要合理设置参数以平衡收益和风险

策略优化方向

- 引入自适应止盈止损机制,根据市场波动率动态调整

- 增加趋势过滤器,在强趋势中调整交易方向

- 加入成交量指标作为辅助确认信号

- 开发更智能的仓位管理系统

- 考虑加入市场情绪指标来优化入场时机

总结

这是一个结合了技术分析和风险管理的完整交易系统。通过多时间框架的信号确认和动态止盈止损,策略在保证稳定性的同时也具备了较好的收益潜力。但是,使用者需要根据自己的交易风格和市场环境对参数进行优化,并始终保持严格的风险控制。

策略源码

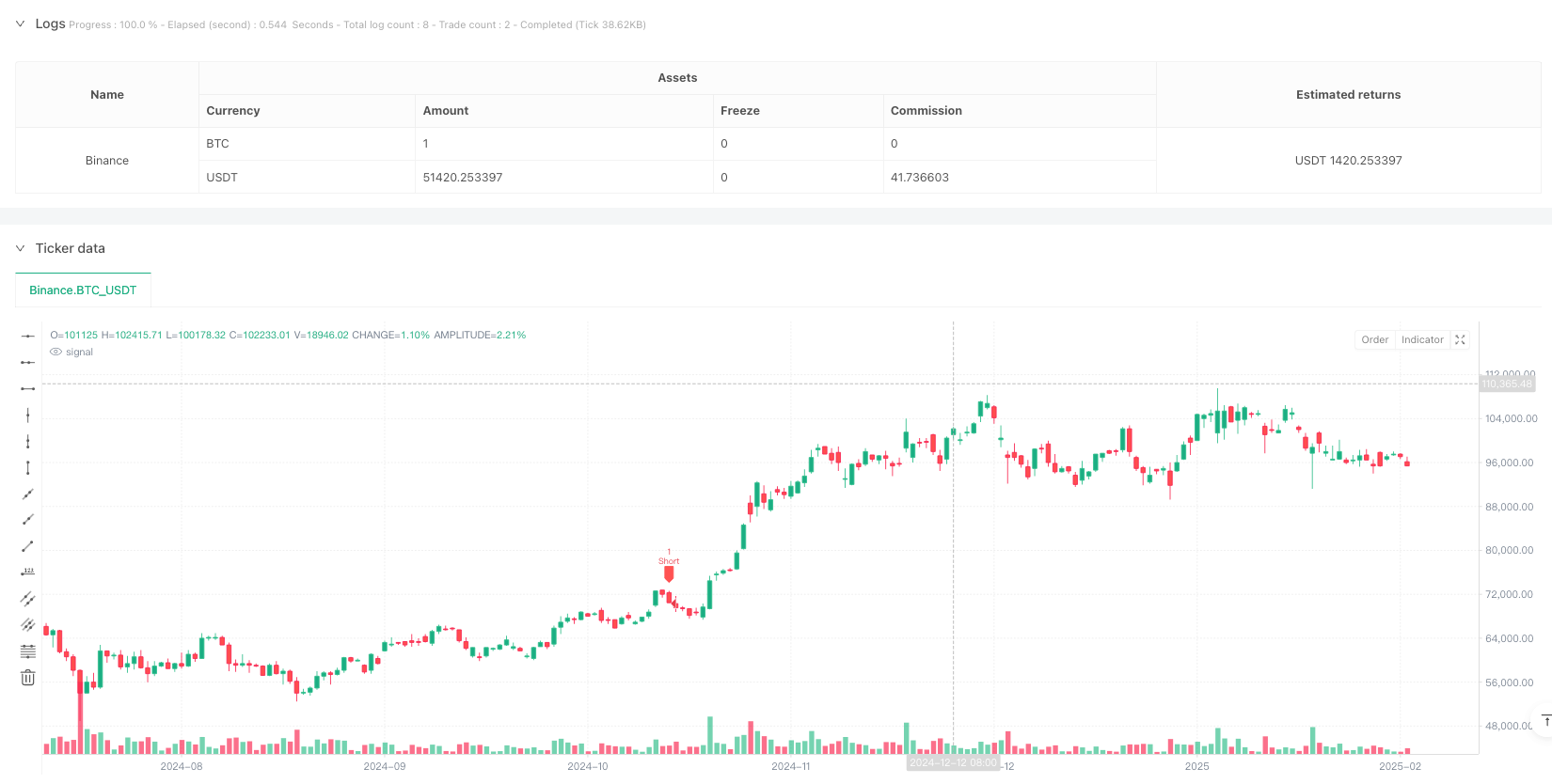

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Fairas Oil", overlay=true)

// Input parameters

kLength = input(14, title="Stochastic K Length")

dLength = input(3, title="Stochastic D Length")

smoothK = input(3, title="Smooth K")

tfHigher = input.timeframe("30", title="Higher Timeframe")

takeProfit = input(1.7, title="Take Profit Multiplier")

stopLoss = input(1.7, title="Stop Loss Multiplier")

// Calculate Stochastic Oscillator for current timeframe

k = ta.sma(ta.stoch(close, high, low, kLength), smoothK)

d = ta.sma(k, dLength)

// Calculate Stochastic Oscillator for higher timeframe

kHTF = request.security(syminfo.tickerid, tfHigher, ta.sma(ta.stoch(close, high, low, kLength), smoothK))

dHTF = request.security(syminfo.tickerid, tfHigher, ta.sma(kHTF, dLength))

// Buy and sell conditions (confirmation from two timeframes)

buyCondition = ta.crossover(k, d) and k < 20 and kHTF < 20 and kHTF > dHTF

sellCondition = ta.crossunder(k, d) and k > 80 and kHTF > 80 and kHTF < dHTF

// Define Take Profit and Stop Loss levels

longStopLoss = close * (1 - stopLoss / 100)

longTakeProfit = close * (1 + takeProfit / 100)

shortStopLoss = close * (1 + stopLoss / 100)

shortTakeProfit = close * (1 - takeProfit / 100)

// Execute Trades

if buyCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

if sellCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// Plot buy/sell signals on candlestick chart

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, size=size.small, title="Buy Signal")

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, size=size.small, title="Sell Signal")

// Highlight candles for buy and sell conditions

barcolor(buyCondition ? color.green : sellCondition ? color.red : na)

// Draw Take Profit and Stop Loss levels dynamically with labels

var float tpLevel = na

var float slLevel = na

if buyCondition

tpLevel := longTakeProfit

slLevel := longStopLoss

if sellCondition

tpLevel := shortTakeProfit

slLevel := shortStopLoss

相关推荐