概述

该策略是一个基于RSI2指标与移动平均线相结合的交易系统。它主要通过监控RSI指标在超卖区域的反转信号来捕捉潜在的做多机会,同时结合移动平均线作为趋势过滤器来提高交易的准确性。策略采用固定退出机制,在持仓达到预设周期后自动平仓。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用周期为2的RSI指标识别超卖状态,当RSI低于设定的买入阈值(默认25)时进入观察状态 2. 在RSI指标由下往上突破时确认入场信号 3. 可选择性地加入移动平均线过滤条件,要求价格位于均线之上才允许入场 4. 采用固定持仓周期(默认5个K线)的退出机制 5. 入场后在图表上绘制交易线,连接买入点和卖出点,用不同颜色标识盈亏情况

策略优势

- 参数灵活可调:支持自定义RSI周期、买入阈值、持仓周期和均线周期等关键参数

- 机制简单可靠:使用经典的RSI超卖反转信号,结合趋势过滤,逻辑清晰易懂

- 风险控制得当:采用固定周期退出机制,避免过度持仓

- 可视化效果好:通过交易线的绘制直观展示每笔交易的盈亏情况

- 回测时间可控:支持设定具体的回测起止时间

策略风险

- 假突破风险:RSI指标可能出现虚假反转信号,导致错误交易

- 固定周期风险:预设的持仓周期可能过短导致提前离场,或过长导致利润回吐

- 趋势依赖性:在震荡市场中,移动平均线过滤可能过度限制交易机会

- 参数敏感性:策略表现对参数设置较为敏感,不同市场环境可能需要频繁调整

策略优化方向

- 动态持仓周期:可根据市场波动率自适应调整持仓时间

- 多重确认机制:增加成交量、波动率等辅助指标提高信号可靠性

- 智能止损设置:引入ATR等指标动态设定止损位置

- 分批建仓方案:在信号触发时采用递进式建仓以分散风险

- 市场环境识别:增加趋势强度判断,在不同市场条件下使用不同的参数组合

总结

这是一个结构完整、逻辑清晰的交易策略,通过RSI超卖反转信号结合均线趋势过滤来捕捉市场机会。策略的优势在于参数灵活、风控合理,但仍需注意假突破风险和参数敏感性问题。通过建议的优化方向,策略还有较大的改进空间,可以进一步提高其在不同市场环境下的适应性。

策略源码

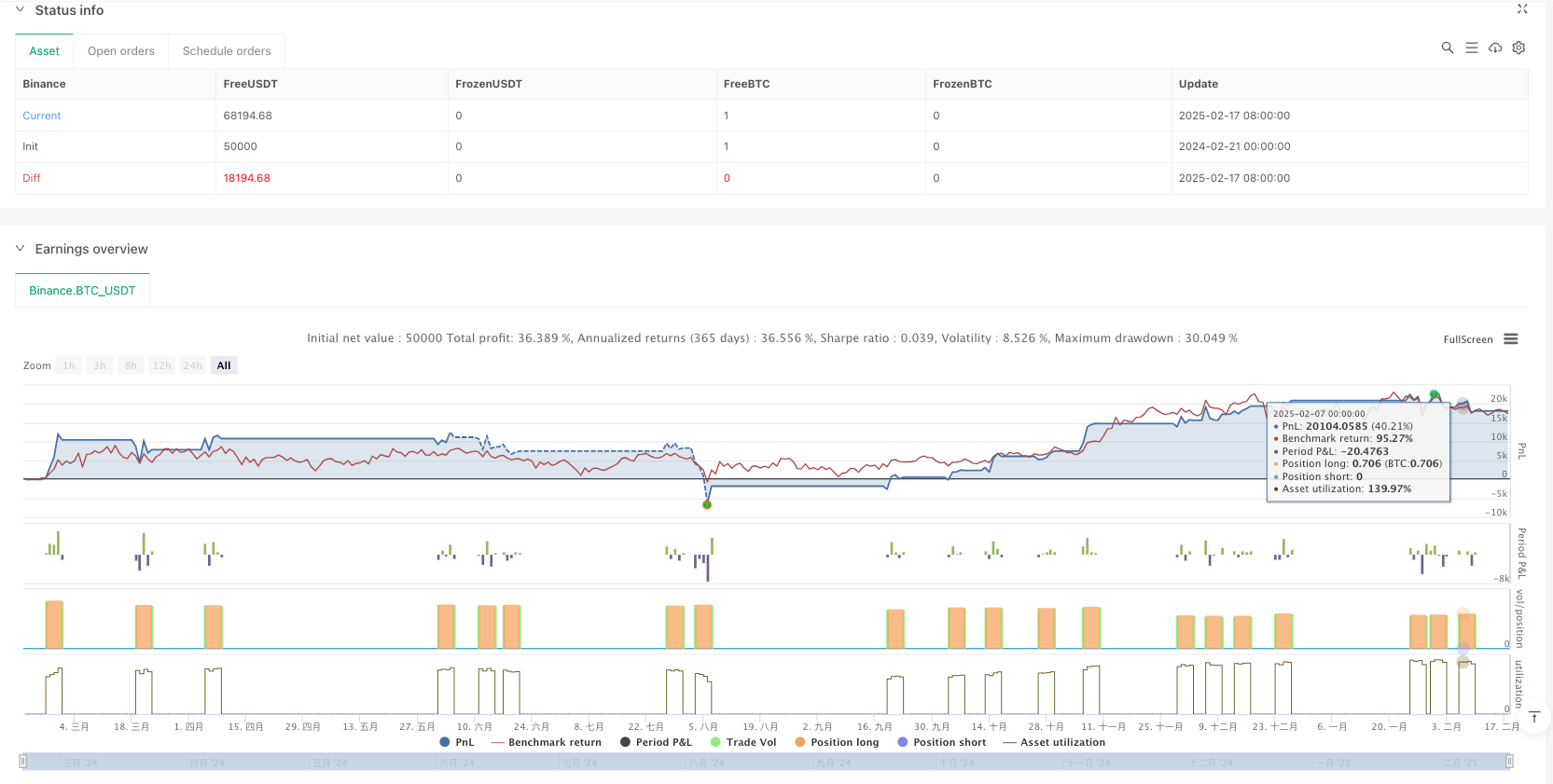

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI 2 Strategy with Fixed Lines and Moving Average Filter", overlay=true)

// Input parameters

rsiPeriod = input.int(2, title="RSI Period", minval=1)

rsiBuyLevel = input.float(25, title="RSI Buy Level", minval=0, maxval=100)

maxBarsToHold = input.int(5, title="Max Candles to Hold", minval=1)

maPeriod = input.int(50, title="Moving Average Period", minval=1) // Moving Average Period

useMAFilter = input.bool(true, title="Use Moving Average Filter") // Enable/Disable MA Filter

// RSI and Moving Average calculation

rsi = ta.rsi(close, rsiPeriod)

ma = ta.sma(close, maPeriod)

// Moving Average filter conditions

maFilterCondition = useMAFilter ? close > ma : true // Condition: price above MA

// Buy conditions

rsiIncreasing = rsi > rsi[1] // Current RSI greater than previous RSI

buyCondition = rsi[1] < rsiBuyLevel and rsiIncreasing and strategy.position_size == 0 and maFilterCondition

// Variables for management

var int barsHeld = na // Counter for candles after purchase

var float buyPrice = na // Purchase price

// Buy action

if buyCondition and na(barsHeld)

strategy.entry("Buy", strategy.long)

barsHeld := 0

buyPrice := close

// Increment the candle counter after purchase

if not na(barsHeld)

barsHeld += 1

// Sell condition after the configured number of candles

sellCondition = barsHeld >= maxBarsToHold

if sellCondition

strategy.close("Buy")

// Reset variables after selling

barsHeld := na

buyPrice := na

相关推荐