概述

该策略是一个结合波动率突破、趋势跟踪和动量确认的量化交易系统。它通过计算基于ATR的动态突破水平,并结合EMA趋势过滤和RSI动量指标来识别交易机会。策略采用严格的风险控制措施,包括固定百分比风险管理和动态止损设置。

策略原理

策略包含三个核心组成部分: 1. 波动率突破计算:使用回溯期内的最高价和最低价,结合ATR倍数计算动态突破阈值,避免前瞻偏差。 2. 趋势过滤:采用短期EMA判断当前趋势方向,只在价格位于EMA之上开多单,位于EMA之下开空单。 3. 动量确认:使用RSI指标确认市场动量,多头入场要求RSI大于50,空头入场要求RSI小于50。

策略优势

- 动态适应性:突破水平会根据市场波动率自动调整,使策略能够适应不同市场环境。

- 多重过滤:结合趋势和动量指标降低虚假信号。

- 严格风险控制:采用固定风险百分比进行头寸管理,并使用动态止损保护。

- 可定制性强:关键参数如ATR周期、突破倍数、EMA周期等都可根据具体需求调整。

策略风险

- 滞后性风险:使用移动平均等指标可能导致入场点滞后。

- 震荡市场风险:在横盘震荡市场中可能产生频繁的虚假突破信号。

- 参数敏感性:策略表现对参数设置较为敏感,需要充分测试。 解决方案:

- 建议在不同市场环境下进行回测优化

- 可以添加市场环境识别模块

- 建议采用更保守的资金管理方案

策略优化方向

- 市场环境适应:添加波动率区间判断,在不同波动环境下使用不同的参数设置。

- 信号优化:可以考虑加入成交量确认,提高突破信号的可靠性。

- 止盈止损优化:可以实现动态调整的盈亏比,根据市场波动性调整目标。

- 时间过滤:增加交易时间窗口过滤,避免在不利时段交易。

总结

这是一个结构完整、逻辑清晰的量化交易策略。通过将波动率突破、趋势跟踪和动量确认相结合,在控制风险的同时捕捉显著的价格波动。策略的可定制性强,适合进一步优化以适应不同的交易品种和市场环境。建议在实盘之前进行充分的参数优化和回测验证。

策略源码

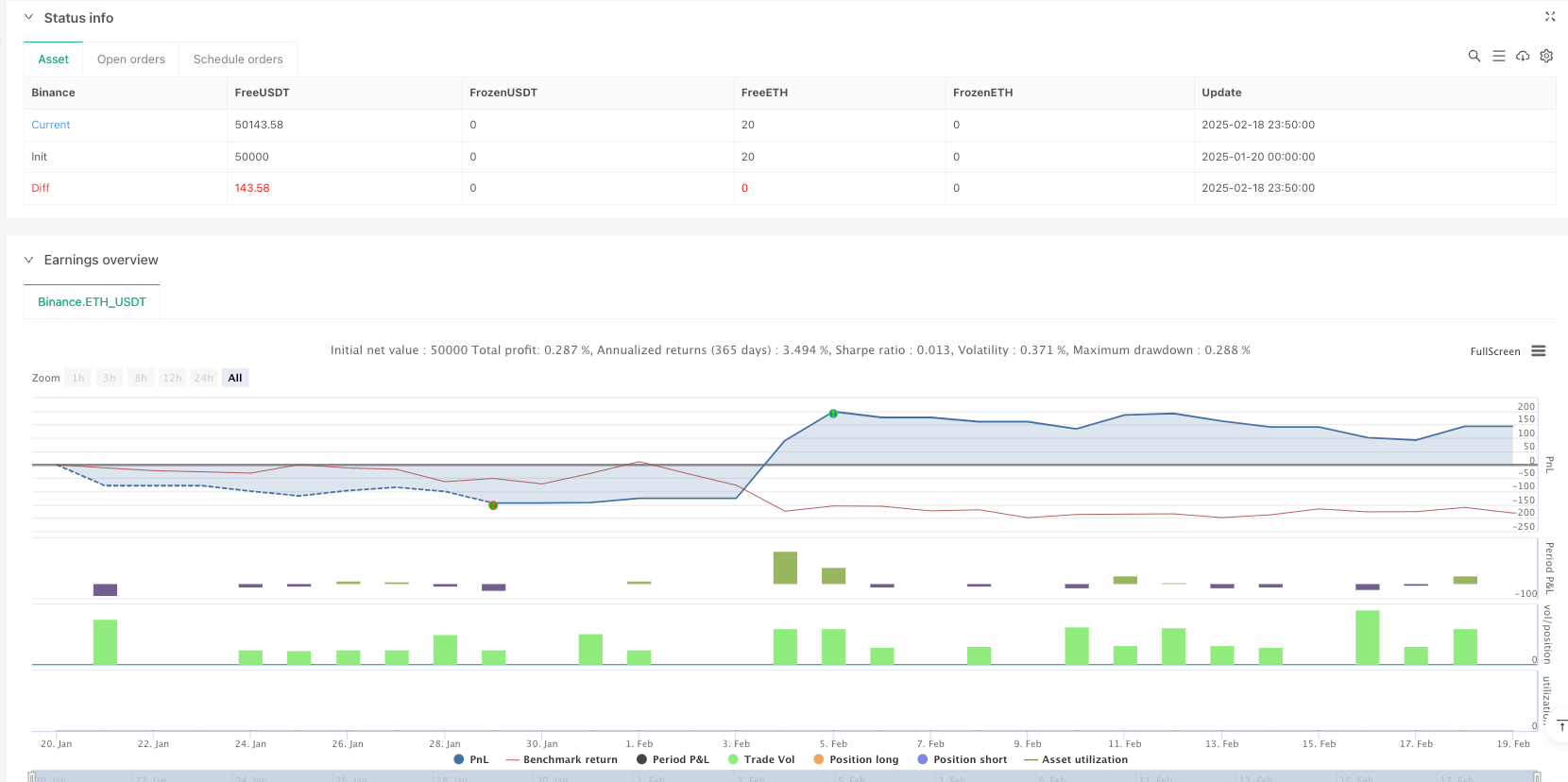

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

// Volatility Momentum Breakout Strategy

//

// Description:

// This strategy is designed to capture significant price moves by combining a volatility breakout method

// with a momentum filter. Volatility is measured by the Average True Range (ATR), which is used to set dynamic

// breakout levels. A short‑term Exponential Moving Average (EMA) is applied as a trend filter, and the Relative

// Strength Index (RSI) is used to help avoid entries when the market is overextended.

//

// Signal Logic:

// • Long Entry: When the current close is above the highest high of the previous N bars (excluding the current bar)

// plus a multiple of ATR, provided that the price is above the short‑term EMA and the RSI is above 50.

// • Short Entry: When the current close is below the lowest low of the previous N bars (excluding the current bar)

// minus a multiple of ATR, provided that the price is below the short‑term EMA and the RSI is below 50.

//

// Risk Management:

// • Trades are sized to risk 2% of account equity.

// • A stop loss is placed at a fixed ATR multiple away from the entry price.

// • A take profit target is set to achieve a 1:2 risk‑reward ratio.

//

// Backtesting Parameters:

// • Initial Capital: $10,000

// • Commission: 0.1% per trade

// • Slippage: 1 tick per bar

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and provided solely for educational

// purposes. Always backtest and paper trade before any live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Volatility Momentum Breakout Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=5, commission_type=strategy.commission.percent, commission_value=0.1, slippage=1)

// ─── INPUTS ─────────────────────────────────────────────────────────────

atrPeriod = input.int(14, "ATR Period", minval=1)

atrMultiplier = input.float(1.5, "ATR Multiplier for Breakout", step=0.1)

lookback = input.int(20, "Breakout Lookback Period", minval=1)

emaPeriod = input.int(50, "EMA Period", minval=1)

rsiPeriod = input.int(14, "RSI Period", minval=1)

rsiLongThresh = input.float(50, "RSI Long Threshold", step=0.1)

rsiShortThresh = input.float(50, "RSI Short Threshold", step=0.1)

// Risk management inputs:

riskPercent = input.float(2.0, "Risk Percent per Trade (%)", step=0.1) * 0.01 // 2% risk per trade

riskReward = input.float(2.0, "Risk-Reward Ratio", step=0.1) // Target profit is 2x risk

atrStopMult = input.float(1.0, "ATR Multiplier for Stop Loss", step=0.1) // Stop loss distance in ATRs

// ─── INDICATOR CALCULATIONS ───────────────────────────────────────────────

atrVal = ta.atr(atrPeriod)

emaVal = ta.ema(close, emaPeriod)

rsiVal = ta.rsi(close, rsiPeriod)

// Calculate breakout levels using the highest high and lowest low of the previous N bars,

// excluding the current bar (to avoid look-ahead bias).

highestHigh = ta.highest(high[1], lookback)

lowestLow = ta.lowest(low[1], lookback)

// Define breakout thresholds.

longBreakoutLevel = highestHigh + atrMultiplier * atrVal

shortBreakoutLevel = lowestLow - atrMultiplier * atrVal

// ─── SIGNAL LOGIC ─────────────────────────────────────────────────────────

// Long Entry: Price closes above the long breakout level,

// the close is above the EMA, and RSI > 50.

longCondition = (close > longBreakoutLevel) and (close > emaVal) and (rsiVal > rsiLongThresh)

// Short Entry: Price closes below the short breakout level,

// the close is below the EMA, and RSI < 50.

shortCondition = (close < shortBreakoutLevel) and (close < emaVal) and (rsiVal < rsiShortThresh)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// ─── RISK MANAGEMENT ──────────────────────────────────────────────────────

// For each new trade, use the entry price as the basis for stop loss and target calculations.

// We assume the entry price equals the close on the bar where the trade is triggered.

var float longEntryPrice = na

var float shortEntryPrice = na

// Record entry prices when a trade is opened.

if (strategy.position_size > 0 and na(longEntryPrice))

longEntryPrice := strategy.position_avg_price

if (strategy.position_size < 0 and na(shortEntryPrice))

shortEntryPrice := strategy.position_avg_price

// Calculate stop loss and take profit levels based on ATR.

longStop = longEntryPrice - atrStopMult * atrVal

longTarget = longEntryPrice + (longEntryPrice - longStop) * riskReward

shortStop = shortEntryPrice + atrStopMult * atrVal

shortTarget= shortEntryPrice - (shortStop - shortEntryPrice) * riskReward

// Issue exit orders if a position is open.

if (strategy.position_size > 0 and not na(longEntryPrice))

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTarget)

if (strategy.position_size < 0 and not na(shortEntryPrice))

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTarget)

// Reset recorded entry prices when the position is closed.

if (strategy.position_size == 0)

longEntryPrice := na

shortEntryPrice := na

// ─── CHART VISUAL AIDS ─────────────────────────────────────────────────────

// Plot the breakout levels and EMA.

plot(longBreakoutLevel, color=color.new(color.green, 0), title="Long Breakout Level", style=plot.style_linebr)

plot(shortBreakoutLevel, color=color.new(color.red, 0), title="Short Breakout Level", style=plot.style_linebr)

plot(emaVal, color=color.blue, title="EMA")

// Optionally, shade the background: green when price is above the EMA (bullish) and red when below.

bgcolor(close > emaVal ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")

相关推荐