概述

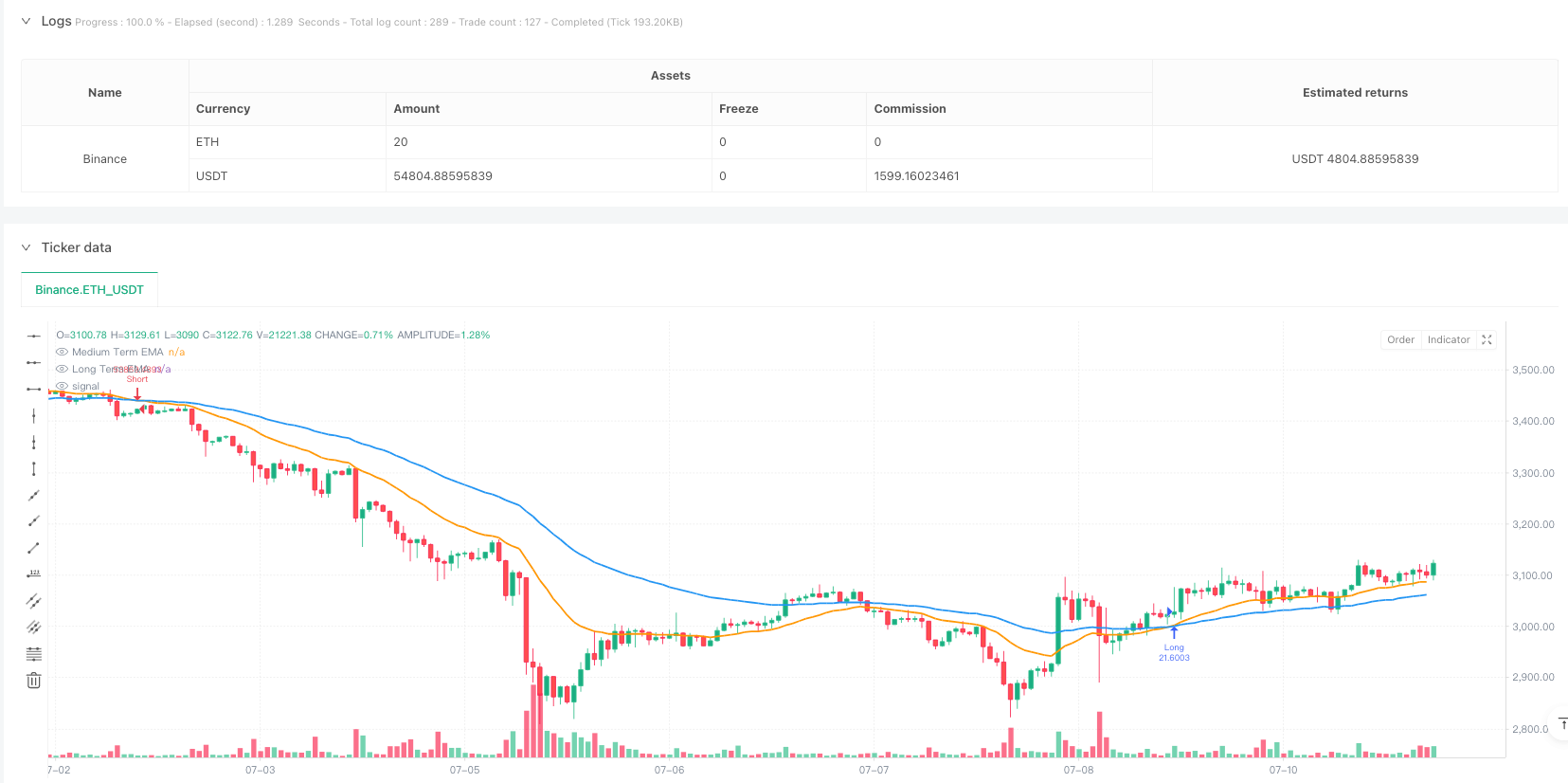

该策略是一个基于中长期指数移动平均线(EMA)交叉的交易系统,结合了动态头寸管理和风险控制机制。策略通过21周期和55周期的EMA交叉来识别市场趋势,同时根据用户自定义的风险收益比和风险百分比来动态调整交易头寸大小,实现了风险的精确控制。

策略原理

策略的核心逻辑建立在两个时间周期的EMA交叉信号基础上。当21周期EMA向上穿越55周期EMA时,系统识别为上升趋势,触发做多信号;当21周期EMA向下穿越55周期EMA时,系统识别为下降趋势,触发做空信号。止损位的设置采用过去两根K线的最低点(做多)或最高点(做空),止盈位则根据用户设定的风险收益比动态计算。头寸规模基于账户总资金、风险百分比和当前止损距离动态计算,确保每笔交易的风险控制在预设范围内。

策略优势

- 动态风险管理:通过动态计算头寸大小,确保每笔交易的风险严格控制在设定的百分比范围内。

- 自适应性强:EMA指标能够自适应市场波动,减少虚假信号。

- 风险收益比可调:用户可以根据自己的风险偏好设置风险收益比。

- 头寸管理科学:基于账户规模和风险距离动态调整头寸,避免过度杠杆。

- 全自动化运行:策略可以24/7持续运行,无需人工干预。

策略风险

- 震荡市场风险:在横盘震荡市场中,EMA交叉信号可能产生频繁的虚假信号。

- 滑点风险:在快速行情中,实际成交价格可能与信号价格有较大偏差。

- 资金管理风险:虽然设置了风险控制,但连续亏损仍可能对账户造成显著影响。

- 系统性风险:市场突发性重大事件可能导致止损失效。

策略优化方向

- 增加趋势过滤器:引入ADX或趋势强度指标,过滤横盘震荡行情。

- 优化止损方式:可考虑使用ATR动态调整止损距离,提高止损的自适应性。

- 加入波动率调节:根据市场波动率动态调整风险参数。

- 时间过滤:增加交易时间过滤,避开低流动性时段。

- 引入量能指标:结合成交量指标验证趋势有效性。

总结

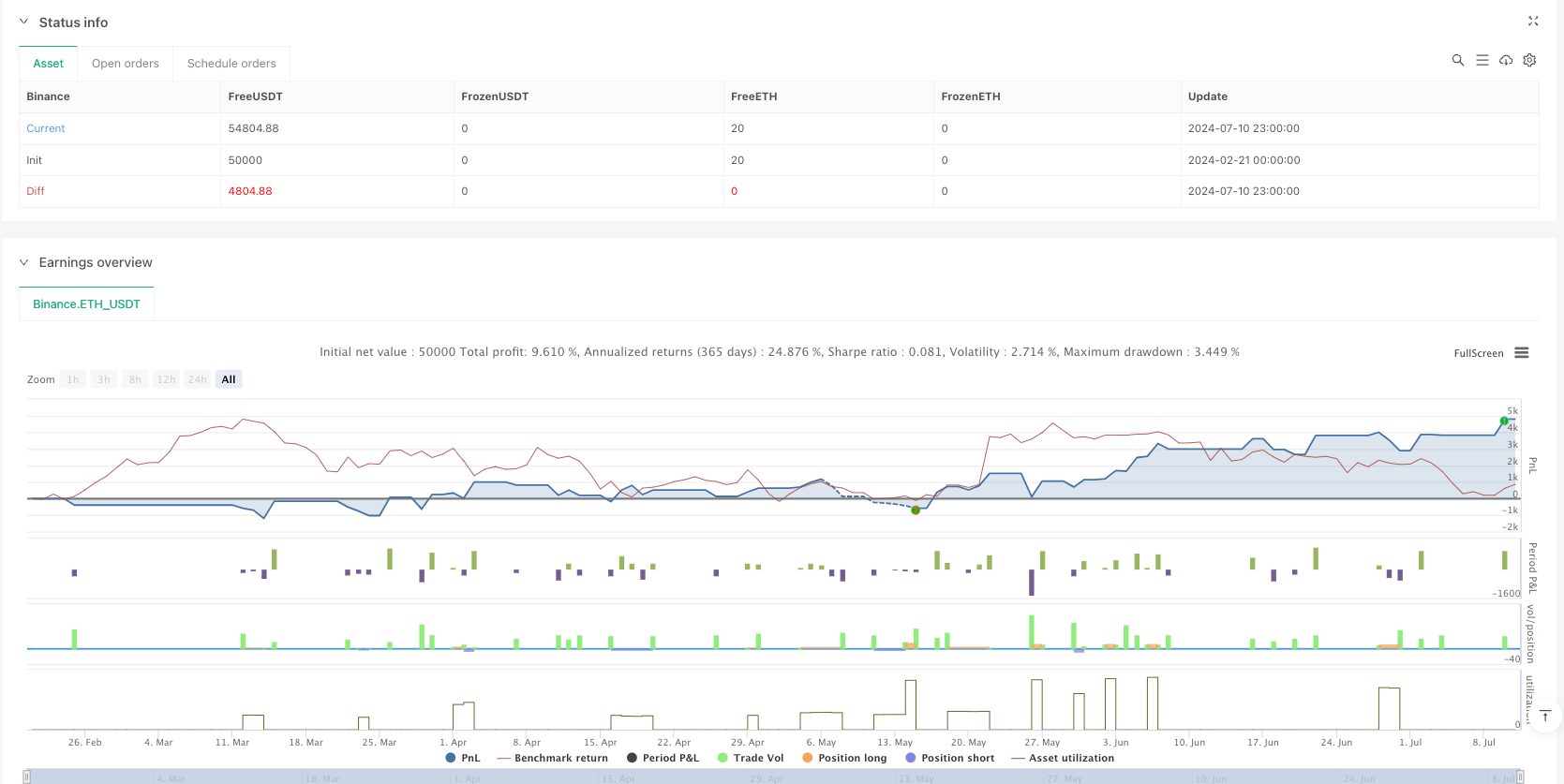

该策略通过结合EMA趋势信号和动态风险管理,构建了一个完整的交易系统。策略的核心优势在于其科学的头寸管理和风险控制机制,但仍需要根据市场环境和个人风险偏好进行适当的参数优化。通过建议的优化方向,策略的稳定性和盈利能力有望得到进一步提升。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2024-07-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Carlos Humberto Rodríguez Arias

//@version=5

strategy("EMA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// EMA periods

MT_EMA = input.int(21, title="Medium Term EMA")

LT_EMA = input.int(55, title="Long Term EMA")

RR = input.float(2.0, title="Risk-Reward Ratio") // User-defined RR

RiskPercent = input.float(1.0, title="Risk Percentage") // User-defined risk percentage

// Calculate EMAs

Signal_MT_EMA = ta.ema(close, MT_EMA)

Signal_LT_EMA = ta.ema(close, LT_EMA)

// Plot EMAs

plot(Signal_MT_EMA, title="Medium Term EMA", color=color.orange, linewidth=2)

plot(Signal_LT_EMA, title="Long Term EMA", color=color.blue, linewidth=2)

// Determine trend conditions

uptrend = ta.crossover(Signal_MT_EMA, Signal_LT_EMA)

downtrend = ta.crossunder(Signal_MT_EMA, Signal_LT_EMA)

// Stop-Loss Calculations

longStopLoss = ta.lowest(low, 2) // SL for buy = lowest low of last 2 candles

shortStopLoss = ta.highest(high, 2) // SL for sell = highest high of last 2 candles

// Take-Profit Calculations

longTakeProfit = close + (close - longStopLoss) * RR

shortTakeProfit = close - (shortStopLoss - close) * RR

// Calculate Position Size based on Risk Percentage

capital = strategy.equity * (RiskPercent / 100)

longPositionSize = capital / (close - longStopLoss)

shortPositionSize = capital / (shortStopLoss - close)

// Execute Buy Order

if uptrend

strategy.entry("Long", strategy.long, qty=longPositionSize)

strategy.exit("Long Exit", from_entry="Long", stop=longStopLoss, limit=longTakeProfit)

// Execute Sell Order

if downtrend

strategy.entry("Short", strategy.short, qty=shortPositionSize)

strategy.exit("Short Exit", from_entry="Short", stop=shortStopLoss, limit=shortTakeProfit)

相关推荐