概述

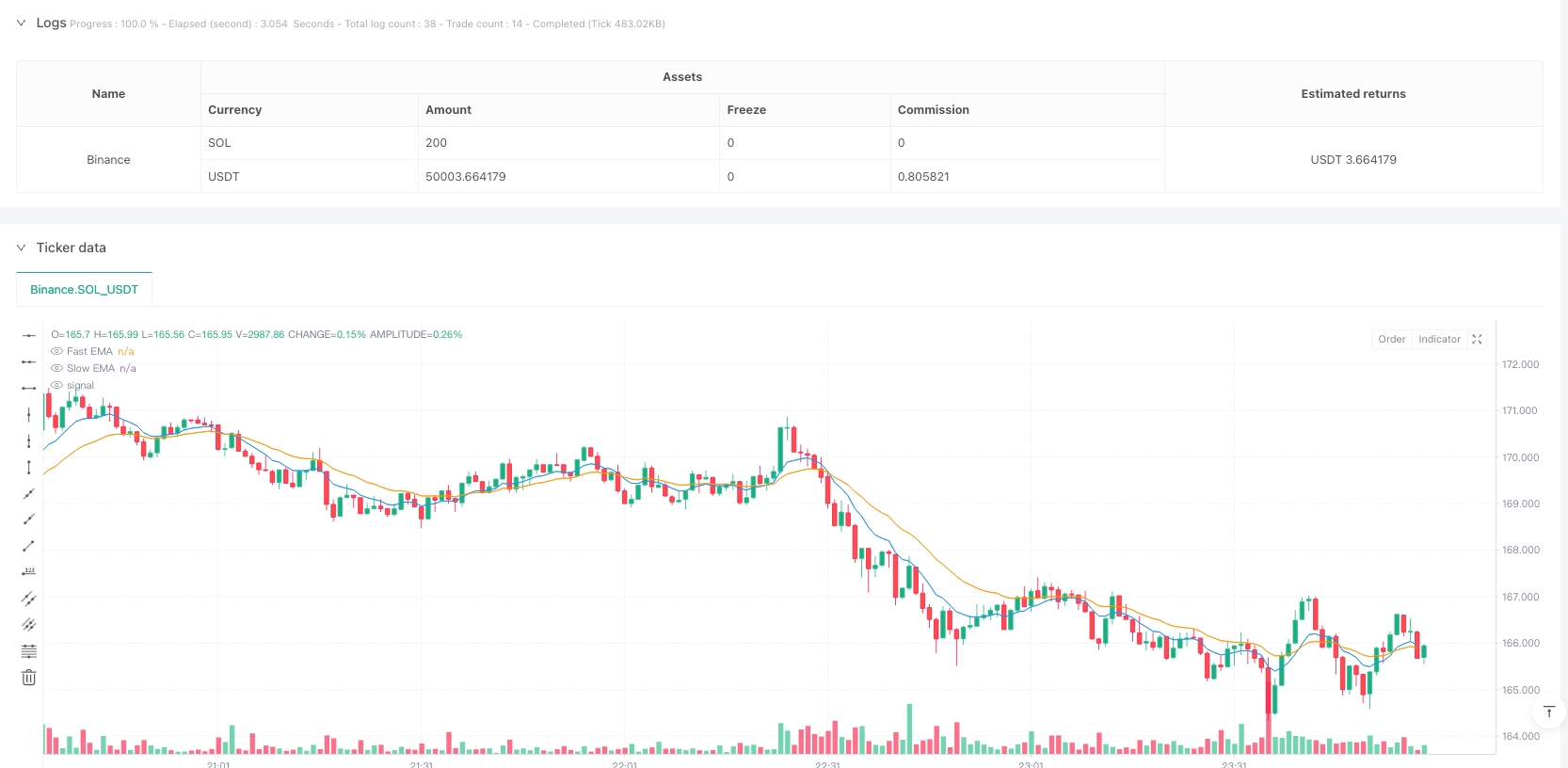

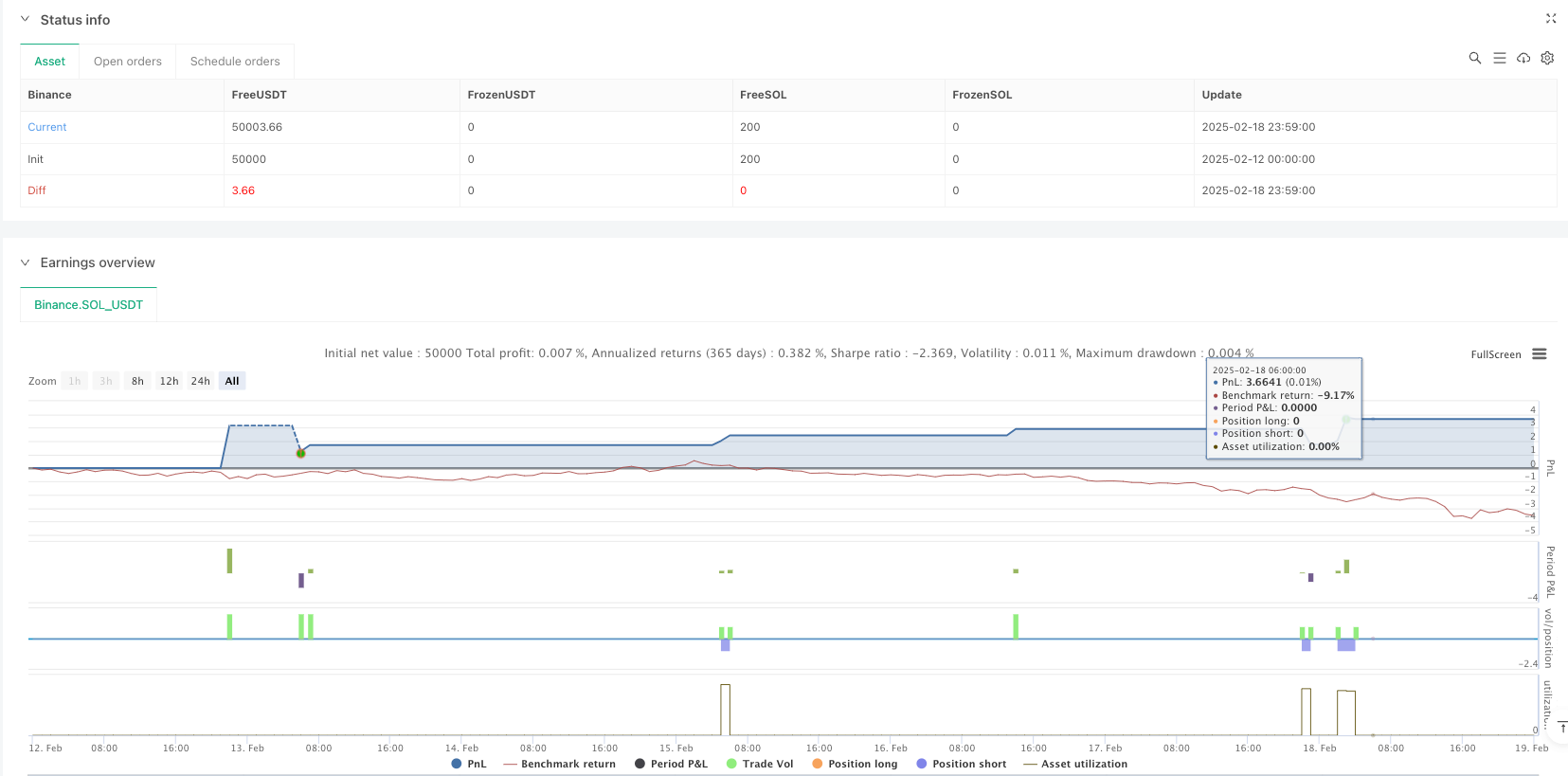

这是一个基于多重技术指标确认的趋势交易策略,结合了移动平均线、动量指标和成交量分析进行交易信号的筛选。策略采用三层过滤机制,包括趋势方向判断(EMA交叉)、动量强度确认(RSI与MACD)以及成交量验证(量能突破与OBV趋势),并配备了基于ATR的风险控制系统。

策略原理

策略运作基于三重确认机制: 1. 趋势确认层: 使用9和21周期的指数移动平均线(EMA)交叉来确定总体趋势方向,快线上穿慢线视为上升趋势,反之为下降趋势。 2. 动量确认层: 结合RSI和MACD两个动量指标。当RSI大于50且MACD金叉时确认多头动量,当RSI小于50且MACD死叉时确认空头动量。 3. 成交量确认层: 要求成交量出现1.8倍于均线的放量,同时通过OBV趋势来验证量价配合的合理性。

风险管理采用1.5倍ATR作为止损标准,默认1:2的风险收益比设置获利目标。

策略优势

- 多层过滤机制显著提高了交易信号的可靠性,减少了虚假信号。

- 将趋势、动量和成交量三个维度结合,全面评估市场状态。

- 基于ATR的动态止损设置,能够根据市场波动性自适应调整。

- 策略包含视觉化工具,便于交易者直观判断入场时机。

- 针对不同波动性资产提供了优化参数建议。

策略风险

- 多重过滤条件可能导致错过部分行情机会。

- 在横盘震荡市场中可能产生频繁的假突破信号。

- 固定的风险收益比可能在某些市场环境下不够灵活。

- 对成交量的依赖可能在低流动性期间产生误导信号。

- EMA参数需要根据不同市场状态进行调整。

策略优化方向

- 引入自适应的指标参数:可根据市场波动率动态调整EMA和RSI的周期。

- 优化成交量判断:考虑引入相对成交量指标,减少异常成交量的影响。

- 改进风险管理:实现基于市场波动性的动态风险收益比调整。

- 增加市场环境过滤:加入趋势强度指标,在强趋势期间采用追踪止损。

- 完善出场机制:结合更多技术指标制定更灵活的出场条件。

总结

这是一个设计完善的多层确认交易策略,通过结合多个技术指标提供了相对可靠的交易信号。策略的风险管理体系较为完善,但仍需要交易者根据具体市场环境进行参数优化。该策略最适合在波动性适中、流动性充足的市场中使用,并且需要交易者具备一定的技术分析基础。

策略源码

/*backtest

start: 2025-02-12 00:00:00

end: 2025-02-19 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("5min Triple Confirmation Crypto Strategy", overlay=true, margin_long=100, margin_short=100)

// ===== Inputs =====

fast_length = input.int(9, "Fast EMA Length")

slow_length = input.int(21, "Slow EMA Length")

rsi_length = input.int(14, "RSI Length")

volume_ma_length = input.int(20, "Volume MA Length")

atr_length = input.int(14, "ATR Length")

risk_reward = input.float(2.0, "Risk:Reward Ratio")

// ===== 1. Trend Confirmation (EMA Crossover) =====

fast_ema = ta.ema(close, fast_length)

slow_ema = ta.ema(close, slow_length)

bullish_trend = ta.crossover(fast_ema, slow_ema)

bearish_trend = ta.crossunder(fast_ema, slow_ema)

// ===== 2. Momentum Confirmation (RSI + MACD) =====

rsi = ta.rsi(close, rsi_length)

[macd_line, signal_line, _] = ta.macd(close, 12, 26, 9)

bullish_momentum = rsi > 50 and ta.crossover(macd_line, signal_line)

bearish_momentum = rsi < 50 and ta.crossunder(macd_line, signal_line)

// ===== 3. Volume Confirmation (Volume Spike + OBV) =====

volume_ma = ta.sma(volume, volume_ma_length)

volume_spike = volume > 1.8 * volume_ma

obv = ta.obv

obv_trend = ta.ema(obv, 5) > ta.ema(obv, 13)

// ===== Entry Conditions =====

long_condition =

bullish_trend and

bullish_momentum and

volume_spike and

obv_trend

short_condition =

bearish_trend and

bearish_momentum and

volume_spike and

not obv_trend

// ===== Risk Management =====

atr = ta.atr(atr_length)

long_stop = low - 1.5 * atr

long_target = close + (1.5 * atr * risk_reward)

short_stop = high + 1.5 * atr

short_target = close - (1.5 * atr * risk_reward)

// ===== Strategy Execution =====

strategy.entry("Long", strategy.long, when=long_condition)

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_target)

strategy.entry("Short", strategy.short, when=short_condition)

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_target)

// ===== Visual Alerts =====

plotshape(long_condition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(short_condition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

plot(fast_ema, "Fast EMA", color=color.blue)

plot(slow_ema, "Slow EMA", color=color.orange)

相关推荐